SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Schedule 14C Information

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

|

|

☐

|

Preliminary Information Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

☒

|

Definitive Information Statement

|

QDM INTERNATIONAL INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the Appropriate Box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which the transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials

|

|

|

☐

|

check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

QDM INTERNATIONAL

INC.

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

July 15, 2021

Dear Stockholders:

We are furnishing the attached

Information Statement to the holders of common stock, par value $0.0001 per share (the “Common Stock”), of QDM International

Inc., a Florida corporation (the “Company,” “we,” “us” or “our”). The purpose of

the Information Statement is to notify stockholders that, in lieu of a special meeting of the stockholders of the Company, and pursuant

to the Florida Business Corporation Act (the “FBCA”), the Board of Directors of the Company (the “Board”) and

Huihe Zheng, the Chairman, President and Chief Executive Officer of the Company and the holder of approximately 89.0% of our outstanding

voting power as of the record date (the “Voting Stockholder”), have by written consent approved and adopted an amendment

to our Articles of Incorporation, as amended (the “Articles of Incorporation”), to effect a reverse stock split of our issued

and outstanding Common Stock at a ratio between one-for-twenty and one-for-thirty five (the “Reverse Split”), with such final

ratio to be determined at the sole discretion of the Board (or its designee or designees) and with such Reverse Split to be effected

at such time and date, if at all, as determined by the Board in its sole discretion (provided that it is effected within one year of

the date on which the stockholders of the Corporation approve the Reverse Split).

This notice and Information

Statement shall constitute notice to you of the Voting Stockholder taking action by written consent under Section 607.0704 of the FBCA.

The accompanying Information Statement

is being provided to you for your information to comply with the requirements of Regulation 14C of the Securities Exchange Act of 1934,

as amended (“Exchange Act”). This Information Statement constitutes notice to you of the aforementioned corporate action to

be taken without a meeting, by less than unanimous consent of our stockholders, pursuant to Section 607.0704 of the FBCA. You are urged

to read this Information Statement carefully in its entirety. However, no action is required on your part in connection with this document,

including with respect to the approval of the Reverse Split. No meeting of our stockholders will be held or proxies requested because

we have received written consent to this matter from the Voting Stockholder who holds a majority of the aggregate issued and outstanding

shares of our voting stock.

Under Rule 14c-2(b) of the

Exchange Act, the action described in the Information Statement may not be taken earlier than 20 calendar days after we have sent or

given the Information Statement to our stockholders. We intend to distribute this Notice and Information Statement to our

stockholders on or about July 21, 2021. The record date established for purposes of determining the number of issued and outstanding

shares of voting stock, and thus voting power, was July 2, 2021.

THIS IS FOR YOUR INFORMATION ONLY. YOU DO NOT

NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER

MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

|

|

Sincerely

|

|

|

|

|

|

/s/

Huihe Zheng

|

|

|

Name: Huihe Zheng

|

|

|

Title: President and Chief Executive Officer

|

|

|

|

QDM INTERNATIONAL

INC.

Room 715, 7F, The Place

Tower C, No. 150 Zunyi Road

Changning District, Shanghai,

China 200051

+86 (21) 22183083

INFORMATION STATEMENT

We Are Not Asking You

for a Proxy and

You Are Requested Not

To Send Us a Proxy

INTRODUCTION

This Information Statement is

being furnished to the stockholders of QDM International Inc. (the “Company,” “we,” “us,” or “our”)

in connection with the actions to be taken by us as a result of a written consent in lieu of a special meeting of stockholders pursuant

to the Florida Business Corporation Act (the “FBCA”), dated July 2, 2021.

This Information Statement and Notice of Stockholder Action by Written

Consent is being furnished by us to our stockholders of record as of July 2, 2021 (the “Record Date”), to inform our stockholders

that the Board of Directors of the Company (the “Board”) and Huihe Zheng, the Chairman, President and Chief Executive Officer

of the Company and the holder of approximately 89.0% of our outstanding voting power as of the Record Date (the “Voting Stockholder”),

have taken and approved the following action (the “Corporate Action”) by written consent to approve an amendment (the “Amendment”)

to our Articles of Incorporation, as amended (the “Articles of Incorporation”) to effect a reverse stock split of our issued

and outstanding Common Stock at a ratio between one-for-twenty and one-for-thirty five (the “Reverse Split”), with such final

ratio to be determined at the sole discretion of the Board (or its designee or designees) and with such Reverse Split to be effected at

such time and date, if at all, as determined by the Board in its sole discretion (provided that it is effected within one year of the

date on which the stockholders of the Corporation approve the Reverse Split).

