Stock Futures Edge Down Ahead of Jobless Figures

June 03 2021 - 5:12AM

Dow Jones News

By Anna Hirtenstein

U.S. stock futures ticked down Thursday ahead of fresh data that

will offer a view into the pace of the labor market's recovery and

the health of the services industry.

Futures tied to the S&P 500 edged 0.2% lower, pointing to a

muted slide for the broad market gauge after the opening bell. It

ground 0.1% higher on Wednesday. Nasdaq-100 futures also slid 0.2%

Thursday, suggesting a subdued retreat for technology stocks.

The major indexes have been sluggish this month as investors

weighed some signs that the economic rebound may slow or falter,

with snarled supply chains bolstering input costs for an array of

products. Concerns about high valuations for many stocks following

the monthslong rally in U.S. markets are also giving some investors

pause.

A Federal Reserve report on Wednesday noted a pickup in growth

as consumers return to restaurants and stores, but also said

supply-chain disruptions and acute labor shortages are leading to

price increases. Thursday's weekly jobless claims figures, seen as

a proxy for unemployment, and Friday's jobs report will provide

insights into the recovery in the labor market, which Fed officials

have said they remain concerned about.

"There is a continued focus on inflation and central banks and

when they taper," said Caroline Simmons, U.K. chief investment

officer at UBS Global Wealth Management. "If the labor market comes

in stronger than people are expecting, it will then raise the

debate that the economy is on track, job growth is good and

therefore we'll end up with wage increases and at some point,

domestic inflation."

The latest data on initial jobless claims is scheduled to be

released at 8:30 a.m. ET. Economists surveyed by The Wall Street

Journal are forecasting a decline below 400,000 applications, from

406,000 the prior week, which would be a new pandemic low.

Meanwhile, a handful of stocks popular on online forums such as

AMC Entertainment Holdings have soared to unprecedented levels in

frenzied trading this week. AMC rose almost 14% in premarket

trading Thursday, while BlackBerry gained over 25%. Naked Brand

Group and Sundial Growers were among the other small stocks to see

outsize moves.

"These are quite astonishing price reactions, but if something

goes up that much, it usually comes down again, as it's not based

on fundamentals," said Ms. Simmons. "These things usually don't end

well, it is very volatile and people can lose quite a lot of money

depending on when they go in and when the stock corrects."

The joke cryptocurrency dogecoin rose above 44 cents from around

41 cents at 5 p.m. ET Wednesday, according to data from

CoinDesk.

Surveys of purchasing managers, slated to be released at 9:45

a.m., are expected to offer insights into the recovery of the U.S.

services industry in May, which were among the hardest-hit by the

lockdowns. Another gauge of services activity will also go out at

10 a.m.

"We're seeing some peaking and plateauing of the data" as the

rate of change from the lows of the pandemic smooths out, said

Grace Peters, an investment strategist at J.P. Morgan Private Bank.

"This does lead to some indigestion in markets: we've seen equity

markets plateau over the last month, which is very much tied to

peak data."

In bond markets, the yield on the benchmark 10-year Treasury

note ticked up to 1.601% from 1.591% on Wednesday. Yields rise when

prices fall.

Oil prices edged up, with Brent crude, the international energy

benchmark, adding 0.4% to trade at $71.74 per barrel. That is the

highest in more than two years.

Overseas, the pan-continental Stoxx Europe 600 pulled back from

a record high, easing down 0.2%.

In Asia, the major benchmarks ended trading on a mixed note. The

Shanghai Composite Index slipped almost 0.4%, while Japan's Nikkei

225 advanced 0.4%. Hong Kong's Hang Seng Index declined 1.1%.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

June 03, 2021 05:12 ET (09:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

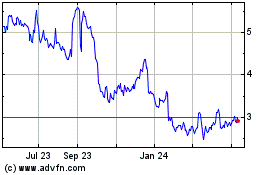

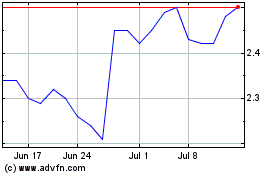

BlackBerry (NYSE:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlackBerry (NYSE:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024