UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

Annual Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

(Mark One)

þ Annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934 (No Fee Required)

For the fiscal year ended December 31, 2020

OR

☐ Transition report pursuant to Section 15(d) of the Securities Exchange Act of 1934 (No Fee Required)

For the transition period from ___to ___

Commission file number 001-00035

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

ITI 401(k) PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

General Electric Company

5 Necco Street

Boston, MA

ITI 401(k) PLAN

Financial Statements and Supplemental Schedule

December 31, 2020 and 2019

(With Report of Independent Registered Public Accounting Firm Thereon)

ITI 401(k) PLAN

December 31, 2020 and 2019

Table of Contents

|

|

|

|

|

|

|

|

|

Page

Number(s)

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

3

|

|

|

|

|

Financial Statements:

|

|

|

Statements of Net Assets Available for Plan Benefits

as of December 31, 2020 and 2019

|

4

|

|

|

|

|

Statements of Changes in Net Assets Available for Plan Benefits

for the Years Ended December 31, 2020 and 2019

|

5

|

|

|

|

|

Notes to Financial Statements

|

6-14

|

|

|

|

|

Supplemental Schedule: (i)

|

|

|

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

as of December 31, 2020

|

15

|

|

|

|

|

|

|

(i) Schedules required by Form 5500 which are not applicable have not been included.

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

ITI 401(k) Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of the ITI 401(k) Plan (the Plan) as of December 31, 2020 and 2019, the related statements of changes in net assets available for plan benefits for the years then ended, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for plan benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2020, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan's auditor since 2000.

Albany, New York

June 24, 2021

ITI 401(k) PLAN

Statements of Net Assets Available for Plan Benefits

December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Investments at fair value (notes 3 and 4)

|

$

|

21,039,136

|

|

|

$

|

18,422,260

|

|

|

Notes receivable from participants

|

859,973

|

|

|

1,005,854

|

|

|

Accrued dividends and interest

|

1,450

|

|

|

7,613

|

|

|

|

|

|

|

|

Net assets available for plan benefits

|

$

|

21,900,559

|

|

|

$

|

19,435,727

|

|

|

|

|

|

|

See accompanying notes to financial statements.

ITI 401(k) PLAN

Statements of Changes in Net Assets Available for Plan Benefits

Years Ended December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Additions to net assets attributed to:

|

|

|

|

|

Investment income:

|

|

|

|

|

Net appreciation in fair value of investments

|

$

|

2,569,665

|

|

|

$

|

2,843,441

|

|

|

Dividend and interest income

|

207,623

|

|

|

325,190

|

|

|

|

2,777,288

|

|

|

3,168,631

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on notes receivable from participants

|

43,172

|

|

|

48,174

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

Employee

|

1,246,891

|

|

|

1,210,391

|

|

|

Employer

|

597,775

|

|

|

581,884

|

|

|

|

1,844,666

|

|

|

1,792,275

|

|

|

|

|

|

|

|

Total additions

|

4,665,126

|

|

|

5,009,080

|

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

Benefits paid to participants

|

1,854,637

|

|

|

627,369

|

|

|

Employee rollovers into other qualified plans

|

333,802

|

|

|

1,544,614

|

|

|

Expenses and loan fees

|

11,855

|

|

|

26,115

|

|

|

Total deductions

|

2,200,294

|

|

|

2,198,098

|

|

|

|

|

|

|

|

Net increase

|

2,464,832

|

|

|

2,810,982

|

|

|

|

|

|

|

|

Net assets available for plan benefits at:

|

|

|

|

|

Beginning of year

|

19,435,727

|

|

|

16,624,745

|

|

|

End of year

|

$

|

21,900,559

|

|

|

$

|

19,435,727

|

|

See accompanying notes to financial statements.

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

(1) Description of the Plan

The ITI 401(k) Plan (the “Plan”) is a defined contribution plan sponsored by Instrument Transformers, LLC (the “Company”), formerly Instrument Transformers, Inc., an affiliate of General Electric Company (“GE”). The Plan is subject to applicable provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Effective January 1, 2016, salaried employees became active participants in the GE Retirement Savings Plan instead of this Plan.

