As

filed with the Securities and Exchange Commission on May 27, 2021

Registration No. 333-240081

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST

EFFECTIVE AMENDMENT NO.1 TO FORM F-1

ON

FORM

F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

METEN

EDTECHX EDUCATION GROUP LTD.

(Exact

name of registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s name into English)

|

Cayman

Islands

|

|

Not

Applicable

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification Number)

|

3rd

Floor, Tower A Tagen

Knowledge&

Innovation Center

2nd

Shenyun West Road

Nanshan

District

Shenzhen,

Guangdong 518045

The

People’s Republic of China

+86

755-8294-5250

(Address

and telephone number of Registrant’s principal executive offices)

Puglisi

& Associates

850

Library Avenue, Suite 204

Newark,

DE 19711

+1

302-738-6680

(Name,

address, and telephone number of agent for service)

With

a Copy to:

Ying

Li, Esq.

Guillaume

de Sampigny, Esq.

Hunter

Taubman Fischer & Li LLC

800

Third Avenue, Suite 2800

New

York, NY 10022

212-530-2206

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of the registration statement.

If

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

|

†

|

The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board

to its Accounting Standards Codification after April 5, 2012.

|

Pursuant

to Rule 429(b) under the Securities Act, upon effectiveness, this Post-effective Amendment shall constitute post-effective amendment

no. 1 to the registration statement on Form F-1 (File No. 333-240081) and post-effective amendment no.2 to the registration statement

on F-4 (File No. 333-235859), which post-effective amendments shall hereafter become effective concurrently with the effectiveness of

this Registration Statement in accordance with Section 8(c) of the Securities Act.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

On

July 24, 2020, the registrant filed a Registration Statement on Form F-1 (Registration No. 333-240081), as amended, which was subsequently

declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on August 7, 2020 (as amended, the “Registration

Statement”).

This

post-effective amendment on Form F-3 is being filed to update the Registration Statement to (i) convert the Registration Statement into

a Registration Statement on Form F-3 because the registrant is eligible to use Form F-3, (ii) include information contained in the registrant’s

Annual Report on Form 20-F (Registration No. 001-39258), as amended, initially filed with the SEC on April 30, 2021, and (iii) to update

certain other information in such Registration Statement.

No

additional securities are being registered under this post-effective amendment. All applicable registration fees were paid at the time

of the original filing of the Registration Statement.

The

information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED MAY 27, 2021

PROSPECTUS

METEN

EDTECHX EDUCATION GROUP LTD.

51,025,947

ORDINARY SHARES (INCLUDING SHARES ISSUED PURSUANT TO THE EXERCISE OF THE WARRANTS)

6,260,000

WARRANTS TO PURCHASE 6,260,000 ORDINARY SHARES

250,000

UNITS PURSUANT TO THE EXERCISE OF THE UNIT PURCHASE OPTIONS

This

prospectus relates to the following securities of Meten EdtechX Education Group Ltd., a Cayman Islands exempted company (“we”,

the “Registrant” or the “Company”):

(i)

the offering of (a) 250,000 units (including the underlying 250,000 warrants and 250,000 ordinary shares), issuable upon exercise of

the outstanding unit purchase options to purchase units (the “unit purchase options”), consisting of one ordinary share of

the Company, or “ordinary share,” and one warrant to purchase one ordinary share (the “units”) and (b) 10,355,000

ordinary shares issuable upon exercise of the warrants (including the warrants underlying the units purchasable upon exercise of the

unit purchase options);

(ii)

the resale of 44,330,947 ordinary shares and 6,260,000 warrants by selling securityholders named in this Combined Prospectus (as defined

herein), comprising (a) 3,200,000 ordinary shares purchased in private placements and held by certain institutional investors (including

2,600,000 ordinary shares underlying the units held by certain institutional investors that purchased in private placements) that have

requested such ordinary shares to be included in the registration statement of which this prospectus forms part, (b) 34,870,947 ordinary

shares held by certain shareholders who received ordinary shares in connection with the consummation of the Mergers (as defined herein)

and became holders of our ordinary shares, (c) 3,660,000 warrants held by certain holders who received redeemable warrants in connection

with the consummation of the Mergers (the “Converted Warrants”), (d) 2,600,000 warrants underlying the units held by certain

institutional investors purchased in private placements (the “PIPE Warrants”) and that have requested such warrants to be

included in the registration statement of which this prospectus forms part, (e) 2,600,000 ordinary shares issuable upon exercise of the

PIPE Warrants underlying the units held by certain institutional investors that purchased in private placements and that have requested

such warrants to be included in the registration statement of which this prospectus forms part and (f) 3,660,000 ordinary shares issuable

upon exercise of the Converted Warrants (as defined herein); and

(iii)

the issuance by us of up to 2,600,000 ordinary shares that are issuable upon the exercise of the Transferred Warrants (as defined herein).

