Current Report Filing (8-k)

June 03 2021 - 4:10PM

Edgar (US Regulatory)

0001811074

false

0001811074

2021-05-31

2021-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

May 31, 2021

(Date of earliest event reported)

Texas Pacific Land Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39804

|

75-0279735

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

1700 Pacific Avenue, Suite 2900, Dallas, Texas

|

75201

|

|

(Address of principal executive offices)

|

(Zip Code)

|

214-969-5530

(Registrant’s telephone number, including

area code)

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transmission period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock (par value $.01 per share)

|

TPL

|

New York Stock Exchange

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

|

As previously announced, Chris Steddum became the

Chief Financial Officer of Texas Pacific Land Corporation (“TPL”) effective June 1, 2021. On May 31, 2021, TPL and Mr. Steddum

entered into an Amended and Restated Employment Agreement (the “A&R Employment Agreement”), effective June 1, 2021. The

A&R Employment Agreement replaces the previous employment agreement between TPL and Mr. Steddum.

Pursuant to the A&R Employment Agreement, Mr.

Steddum receives a base salary of $475,000 per annum, subject to annual review, and is eligible for an annual bonus of up to 225% of such

base salary for achievement of specified performance targets as established by the Compensation Committee of the Board of Directors. The

bonus may be paid in cash or in shares of TPL’s common stock, par value $.01 per share (the “Common Stock”) or a combination

thereof, at TPL’s discretion. In addition, Mr. Steddum received a one-time promotion bonus of $50,000 when the A&R Employment

Agreement became effective. The term of the A&R Employment Agreement ends on December 31, 2022, with automatic one (1) year extensions

unless notice not to renew is given by either party at least 120 days prior to the relevant end date.

The Steddum Agreement provides for payment of severance

benefits if the officer’s employment is terminated by the Company without cause or by Mr. Steddum for good reason, provided that

Mr. Steddum executes a general waiver and release of claims and complies with the restrictive covenants described below. The severance

benefits include (i) accrued but unpaid bonuses, (ii) long-term incentive benefits to the extent provided for pursuant to the underlying

award and plan documents, (iii) a pro rata bonus for the year of termination (if such termination occurs after the first calendar quarter),

(iv) monthly payments for up to 18 months of COBRA premiums for continued group health, dental and vision coverage for the officer and

his dependents, and (v) an amount equal to one times the average of his base salary and bonus for the preceding two years. If Mr. Steddum’s

employment is terminated by the Company without cause, by the officer for good reason, or upon failure of the Company to renew the term

of the Agreement, in all such cases, within 24 months following a change in control of the Company as defined in the Steddum Agreement,

then, in lieu of the amount specified in clause (v), Mr. Steddum will be entitled to an amount equal to 2.99 times the greater of (a)

the average of his base salary and bonus for the two years preceding the year in which the change in control occurs, and (b) his base

salary and target bonus for the year in which the change in control occurs. If Mr. Steddum’s employment terminates due to death

or disability, he or his estate will be entitled to the benefits described in clauses (i), (ii) and (iii) above. Mr. Steddum will also

be entitled to payment of accrued but unpaid salary, accrued but unused vacation, unsubsidized COBRA benefits, and unreimbursed business

expenses, following termination of employment for any reason.

The Steddum Agreement provides that Mr. Steddum

will be entitled to participate in all benefit plans provided to the Company’s executives of like status from time to time in accordance

with the applicable plan, policy or practices of the Company, as well as in any long-term incentive program established by the Company.

It also provides for four weeks of annual paid vacation, reimbursement of business expenses, and indemnification rights.

The Steddum Agreement contains restrictive covenants

prohibiting Mr. Steddum from disclosing the Company’s confidential information at any time, from competing with the Company in specified

counties where the Company does business during his employment, subject to certain exceptions, and for one year thereafter (or six months

thereafter if he terminates his employment voluntarily without good reason), and from soliciting the Company’s clients, suppliers

and business partners during his employment and for one year thereafter.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

TEXAS PACIFIC LAND CORPORATION

|

|

|

|

|

|

|

|

|

|

Dated: June 3, 2021

|

|

By:

|

/s/ Micheal W. Dobbs

|

|

|

|

|

Name: Micheal W. Dobbs

Title: SVP, General Counsel and Secretary

|

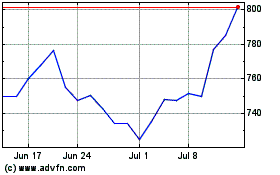

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

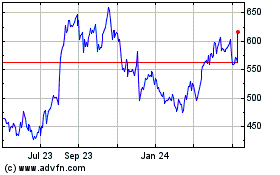

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Apr 2023 to Apr 2024