This Information Statement is being sent to you to notify you of the Corporate Action being taken by written consent

in lieu of a special meeting of our stockholders. On the Record Date, our Board and the Voting Stockholder, representing approximately

89.0% of the voting power of our Company as of the Record Date, adopted and approved the Reverse Split.

The ability to proceed without

a special meeting of the stockholders to approve, adopt and/or ratify the Corporate Action is authorized by Section 607.0704 of the FBCA

which provides that, unless otherwise provided in our Articles of Incorporation, action required or permitted to be taken at a meeting

of our stockholders may be taken without a meeting if a written consent that sets forth the action so taken is signed by stockholders

holding at least a majority of the voting power of the Company and delivered to the Company, except that if a different proportion of

voting power is required for such an action at a meeting, then that proportion of written consents is required. Such consent shall have

the same force and effect as a majority vote of the stockholders and may be stated as such in any document. Our Articles of Incorporation

does not contain any provisions contrary to the provisions of Section 607.0704 of the FBCA. Thus, to eliminate the costs to us and management

time involved in holding a special meeting, and in order to take the Corporate Action as described in this Information Statement, one

of our stockholders representing in excess of 50% of the voting stock executed and delivered a written consent to us.

We are distributing this Information

Statement to our stockholders in full satisfaction of any notice requirements we may have under the FBCA and of Regulation 14C of the

Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

This Information Statement is

dated as of and is first being sent or given to our stockholders of record on or about July 21, 2021.

On the Record Date, there were

6,238,553 shares of our Common Stock, 13,500 shares of Series B Preferred Stock and 531,886 shares of Series C Convertible Preferred

Stock issued and outstanding and entitled to notice of and to vote on all matters presented to stockholders. The required vote for the

adoption of the Amendment and the approval of the Reverse Split was a majority of the issued and outstanding shares of Common Stock, Series

B Preferred Stock and Series C Convertible Preferred Stock, voting together as a single class. On the Record Date, the Voting Stockholder,

as the holder of record of approximately 89.0% of the outstanding shares of our voting stock, executed a written consent adopting, approving

and ratifying the Corporate Action. When actions are taken by written consent of less than all of the stockholders entitled to vote on

a matter, Section 607.0704 of the FBCA requires notice of the action to those stockholders who did not vote. This Information Statement

and the accompanying notice constitute notice to you of action by written consent as required by Section 607.0704 of the FBCA. Because

we have obtained sufficient stockholder approval of the Corporate Action, no other consents or votes will be solicited in connection with

this Information Statement.

WE ARE NOT ASKING YOU FOR A

PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Under federal securities laws,

the Corporate Action may not be completed until 20 calendar days after the date of distribution of this Information Statement to our stockholders.

Therefore, notwithstanding the execution and delivery of the written consent, the Corporate Action will not occur until that time has

elapsed.

Dissenters’ Rights of Appraisal

Under FBCA, the Company’s

stockholders of Common Stock are not entitled to appraisal right with respect to the Reverse Split.

Information Statement Costs

The entire

cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries

and other like parties to forward this Information Statement to the beneficial owners of the voting stock held of record by them and will

reimburse such persons for their reasonable charges and expenses in connection therewith.

Vote Required to Approve

the Corporate Action

As of the

Record Date, there were 6,238,553 shares of our Common Stock, 13,500 shares of Series B Preferred Stock and 531,886 shares of Series

C Convertible Preferred Stock issued and outstanding and entitled to notice of and to vote on all matters presented to stockholders. The

affirmative vote of a majority of the shares of Common Stock, Series B Preferred Stock and Series C Convertible Preferred Stock entitled

to vote is required for approval of the Corporate Action.

Proposals by Security Holders

No stockholder has requested

that we include any additional proposals in this Information Statement.