This

prospectus may not be used to offer or sell any securities unless accompanied by the applicable prospectus supplement.

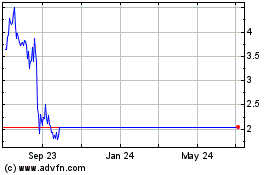

Our

ordinary shares are listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “METX.” On May 26, 2021, the last reported

sale price of the ordinary shares on Nasdaq was US$0.98 per ordinary share.

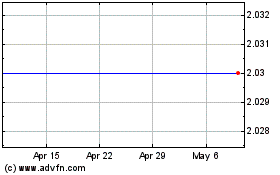

Our

warrants are listed on Nasdaq under the symbol “METXW.” On May 26, 2021, the last reported sale price of the warrants was

US$0.235 per warrant.

We

have experienced and may continue to experience price volatility in our ordinary shares. See related risk factors in our most recent

annual report on Form 20-F (File Number: 001-39258), as amended, initially filed with the Securities and Exchange Commission on April

30, 2021. All information filed with the SEC can be inspected over the Internet at the SEC’s website at www.sec.gov and copied

at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You can request copies of these

documents, upon payment of a duplicating fee, by writing to the SEC.

The

aggregate market value of our outstanding ordinary shares held by non-affiliates, or public float, as of May 26, 2021, was approximately

US$197.1 million, which was calculated based on 81,131,464 ordinary shares held by non-affiliates and the per price of US$2.43, which

was the closing price of our ordinary shares on Nasdaq on April 6, 2021. During the 12 calendar months prior to and including the date

of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Investing

in our securities involves risks. See “Risk Factors” beginning on page 10 of this prospectus and risk factors set forth

in our most recent annual report on Form 20-F, in other reports incorporated herein by reference, and in an applicable prospectus

supplement under the heading “Risk Factors.”

We

may offer and sell the securities from time to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters,

to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities

with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions or discounts

will be set forth in a prospectus supplement. The offering price of such securities and the net proceeds we expect to receive from such

sale will also be set forth in a prospectus supplement. See “Plan of Distribution” elsewhere in this prospectus for a more

complete description of the ways in which the securities may be sold.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2021

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

Registrant was formed for the purpose of effecting the Agreement and Plan of Reorganization (the “Merger Agreement”), dated

as of December 12, 2019, by and among EdtechX Holdings Acquisition Corp., a Delaware corporation (“EdtechX”), the Company,

Meten Education Inc., a Delaware corporation and wholly owned subsidiary of the Company (“EdtechX Merger Sub”), Meten Education

Group Ltd., a Cayman Islands exempted company and wholly owned subsidiary of the Company (“Meten Merger Sub,” and together

with EdtechX Merger Sub, the “Merger Subs”), and Meten International Education Group, a Cayman Islands exempted company (“Meten

International” or “Meten”).

Upon

the terms and subject to the conditions of the Merger Agreement and in accordance with the Delaware General Corporation Law and the Companies

Law of the Cayman Islands, the Company, EdtechX, the Merger Subs and Meten International entered into a merger transaction by which (i)

EdtechX Merger Sub merged with and into EdtechX, with EdtechX being the surviving entity of the merger (the “EdtechX Merger”)

and becoming a wholly-owned subsidiary of the Company (“Surviving Delaware Corporation”), and (ii) Meten Merger Sub merged

with and into Meten International, with Meten International being the surviving entity of such merger (the “Meten Merger,”

and together with the EdtechX Merger, the “Mergers”) and a wholly-owned subsidiary of the Company (“Surviving Cayman

Islands Company”).

