|

Prospectus

Supplement

|

Filed

pursuant to Rule 424(b)(5)

|

|

(To

Prospectus dated February 13, 2019)

|

Registration

No. 333-229505

|

DOGNESS

(INTERNATIONAL) CORPORATION

2,178,120

Class A Common Shares

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering up to 2,178,120 Class A Common Shares directly to selected

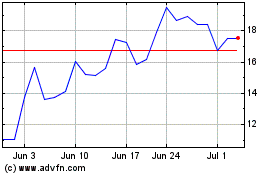

investors. Our Class A Common Shares trade on the NASDAQ Global Market under the symbol “DOGZ.”

As

of the date of this prospectus supplement, the aggregate market value of our outstanding Class A Common Shares held by non-affiliates

was approximately $48,306,163 based on 20,555,814 outstanding Class A Common Shares all of which are held by non-affiliates, and

a per share price of $2.35, which was the last reported price on the NASDAQ Global Market of our Class A Common Shares on July 14, 2021.

During the prior 12 calendar month period that ends on and includes the date of this prospectus supplement, the value of securities we

have sold under this shelf registration statement on Form F-3 is $12,137,870.75. For a more detailed description of the Class A Common

Shares, see the section entitled “Description of Our Securities We Are Offering” beginning on page S-9.

We

have retained FT Global Capital, Inc. to act as the exclusive placement agent to use its best efforts to solicit offers from investors

to purchase the securities in this offering. The placement agent has no obligation to buy any securities from us or to arrange for the

purchase or sale of any specific number or dollar amount of securities. The placement agent is not purchasing or selling any Class A

Common Shares in this offering. We will pay the placement agent a fee equal to the sum of 8% of the aggregate purchase price paid by

investors placed by the placement agent. Additionally, we will issue to the placement agent warrants to purchase 174,249 Class A Common

Shares, which shall expire thirty-six (36) months after issuance and shall have no anti-dilution protection other than adjustments based

on stock splits, stock dividends, combinations of shares and similar recapitalization transactions. The placement agent warrants and

Class A Common Shares underlying such warrant are not being registered herein.

We

estimate the total expenses of this offering, excluding the placement agency fees, will be approximately $200,000. Because there is no

minimum offering amount, the actual offering amount, the placement agency fees and net proceeds to us, if any, in this offering may be

substantially less than the total offering amounts set forth above. We are not required to sell any specific number or dollar amount

of the securities offered in this offering. Assuming we complete the maximum offering, the net proceeds to us from this offering will

be approximately $3.4 million. We expect to deliver the shares to the purchasers on or before July 19, 2021.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.82

|

|

|

$

|

3,964,178.40

|

|

|

Placement agent fees(1)

|

|

$

|

0.1456

|

|

|

$

|

317,134.27

|

|

|

Offering proceeds to us, before expenses

|

|

$

|

1.6744

|

|

|

$

|

3,647,044.13

|

|

|

(1)

|

See

“Plan of Distribution” for additional information regarding total compensation payable to the placement agent, including

expenses for which we have agreed to reimburse the placement agent.

|

Our

business and holding our Class A Common Shares involve a high degree of risk. See “Risk Factors” beginning on page S-5 of

this prospectus supplement, on page 7 of the accompanying base prospectus and the risk factors described in the documents incorporated

by reference into this prospectus supplement and the accompanying base prospectus for more information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

FT

Global Capital, Inc.

The

date of this prospectus supplement is July 15, 2021

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone

else to provide you with additional or different information. We are offering to sell, and seeking offers to buy, Class A Common Shares

only in jurisdictions where offers and sales are permitted. You should not assume that the information in this prospectus supplement

or the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that any document incorporated

by reference is accurate as of any date other than its filing date.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the Class A Common Shares or possession

or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of

this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves

about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying prospectus

applicable to that jurisdiction.

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

February 4, 2019, we filed with the SEC a registration statement on Form F-3 (File No. 333-229505) utilizing a shelf registration process

relating to the securities described in this prospectus supplement, which registration statement was declared effective on February 13,

2019. Under this shelf registration process, we may, from time to time, sell up to $88 million in the aggregate of Class A Common Shares,

share purchase contracts, share purchase units, warrants, rights and units, of which approximately $76.6 million will remain available

for sale following the offering and as of the date of this prospectus supplement, excluding the shares issuable upon exercise of the

warrants issued in this and prior offerings.

The

two parts of this document include: (1) this prospectus supplement, which describes the specific details regarding this offering; and

(2) the accompanying base prospectus, which provides a general description of the securities that we may offer, some of which may not

apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. If information

in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus supplement. You

should read this prospectus supplement together with the additional information described below under the heading “Where You Can

Find More Information” and “Incorporation of Documents by Reference.”

Any

statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus

supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained

in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus

supplement modifies or supersedes that statement. Any statements so modified or superseded will be deemed not to constitute a part of

this prospectus supplement except as so modified or superseded. In addition, to the extent of any inconsistencies between the statements

in this prospectus supplement and similar statements in any previously filed report incorporated by reference into this prospectus supplement,

the statements in this prospectus supplement will be deemed to modify and supersede such prior statements.

The

registration statement that contains this prospectus supplement, including the exhibits to the registration statement and the information

incorporated by reference, contains additional information about the securities offered under this prospectus supplement. That registration

statement can be read on the SEC’s website or at the SEC’s offices mentioned below under the heading “Where You Can

Find More Information.”

We

are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying base prospectus

and any related free writing prospectus that we prepare or authorize. We have not authorized anyone to provide you with different or

additional information, and we take no responsibility for any other information that others may give you. If you receive any other information,

you should not rely on it.

This

prospectus supplement and the accompanying base prospectus do not constitute an offer to sell or the solicitation of an offer to buy

any securities other than the registered securities to which this prospectus supplement relates, nor do this prospectus supplement and

the accompanying base prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to

any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information in this prospectus supplement and the accompanying base prospectus is accurate at any date other

than the date indicated on the cover page of this prospectus supplement or that any information that we have incorporated by reference

is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of

operations or prospects may have changed since that date.

You

should not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed in connection with this

offering or that we may otherwise publicly file in the future because any such representation or warranty may be subject to exceptions

and qualifications contained in separate disclosure schedules, may represent the applicable parties’ risk allocation in the particular

transaction, may be qualified by materiality standards that differ from what may be viewed as material for securities law purposes or

may no longer continue to be true as of any given date.