THIS IS NOT A NOTICE OF A

MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE COMPANY’S

VOTING STOCKHOLDER HAS VOTED TO APPROVE THE CORPORATE ACTION. THE NUMBER OF VOTES HELD BY THE VOTING STOCKHOLDER EXECUTING THE CONSENT

IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH MATTER UNDER APPLICABLE LAW AND THE COMPANY’S CHARTER, SO NO

ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THIS ACTION.

FORWARD-LOOKING STATEMENTS

Certain

statements included in this Information Statement regarding the Company are forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. This information may involve known and unknown risks,

uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future

results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve

assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,”

“will,” “should,” “expect,” “anticipate,” “estimate,” “believe,”

“intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors. In light

of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Information Statement

will in fact occur. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking

statements, whether as a result of new information, future events or otherwise.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth

certain information known to us with respect to the beneficial ownership of our voting stock by (i) each person, entity or group (as that

term is used in Section 13(d)(3) of the Exchange Act) known to us to be the beneficial owner of more than 5% of the outstanding shares

of our voting stock, (ii) each of our directors and executive officers, and (iii) all of our directors and executive officers as a group.

The percentage of class is based on 6,238,553 shares of Common Stock issued and outstanding as of the Record Date.

|

Name of Beneficial Owner 5% Stockholders

|

|

Number of Shares of Common Stock Owned

|

|

Percentage of Shares of Common Stock Owned

|

|

Number of Shares of Series B Preferred Stock Owned

|

|

Percentage of Shares of Series B Preferred Stock Owned

|

|

Number of Shares of Series C Preferred Stock Owned

|

|

Percentage of Shares of Series C Preferred Stock Owned

|

|

Percentage of Aggregate Voting Power

|

|

Huihe Zheng

|

|

|

4,764,254

|

|

|

|

76.4

|

%

|

|

|

13,500

|

|

|

|

100

|

%

|

|

|

531,886

|

|

|

|

100

|

%

|

|

|

89.0

|

%(1)(2)

|

|

Directors and Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Huihe Zheng

|

|

|

4,764,254

|

|

|

|

76.4

|

%

|

|

|

13,500

|

|

|

|

100

|

%

|

|

|

531,886

|

|

|

|

100

|

%

|

|

|

89.0

|

%(1)(2)

|

|

Tim Shannon(3)

|

|

|

5,834

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

*

|

|

|

Huili Shen

|

|

|

5,000

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

*

|

|

|

Timothy Miles(4)

|

|

|

5,000

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

*

|

|

|

All officers and directors as a group (four persons)

|

|

|

4,780,088

|

|

|

|

76.6

|

%

|

|

|

13,500

|

|

|

|

100

|

%

|

|

|

531,886

|

|

|

|

100

|

%

|

|

|

89.1

|

%

|

|

(1)

|

Each share of Series B Preferred Stock entitles the holder to 100 votes on all corporate matters submitted for stockholder approval.

|

|

(2)

|

Each share of Series C Convertible Preferred Stock entitles the holder to

11 votes initially on all corporate matters submitted for stockholder approval.

|

|

(3)

|

The address for this stockholder is PO Box 372568, Satellite Beach, FL 32937.

|

|

(4)

|

The address for this stockholder is PO Box 30, Dundee, MI 48131.

|

DESCRIPTION OF STOCKHOLDER

ACTION

Introduction

On July 2, 2021, our Board approved,

by unanimous written consent, to adopt the Amendment to our Articles of Incorporation effecting a Reverse Split of our issued and outstanding

Common Stock at a ratio between one-for-twenty and one-for-thirty five, with such ratio to be determined at the sole discretion of the

Board (or its designee or designees) and with such Reverse Split to be effected at such time and date, if at all, as determined by the

Board in its sole discretion (provided that it is effected within one year of the date on which the stockholders of the Corporation approve

the Reverse Stock Split). On July 2, 2021, the Voting Stockholder, acting by written consent, approved the Amendment and the Reverse Split.

Effecting the Reverse Split requires

that our Articles of Incorporation be amended. The text that will be incorporated into our Articles of Incorporation upon effecting the

Reverse Split is attached as Annex A to this Information Statement. The Amendment, which will not be filed until at least

twenty days following the date of this Information Statement, will be effective upon the filing of such Amendment to the Articles of Incorporation

in the form attached as Annex A with the Secretary of State of Florida with such filing to occur, if at all, at the sole

discretion of the Board.

