Current Report Filing (8-k)

June 16 2021 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_________________

Date of Report (Date of earliest event reported): June 16, 2021

Centrus Energy Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

1-14287

|

52-2107911

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

(301) 564-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Class A Common Stock, par value $0.10 per share

|

LEU

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On June 16, 2021, Centrus Energy Corp. (the “Company”) entered into a Fourth Amendment to the Section 382 Rights Agreement (the “Fourth Amendment”), which amends the Section 382 Rights Agreement, dated as of April 6, 2016 (the “Rights Agreement”), by and among the Company and Computershare Trust Company, N.A. and Computershare Inc., as rights agent, as previously amended by (i) the First Amendment to the Section 382 Rights Agreement dated as of February 14, 2017 (the “First Amendment”), (ii) the Second Amendment to the Section 382 Rights Agreement dated as of April 3, 2019 (the “Second Amendment”), and (iii) the Third Amendment to the Section 382 Rights Agreement dated as of April 13, 2020 (the “Third Amendment”). The Fourth Amendment was approved by the Board of Directors of the Company on March 18, 2021, and approved by the Company’s stockholders at the Company’s annual meeting of the stockholders held on June 16, 2021.

The Fourth Amendment extends the Final Expiration Date (as defined in the Rights Agreement) from June 30, 2021 to June 30, 2023.

The Fourth Amendment was not adopted as a result of, or in response to, any effort to acquire control of the Company. The Fourth Amendment has been adopted in order to preserve for the Company’s stockholders the long-term value of the Company’s net operating loss carry-forwards for United States federal income tax purposes and other tax benefits.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Rights Agreement, which was filed with the Securities and Exchange Commission in a Current Report on Form 8-K on April 7, 2016, the First Amendment, which was filed with the Securities and Exchange Commission in a Current Report on Form 8-K on January 5, 2017, the Second Amendment, which was filed with the Securities and Exchange Commission in a Current Report on Form 8-K on April 4, 2019, the Third Amendment, which was filed with the Securities and Exchange Commission in a Current Report on Form 8-K on April 14, 2020, and the Fourth Amendment, a copy of which is attached as Exhibit 4.1 hereto and incorporated herein by reference.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 3.03 by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its 2021 annual meeting of stockholders on June 16, 2021. As of April 19, 2021, the meeting’s record date, there were 12,918,602 shares of the Company’s Class A common stock outstanding, each entitled to one vote. Approximately 79.8 percent of those shares were represented at the annual meeting.

At the annual meeting, the Company’s stockholders voted on five proposals and cast their votes as described below. The proposals are described in detail in the Company’s proxy statement.

Proposal 1

The Company’s stockholders elected eight directors (listed below) to hold office until the next annual meeting of stockholders and until his or her successor is elected and has qualified. There were no abstentions. The number of votes cast for or withheld and the broker non-votes were as follows:

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

For

|

Withheld

|

|

Kirkland H. Donald

|

8,015,875

|

6,345

|

|

W. Thomas Jagodinski

|

7,972,170

|

50,050

|

|

Tina W. Jonas

|

8,011,742

|

10,478

|

|

William J. Madia

|

7,970,122

|

52,098

|

|

Daniel B. Poneman

|

8,013,959

|

8,261

|

|

Bradley J. Sawatzke

|

8,015,798

|

6,422

|

|

Neil S. Subin

|

7,925,785

|

96,435

|

|

Mikel H. Williams

|

7,970,397

|

51,823

|

Broker Non-Votes: 2,290,628

Proposal 2

The Company’s stockholders cast their votes with respect to the approval of the Section 382 Rights Agreement, as amended as set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

7,899,625

|

80,050

|

42,545

|

2,290,628

|

Proposal 3

The Company’s stockholders cast their votes with respect to the approval of the 2014 Equity Incentive Plan, as amended and restated, as set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

7,938,481

|

67,690

|

16,049

|

2,290,628

|

Proposal 4

The Company’s stockholders cast their votes with respect to the advisory approval of the Company’s 2020 executive compensation (i.e., "say on pay") as set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

7,866,065

|

142,502

|

13,653

|

2,290,628

|

Proposal 5

The Company’s stockholders ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2021 as set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

10,260,439

|

30,067

|

22,342

|

0

|

Item 9.01 Financial Statements and Exhibits.

On June 16, 2021, the Company issued a press release with respect to the Fourth Amendment and the results of the annual meeting of stockholders. The press release, furnished as Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

(d) Exhibits.

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

4.1

|

|

|

99.1

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Centrus Energy Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

June 16, 2021

|

By:

|

/s/ Philip O. Strawbridge

|

|

|

|

|

|

Philip O. Strawbridge

|

|

|

|

|

|

Senior Vice President, Chief Financial Officer,

|

|

|

|

|

|

Chief Administrative Officer and Treasurer

|

|

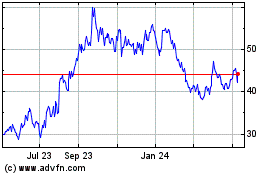

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

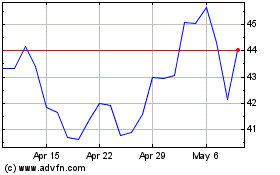

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Apr 2023 to Apr 2024