Current Report Filing (8-k)

June 11 2021 - 5:16PM

Edgar (US Regulatory)

0000837852

false

0000837852

2021-06-11

2021-06-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 11 2021

IDEANOMICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

001-35561

|

20-1778374

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

55 Broadway, 19th Floor, New York, NY 10006

(Address of principal executive offices) (Zip Code)

212-206-1216

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001

|

|

IDEX

|

|

The NASDAQ Stock Market

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

ITEM 1.01

|

Entry into a Material Definitive Agreement

|

On

June 11, 2021, the Company entered into a Standby Equity Distribution Agreement (the “SEDA”) with YA II PN, Ltd., (“YA”).

The Company will be able to sell up to 80,396,000 shares of its common stock at the Company’s request any time during the 36 months

following the date of the SEDA’s entrance into force. The shares would be purchased at (i) 95%

of the Market Price (as defined below) if the applicable pricing period is two consecutive trading days or (ii) 96% of the Market Price

if the applicable pricing period is five consecutive trading days, and, in each case, would be subject to certain limitations, including

that YA could not purchase any shares that would result in it owning more than 4.99% of the Company’s common stock. “Market

Price” shall mean the lowest daily VWAP (as defined below) of the Company’s common stock during the two or five consecutive

trading days, as applicable, commencing on the trading day following the date the Company submits an advance notice to YA. “VWAP”

means, for any trading day, the daily volume weighted average price of the Company’s common stock for such date on the principal

market as reported by Bloomberg L.P. during regular trading hours.

Pursuant

to the SEDA, we are required to register all shares which YA may acquire. The Company shall file with the Securities and Exchange Commission

a prospectus supplement to the Company's prospectus, dated January 19, 2021, filed as part of the Company’s effective shelf registration

statement on Form S-3ASR, File No. 333- 253061, registering all of the shares of Common Stock that are to be offered and sold to YA pursuant

to the SEDA.

Pursuant to the SEDA, we shall

use the net proceeds from any sale of the shares for working capital purposes, including for general working capital purposes, which may

include the repayment of outstanding debt and investment and acquisition activities.

There

are no other restrictions on future financing transactions. The SEDA does not contain any right of first refusal, participation rights,

penalties or liquidated damages. We did not pay any additional amounts to reimburse or otherwise compensate YA in connection with the

transaction.

YA

has agreed that neither it nor any of its affiliates shall engage in any short-selling or hedging of our common stock during any time

prior to the public disclosure of the SEDA.

The

foregoing is a summary description of certain terms of the Agreement. For a full description of all terms, please refer to the copy of

the Agreement that is filed herewith as Exhibits 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. All

readers are encouraged to read the entire text of the Purchase Agreement.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Ideanomics, Inc.

|

|

|

|

|

Date: June 11, 2021

|

By:

|

/s/ Alfred Poor

|

|

|

Name:

|

Aldred Poor

|

|

|

Title:

|

Chief Executive Officer

|

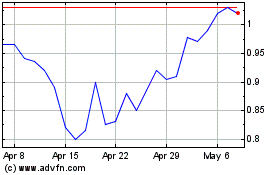

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

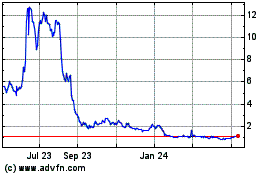

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024