Unless

stated otherwise or the context otherwise requires, references in this prospectus supplement and the accompanying base prospectus to

the “Company,” “Dogness,” “we,” “us” or “our” refer to Dogness (International)

Corporation.

CAUTIONARY

NOTE ON FORWARD LOOKING STATEMENTS

Certain

statements contained or incorporated by reference in this prospectus, including the documents referred to or incorporated by reference

in this prospectus or statements of our management referring to our summarizing the contents of this prospectus, include “forward-looking

statements”. We have based these forward-looking statements on our current expectations and projections about future events. Our

actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking statements.

Forward-looking statements are identified by words such as “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “plan,” “project” and other similar expressions. In addition, any statements that refer

to expectations or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements

included or incorporated by reference in this prospectus or our other filings with the Securities and Exchange Commission, or the SEC

include, but are not necessarily limited to, those relating to:

|

|

●

|

risks

and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future;

|

|

|

●

|

our

possible inability to raise or generate additional funds that will be necessary to continue and expand our operations;

|

|

|

●

|

our

potential lack of revenue growth;

|

|

|

●

|

our

potential inability to add new products and services that will be necessary to generate increased sales;

|

|

|

●

|

our

potential lack of cash flows;

|

|

|

●

|

our

potential loss of key personnel;

|

|

|

●

|

the

availability of qualified personnel;

|

|

|

●

|

international,

national regional and local economic political changes;

|

|

|

●

|

general

economic and market conditions;

|

|

|

●

|

increases

in operating expenses associated with the growth of our operations;

|

|

|

●

|

the

potential for increased competition; and

|

|

|

●

|

other

unanticipated factors.

|

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipate in our forward-looking statements.

Please see “Risk Factors” in our reports filed with the SEC or in a prospectus supplement related to this prospectus for

additional risks which could adversely impact our business and financial performance.

Moreover,

new risks regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the

impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from

those contained in any forward-looking statements. All forward-looking statements included in this prospectus are based on information

available to us on the date of this prospectus. Except to the extent required by applicable laws or rules, we undertake no obligation

to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent

written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by the cautionary statements contained above and throughout (or incorporated by reference in) this prospectus.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus. This summary does not contain

all of the information you should consider before investing in the securities. Before making an investment decision, you should read

the entire prospectus and any supplement hereto carefully, including the risk factors section as well as the financial statements and

the notes to the financial statements incorporated herein by reference.

In

this prospectus and any amendment or supplement hereto, unless otherwise indicated, the terms “Dogness (International) Corporation”,

“DOGZ”, the “Company”, “we”, “us”, and “our” refer and relate to Dogness

(International) Corporation and its consolidated subsidiaries.

Our

Company

Dogness

was incorporated as a British Virgin Islands company limited by shares under the BVI Business Companies Act, 2004, on July 11, 2016.

At Dogness we combine our research and development expertise with customer feedback to make products that improve pets’ lives.

We create and manufacture fun, useful and high-quality products for everyone to experience. We believe that high technology pet products

must be accessible and reliable to capture pet lovers’ imagination and to enhance their pets’ lives.

Dogness

has been making the highest quality collars, harnesses, and traditional and retractable leashes since 2003, featuring stylish design

and rugged engineering. Beginning with smart collars and harnesses in 2016, based on the belief that internet-connected products could

improve the lives of pets and their caregivers, Dogness developed a suite of smart products, moving past these first products into smart

feeders, fountains, treat dispensers and robots to interact with pets.

Dogness

focuses on connected pet care, to link pets and pet caregivers and ultimately to integrate the “Smart Pet Ecosystem” into

a single cohesive platform that integrates smart technology into pets’ lives. The Smart Pet Ecosystem has four major areas: smart

pet technology, pet care, leashes and collars, and pet health and wellness.

Dogness

has marketing and sales networks all over the world and has businesses in Dallas, Dongguan, Hong Kong and Zhangzhou. In addition, Dogness

is the process of registering an office in Tokyo. Senior management, R&D and production, marketing, customer service and finance

operate from Dogness’ headquarters in Dongguan, Guangdong Province, which also serves as the manufacturing base for smart products

and dog leashes. Dogness Group LLC in Dallas, Texas, USA serves as the sales and service center for all international markets and R&D

center for pet health and wellness. The company’s factory in Zhangzhou, Fujian serves as a material production base, responsible

for sample dyeing, ribbon dyeing and electroplating. One of Dogness’ competitive advantages comes from integrating the whole industrial

chain, including retraction ropes, textiles, printing and dyeing, mold development, and hardware and plastics. In addition, Dogness’

subsidiaries in the United States and Japan have R&D and design centers for pet smart products, forming a complete supply chain system

with manufacturing bases in China. We benefit from vertically integrated manufacturing operations, which allow us to design, machine

and assemble the vast majority of our products in house, so we can easily incorporate improvements in design.

Our

primary market is mainland China and the United States is the primary market for our export sales.

Corporate

Information

Our

principal executive offices are located at No. 16 N Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong, People’s Republic

of China. Our telephone number at this address is +86-769-8875-3300. Our Class A Common Shares are traded on the NASDAQ Global Market

under the symbol “DOGZ.”

Our

Internet website, www.dogness.com, provides a variety of information about our Company. We do not incorporate by reference into this

prospectus the information on, or accessible through, our website, and you should not consider it as part of this prospectus. Our Annual

Reports on Form 20-F and reports on Form 6-K filed with the United States Securities and Exchange Commission (the “SEC”)

are available, as soon as practicable after filing, at the investors’ page on our corporate website, or by a direct link to its

filings on the SEC’s free website.

