Current Report Filing (8-k)

July 09 2021 - 4:36PM

Edgar (US Regulatory)

0001425292false00014252922021-07-072021-07-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

___________________________________

Date of Report (Date of earliest event reported): July 7, 2021

CVR PARTNERS, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-35120

|

56-2677689

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

2277 Plaza Drive, Suite 500

Sugar Land, Texas 77479

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (281) 207-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common units representing limited partner interests

|

UAN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 7, 2021, David Willetts was appointed to the board of directors (the “Board”) of CVR GP, LLC (the “Company”), the general partner of CVR Partners, LP (the “Partnership”), as well as to the Board’s Compensation Committee and Special Committee. Mr. Willetts was affirmatively determined by the Board to be qualified to serve on the Board and its committees.

Mr. Willetts has been the Chief Financial Officer and a director of Icahn Enterprises L.P. (“Icahn Enterprises”), a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate, and home fashion, since June 2021. Prior to Icahn Enterprises, he served as a managing director at AlixPartners, a global consulting firm which specializes in improving corporate financial and operational performance and executing corporate turnarounds. Since 2012, Mr. Willetts has worked continuously with Private Equity firms and public companies in the industrial, automotive, consumer products, retail, and energy sectors. Mr. Willetts has been a director of CVR Energy, Inc. (“CVR Energy”), a diversified holding company primarily engaged in petroleum refining and nitrogen fertilizer production, since July 2021; and a director and chairman of the board of Viskase Companies, Inc., a meat casing company, since June 2021. Icahn Enterprises, CVR Energy, and Viskase Companies, Inc. are indirectly controlled by Carl C. Icahn. Mr. Willetts graduated from Franklin and Marshall College in 1997 Summa Cum Laude, with a B.A. in business, with a double concentration in accounting and finance.

Mr. Icahn indirectly owns approximately 71% of the common shares of CVR Energy. CVR Energy indirectly owns 100% of the Company and approximately 36% of the common units representing limited partner interests in the Partnership. Other than the foregoing, as of the date of his appointment, Mr. Willetts is not a party to any transactions that would be required to be reported under Item 404(a) of Regulation S-K and there are no other arrangements or understandings between him and any other persons pursuant to which he was selected as a director. Mr. Willetts will not receive compensation for his service on the Board or its committees.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is being “furnished” as part of this Current Report on Form 8-K:

|

|

|

|

|

|

|

|

Exhibit

Number

|

Exhibit Description

|

|

|

|

|

104

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 9, 2021

|

|

|

|

|

|

|

|

CVR Partners, LP

|

|

By: CVR GP, LLC, its general partner

|

|

|

|

|

By:

|

/s/ Tracy D. Jackson

|

|

|

Tracy D. Jackson

|

|

|

Executive Vice President and

Chief Financial Officer

|

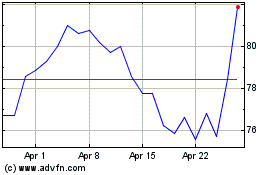

CVR Partners (NYSE:UAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

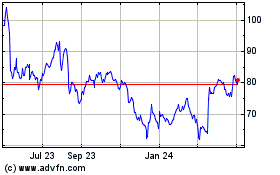

CVR Partners (NYSE:UAN)

Historical Stock Chart

From Apr 2023 to Apr 2024