There are two principal reasons

for the Reverse Split: (1) the Reverse Split should increase the stock price of our Common Stock, which is currently trading on the OTCQB

Market operated by OTC Markets Group Inc. (the “OTCQB”), to a level sufficiently above the minimum bid price requirement that

is required to list on either The Nasdaq Capital Market and the NYSE American LLC (the Nasdaq Capital Market and the NYSE American LLC

collectively referred to as the “Exchanges”) such that the Board, in its sole discretion, may apply for initial listing on

either of the Exchanges and (2) the Reverse Split may make it more feasible for the Company to raise third party equity funding which

we will need for business operations.

Based on discussions with our

advisors, we believe the Reverse Split would increase our chances of raising funding by: (i) increasing the price of our Common Stock

to levels that might attract a broader audience of potential investors (as of July 2, 2021, the closing price of our Common Stock was

$0.60) and (ii) lower the number of our outstanding shares of Common Stock, resulting in a capitalization for our Company that might attract

a broader audience of potential investors.

One principal effect of the Reverse

Split would be to decrease the number of outstanding shares of our Common Stock. Except for de minimus adjustments that may result from

the treatment of fractional shares as described below, the Reverse Split will not have any dilutive effect on our stockholders since each

stockholder would hold the same percentage of our Common Stock outstanding immediately following the Reverse Split as such stockholder

held immediately prior to the Reverse Split. The relative voting and other rights that accompany the shares of Common Stock would not

be affected by the Reverse Split.

The table below sets forth the

number of shares of our Common Stock outstanding before and after the Reverse Split based on 6,238,553 shares of Common Stock outstanding

as of the Record Date.

|

|

Prior to the

Reverse Split

|

Assuming a 1-for-

20 Reverse Split

|

Assuming a 1-for-

25 Reverse Split

|

Assuming a 1-for-

30 Reverse Split

|

Assuming a 1-for-

35 Reverse Split

|

|

Aggregate Number of Shares of Common Stock Outstanding

|

6,238,553

|

311,928

|

249,542

|

207,952

|

178,244

|

The Reverse Split will not have any impact on the number

of authorized shares of Common Stock provided for in our Articles of Incorporation which shall remain at 200,000,000 shares.

Although the Reverse Split will

not have any dilutive effect on our stockholders, the proportion of shares owned by our stockholders relative to the number of shares

authorized for issuance will decrease because we will not be reducing out authorized shares of Common Stock. The additional authorized

but unissued shares may be used for various purposes, including, without limitation, raising capital, providing equity incentives to employees,

officers or directors, effecting stock dividends, establishing strategic relationships with other companies and expanding our business

through the acquisition of other businesses or products. We do not currently have any plans, proposals or arrangements to issue any of

the potentially newly available authorized shares that result from the Reverse Split for any purposes. The Reverse Split is not part of

a broader plan to take us private.

Reasons for the Reverse Split

The Board’s primary objectives

in effecting the Reverse Split, if necessary or if the Board otherwise desires, is to enable the Board to (i) raise the per share trading

price of our Common Stock, which is currently trading only on the OTCQB, to allow for a listing of our Common Stock on one of the Exchanges

and (ii) enable the Board to facilitate capital raising by the Company by attracting a broader audience of potential investors.

Our Board has determined that

by increasing the market price per share of our Common Stock, we would meet the stock price element of the initial listing requirements

of each of the Exchanges and our Common Stock could be initially listed on one of the Exchanges. Our Board concluded that the liquidity

and marketability of our Common Stock will be adversely affected if it is not quoted on a national securities exchange as investors can

find it more difficult to dispose of, or to obtain accurate quotations as to the market value of, our Common Stock. Our Board believes

that current and prospective investors may view an investment in our Common Stock more favorably if our Common Stock is quoted on one

of the Exchanges.

Our Board also believes that the

Reverse Split and any resulting increase in the per share price of our Common Stock should enhance the acceptability and marketability

of our Common Stock to the financial community and investing public. Many institutional investors have policies prohibiting them from

holding lower-priced stocks in their portfolios, which reduces the number of potential buyers of our Common Stock. Additionally, analysts

at many brokerage firms are reluctant to recommend lower-priced stocks to their clients or monitor the activity of lower-priced stocks.

