Mortgage Rates Climb Above 3%, Freddie Mac Says

June 24 2021 - 10:24AM

Dow Jones News

By Matt Grossman

Thirty-year mortgage rates climbed above 3% in the latest week,

the first time they rose above that threshold in the last 10 weeks,

according to Freddie Mac's latest survey.

For the week ended Thursday, the rate on a 30-day fixed rate

mortgage averaged 3.02%, up from 2.93% last week but lower than the

3.13% average a year earlier.

Rates on 15-year fixed-rate mortgages averaged 2.34%, compared

with 2.24% a week earlier. Fifteen-year rates averaged 2.59% a year

earlier, according to Freddie Mac.

Five-year Treasury-indexed hybrid adjustable-rate mortgages, or

ARMs, on average stood at 2.53%, up from 2.52% last week but lower

than the 3.08% rate a year earlier.

"As the economy progresses and inflation remains elevated, we

expect that rates will continue to gradually rise in the second

half of the year," said Sam Khater, Freddie Mac's chief

economist.

Mortgage rates fell throughout most of 2020 as the Covid-19

pandemic ravaged the economy. That helped power a boom in mortgage

lending, fueled by refinancings. When rates hit 2.98% in July 2020,

it was their first time under the 3% mark in some 50 years of

recordkeeping.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

June 24, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

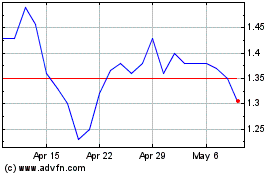

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024