THE

OFFERING

|

Class

A Common Shares offered by us pursuant to this prospectus supplement

|

|

2,178,120

|

|

|

|

|

|

Class

A Common Shares to be outstanding after this offering

|

|

22,733,934

|

|

|

|

|

|

Use

of proceeds

|

|

We

intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds”

on page S-6 of this prospectus supplement.

|

|

|

|

|

|

Risk

factors

|

|

Investing

in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest

in our Class A Common Shares, see the information contained in or incorporated by reference under the heading “Risk Factors”

beginning on page S-5 of this prospectus supplement, on page 7 of the accompanying prospectus, in our Annual Report on Form 20-F

for the fiscal year ended June 30, 2020 and in the other documents incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

Market

for the Class A Common Shares

|

|

Our

Class A Common Shares are quoted and traded on the NASDAQ Global Market under the symbol “DOGZ.”

|

Unless

specifically stated otherwise, the information in this prospectus supplement excludes:

|

●

|

2,503,975

Class A Common Shares issuable upon the exercise of outstanding share options with a weighted-average exercise price of $2.46 per

share;

|

RISK

FACTORS

Before

you make a decision to invest in our securities, you should consider carefully the risks described below, together with other information

in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein. If any of

the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely

affected. This could cause the trading price of our Class A Common Shares to decline and you may lose all or part of your investment.

The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial

may also significantly impair our business operations and could result in a complete loss of your investment.

RISKS

RELATED TO THIS OFFERING

Since

we have some discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you disagree.

We

have not allocated specific amounts of the net proceeds from this offering for any specific purpose. Accordingly, subject to any agreed

upon contractual restrictions under the terms of the securities purchase agreement, our management will have some flexibility in applying

the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds,

and subject to any agreed upon contractual restrictions under the terms of the purchase agreement, you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the net proceeds

will be invested in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds effectively

could have a material adverse effect on our business, financial condition, operating results and cash flow.

There

is no minimum offering amount required to consummate this offering.

There

is no minimum offering amount which must be raised in order for us to consummate this offering. Accordingly, the amount of money raised

may not be sufficient for us to meet our business objectives. Moreover, if only a small amount of money is raised, all or substantially

all of the offering proceeds may be applied to cover the offering expenses and we will not otherwise benefit from the offering. In addition,

because there is no minimum offering amount required, investors will not be entitled to a return of their investment if we are unable

to raise sufficient proceeds to meet our business objectives.

You

will experience immediate dilution in the book value per share you purchase.

Because

the price per share being offered is substantially higher than the book value per share of our Class A Common Shares, you will suffer

substantial dilution in the net tangible book value of the Class A Common Shares you purchase in this offering. After giving effect to

the sale by us of 2,178,120 Class A Common Shares in this offering, and based on a public offering price of $1.82 per share and a net

tangible book value per share of $2.10 as of December 31, 2020, if you purchase securities in this offering, you will suffer immediate

and substantial dilution of $0.24 per share in the net tangible book value of the Common Shares purchased. See “Dilution”

on page S-8 for a more detailed discussion of the dilution you will incur in connection with this offering.

A

large number of shares may be sold in the market following this offering, which may significantly depress the market price of our Class

A Common Shares.

The

Class A Common Shares sold in the offering will be freely tradable without restriction or further registration under the Securities Act.

As a result, a substantial number of our Class A Common Shares may be sold in the public market following this offering. If there are

significantly more Class A Common Shares offered for sale than buyers are willing to purchase, then the market price of our Class A Common

Shares may decline to a market price at which buyers are willing to purchase the offered Class A Common Shares and sellers remain willing

to sell our Class A Common Shares.

RISKS

RELATED TO THE CURRENT PANDEMIC

We

face risks related to health epidemics that could impact our sales and operating results.

Our

business could be adversely affected by the effects of a widespread outbreak of contagious disease, including the recent outbreak of

respiratory illness caused by a novel coronavirus first identified in Wuhan, Hubei Province, China. Any outbreak of contagious diseases,

and other adverse public health developments, particularly in China, could have a material and adverse effect on our business operations.

These could include disruptions or restrictions on our ability to resume the general shipping agency services, as well as temporary closures

of our facilities and ports or the facilities of our customers and third-party service providers. Any disruption or delay of our customers

or third-party service providers would likely impact our operating results and the ability of the Company to continue as a going concern.

In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could

adversely affect the economies and financial markets of China and many other countries, resulting in an economic downturn that could

affect demand for our services and significantly impact our operating results.

The

coronavirus disease 2019 (COVID-19) has had a significant impact on our operations since January 2020 and could materially adversely

affect our business and financial results during the 2021 calendar year.

Our

ability to manufacture and/or sell our products may be impaired by damage or disruption to our manufacturing, warehousing or distribution

capabilities, or to the capabilities of our suppliers, logistics service providers or distributors as a result of the impact from the

COVID-19. This damage or disruption could result from events or factors that are impossible to predict or are beyond our control, such

as raw material scarcity, pandemics, government shutdowns, disruptions in logistics, supplier capacity constraints, adverse weather conditions,

natural disasters, fire, terrorism or other events. In December 2019, COVID-19 emerged in Wuhan, China. In compliance with the government

mandates, the Company temporarily closed and its production operations were halted from late January 2020 through the middle of February

2020. During this closure, employees had only limited access to the Company’s facilities, which led to delayed order manufacturing,

assembly and fulfillment. While the spread of the disease has gradually returned under control in China, COVID-19 could adversely affect

our business and financial results in 2021 due to the effect of COVID-19 in our customers’ jurisdictions. As a result, there is

a possibility that the Company’s revenues and operating cash flows may be significantly lower than expected for fiscal year 2021.

USE

OF PROCEEDS

We

estimate that the net proceeds from the sale of the Shares offered by this prospectus supplement, after deducting the Placement Agent

fee and other estimated expenses of this offering payable by us, will be approximately $3.4 million.

Although

we have not yet determined with certainty the manner in which we will allocate the net proceeds of this offering, we expect to use the

net proceeds from this offering for working capital, capital expenditures, product development, and other general corporate purposes,

including investments in more sales and marketing in the United States and internationally. The precise amount and timing of the application

of these proceeds will depend on our funding requirements and the availability and costs of other funds. Accordingly, we will retain

broad discretion over the use of such proceeds.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our Class A Common Shares. We anticipate that we will retain any earnings to support

operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable

future. Any future determination relating to our dividend policy will be made at the discretion of our Board of Directors (the “Board”)

and will depend on a number of factors, including future earnings, capital requirements, financial conditions and future prospects and

other factors the Board may deem relevant. Payments of dividends to our company are subject to restrictions including primarily the restriction

that foreign invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange

business after providing valid commercial documents.