Brokerage houses frequently have internal practices and policies that discourage individual brokers from dealing in lower-priced stocks.

Further, because brokers’ commissions on lower-priced stock generally represent a higher percentage of the stock price than commissions

on higher priced stock, investors in lower-priced stocks pay transaction costs which are a higher percentage of their total share value,

which may limit the willingness of individual investors and institutions to purchase our Common Stock.

While we believe that we will

likely implement the Reverse Split in connection with a contemplated uplisting onto an Exchange and subsequent financing activities, we

cannot assure you that the Board will ultimately determine to effect the Reverse Split or if effected, at what ratio it will be effected

or that the Reverse Split will have any of the desired effects described above. More specifically, we cannot assure you that after the

Reverse Split the market price of our Common Stock will increase proportionately to reflect the ratio for the Reverse Split, that the

market price of our Common Stock will not decrease to its pre-split level, or that our market capitalization will be equal to the market

capitalization before the Reverse Split.

Potential Disadvantages of the Reverse Split

As noted above, the principal

purpose of the Reverse Split would be to help increase the per share market price of our Common Stock by up to a factor of 20-35. We cannot

assure you, however, that the Reverse Split will accomplish this objective for any meaningful period of time. While we expect that the

reduction in the number of outstanding shares of Common Stock will increase the market price of our Common Stock, we cannot assure you

that the Reverse Split will increase the market price of our Common Stock by an equivalent multiple, or result in any permanent increase

in the market price of our Common Stock. The price of our Common Stock is dependent upon many factors, including our business and financial

performance, general market conditions and prospects for future success. If the per share market price does not increase proportionately

as a result of the Reverse Split, then the value of our Company as measured by our stock capitalization will be reduced, perhaps significantly.

The number of shares held by each

individual stockholder would be reduced if the Reverse Split is implemented. This will increase the number of stockholders who hold less

than a “round lot,” or 100 shares. This has two disadvantages. First, the OTCQB and each of the Exchanges requires that we

have a certain number of round lot stockholders to be initially listed (the OTCQB requires that we have 50 round lot stockholders, the

Nasdaq Marketplace Rules require that we have 300 round lot stockholders and the NYSE MKT LLC requires that we have 400 round lot stockholders).

Second, the transaction costs to stockholders selling “odd lots” are typically higher on a per share basis. Consequently,

the Reverse Split could increase the transaction costs to existing stockholders in the event they wish to sell all or a portion of their

position.

Although our Board believes that

the decrease in the number of shares of our Common Stock outstanding as a consequence of the Reverse Split and the anticipated increase

in the market price of our Common Stock could encourage interest in our Common Stock and possibly promote greater liquidity for our stockholders,

such liquidity could also be adversely affected by the reduced number of shares outstanding after the Reverse Split.

Effecting the Reverse Split

Any time twenty calendar days

following the date of this Information Statement, if our Board concludes that it is in the best interests of our Company and our stockholders

to effect the Reverse Split, the Amendment will be filed with the Secretary of State of Florida. The actual timing of the filing of the

Amendment with the Secretary of State of Florida to effect the Reverse Split will be determined by our Board (provided that it is effected

within one year of the date on which the stockholders of the Corporation approve the Reverse Split). In addition, if for any reason our

Board deems it advisable to do so, the Reverse Split may be abandoned at any time prior to the filing of the Amendment, without further

action by our stockholders. The Reverse Split will be effective as of the date of filing with the Secretary of State of Florida or at

such time and date as specified in the Amendment (the “Effective Time”). Upon the filing of the Amendment, without further

action on our part or our stockholders, the outstanding shares of Common Stock held by stockholders of record as of the Effective Time

would be converted into a lesser number of shares of Common Stock based on a Reverse Split ratio as determined by the Board. For example,

if you presently hold 1,500 shares of our Common Stock, you would hold 50 shares of our Common Stock following the Reverse Split if the

ratio is one-for-thirty or you would hold 75 shares of our Common Stock following the Reverse Split if the ratio is one-for-twenty.

