Current Report Filing (8-k)

June 15 2021 - 4:10PM

Edgar (US Regulatory)

false000087652300008765232021-06-092021-06-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________

FORM 8-K

_______________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 9, 2021

_______________________________________________

EZCORP, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-19424

|

|

74-2540145

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

2500 Bee Cave Road, Bldg One, Suite 200, Rollingwood, Texas 78746

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (512) 314-3400

_______________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

|

Class A Non-voting Common Stock, par value $.01 per share

|

|

EZPW

|

|

NASDAQ Stock Market

|

(NASDAQ Global Select Market)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 — Entry into a Material Definitive Agreement

On June 9, 2021 (the “Closing Date”), EZCORP, Inc. (the “Company”) completed the acquisition of 128 pawn stores in Mexico operating under the name “Cash Apoyo Efectivo.” The acquisition was completed pursuant to an Equity Interest Purchase Agreement (the “Purchase Agreement”), which was executed and delivered on the Closing Date. The parties to the Purchase Agreement are EZPAWN Management Mexico, S. de R.L. de C.V. and EZPAWN Services Mexico, S. de R.L. de C.V., two indirect wholly-owned subsidiaries of the Company (the “Buyers”); Gabriel Rafael Mondragón Mondragón and Ana Dolores Negrete Culbert (the “Sellers”); and PLO del Bajio, S. de R.L. de C.V. (the “Acquired Company”).

Under the terms of the Purchase Agreement, the Sellers agreed to sell, and the Buyers agreed to purchase, 100% of the equity interests in the Acquired Company for an initial purchase price of $33.8 million. The initial purchase price included:

•$17.3 million in cash;

•212,879 shares of the Company’s Class A Non-Voting Common Stock, valued at $1.6 million, consisting of registered shares from the Company’s shelf registration statement on Form S-4; and

•Repayment of $14.9 million of the Acquired Company’s existing debt.

The Sellers will be entitled to receive additional “earn-out” payments of up to $4.6 million over the first two years following the Closing Date so long as the aggregate pawn portfolio balance of the acquired stores reaches specified levels. The Company will have the option of paying up to 50% of the earn-out payments in the form of Class A Non-Voting Common Stock.

The Purchase Agreement contains customary representations and warranties. Most of those representations and warranties survive for a period of one year following the Closing Date, but certain fundamental representations and tax representations survive for a period of five years. The Sellers have agreed to indemnify the Buyers for breaches of such representations and warranties, and the Company withheld $2.0 million of the initial purchase price as a contingency fund to secure the Seller’s indemnification obligations. Absent breaches of representations and warranties that trigger such indemnification obligations, the contingency fund will be released to the Sellers primarily over a period of one year following the Closing Date, with a smaller portion being held for up to five years.

The Sellers have agreed that, for a period of three years following the Closing Date, neither they nor any of their affiliates will (a) engage in any competitive business within 10 kilometers of any of the Company’s existing locations or (b) solicit or hire any of the Company’s existing employees.

The transaction was approved by the Mexican Comisión Federal de Competencia Económica (Federal Economic Competition Commission) prior to the Closing Date.

Item 7.01 — Regulation FD Disclosure

On June 9, 2021, the Company issued a press release announcing the completion of the Cash Apoyo Efectivo acquisition. A copy of that press release is included as Exhibit 99.1 to this report.

Item 9.01 — Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EZCORP, INC.

|

|

|

|

|

|

|

|

|

|

|

Date:

|

June 15, 2021

|

|

|

|

By:

|

|

/s/Thomas H. Welch, Jr.

|

|

|

|

|

|

|

|

|

Thomas H. Welch, Jr.

|

|

|

|

|

|

|

|

|

Chief Legal Officer and Secretary

|

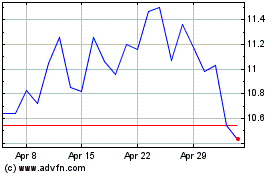

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

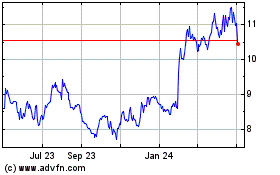

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Apr 2023 to Apr 2024