CAPITALIZATION

The

following table sets forth our capitalization as of December 31, 2020:

|

|

●

|

on

an actual basis; and

|

|

|

●

|

on

a pro forma basis to give effect to (i) the issuance of 3,455,130 of Class A Common Shares on January 20, 2021 for an aggregate

purchase price of $7,428,529.50, (ii) the issuance of 250,000 Class A Common Shares on April 15, 2021 to a consultant and

(iii) the cashless exercise of options resulting the issuance of 6,053 Class A Common Shares on February 18, 2021; and

|

|

|

●

|

on

a pro forma as adjusted basis to give effect to (i) the issuance of 3,455,130 of Class A Common Shares on January 20, 2021

for an aggregate purchase price of $7,428,529.50, (ii) the issuance of 250,000 Class A Common Shares on April 15, 2021 to a consultant,

(iii) the cashless exercise of options resulting the issuance of 6,053 Class A Common Shares on February 18, 2021 and (iv)

the issuance of 2,178,120 Class A Common Shares at the offering price of $1.82 per share, after deducting placement agent fees

and expenses and estimated offering expenses payable by us.

|

|

|

|

As of December 31, 2020

|

|

|

|

|

Actual

|

|

|

Pro forma

|

|

|

Pro forma

as adjusted

|

|

|

|

|

(in US$)

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares, $0.002 par value, 100,0000,000 shares authorized, 25,913,631 issued and outstanding (actual);

29,624,814 issued and outstanding (pro forma); and 31,802,934 issued and outstanding (pro forma as adjusted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Shares, 16,844,631 shares issued and outstanding at December 31, 2020 (actual);

20,555,814 shares issued and outstanding (pro forma); 22,733,934 shares issued and outstanding (pro forma as adjusted)

|

|

$

|

33,689

|

|

|

$

|

41,112

|

|

|

$

|

45,468

|

|

|

Class B Common Shares, 9,069,000 shares issued and outstanding

|

|

$

|

18,138

|

|

|

$

|

18,138

|

|

|

$

|

18,138

|

|

|

Additional paid in capital

|

|

$

|

53,292,689

|

|

|

$

|

60,264,953

|

|

|

$

|

63,719,640

|

|

|

Statutory reserve

|

|

$

|

194,401

|

|

|

$

|

194,401

|

|

|

$

|

194,401

|

|

|

Retained earnings

|

|

$

|

4,052,634

|

|

|

$

|

4,052,634

|

|

|

$

|

4,052,634

|

|

|

Accumulated other comprehensive loss

|

|

$

|

(1,666,480

|

)

|

|

$

|

(1,666,480

|

)

|

|

$

|

(1,666,480

|

)

|

|

Total shareholders’ equity

|

|

$

|

55,925,071

|

|

|

$

|

62,904,758

|

|

|

$

|

66,363,802

|

|

|

Non-controlling interest

|

|

$

|

645,378

|

|

|

$

|

645,378

|

|

|

$

|

645,378

|

|

|

Total equity

|

|

$

|

56,570,449

|

|

|

$

|

63,550,136

|

|

|

$

|

67,009,180

|

|

The

number of issued and outstanding shares as of December 31, 2020 in the table above excludes, as of such date:

|

●

|

2,503,975

Class A Common Shares issuable upon the exercise of outstanding share options with a weighted-average exercise price of $2.46 per

share;

|

DILUTION

Your

ownership interest, as a result of the issuance of the Class A Common Shares in this offering, will be diluted immediately to the extent

of the difference between the offering price per Class A Common Share and the pro forma net tangible book value per share of our Class

A Common Shares after this offering.

Our

historical net tangible book value as of December 31, 2020 was $54,332,243, or $2.10 per Common Share. Historical net tangible book value

per share represents the amount of our total tangible assets, less total liabilities, divided by the number of our Common Shares outstanding

as of December 31, 2020.

After

giving effect to the sale by us in this offering of 2,178,120 Class A Common Shares at a price per share of $1.82, after deducting estimated

placement agent fees and estimated offering expenses payable by us, our pro forma net tangible book value as of December 31, 2020 would

have been approximately $57,791,287, or approximately $2.06 per Common Share. This represents an immediate decrease in pro forma

net tangible book value of approximately $0.03 per Common Share to our existing Common Shareholders and an immediate dilution in pro

forma as adjusted net tangible book value of approximately $0.24 per Common Share to purchasers in this offering, as illustrated by the

following table:

|

Public offering price per share

|

|

|

|

|

|

$

|

1.82

|

|

|

Historical net tangible book value per share as of December 31, 2020

|

|

$

|

2.10

|

|

|

|

|

|

|

Decrease in pro forma as adjusted net tangible book value per share attributed

to the investors purchasing shares issued in this offering

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

Pro forma, as adjusted, net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

$

|

2.06

|

|

|

Dilution to pro forma, as adjusted, net tangible book value per share to new investors purchasing Shares in this offering

|

|

|

|

|

|

$

|

(0.24

|

)

|

The

following table summarizes as of December 31, 2020, on a pro forma basis, as described above, the number of our Common Shares, the total

consideration and the average price per share (1) paid to us by our existing shareholders and (2) issued to persons in this offering

at an offering price of $1.82 per share, before deducting estimated offering expenses payable by us:

|

|

|

Common Shares

Purchased

|

|

|

Total Consideration

|

|

|

Average

Price

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

Per Share

|

|

|

Existing shareholders

|

|

|

29,624,814

|

|

|

|

93.2

|

%

|

|

$

|

60,324,203

|

|

|

|

93.8

|

%

|

|

$

|

2.04

|

|

|

New investors

|

|

|

2,178,120

|

|

|

|

6.8

|

%

|

|

$

|

3,964,178

|

|

|

|

6.2

|

%

|

|

$

|

1.82

|

|

|

Total

|

|

|

31,802,934

|

|

|

|

100.0

|

%

|

|

$

|

64,288,381

|

|

|

|

100.0

|

%

|

|

$

|

2.02

|

|

The

total number of shares of our common stock reflected in the discussion and tables above is based on 29,624,814 Common Shares outstanding

as of July 15, 2021 and excludes:

|

●

|

2,503,975

Class A Common Shares issuable upon the exercise of outstanding share options with a weighted-average exercise price of $2.46 per

share;

|

DESCRIPTION

OF OUR SECURITIES WE ARE OFFERING

Common

Shares

A

description of our Class A Common Shares we are offering pursuant to this prospectus supplement is set forth under the heading “Description

of Share Capital,” starting on page 9 of the accompanying prospectus. The Description of Share Capital also sets forth the terms

of our Class B Common Shares, which are not being offered in this offering. As of July 15, 2021, we had 29,624,814 outstanding

Class A Common Shares and 9,069,000 Class B Common Shares.