Ascensus Trust Company (the “Trustee”), is the Plan’s custodian and trustee, and Mid-Atlantic Trust Company is the sub-custodian with respect to the GE Common Stock Fund and the Westinghouse Air Brake Technologies Stock Fund (the “Wabtec Stock Fund”). Newport Trust Company ("Newport") is the independent fiduciary and investment manager for the Wabtec Stock Fund. Ascensus, Inc. (“Ascensus”) is the recordkeeper for the Plan.

The following description of the Plan is provided for general information purposes only. The complete terms of the Plan are provided in the ITI 401(k) Plan Document. Information concerning the Plan, including benefits and vesting provisions, is also included in the Summary Plan Description (“SPD”) and other material distributed to participants.

Employee Contributions and Investment Options

Participants are permitted to allocate their account balances in increments of 1% to one or more of the following investment options:

(a)GE Common Stock Fund - This fund is invested primarily in GE common stock, with the remainder held in cash or cash equivalents to provide for the GE Common Stock Fund’s estimated liquidity needs.

(b)Wabtec Stock Fund - This fund is invested primarily in Wabtec common stock, with the remainder held in cash or cash equivalents to provide for the Wabtec Stock Fund’s estimated liquidity needs. Participants who were invested in the GE Common Stock Fund as of February 25, 2019 were eligible to receive a proportionate share of Wabtec Stock Fund units. This fund was liquidated in February 2020 and eliminated as an investment option. Proceeds were invested in the Vanguard Target Retirement Fund consistent with the participant's age.

(c)Vanguard 500 Index Admiral Fund - This fund seeks to track the performance of the S&P 500 Index. It attempts to replicate the target index by investing all or substantially all of its assets in the stocks that make up the S&P 500 Index.

(d)Vanguard Extended Market Index Admiral Fund - This fund seeks to track the performance of a benchmark index that measures the investment return of domestic small- and mid-capitalization stocks.

(e)Vanguard Total International Stock Index Admiral Fund - This fund seeks to track the performance of a benchmark index by investing in stocks issued by companies located in developed and emerging markets, excluding the United States. The benchmark index includes approximately 5,500 stocks located in 46 countries.

(f)Vanguard Total Bond Market Index Admiral Fund - This fund seeks to track the performance of a benchmark index by investing in a wide spectrum of public, investment-grade, taxable fixed income securities in the United States. At least 80% of the fund’s assets will be invested in bonds held by the benchmark index.

(g)Vanguard Short-Term Bond Index Admiral Fund - This fund offers a low-cost, diversified approach to bond investing, providing broad exposure to U.S. investment-grade bonds with maturities from one to five years. The fund invests about 30% of assets in corporate bonds and 70% in U.S. government bonds within that maturity range. This fund became an investment option on September 9, 2019.

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

(h)Vanguard Target Retirement Funds - The Vanguard Target Retirement Funds are a series of registered investment companies (“mutual funds”) that separately invest in up to five other Vanguard mutual funds. Because they invest in other mutual funds, rather than individual securities, each fund is considered a “fund of funds”. The suite of Target Retirement Funds include the following:

Vanguard Target Retirement Income Fund

Vanguard Target Retirement 2015 Fund

Vanguard Target Retirement 2020 Fund

Vanguard Target Retirement 2025 Fund

Vanguard Target Retirement 2030 Fund

Vanguard Target Retirement 2035 Fund

Vanguard Target Retirement 2040 Fund

Vanguard Target Retirement 2045 Fund

Vanguard Target Retirement 2050 Fund

Vanguard Target Retirement 2055 Fund

Vanguard Target Retirement 2060 Fund

Vanguard Target Retirement 2065 Fund

The Vanguard Target Retirement Income Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors currently in retirement. The other Vanguard Target Retirement Funds invest in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of the target year. These funds’ asset allocations will become more conservative over time as the target retirement date draws closer.

(i) American Funds Growth Fund of America - This fund seeks growth of capital by investing in U.S. and international companies with a history of rapidly growing earnings and generally higher price-to-earnings ratios.

(j) DFA U.S. Targeted Value Portfolio Fund - This fund seeks long-term capital appreciation. It uses a market capitalization weighted approach by purchasing a broad and diverse group of readily marketable securities of U.S. small and mid-cap companies.

(k) MFS Institutional International Equity Fund - This fund seeks to outperform the MSCI EAFE Index (net dividends) over full market cycles. The fund's strategy is to construct a well-diversified portfolio of high-conviction ideas following a growth-at-a-reasonable price style with a quality bias. This fund became an investment option on September 9, 2019.