Effect on Outstanding Shares, Options and Certain Other Securities

If the Reverse Split is implemented,

the number of shares our Common Stock owned by each stockholder will be reduced in the same proportion as the reduction in the total number

of shares outstanding, such that the percentage of our Common Stock owned by each stockholder will remain unchanged except for any de

minimus change resulting from rounding up to the nearest number of whole shares so that we are not obligated to issue cash in lieu of

any fractional shares that such stockholder would have received as a result of the Reverse Split. The number of shares of our Common Stock

that may be purchased upon conversion or exercise of outstanding preferred stock, options or other securities convertible into, or exercisable

or exchangeable for, shares of our Common Stock, and the exercise or conversion prices for these securities, will also be ratably adjusted

in accordance with their terms as of the Effective Time.

Effect on Registration and Stock Trading

We are subject to the periodic

reporting and other requirements of the Exchange Act. The proposed Reverse Split will not affect the registration of our Common Stock.

Our Common Stock will continue to trade under the symbol “QDMI” on the OTCQB.

Fractional Shares; Exchange of Stock Certificates

Our Board does not currently intend

to issue fractional shares in connection with the Reverse Split. Therefore, we do not expect to issue certificates representing fractional

shares. In lieu of any fractional shares, we will issue to stockholders of record who would otherwise hold a fractional share because

the number of shares of Common Stock they hold before the Reverse Split is not evenly divisible by the Reverse Split ratio that number

of shares of Common Stock as rounded up to the nearest whole share. For example, if a stockholder holds 150.25 shares of Common Stock

following the Reverse Split, that stockholder will receive certificate representing 151 shares of Common Stock. No stockholders will receive

cash in lieu of fractional shares.

As of the Record Date, we had

253 holders of record of our Common Stock (although we have more beneficial holders). We do not expect the Reverse Split and the rounding

up of fractional shares to whole shares to result in a significant reduction in the number of record holders. We presently do not intend

to seek any change in our status as a reporting company for federal securities law purposes, either before or after the Reverse Split.

On or after the Effective Time,

we will mail a letter of transmittal to each stockholder. Each stockholder will be able to obtain a certificate evidencing his, her or

its post-Reverse Split shares only by sending the exchange agent (who will be the Company’s transfer agent) the stockholder’s

old stock certificate(s), together with the properly executed and completed letter of transmittal and such evidence of ownership of the

shares as we may require. Stockholders will not receive certificates for post-Reverse Split shares unless and until their old certificates

are surrendered. Stockholders should not forward their certificates to the exchange agent until they receive the letter of transmittal,

and they should only send in their certificates with the letter of transmittal. The exchange agent will send each stockholder, if elected

in the letter of transmittal, a new stock certificate after receipt of that stockholder’s properly completed letter of transmittal

and old stock certificate(s). A stockholder that surrenders his, her or its old stock certificate(s) but does not elect to receive a new

stock certificate in the letter of transmittal will be deemed to have requested to hold that stockholder’s shares electronically

in book-entry form with our transfer agent.

Certain of our registered holders

of Common Stock hold some or all of their shares electronically in book-entry form with our transfer agent. These stockholders do not

have stock certificates evidencing their ownership of our Common Stock. They are, however, provided with a statement reflecting the number

of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with our transfer agent, the stockholder

may return a properly executed and completed letter of transmittal.

Stockholders who hold shares in

street name through a nominee (such as a bank or broker) will be treated in the same manner as stockholders whose shares are registered

in their names, and nominees will be instructed to effect the Reverse Split for their beneficial holders. However, nominees may have different

procedures and stockholders holding shares in street name should contact their nominees. Stockholders will not have to pay any service

charges in connection with the exchange of their certificates.

Authorized Shares

The Reverse Split will not have

any effect on the authorized number of shares of our Common Stock which is currently 200,000,000 shares. In accordance with our Articles

of Incorporation and Florida law, our stockholders do not have any preemptive rights to purchase or subscribe for any of our unissued

or treasury shares.