Transfer

Agent and Registrar

The

transfer agent and registrar for the Class A Common Shares is TranShare Corporation, Bayside Center

1, 17755 North US Highway 19 Suite 140, Clearwater, Florida 33764.

Listing

Our

Class A Common Shares are listed on the NASDAQ Global Market under the symbol “DOGZ”.

PLAN

OF DISTRIBUTION

Placement

Agency Agreement and Securities Purchase Agreement

FT

Global Capital, Inc., which we refer to as the placement agent, has agreed to act as the exclusive placement agent in connection with

this offering subject to the terms and conditions of a placement agency agreement dated as of July 15, 2021. The placement agent is not

purchasing or selling any securities offered by this prospectus supplement, nor is it required to arrange the purchase or sale of any

specific number or dollar amount of securities, but it has agreed to use its reasonable efforts to arrange for the sale of all of the

securities offered hereby.

We

will enter into a securities purchase agreement with the purchasers pursuant to which we will sell to the purchasers 2,178,120 Class

A Common Shares at a price of $1.82 per share. We negotiated the price for the securities offered in this offering with the purchasers.

The factors considered in determining the price included the recent market price of our Class A Common Shares, the general condition

of the securities market at the time of this offering, the history of, and the prospects, for the industry in which we compete, our past

and present operations, and our prospects for future revenues.

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any fees or commissions

received by it and any profit realized on the resale of securities sold by it while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the placement agent is required to comply with the requirements

of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and

Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of Class A Common Shares

by the placement agent. Under these rules and regulations, the placement agent:

●

may not engage in any stabilization activity in connection with our securities; and

●

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution.

From

time to time in the common course of their respective businesses, the placement agent or its affiliates have in the past or may in the

future engage in investment banking and/or other services with us and our affiliates for which it has or may in the future receive customary

fees and expenses. In January 2021, the placement agent in connection with this Offering served as our placement agent in connection

with the issuance and sale of 3,455,130 Class A Common Shares and warrants to purchase an aggregate of 1,727,565 Class A Common Shares

with a per share exercise price of $2.70. In connection with such offering, we (i) paid the placement agent a cash fee equal to 8% of

the aggregate purchase price of the securities sold, (ii) reimbursed the placement agent for expenses incurred by it in connection with

the offering in the amount of $40,000; and (iii) issued the placement agent a warrant to purchase 8% of the Class A Common Shares sold

to the purchasers (or 276,410 Class A Common Shares) at an exercise price of $2.70 per share.

Under

the securities purchase agreement, we will be precluded from engaging in equity or equity-linked securities offerings for a period of

90 days from closing of the offering, subject to certain exceptions.

In

addition, we also agreed with the purchasers that for twelve months following this offering, we will not effect or enter into an agreement

to effect a “Variable Rate Transaction,” which means a transaction in which we:

●

issue or sell any convertible securities either (A) at a conversion, exercise or exchange rate or other price that is based upon and/or

varies with the trading prices of, or quotations for, the shares of our Class A Common Shares at any time after the initial issuance

of such convertible securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date

after the initial issuance of such convertible securities or upon the occurrence of specified or contingent events directly or indirectly

related to our business or the market for our Class A Common Shares, other than pursuant to a customary “weighted average”

anti-dilution provision; or

●

enter into any agreement (including, without limitation, an “equity line of credit”) whereby we may sell securities at a

future determined price (other than standard and customary “preemptive” or “participation” rights).

We

agreed with the purchasers that, subject to certain exceptions, if we issue securities within the 12 months following the closing of

this offering, the purchasers shall have the right to purchase 35% of the securities on the same terms, conditions and price provided

for in the proposed issuance of securities.

We

also agreed to indemnify the purchasers against certain losses resulting from our breach of any of our representations, warranties, or

covenants under agreements with the purchasers as well as under certain other circumstances described in the securities purchase agreement.

Fees

and Expenses

We

have agreed to pay the placement agent upon the closing of this offering a cash fee equal to 8% of the aggregate purchase price of the

securities offered under this prospectus supplement and accompanying prospectus. In addition, we have agreed to pay additional compensation

in the form of warrants to purchase 8% of the Class A Common Shares to be sold to the purchasers (or 174,249 Class A Common Shares assuming

the maximum offering is completed) at an exercise price of $1.82 per share. Under the placement agent agreement, the placement agent

is also entitled to additional tail compensation for any financings consummated within the twelve month period following the closing

date of this offering to the extent that such financing is provided to us by investors that the placement agent had introduced to us.

The

warrant issuable to the placement agent shall expire thirty-six (36) months after the warrants are issued and shall have no anti-dilution

protection other than adjustments based on stock splits, stock dividends, combinations of shares and similar recapitalization transactions.

Pursuant to FINRA Rule 5110(e)(1), with limited exceptions, neither the placement agent warrants nor any of the Class A Common Shares

issued upon exercise of the placement agent warrants shall be sold, transferred, assigned, pledged, or hypothecated, or be the subject

of any hedging, short sale, derivative, put, or call transaction that would result in the effective economic disposition of the securities

by any person for a period of 180 days immediately following the date commencement of sales in this offering.

Because

there is no minimum offering amount in this offering, the actual total placement agent fees are not presently determinable.

We

are obligated to reimburse the placement agent for expenses incurred by it in connection with the offering, not to exceed $40,000.

We

have agreed to indemnify the placement agent and certain other persons against certain liabilities, including liabilities under the Securities

Act of 1933, as amended. We also have agreed to contribute to payments the placement agent may be required to make in respect of such

liabilities.

After

deducting fees due to the placement agent and our estimated offering expenses, we expect the net proceeds from this offering to be approximately

$3.4 million assuming completion of the maximum offering.

Delivery

of Class A Common Shares

Delivery

of our Class A Common Shares issued and sold in this offering will occur on or before July 19, 2021.

LEGAL

MATTERS

Certain

legal matters relating to the offering of Class A Common Shares under this prospectus supplement will be passed upon for us by Campbells

with respect to matters of British Virgin Islands law and by Kaufman & Canoles, P.C., Richmond, Virginia, with respect to matters

of U.S. law. Certain legal matters in connection with this offering will be passed upon for the placement agent by Schiff Hardin LLP,

Washington, D.C., with respect to U.S. law.