(l) Prudential Core Plus Bond Fund - This fund seeks to add +150 bps of annualized excess return over a broad U.S. bond market index over a full market cycle (three to five years) by emphasizing relative-value based sector allocation, research-based security selection, and modest duration and yield curve positioning. This fund became an investment option on September 9, 2019.

(m) American Beacon Stephens Mid-Cap Growth Institutional Fund - This fund seeks long-term growth of capital. It invests at least 80% of its net assets in equity securities of medium capitalization companies, which are companies whose market capitalization falls within the capitalization range of $1 billion and the market capitalization of the largest company in the Russell Midcap Index.

(n) Vanguard Federal Money Market Fund - This fund invests in U.S. government securities, seeks to provide current income and preserve shareholders’ principal investment by maintaining a share price of $1. As such, it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term U.S. government securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment. This fund became an investment option on September 9, 2019.

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

(o) JP Morgan U.S. Government Money Market Fund - This fund seeks high current income with liquidity and stability of principal. It invests exclusively in high-quality, short-term securities that are issued or guaranteed by the U.S. government or by U.S. government agencies and instrumentalities. This fund was no longer an investment option on September 9, 2019.

(p) Franklin Templeton Mutual Global Discovery Fund - This fund seeks long term capital appreciation by investing significantly (up to 100%) in foreign equity and debt securities. This fund was no longer an investment option on September 9, 2019.

(q) State Street Institutional Income Fund - This fund managed by State Street Global Advisors ("SSGA") seeks a high interest rate of return over a long-term period consistent with the preservation of capital by investing at least 80% of its net assets in debt securities. This fund was no longer an investment option on September 9, 2019.

(r) State Street Institutional International Equity Fund - This fund managed by SSGA seeks long-term growth of capital by investing at least 80% of its net assets in equity securities, such as common and preferred stocks. The fund invests primarily in companies in both developed and emerging market countries outside the United States. This fund was no longer an investment option on September 9, 2019.

Audited financial statements and prospectuses or other disclosure documents of the registered investment companies (“mutual funds”) are made available to participants.

Participants may elect to defer any whole percentage of their eligible compensation, on a pre-tax basis, subject to limitations imposed by law. Participants may also contribute amounts as “rollover” provisions representing distributions from other qualified defined benefit or defined contribution plans of a former employer.

The United States Internal Revenue Code (“IRC”) limits the amount of pre-tax contributions that can be made each year. The limit for participants under age 50 was generally $19,500 and $19,000 in 2020 and 2019, respectively. For participants who were at least age 50 during the year, the limit was generally $26,000 and $25,000 in 2020 and 2019, respectively.

Employer Contributions

The Plan generally provides for employer matching contributions at a rate of 50% of the employee’s pre-tax contributions on the first 14% of compensation.

Vesting

Participants are immediately fully vested in their employee contributions and related investment results. Vesting in the Company’s contributions and related investment results is based on years of continuous service. A participant is 100% vested in the Company’s contributions after six years of service as follows:

Years of Service Percent

Less than 2 0%

2 20%

3 40%

4 60%

5 80%

6 100%

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Participant Accounts

Each participant’s account is credited with the participant’s contributions and allocation of (a) employer matching contributions and (b) investment results. The benefit to which a participant is entitled is the value of the participant’s vested account.

Notes Receivable from Participants

The Plan permits participants, under certain circumstances, to borrow a minimum of $1,000 from their participant accounts. Subject to certain IRC and Plan limits, a participant may not borrow more than the lesser of $50,000 minus the highest outstanding balance of loans from any plan sponsored by the Company, GE or any of its affiliates during the past 12 months or 50% of their vested account balance. There is a $50 charge for each loan.

The term of any loan is up to 5 years from the effective date of the loan unless the loan is used to acquire a principal residence for which a term of up to 15 years may be permissible. Loans are secured by the remaining balance in the participant’s account. The interest rate applicable to participant notes receivable is 1% above the prime interest rate in effect as of the last business day before the loan is requested. Loans are repaid with interest in equal payments over the term of the loan by payroll deductions, personal check or other methods as may be required. Participants may repay the principal amount with written notice and without penalty.