Anti-Takeover and Dilutive Effects

As previously described, although

the Reverse Split will not have any dilutive effect on our stockholders, the proportion of shares owned by our stockholders relative to

the number of shares authorized for issuance will decrease because we will not be reducing our authorized shares of Common Stock. The

additional shares of Common Stock that are authorized but unissued provide our Board with flexibility to effect, among other transactions,

public or private refinancings, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. However, these

authorized but unissued shares may also be used by our Board, consistent with and subject to its fiduciary duties, to deter future attempts

to gain control of us or make such actions more expensive and less desirable. The Reverse Split will give our Board authority to issue

additional shares from time to time without delay or further action by the stockholders except as may be required by applicable law or

the rules of the trading market of our Common Stock. The Reverse Split is not being recommended in response to any specific effort of

which we are aware to obtain control of us, nor does our Board have any present intent to use the authorized but unissued Common Stock

to impede a takeover attempt. There are no plans or proposals to adopt other provisions or enter into any arrangements that have material

anti-takeover effects.

In addition, the issuance of additional

shares of Common Stock for any of the corporate purposes listed above could have a dilutive effect on earnings per share and the book

or market value of our outstanding Common Stock, depending on the circumstances, and would likely dilute a stockholder’s percentage

voting power in us. Holders of our Common Stock are not entitled to preemptive rights or other protections against dilution. Our Board

intends to take these factors into account before authorizing any new issuance of shares.

Accounting Consequences

As of the Effective Time, the

stated capital attributable to Common Stock on our balance sheet will be reduced proportionately based on the Reverse Split ratio (including

a retroactive adjustment of prior periods), and the additional paid-in capital account will be credited with the amount by which the stated

capital is reduced. Reported per share net income or loss will be higher because there will be fewer shares of our Common Stock outstanding.

Federal Income Tax Consequences

The following summary describes

certain material U.S. federal income tax consequences of the Reverse Split to holders of our Common Stock. This summary addresses the

tax consequences only to a beneficial owner of our Common Stock that is a citizen or individual resident of the United States, a corporation

organized in or under the laws of the United States or any state thereof or the District of Columbia or otherwise subject to U.S. federal

income taxation on a net income basis in respect of our Common Stock (a “U.S. holder”). This summary does not address all

of the tax consequences that may be relevant to any particular stockholder, including tax considerations that arise from rules of general

application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary also

does not address the tax consequences to persons that may be subject to special treatment under U.S. federal income tax law or persons

that do not hold our Common Stock as “capital assets” (generally, property held for investment). This summary is based on

the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial authority,

all as in effect as of the date hereof. Subsequent developments in U.S. federal income tax law, including changes in law or differing

interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse

Split. Each stockholder should consult his, her or its own tax advisor regarding the U.S. federal, state, local and foreign income

and other tax consequences of the Reverse Split.

If a partnership (or other entity

classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Common Stock, the U.S. federal income

tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership.

Partnerships that hold our Common Stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal

income tax consequences of the Reverse Split.

The Reverse Split should be treated

as a recapitalization for U.S. federal income tax purposes. Therefore, no gain or loss should be recognized by a U.S. holder upon the

Reverse Split. Accordingly, the aggregate tax basis in the Common Stock received pursuant to the Reverse Split should equal the aggregate

tax basis in the Common Stock surrendered and the holding period for the Common Stock received should include the holding period for the

Common Stock surrendered.

INTEREST OF CERTAIN PERSONS IN OR IN OPPOSITION

TO MATTERS TO BE ACTED UPON

Except in their capacity as stockholders

(which interest does not differ from that of the other holders of Company’s Common Stock), none of our officers, directors or any

of their respective affiliates or associates will have any interest in the Reverse Split.

ANNUAL REPORT ON FORM

10-K AND ADDITIONAL INFORMATION

Information Available

The Company is subject to the information and reporting

requirements of the Exchange Act and in accordance with the Exchange Act, the Company files periodic reports, documents and other information

with the SEC relating to its business, financial statements and other matters. These reports and other information filed by the Company

with the SEC may be inspected and are available for copying at the public reference facilities maintained at the SEC at 100 F Street NW,

Washington, D.C. 20549.

The Company’s filings with the SEC are also available to the public

from the SEC’s website, http://www.sec.gov. The Company’s Annual Report on Form 10-K for the year ended December 31,

2019 and Current Report on Form 8-K filed on October 27, 2020, and other reports filed under the Exchange Act, are also available to any

stockholder at no cost upon request to: Room 715, 7F, The Place Tower C, No. 150 Zunyi Road, Changning District, Shanghai, China, telephone

number +86 (21) 22183083.