EXPERTS

The

consolidated financial statements of our Company for the years ended June 30, 2020 and 2019 appearing in our annual report on Form 20-F

for the fiscal years ended June 30, 2020 have been audited by Friedman LLP, independent registered public accounting firm, as set forth

in the reports thereon included therein and incorporated herein by reference. Such consolidated financial statements are incorporated

herein by reference in reliance upon such report given on the authority of such firm as an expert in accounting and auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

All

documents filed by the registrant after the date of filing the initial registration statement on Form F-3 of which this prospectus forms

a part and prior to the effectiveness of such registration statement pursuant to Section 13(a), 13(c), 14 and 15(d) of the Securities

Exchange Act of 1934 shall be deemed to be incorporated by reference into this prospectus and to be part hereof from the date of filing

of such documents. In addition, the documents we are incorporating by reference as of the date hereof are as follows:

(1)

Our Annual Report on Form 20-F for the year ended June 30, 2020, filed on October 30, 2020;

(2)

Our Report on Form 6-K filed on January 15, 2021, January 19, 2021, January 20, 2021, March 23, 2021, April 4, 2021, May 19, 2021, and

June 4, 2021;

(3)

All other reports filed by the Registrant pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered

by the Annual Report on Form 20-F referred to in the paragraph above;

(4)

The description of the Class A Common Shares, $0.002 par value per share, contained in the Registrant’s registration statement

on Form F-3 filed with the SEC on February 4, 2019 (File Number 333-229505), and declared effective by the SEC on February 13, 2019;

and

(5)

The description of our 2017 Share Incentive Plan in our Registration Statement on Form S-8 (File 333-226985) filed pursuant to Rule 428

of the Securities Act on August 23, 2018.

Any

statement contained in a document we incorporate by reference will be modified or superseded for all purposes to the extent that a statement

contained in this prospectus (or in any other document that is subsequently filed with the Securities and Exchange Commission and incorporated

by reference herein prior to the termination of this offering) modifies or is contrary to that previous statement. Any statement so modified

or superseded will not be deemed a part of this prospectus except as so modified or superseded.

You

may obtain a copy of these filings, without charge, by writing or calling us at:

Dogness

(International) Corporation

No.

16 N Dongke Road, Tongsha Industrial Zone,

Dongguan,

Guangdong, People’s Republic of China.

+86-769-8875-3300

Attn:

Investor Relations

You

should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not

authorized anyone else to provide you with different information. You should not assume that the information in this prospectus or any

prospectus supplement is accurate as of any date other than the date on the front page of those documents.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed a registration statement with the Securities and Exchange Commission under the Securities Act of 1933, as amended, with respect

to the Class A Common Shares offered by this prospectus. This prospectus is part of that registration statement and does not contain

all the information included in the registration statement.

For

further information with respect to our Class A Common Shares and us, you should refer to the registration statement, its exhibits and

the material incorporated by reference therein. Portions of the exhibits have been omitted as permitted by the rules and regulations

of the Securities and Exchange Commission. Statements made in this prospectus as to the contents of any contract, agreement or other

document referred to are not necessarily complete. In each instance, we refer you to the copy of the contracts or other documents filed

as an exhibit to the registration statement, and these statements are hereby qualified in their entirety by reference to the contract

or document.

The

registration statement may be inspected and copied at the public reference facilities maintained by the Securities and Exchange Commission

at Room 1024, Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549 and the Regional Offices at the Commission located in the Citicorp

Center, 500 West Madison Street, Suite 1400, Chicago, Illinois 60661, and at 233 Broadway, New York, New York 10279. Copies of those

filings can be obtained from the Commission’s Public Reference Section, Judiciary Plaza, 100 F Fifth Street, N.E., Washington,

D.C. 20549 at prescribed rates and may also be obtained from the web site that the Securities and Exchange Commission maintains at http://www.sec.gov.

You may also call the Commission at 1-800-SEC-0330 for more information. We file annual, quarterly and current reports and other information

with the Securities and Exchange Commission. You may read and copy any reports, statements or other information on file at the Commission’s

public reference room in Washington, D.C. You can request copies of those documents upon payment of a duplicating fee, by writing to

the Securities and Exchange Commission.

DISCLOSURE

OF COMMISSION POSITION ON

INDEMNIFICATION FOR SECURITIES LAW VIOLATIONS

British

Virgin Islands law does not limit the extent to which a company’s articles of association may provide for indemnification of officers

and directors, except to the extent any such provision may be held by the British Virgin Islands courts to be contrary to public policy,

such as to provide indemnification against civil fraud or the consequences of committing a crime. Under our memorandum and articles of

association, we may indemnify our directors, officers and liquidators against all expenses, including legal fees, and against all judgments,

fines and amounts paid in settlement and reasonably incurred in connection with civil, criminal, administrative or investigative proceedings

to which they are party or are threatened to be made a party by reason of their acting as our director, officer or liquidator. To be

entitled to indemnification, these persons must have acted honestly and in good faith with a view to our best interest and, in the case

of criminal proceedings, they must have had no reasonable cause to believe their conduct was unlawful.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us

pursuant to the foregoing provisions, we have been informed that in the opinion of the Commission such indemnification is against public

policy as expressed in the Securities Act and is therefore unenforceable.

DOGNESS

(INTERNATIONAL) CORPORATION

$88,000,000

Class

A Common Shares, Share Purchase Contracts, Share Purchase Units,

Warrants,

Debt Securities, Rights and Units

We

may offer and sell, from time to time in one or more offerings on terms we may determine at the time of offering, any combination of

Class A Common Shares, warrants, debt securities, rights, share purchase contracts, share purchase units or units having an aggregate

initial offering price of up to $88,000,000.

We

will provide the specific terms of these securities in supplements to this prospectus. The prospectus supplement may also add, update

or change information in this prospectus. Before you invest, we urge you to read carefully this prospectus and any prospectus supplement,

as well as the documents incorporated by reference or deemed to be incorporated by reference into this prospectus.

These

securities may be offered and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or

directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities, their compensation

and any over-allotment options held by them will be described in the applicable prospectus supplement. For a more complete description

of the plan of distribution of these securities, see the section entitled “Plan of Distribution” beginning on page 25 of

this prospectus.