In the event of a loan default, the amount of the outstanding balance will be reported to the Internal Revenue Service in the year of default as ordinary income.

Consistent with the Coronavirus Aid, Relief, and Economic Security Act, loan repayments by eligible participants have been deferred during the 2020 plan year.

Payment of Benefits

Participants’ withdrawals are permitted under the plan subject to certain restrictions. Participants are allowed to withdraw all or a portion of their rollover contributions, including earnings thereon. Generally, before-tax contributions and Company contributions may not be withdrawn while employed by the Company prior to age 59½. In the case of a hardship, a participant may elect to withdraw, as applicable, all or a portion of pre-tax contributions and Company matching contributions. In order to make a hardship withdrawal, a participant must first withdraw the maximum rollover contributions.

On termination of employment, a participant may elect to receive either a lump-sum amount equal to the value of the participant’s vested interest in his or her account, installments (quarterly, monthly, annually or semi-annually), or a direct rollover.

Consistent with the Coronavirus Aid, Relief, and Economic Security Act, eligible participants have taken limited-time in-service withdrawals during the 2020 plan year.

Plan Termination and Amendment

Although the Company has not expressed any intent to do so, it has the right under the Plan, to the extent permitted by law, to discontinue its contributions and to terminate the Plan in accordance with the provisions of ERISA. If the Plan is terminated, each participant’s interest will be payable in full according to Plan provisions. The Company also has the right under the Plan, to the extent permitted by law, to amend or replace the Plan for any reason.

Administrative and Investment Advisory Costs

Expenses related to the administration of the Plan, including recordkeeping expenses and Trustee’s fees, are liabilities of the Plan. However, the Company may choose to pay these expenses (see note 2(f)). For the registered investment companies and the money market fund, investment advisers are reimbursed for costs incurred or receive a management fee for providing

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

investment advisory services. These reimbursed costs and management fees are reflected in the net appreciation (depreciation) in the fair value of investments on the statement of changes in net assets available for plan benefits.

(2) Summary of Significant Accounting Policies

(a) Basis of Accounting

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the Unites States of America (GAAP).

(b) Investments

Plan investments are reported at fair value. See notes 3 and 4 for additional information.

Investment transactions are recorded on a trade date basis. Dividends are recorded on the ex-dividend date. Interest income is recorded on the accrual basis. The net appreciation (depreciation) in the fair value of investments consists of the realized gains or losses on the sales of investments and the net unrealized gains (losses) on investments held as of December 31, 2020 and 2019.

(c) Fair Value Measurements

For financial assets and liabilities, fair value is the price the Plan would receive to sell an asset or pay to transfer a liability in an orderly transaction with a market participant at the measurement date. In the absence of active markets for the identical assets and liabilities, such measurements involve developing assumptions based on market observable data and, in the absence of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs at the measurement date.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions. Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level 1 - Quoted prices for identical investments in active markets.

Level 2 - Quoted prices for similar investments in active markets; quoted prices for identical or similar investments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 - Significant inputs to the valuation model are unobservable.

When available, quoted market prices are used to determine the fair value of investment securities, and they are included in Level 1. Level 1 securities include common stock, registered investment companies, short-term investments and interest-bearing cash.

See note 4 for additional information.

(d) Notes Receivable from Participants

Loans to participants are recorded at the outstanding principal balance plus accrued interest.

(e) Payment of Benefits

Benefit payments are recorded when paid to participants.

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

(f) Expenses

Substantially all expenses related to administration of the Plan are paid by the Company or out of the Plan’s forfeiture account at the discretion of the Plan sponsor, with the exception of the Plan’s loan expenses, which are paid by the Plan’s Trustee out of the respective participant’s investment fund’s assets.

