Additional Proxy Soliciting Materials (definitive) (defa14a)

June 07 2021 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 90549

SCHEDULE

14A

(RULE

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

|

Filed

by the Registrant

|

[X]

|

|

Filed

by a Party other than the Registrant

|

[ ]

|

|

|

|

|

Check

the appropriate box:

|

|

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

For Use of the Commission Only (as permitted by Rule 14a–6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[X]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material under Rule 14a-12

|

Advaxis,

Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transactions applies:

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction.

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials:

|

|

|

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

|

(1)

|

Amount

previously paid:

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

|

|

June

4, 2021

Dear

Fellow Advaxis Stockholders:

As

you may have seen, at our Annual Meeting of Stockholders (AMS) held yesterday, several of the stockholder proposals were approved. However,

the AMS was partially adjourned to June 17, 2021 in order to solicit additional proxies to vote in favor of Proposal 3, to approve the

reverse stock split proposal, and Proposal 5 to ratify and approve the prior amendment to the Company’s 2015 Incentive Plan (each

such proposals as further described in our Definitive Proxy Statement (the “Proxy Statement”) on Schedule 14A relating to

the Annual Meeting, filed with the Securities and Exchange Commission on April 21, 2021).

I

have previously written to remind you of the Advaxis Board of Directors’ recommendation that our stockholders approve Proposal

3, the reverse stock split proposal, as outlined in our Proxy Statement.

We

are continuing to work towards gaining approval of the reverse

stock split because we believe it is important to retain our Nasdaq Capital Market listing, as further described and for the reasons

mentioned in our prior communications, including in our Proxy Statement. While a significant percentage of our stockholder base, to date,

agree and have voted FOR this proposal, we still have not received the requisite support of the majority of shares entitled to vote on

this proposal.

Through

discussions with various stockholders, we have learned that one concern held by those stockholders who have not voted FOR the reverse

stock split proposal, relates to the potential for dilution in the future. We are writing to emphasize to all of our stockholders that

the reverse stock split, in and of itself, does not result in dilution, as the reverse split would apply in the same manner to all of

our stockholders, including our executive officers and directors. Instead, dilution would occur only if the Company raised additional

capital by issuing additional equity securities following the reverse split. The Company does not have any current plans to raise capital

in the near term, absent an extraordinary change in circumstances, such as unforeseen liabilities or if we acquire new assets that require

additional investment. We do not believe we will need to raise additional capital in the near term because we have a) built a strong

balance sheet (including the proceeds from the financing completed in April 2021) and b) executed on our cost reduction plans that have

reduced our annual cash burn by greater than 75% over the past few years, securing a cash runway through potential future clinical and

corporate milestones.

Finally,

to further assuage any remaining concerns about potential dilution, the Company will no longer be seeking shareholder approval of an

amendment to our Charter to increase the number of our authorized shares to 300,000,000, as previously described in Proposal 2 of the

Proxy Statement.

It

is important to understand that time is running out for the Company to regain compliance with the $1 minimum bid price per share requirement

as the deadline for doing so is June 21, 2021. Therefore, we are seeking your assistance to vote for Proposal 3, the reverse stock split

proposal, in order for us to regain compliance requirement as soon as possible.

How

to Vote

To

vote, or if you have already voted and would like to change your vote, or if you have any questions or need assistance voting your shares,

please call the firm assisting us with the solicitation of proxies:

Alliance

Advisors

1-855-928-4484

Thank

you for attention to this matter.

Kenneth

A. Berlin

President

and Chief Executive Officer

and

Interim Chief Financial Officer

Advaxis,

Inc. / 9 Deer Park Drive, Suite K-1 / Monmouth Junction, NJ 08852

T:

609-452-9813 / F: 609-452-9818

www.advaxis.com

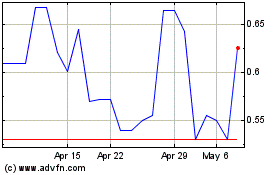

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024