Current Report Filing (8-k)

July 22 2021 - 4:17PM

Edgar (US Regulatory)

0000033213

false

0000033213

2021-07-21

2021-07-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

July 22, 2021 (July 21, 2021)

EQT CORPORATION

(Exact name of registrant as specified in

its charter)

|

Pennsylvania

|

|

001-3551

|

|

25-0464690

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

625 Liberty Avenue, Suite 1700,

Pittsburgh, Pennsylvania 15222

(Address of principal executive offices,

including zip code)

(412) 553-5700

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

EQT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

On July 21, 2021, EQT Corporation (the “Company”)

consummated the previously announced acquisition (the “Acquisition”) of Alta Marcellus Development, LLC, a Delaware limited

liability company (“ARD Marcellus”), and ARD Operating, LLC, a Delaware limited liability company (“ARD” and,

together with ARD Marcellus, the “Alta Target Entities”), pursuant to that certain Membership Interest Purchase Agreement,

dated May 5, 2021 (the “Purchase Agreement”), by and among the Company, EQT Acquisition HoldCo LLC (a wholly owned indirect

subsidiary of the Company), Alta Resources Development, LLC, a Delaware limited liability company (“Alta Resources”), and

the Alta Target Entities. The Alta Target Entities collectively hold all of Alta Resources’ upstream and midstream assets. The events

described in this Current Report on Form 8-K took place in connection with the closing of the Acquisition.

The Company plans to provide an update with respect

to the Acquisition and corresponding integration plans, as well as revised 2021 financial and operational guidance that reflects the Acquisition,

in conjunction with its second quarter earnings and conference call scheduled for July 29, 2021.

Item 1.01 Entry into a Material Definitive Agreement.

Upon consummation of the

Acquisition, pursuant to the terms of the Purchase Agreement, the Company and certain direct and indirect equityholders of Alta Resources

or their designees (together with their permitted assignees, the “Alta RRA Holders”) entered into that certain Registration

Rights Agreement, dated as of July 21, 2021 (the “Registration Rights Agreement”). Under the Registration Rights Agreement,

among other things, subject to certain requirements and exceptions, the Company is required to file with the Securities and Exchange

Commission, no later than three business days following the closing of the Acquisition, a registration statement on Form S-3 (or amend

an existing shelf registration statement previously filed by it) to permit the public resale of

all of the Registrable Securities (as defined in the Registration Rights Agreement) by the Alta RRA Holders from time to time as permitted

by Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), and to use its commercially

reasonable efforts to cause such registration statement to remain effective until all of the Registrable Securities have ceased to be

Registrable Securities or the earlier termination of the Registration Rights Agreement pursuant to its terms. Furthermore, under

the Registration Rights Agreement, the Alta RRA Holders have certain demand rights and piggyback registration rights with respect to certain

other underwritten offerings conducted by the Company for its own account or other shareholders of the Company. The Registration Rights

Agreement contains customary indemnification and contribution obligations of the Company for the benefit of the Alta RRA Holders and vice

versa (provided, however, that each Alta RRA Holder’s indemnification and contribution obligation is limited to the net proceeds

received by such Alta RRA Holder from the sale of Registrable Securities pursuant to an offering made in accordance with the Registration

Rights Agreement), in each case, subject to certain qualifications and exceptions.

In

connection with entering into the Registration Rights Agreement, the Company also entered into a lockup agreement with each of the Alta

RRA Holders (collectively, the “Lockup Agreements”), pursuant to which, among other things, each Alta RRA Holder agreed not

to sell its portion of the Stock Consideration (as defined below) during the 180 days following the closing of the Acquisition; provided,

however, that (i) the Alta RRA Holders may sell up to 25% of the Registrable Securities in a single shelf underwritten offering

between the 31st day following closing and the 90th day following closing and up to an aggregate of 50%

of the Registrable Securities pursuant to up to two shelf underwritten offerings in the first 180 days following closing, and (ii) certain

Alta RRA Holders may sell their pro rata portion of up to an aggregate amount of 2,500,000 additional shares of common stock, no

par value, of the Company under certain circumstances and subject to certain limitations. Pursuant to the Lockup Agreements, the Company

also agreed with each Alta RRA Holder not to sell shares of common stock during the first 30 days following the closing of the Acquisition.

The foregoing description of the Registration Rights

Agreement and the Lockup Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text

of the Registration Rights Agreement (including the form of Lockup Agreement), a copy of which is attached hereto as Exhibit 10.1 and

incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory

Note” above is incorporated into this Item 2.01 by reference. As a result of the Acquisition and on the terms and pursuant to the

conditions contained in the Purchase Agreement, on July 21, 2021, Alta Resources sold to the Company, and the Company purchased and accepted,

all of the issued and outstanding equity interests of the Alta Target Entities (the “Target Interests”), free and clear of

all liens (other than liens arising under federal and state securities laws, arising pursuant to the governing documents of the Alta Target

Entities or imposed by the Company or any of its affiliates).