(g) Management Estimates and Assumptions

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management of the Plan to make estimates and assumptions that affect the reported amount of assets, liabilities and changes therein, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

(3) Investments

A summary of the fair values of the Plan’s investments at December 31, 2020 and 2019 follow.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

$

|

466,620

|

|

|

$

|

459,412

|

|

|

Registered investment companies

|

17,246,738

|

|

|

14,916,814

|

|

|

Short-term investments

|

3,310,850

|

|

|

3,025,829

|

|

|

Interest-bearing cash

|

14,928

|

|

|

20,205

|

|

|

Total investments at fair value

|

$

|

21,039,136

|

|

|

$

|

18,422,260

|

|

(4) Fair Value Measurements

The Plan’s investments measured at fair value on a recurring basis at December 31, 2020 follow.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

$

|

466,620

|

|

|

$

|

—

|

|

|

|

|

$

|

466,620

|

|

|

Registered investment companies

|

17,246,738

|

|

|

—

|

|

|

|

|

17,246,738

|

|

|

Short-term investments

|

3,310,850

|

|

|

—

|

|

|

|

|

3,310,850

|

|

|

Interest-bearing cash

|

14,928

|

|

|

—

|

|

|

|

|

14,928

|

|

|

Total investments at fair value

|

$

|

21,039,136

|

|

$

|

—

|

|

|

|

$

|

21,039,136

|

|

|

|

|

|

|

|

|

|

|

The Plan’s investments measured at fair value on a recurring basis at December 31, 2019 follow.

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

$

|

459,412

|

|

|

$

|

—

|

|

|

|

|

$

|

459,412

|

|

|

Registered investment companies

|

14,916,814

|

|

|

—

|

|

|

|

|

14,916,814

|

|

|

Short-term investments

|

3,025,829

|

|

|

—

|

|

|

|

|

3,025,829

|

|

|

Interest-bearing cash

|

20,205

|

|

|

—

|

|

|

|

|

20,205

|

|

|

Total investments at fair value

|

$

|

18,422,260

|

|

$

|

—

|

|

|

|

$

|

18,422,260

|

|

|

|

|

|

|

|

|

|

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Transfers in and out of levels are considered to occur at the beginning of the period. There were no transfers during 2020 or 2019.

There were no level 3 assets during the years ended December 31, 2020 and 2019.

As discussed in Note 1(a), the GE Common Stock Fund, is a unitized fund that consists of GE common stock with a small portion of the fund held in cash or other short-term investments which are assets of the Plan. All are included in the fair value measurements table as Level 1 investments.

As discussed in Note 1(b), the Wabtec Stock Fund was liquidated in February 2020, and was a unitized fund that consists of Wabtec common stock with a small portion of the fund held in cash or other short-term investments which are assets of the Plan. All are included in the fair value measurements table as Level 1 investments as of December 31, 2019.

(5) Risk and Uncertainties

The Plan offers a number of investment options including the GE Common Stock Fund and a variety of investment funds, consisting of registered investment companies and a money market fund. The registered investment companies invest in U.S. equities, international equities and fixed income securities. Investment securities in general, are exposed to various risks, such as interest rate, credit and overall market volatility risk. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur (including in the near term) and that such changes could materially affect participant account balances and amounts reported in the statements of net assets available for plan benefits.

The Plan’s exposure to a concentration of credit risk is limited by the opportunity to diversify investments across multiple participant-directed fund elections. Additionally, the investments within each participant-directed fund election are further diversified into varied financial instruments, with the exception of the GE Common Stock Fund, which primarily invests in a single security.

As of December 31, 2020 and 2019, the following investments represents more than 10% of the fair value of the Plan's total investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

American Funds Growth Fund of America

|

$

|

2,616,222

|

|

|

$

|

1,970,602

|

|

|

American Beacon Stephens Mid-Cap Growth Institutional Fund

|

2,225,851

|

|

**

|

|

Vanguard Federal Money Market Fund

|

3,310,850

|

|

3,025,829

|

|

|

|

|

|

** Investment did not exceed more than 10% of fair value of total investments.

(6) Related Party Transactions (Parties in Interest)

Certain fees paid to related parties for services to the Plan were paid by the Plan. Registered investment company and money market fund operating expenses reduce the respective fund’s assets and are reflected in the fund’s share/unit price and dividends.

In addition to the recordkeepers, trustees and custodians of the Plan, which are mentioned in note 1, KPMG LLP, the auditor of the Plan’s financial statements, is also a party in interest as defined by ERISA.

The Plan held 43,206 and 39,919 shares with a cost basis of $466,620 and $445,493 of GE Common Stock, for the years ended, December 31, 2020 and 2019, respectively. During the years ended December 31, 2020 and 2019, the Plan recorded dividend income for GE Common Stock of $1,692 and $1,602, respectively.