Our

Class A Common Shares are listed on the NASDAQ Global Market under the symbol “DOGZ”. On February 1, 2019, the closing sale

price of our Common Shares as reported by the NASDAQ Global Market was $3.90. We have not offered any securities pursuant to General

Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus. We will

provide information in any applicable prospectus supplement regarding any listing of securities other than our Common Shares on any securities

exchange.

This

prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement. The information contained or

incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this prospectus, or such prospectus

supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of our securities.

Investing

in our securities being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the

risk factors beginning on page 7 of this prospectus and in the applicable prospectus supplement before you make your investment decision.

Neither

the Securities and Exchange Commission, British Virgin Islands, nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 13, 2019

Table

of Contents

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized any person to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate

as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have

changed since those dates.

Prospectus

Summary

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) using a

shelf registration process. Under this shelf registration process, we may offer from time to time, in one or more offerings, securities

having an aggregate initial offering price of up to $88,000,000 (or its equivalent in foreign or composite currencies). This prospectus

provides you with a general description of the securities that may be offered. Each time we offer securities under this shelf registration

statement, we will provide you with a prospectus supplement that describes the specific amounts, prices and terms of the securities being

offered. The prospectus supplement also may add, update or change information contained in this prospectus. You should read carefully

both this prospectus and any prospectus supplement together with additional information described below under the caption “Where

You Can Find More Information,” before making an investment decision. We have incorporated exhibits into this registration statement.

You should read the exhibits carefully for provisions that may be important to you.

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized any person to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate

as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have

changed since those dates.

We

may sell securities through underwriters or dealers, through agents, directly to purchasers or through a combination of these methods.

We and our agents reserve the sole right to accept or reject, in whole or in part, any proposed purchase of securities. The prospectus

supplement, which we will provide to you each time we offer securities, will set forth the names of any underwriters, agents or others

involved in the sale of securities and any applicable fee, commission or discount arrangements with them. See the information described

below under the heading “Plan of Distribution.”

Except

where the context otherwise requires and for purposes of this prospectus only, “we”, “us”, “our company”,

“Company”, “our”, “Dogness” and “DOGZ” refer to

|

|

●

|

Dogness

(International) Corporation, a British Virgin Islands business company (“Dogness” when individually referenced), which

is the parent holding company issuing securities hereby);

|

|

|

|

|

|

|

●

|

Jiasheng

Enterprise (Hongkong) Co., Limited, a Hong Kong company (“HK Jiasheng” when individually referenced), which is a wholly

owned subsidiary of Dogness;

|

|

|

|

|

|

|

●

|

Dogness

(Hongkong) Pet’s Products Co., Limited, a Hong Kong company (“HK Dogness” when individually referenced), which

is a wholly owned subsidiary of Dogness;

|

|

|

|

|

|

|

●

|

Dogness

Intelligent Technology (Dongguan) Co., Ltd., a PRC company (“Dongguan Dogness”), which is a wholly owned subsidiary of

HK Dogness;

|

|

|

|

|

|

|

●

|

Dongguan

Jiasheng Enterprise Co., Ltd., a PRC company (“Dongguan Jiasheng”), which is a wholly owned subsidiary of Dongguan Dogness;

|

|

|

|

|

|

|

●

|

Dogness

Group LLC (“Dogness Group”), a Delaware limited company, which is a wholly owned subsidiary of Dogness Overseas; and

|

|

|

|

|

|

|

●

|

Dogness

Overseas Ltd (“Dogness Overseas”), a British Virgin Islands business company, which is owned by Dogness.

|

Our

Company

Overview

Technology

can bring pets and their caregivers closer together. At Dogness we combine our research and development expertise with customer feedback

to make products that improve pets’ lives. We create and manufacture fun, useful and high-quality products for everyone to experience.

We believe that high technology pet products must be accessible and reliable to capture pet lovers’ imagination and to enhance

their pets’ lives.

Dogness

has been making the highest quality collars, harnesses, and traditional and retractable leashes since 2003, featuring stylish design

and rugged engineering. Beginning with smart collars and harnesses in 2016, based on the belief that internet-connected products could

improve the lives of pets and their caregivers, Dogness developed a suite of smart products, moving past these first products into smart

feeders, fountains, treat dispensers and robots to interact with pets.

Dogness

focuses on connected pet care, to link pets and pet caregivers and ultimately to integrate the “Smart Pet Ecosystem” into

a single cohesive platform that integrates smart technology into pets’ lives. The Smart Pet Ecosystem has four major areas: smart

pet technology, pet care, leashes and collars, and pet health and wellness.

Smart

Pet Technology

Through

a single platform, the Dogness mobile app, the Company’s smart products allow pet owners to remotely see, hear, speak, feed, play,

and interact with their pets in different ways. We accomplish all of this with a tool the owner likely already has, a smart phone. The

Dogness app is available for both Android and iOS and communicates with the smart product anywhere the phone and smart product both have

wifi or cellular service. If your dog will listen to you from across the room, you can tell her to roll over from around the world

Dogness

Smart Wearables: Our smart wearable collars and harnesses feature integrated electronics, which allows us to pair high quality collars

with a lightweight smart component and LED lights. We have focused on the important details for dog owners, allowing owners to locate

their pets, direct their pets’ movements, communicate with their dogs, provide tailored instantaneous feedback to problem barking

and keep track of exercise and other biodata.

Dogness

Smart iPet Robot: Pet owners will be able to see their pets through a camera, hear their pets through a built-in microphone, interact

with their pets by feeding them treats, and play with their pets through an interactive laser pointer. Pet owners have full control over

the 360-degree mobility of the robot through the Dogness app and can securely take and save pictures and videos of their dogs.

Dogness

Mini Treat Robot: Space-conscious pet owners can see their pets through a stationary tilting camera that securely records photo and

video, hear their pets through a built-in microphone, interact with their pets by feeding them treats, and play with them through an

interactive laser pointer.

Dogness

Smart CAM Feeder: Pet owners can now ensure that their pets are well-fed and on-schedule. Able to hold around 6.5 pounds of dry food,

the smart feeder helps pet owners ensure the health of their pets, even when away from home. Pet owners can see their pets’ eating

habits night and day through a built-in camera with night vision and call their pets to the feeder through a voice recording that can

be programmed to be played at meal times.