Pursuant to the Purchase Agreement, the consideration

to be paid to Alta Resources for the Acquisition consists of $1.0 billion in cash and 105,306,346 shares of common stock, which

shares represented an aggregate dollar value equal to $1.925 billion as of the date of the Purchase Agreement based on the 30-day volume-weighted

average price of a share of common stock as of May 4, 2021 ($18.28), subject to customary purchase price adjustments. As a result of such

purchase price adjustments, upon consummation of the Acquisition on July 21, 2021, 98,789,388 shares of common stock (the “Stock

Consideration”) were issued to certain direct and indirect equityholders of Alta Resources or their designees (the “Issuance”).

The foregoing description of the Acquisition and

the Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its

entirety by, reference to the Purchase Agreement, which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on May 7, 2021 and is incorporated by reference herein.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth in Item 2.01 of this

Current Report on Form 8-K is incorporated by reference in response to this Item 3.02. The Issuance was completed in reliance upon the

exemption from the registration requirements of the Securities Act, provided by Section 4(a)(2) thereof as a transaction by an issuer

not involving any public offering.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements

of businesses acquired

The audited consolidated financial statements of

Alta Resources and its subsidiaries as of June 30, 2020 and 2019, and for each of the three years in the period ended June 30, 2020, and

the notes related thereto, are attached to this Current Report on Form 8-K as Exhibit 99.1 and are incorporated herein by reference.

The unaudited condensed consolidated financial

statements of Alta Resources and its subsidiaries as of March 31, 2021 and for the nine months ended March 31, 2021 and 2020, and the

notes related thereto, are attached to this Current Report on Form 8-K as Exhibit 99.2 and are incorporated herein by reference.

(b) Pro

forma financial information

The unaudited pro forma condensed combined balance

sheet of the Company and its subsidiaries as of March 31, 2021 and the unaudited pro forma condensed combined statements of operations

of the Company and its subsidiaries for the three months ended March 31, 2021 and the year ended December 31, 2020, and the notes related

thereto, are attached to this Current Report on Form 8-K as Exhibit 99.3 and are incorporated herein by reference.

(d) Exhibits

|

23.1

|

Consent of Moss Adams LLP.

|

|

|

|

|

23.2

|

Consent of Netherland, Sewell & Associates, Inc.

|

|

|

|

|

99.1

|

Audited consolidated financial statements of Alta Resources Development, LLC and its subsidiaries as of June 30, 2020 and 2019, and for each of the three years in the period ended June 30, 2020, and the notes related thereto.

|

|

|

|

|

99.2

|

Unaudited condensed consolidated financial statements of Alta Resources Development, LLC and its subsidiaries as of March 31, 2021 and for the nine months ended March 31, 2021 and 2020, and the notes related thereto.

|

|

|

|

|

99.3

|

Unaudited pro forma condensed combined balance sheet of EQT Corporation and its subsidiaries as of March 31, 2021 and unaudited pro forma condensed combined statements of operations of EQT Corporation and its subsidiaries for the three months ended March 31, 2021 and the year ended December 31, 2020, and the notes related thereto.

|

|

|

|

|

99.4

|

Reserves report prepared by Netherland, Sewell & Associates, Inc., dated May 3, 2021, with respect to estimates of reserves and future revenue of Alta Marcellus Development, LLC as of June 30, 2020.

|

|

|

|

|

99.5

|

Audit letter prepared by Netherland, Sewell & Associates, Inc., dated May 5, 2021, with respect to estimates of reserves and future revenue of Alta Marcellus Development, LLC as of December 31, 2020.

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EQT CORPORATION

|

|

|

|

|

|

Date: July 22, 2021

|

By:

|

/s/ William E. Jordan

|

|

|

Name:

|

William E. Jordan

|

|

|

Title:

|

Executive Vice President, General Counsel and Corporate Secretary

|

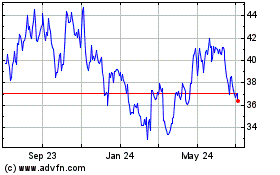

EQT (NYSE:EQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

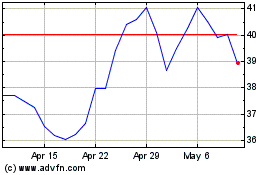

EQT (NYSE:EQT)

Historical Stock Chart

From Apr 2023 to Apr 2024