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

(7) Tax Status

In December 2016, the IRS began publishing a Required Amendments List for individually designed plans which specifies changes in qualification requirements. The list is published annually and requires plans to be amended for each item on the list, as applicable, to retain its tax-exempt status.

The Internal Revenue Service has notified Ascensus, the prototype sponsor, by a letter dated March 31, 2014 that the basic plan document is qualified under the appropriate sections of the IRC. The Plan has adopted the Ascensus prototype document which has been amended since that letter was issued. However, the Plan administrator and the Plan’s counsel believe that the Plan’s current design and operations comply in all material respects with the applicable requirements of the IRC, and that the letter remains valid.

The portion of a participant’s compensation contributed to the Plan as a pre-tax contribution and the Company’s matching contribution are not subject to Federal income tax when such contributions are credited to participant accounts, subject to certain limitations. These amounts and any investment earnings may be included in the participant’s gross taxable income for the year in which such amounts are withdrawn from the Plan.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) of the Plan if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. For the years ended December 31, 2020 and 2019, the Plan has not recognized a tax liability (or asset) related to uncertain tax positions.

(8) Subsequent Events

Subsequent events after the statement of net assets available for plan benefits date through June 24, 2021, the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

In June 2021, GE Company’s Board of Directors approved proceeding with a reverse stock split at a ratio of 1:8, which would reduce the number of outstanding shares of GE Common Stock held by the Plan.

(9) (9) Reconciliation of Financial Statements to Form 5500

Notes receivable from participants are classified as investments per Form 5500 instructions. In addition, any deemed distributions are not considered to be plan assets per Form 5500 and are excluded from notes receivable from participants. However, these distributions remain a plan asset for purposes of these financial statements until a distributable event occurs and they are offset against plan assets.

A reconciliation of investments per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

Total investments at fair value per financial statements

|

$

|

21,039,136

|

|

|

$

|

18,422,260

|

|

|

|

|

|

|

|

Total notes receivable from participants

|

859,973

|

|

|

1,005,854

|

|

|

Deemed distributions

|

(9,813)

|

|

|

(9,813)

|

|

|

Total notes receivable per Form 5500

|

850,160

|

|

|

996,041

|

|

|

|

|

|

|

|

Total investments per Form 5500

|

$

|

21,889,296

|

|

|

$

|

19,418,301

|

|

ITI 401(k) PLAN

Notes to Financial Statements

December 31, 2020 and 2019

A reconciliation of total deductions from net assets per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

Total deductions from net assets per financial statements

|

$

|

2,200,294

|

|

|

$

|

2,198,098

|

|

|

Changes in deemed distributions

|

—

|

|

|

9,400

|

|

|

Total expenses per Form 5500

|

$

|

2,200,294

|

|

|

$

|

2,207,498

|

|

A reconciliation of amounts per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

Net assets available for plan benefits per financial statements

|

$

|

21,900,559

|

|

|

$

|

19,435,727

|

|

|

Deemed distributions

|

(9,813)

|

|

|

(9,813)

|

|

|

Net assets available for plan benefits per Form 5500

|

$

|

21,890,746

|

|

|

$

|

19,425,914

|

|

|

|

|

|

|

|

Total net increase per financial statements

|

$

|

2,464,832

|

|

|

$

|

2,810,982

|

|

|

Changes in deemed distributions

|

—

|

|

|

9,400

|

|

|

Total net gain per Form 5500

|

$

|

2,464,832

|

|

|

$

|

2,820,382

|

|

|

|

|

|

|

ITI 401(k) PLAN

Schedule H, Line 4i- Schedule of Assets (Held at End of Year)

As of December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b) Identity of issue, borrower, lessor, or similar party

|

|

(c) Description of investment including maturity date, rate of interest, collateral, par or maturity value