Dogness

Smart Fountain: The smart fountain ensures that pets stay hydrated with a source of clean filtered water from a patented filtering

technology. Additional features include an oxygenating, free-falling, recirculating water stream for optimal freshness, the ability to

increase or decrease the flow of water, a replaceable carbon water filter and a nano filter to maintain water freshness, a submersible

pump for quiet operation, dishwasher-safe material, and an easily assembled and disassembled design.

Dogness

Smart CAM Treater: Allows pet owners to see their pets night and day through a 160-degree full HD camera with night vision, hear

their pets through a built-in microphone, interact with their pets by speaking to them through a built-in speaker, and play with their

pets by tossing them treats.

Pet

Care

Our

pet care products currently focus on high quality pet shampoos. We launched these shampoo products in August 2018.

We

have two lines of shampoos, which are focused on and tailored to Chinese online and offline consumption. Our One on One Service line

is focused on consumer purchasers and consists of dog and cat shampoo products that feature natural plant and amino acid composition.

In addition to universal-purpose products, we have also developed seven breed-tailored shampoo products for golden retrievers, poodles,

huskies, bulldogs, border collies and corgis. Our Professional Bathing & Spa line is focused on professional purchasers, like dog

and cat groomers. These products consist of bathing products, hair conditioners and essential oil products.

Leashes

and Collars

Traditional

Product Lines: We produce collars, harnesses and leashes in seven main series (Classic, Elegance, Luxury, LED, Holiday, Special Function,

and Cat series). Given the choices available to customers, we currently manufacture between 500 and 600 traditional products and can

add additional options to meet customer preferences. Our traditional product lines use leather, nylon, Teflon-coated fabrics and other

materials to suit consumer preferences. Not only do we produce these products; we also design fabric patterns and invent improved components

such as a comfort curved buckle for collars and locking closing mechanism for leashes.

Retractable

Leashes: In addition to our newest smart products, we have devoted significant effort to designing and manufacturing some of the

finest retractable leashes available. Retractable leashes balance freedom for the dog with control for the owner. If used well, a retractable

leash promotes good communication between the two, as the dog has exactly as much room to roam as the owner permits, and this amount

can be adjusted to suit the environment and circumstances. Dogness also offers an updated retractable leash to enhance the pet walking

experience. The new leash allows pet owners to attach Dogness accessories to their retractable leashes, which currently include an LED

light for better visibility in low light settings; a convenience box to store items such as doggie bags, treats, or keys; and a Bluetooth

speaker to listen to music or answer calls.

Other

Products: In addition to collars, leashes and harnesses, we also produce lanyards for use by humans and ornaments that attach to

collars. As to the lanyards, we produce such lanyards using our fabric weaving machines. Because we have our production in-house, we

can design lanyards that match a customer’s need, in terms of color, size, quantity and pattern. Our hanging ornament series uses

high-quality electroplating techniques to create fashionable accents for pet collars. We make a variety of patterns in bright and vibrant

colors, as well as custom bells for cat collars.

Pet

Health and Wellness

One

of our new research areas is pet-focused health and wellness products. While we do not currently offer these products for sale, we are

currently developing supplements and nutrition products in consultation with veterinarians and pharmacists and anticipate introducing

these products in the near term.

Operations

Dogness

has marketing and sales networks all over the world and has businesses in Dallas, Dongguan, Hong Kong and Zhangzhou. In addition, Dogness

is the process of registering an office in Tokyo. Senior management, R&D and production, marketing, customer service and finance

operate from Dogness’ headquarters in Dongguan, Guangdong Province, which also serves as the manufacturing base for smart products

and dog leashes. Dogness Group LLC in Dallas, Texas, USA serves as the sales and service center for all international markets and R&D

center for pet health and wellness. The company’s factory in Zhangzhou, Fujian serves as a material production base, responsible

for sample dyeing, ribbon dyeing and electroplating. One of Dogness’ competitive advantages comes from integrating the whole industrial

chain, including retraction ropes, textiles, printing and dyeing, mold development, and hardware and plastics. In addition, Dogness’

subsidiaries in the United States and Japan have R&D and design centers for pet smart products, forming a complete supply chain system

with manufacturing bases in China. We benefit from vertically integrated manufacturing operations, which allow us to design, machine

and assemble the vast majority of our products in house, so we can easily incorporate improvements in design.

Intellectual

Property

From

2015 to 2017, Dogness has owned over 120 approved and pending patents. Unique patents such as switches, webbing, retractable leashes

and buckles reflect the uniqueness and innovation of Dogness. After listing on NASDAQ in 2017, Dogness has continued to invest in product

research and development. In 2018, Dogness won four international patents in the pet smart category and has more than 20 new patents

pending.

General

Description of the Securities We May Offer

We

may offer our Class A Common Shares, share purchase contracts, share purchase units, warrants, debt securities, rights or units, with

a total value of up to $88,000,000 from time to time under this prospectus at prices and on terms to be determined by our board of directors

and based on market conditions at the time of any offering. This prospectus provides you with a general description of the securities

we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will

describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

|

|

●

|

Designation

or classification;

|

|

|

|

|

|

|

●

|

Aggregate

offering price;

|

|

|

●

|

Rates

and times of payment of dividends, if any;

|

|

|

|

|

|

|

●

|

Redemption,

conversion, exercise and exchange terms, if any;

|

|

|

|

|

|

|

●

|

Restrictive

covenants, if any;

|

|

|

|

|

|

|

●

|

Voting

or other rights, if any;

|

|

|

|

|

|

|

●

|

Conversion

prices, if any; and

|

|

|

|

|

|

|

●

|

Material

U.S. federal income tax considerations.

|

The

prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change

information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free

writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of

the registration statement of which this prospectus is a part.

Risk

Factors

Before

making an investment decision, you should carefully consider the risks described under “Risk Factors” in the applicable prospectus

supplement and in our then most recent Annual Report on Form 20-F, or included in any Annual Report on Form 20-F filed with the SEC after

the date of this prospectus or Reports on Form 6-K furnished to the SEC after the date of this prospectus, together with all of the other

information appearing in this prospectus or incorporated by reference into this prospectus and any applicable prospectus supplement,

in light of your particular investment objectives and financial circumstances. Please see “Where You Can Find More Information”