Stockholder Communications

Stockholders wishing to communicate

with the Board may direct such communications to the Board c/o the Company, Attn: Huihe Zheng. Mr. Zheng will present a summary of all

stockholder communications to the Board at subsequent Board meetings. The directors will have the opportunity to review the actual communications

at their discretion.

Delivery of Documents to Security Holders Sharing An Address

If hard copies of the materials

are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless

we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed

to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the

Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may

make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the

address to which the Company should direct the additional copy of the Information Statement, to the Company at Room 715, 7F, The Place

Tower C, No. 150 Zunyi Road, Changning District, Shanghai, China.

If multiple stockholders sharing

an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each

stockholder a separate copy of future mailings, you may send notification to or call the Company’s principal executive offices.

Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate

mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address, notification of such

request may also be made by mail or telephone to the Company’s principal executive offices.

By Order of the Board of Directors

|

/s/

Huihe Zheng

|

|

|

Name: Huihe Zheng

|

|

|

Title: President and Chief Executive Officer

|

|

Annex A

ARTICLES

OF AMENDMENT

TO

ARTICLES

OF INCORPORATION

OF

QDM

INTERNATIONAL INC.

______________________________________________________________________________

Pursuant

to Section 607.1006 of the Florida Business Corporation Act (the “FBCA”), it is hereby certified that:

|

|

1.

|

The

name of the Corporation is: QDM International Inc. (the “Corporation”).

|

|

|

2.

|

The

Articles of Incorporation of the Corporation were filed with the Secretary of State of the

State of Florida on March 9, 2020.

|

|

|

3.

|

Upon

the filing and effectiveness (the “Effective Time”) pursuant to the FBCA

of this amendment to the Corporation’s Articles of Incorporation, each [●][1]

shares of common stock, par value $0.0001 per share (the “Common Stock”)

issued and outstanding immediately prior to the Effective Time either issued and outstanding

or held by the Corporation as treasury stock shall be combined into one (1) validly issued,

fully paid and non-assessable share of Common Stock without any further action by the Corporation

or the holder thereof (the “Reverse Split”); provided that no fractional

shares shall be issued to any holder and that instead of issuing such fractional shares,

the Corporation shall round shares up to the nearest whole number. Each certificate that

immediately prior to the Effective Time represented shares of Common Stock (“Old

Certificates”), shall thereafter represent that number of shares of Common Stock

into which the shares of Common Stock represented by the Old Certificate shall have been

combined, subject to the treatment of fractional shares as described above.

|

|

|

4.

|

This

Articles of Amendment shall become effective as of [—], at [—] [a.m./p.m.].

|

|

|

5.

|

This Articles of Amendment were duly adopted in accordance with Section

607.1001 of the FBCA. The Board of Directors duly adopted resolutions setting forth and declaring advisable this Articles of Amendment

and directed that the proposed amendments be considered by the stockholders of the Corporation. The Articles of Amendment were duly approved

and adopted by written consent of stockholders holding a majority of the Corporation’s voting power as of the record date pursuant

to Section 607.0704 of the FBCA.

|

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK; SIGNATURE FOLLOWS]

1

Whole number between twenty (20) and thirty five

(35) as determined in the sole discretion of the Board of Directors (or its designee or designees).

IN

WITNESS WHEREOF, QDM International Inc. has caused this Articles of Amendment to Articles of

Incorporation to be executed by its duly authorized officer as of this ______ day of __________, 2021.

|

|

QDM

INTERNATIONAL INC.

|

|

|

|

|

|

|

By:

|

|

|

|

|

Name:

Huihe Zheng

|

|

|

|

Title: President

and Chief Executive Officer

|

11

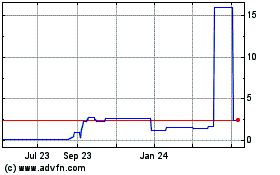

QDM (QB) (USOTC:QDMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

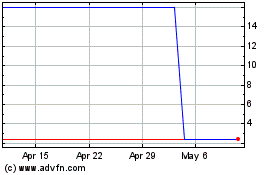

QDM (QB) (USOTC:QDMI)

Historical Stock Chart

From Apr 2023 to Apr 2024