|

|

|

(d) Current value**

|

|

*

|

|

GE Common Stock

|

|

Common stock, 43,206 shares

|

|

$

|

466,620

|

|

|

|

|

Vanguard 500 Index Admiral Fund

|

|

Registered investment company, 5,907 shares

|

|

|

2,047,252

|

|

|

|

|

Vanguard Extended Market Index Admiral Fund

|

|

Registered investment company, 1,989 shares

|

|

|

248,128

|

|

|

|

|

Vanguard Total International Stock Index Admiral Fund

|

|

Registered investment company, 1,714 shares

|

|

|

55,651

|

|

|

|

|

Vanguard Total Bond Market Index Admiral Fund

|

|

Registered investment company, 7,274 shares

|

|

|

84,528

|

|

|

|

|

Vanguard Short-Term Bond Index Admiral Fund

|

|

Registered investment company, 7,362 shares

|

|

|

80,028

|

|

|

|

|

Vanguard Target Retirement Income Fund

|

|

Registered investment company, 18,957 shares

|

|

|

283,035

|

|

|

|

|

Vanguard Target Retirement 2015 Fund

|

|

Registered investment company, 32,166 shares

|

|

|

505,973

|

|

|

|

|

Vanguard Target Retirement 2020 Fund

|

|

Registered investment company, 43,044 shares

|

|

|

1,475,984

|

|

|

|

|

Vanguard Target Retirement 2025 Fund

|

|

Registered investment company, 37,115 shares

|

|

|

799,450

|

|

|

|

|

Vanguard Target Retirement 2030 Fund

|

|

Registered investment company, 31,810 shares

|

|

|

1,289,907

|

|

|

|

|

Vanguard Target Retirement 2035 Fund

|

|

Registered investment company, 56,639 shares

|

|

|

1,428,447

|

|

|

|

|

Vanguard Target Retirement 2040 Fund

|

|

Registered investment company, 15,200 shares

|

|

|

672,947

|

|

|

|

|

Vanguard Target Retirement 2045 Fund

|

|

Registered investment company, 14,566 shares

|

|

|

410,609

|

|

|

|

|

Vanguard Target Retirement 2050 Fund

|

|

Registered investment company, 5,051 shares

|

|

|

229,570

|

|

|

|

|

Vanguard Target Retirement 2055 Fund

|

|

Registered investment company, 5,297 shares

|

|

|

261,344

|

|

|

|

|

Vanguard Target Retirement 2060 Fund

|

|

Registered investment company, 2,721 shares

|

|

|

118,598

|

|

|

|

|

Vanguard Target Retirement 2065 Fund

|

|

Registered investment company, 431 shares

|

|

|

11,854

|

|

|

|

|

American Funds Growth Fund of America

|

|

Registered investment company, 38,707 shares

|

|

|

2,616,222

|

|

|

|

|

DFA U.S. Targeted Value Portfolio Fund

|

|

Registered investment company, 52,303 shares

|

|

|

1,233,832

|

|

|

|

|

MFS Institutional International Equity Fund

|

|

Registered investment company, 15,828 shares

|

|

|

484,960

|

|

|

|

|

Prudential Core Plus Bond Fund

|

|

Registered investment company, 3,471 shares

|

|

|

682,568

|

|

|

|

|

American Beacon Stephens Mid-Cap Growth Institutional Fund

|

|

Registered investment company, 59,041 shares

|

|

|

2,225,851

|

|

|

|

|

Vanguard Federal Money Market Fund

|

|

Short-term investments, 3,310,850 shares

|

|

|

3,310,850

|

|

|

*

|

|

Mid-Atlantic Capital Group

|

|

Interest-bearing cash

|

|

|

14,928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

|

|

21,039,136

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Notes receivable from participants (179 loans with interest

|

|

|

|

|

|

|

|

|

rates from 4.25% to 8.00% from 1 months to 15 years)

|

|

|

|

|

850,160

|

|

|

|

|

Total Assets (Held at End of Year)

|

|

|

|

$

|

21,889,296

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Party in interest as defined by ERISA.

|

|

|

|

|

|

|

**

|

|

Cost omitted for participant directed investments.

|

|

|

|

|

|

See accompanying Report of Independent Registered Public Accounting Firm.

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITI 401(k) Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

June 24, 2021

|

|

/s/ Brenda Skinner

|

|

|

Date

|

|

Human Resources Manager, Instrument Transformers, LLC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description of the Exhibit

|

|

|

|

|

|

|

|

|

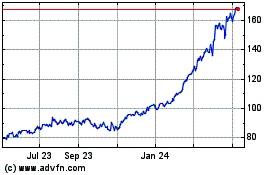

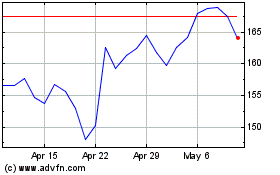

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024