On

March 30, 2020, the parties to the Merger Agreement consummated the Mergers. Immediately prior to the Mergers, the designees of

Azimut Enterprises Holdings S.r.l. (the “Azimut Investor”) invested US$20 million in EdtechX to purchase 2,000,000 units

of EdtechX (with each unit consisting of one ordinary share and one warrant to purchase one ordinary share of EdtechX at a price of

US$11.50 per share, which has been subsequently reset to $1.00 as of the date of this prospectus) (the “Azimut

Investment”), which units converted into the same number of our units upon closing of the Mergers. Concurrently with the

closing of the Mergers, our PIPE financing with two unaffiliated third-party investors (each a “PIPE Investor”), one of

which is Xiamen ITG Holding Group, a China-based Fortune Global 500 company (the “ITG Education”), in an aggregate

investment of US$12 million was completed on March 30, 2020 (the “PIPE Investment”).

Combined

Prospectus

This

Post-effective Amendment, which is a post-effective amendment on Form F-3 to our registration statement on Form F-1 (File No. 333-240081),

which constituted post-effective amendment no. 1 on Form F-1 to the registration statement on Form F-4 (File No. 333-235859) filed by

the Company and, in that regard, was filed pursuant to the undertakings in Item 22 in such Form F-4 to file a post-effective amendment

in relation thereto. Accordingly, this Post-effective Amendment contains a combined prospectus (the “Combined Prospectus”)

pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”). The Combined Prospectus relates

to the following registration statements:

|

|

(1)

|

the

Registration Statement on Form F-4 originally filed with the SEC on January 9, 2020 (File No. 333-235859), which was declared effective

on March 16, 2020 (the “Prior Registration Statement”); and

|

|

|

(2)

|

the

Registration Statement on Form F-1 originally filed with the SEC on July 24, 2020 (File No. 333-240081), which was declared effective

on August 7, 2020 (the “Registration Statement”).

|

The

Prior Registration Statement registered the offering of (a) 250,000 units (including 250,000 underlying ordinary shares and 250,000 underlying

warrants) issuable upon exercise of the outstanding unit purchase options; and (b) 10,355,000 ordinary shares issuable upon the exercise

of 10,355,000 warrants of the Company (including the 250,000 warrants issuable upon the exercise of outstanding unit purchase options),

and the offering of such warrants and units in connection with the Mergers was also registered on the Prior Registration Statement. Pursuant

to the Registration Statement, our offering of 250,000 units (including the underlying 250,000 warrants and 250,000 ordinary shares)

issuable upon exercise of the outstanding unit purchase options and 10,355,000 ordinary shares issuable upon exercise of the warrants

(including the warrants underlying the units purchasable upon exercise of the unit purchase options) is ongoing and remains registered

pursuant to the Prior Registration Statement. Therefore, the Combined Prospectus covers such 250,000 units (including the underlying

250,000 warrants and 250,000 ordinary shares) issuable upon exercise of the unit purchase options and 10,355,000 ordinary shares issuable

upon exercise of the warrants (including warrants underlying the units purchasable upon exercise of the unit purchase options). Upon

the exercise of the warrants and unit purchase options, the ordinary shares and the warrants (including those underlying the units issuable

upon exercise of unit purchase options) issued in connection with such exercise will be freely tradable under the U.S. securities laws,

unless held by affiliates of ours (which securities shall be freely tradable under the U.S. securities laws if the related resales are

also registered under the Registration Statement). Pursuant to Rule 416(a) of the Securities Act, the Prior Registration Statement also

registered an indeterminable number of additional ordinary shares as may be issued to prevent dilution resulting from share splits, share

capitalizations and similar transactions and accordingly the Combined Prospectus also covers any such additional ordinary shares. We

are filing the Combined Prospectus to satisfy the requirements of the Securities Act and the rules and regulations thereunder for the

offering registered on the Prior Registration Statement in order to maintain the effectiveness of the Prior Registration Statement to

the extent that such Prior Registration Statement pertains to the ordinary shares issuable upon exercise of the warrants and the warrants

and ordinary shares underlying the units issuable upon exercise of the unit purchase options.

Pursuant

to Rule 429(b) under the Securities Act, upon effectiveness, this Post-effective Amendment shall constitute a post-effective amendment

to the Prior Registration Statement and Registration Statement, which post-effective amendments shall hereafter become effective concurrently

with the effectiveness of this Post-effective Amendment in accordance with Section 8(c) of the Securities Act.

This

Post-effective Amendment registers the resale of 44,330,947 ordinary shares and 6,260,000 warrants by the selling securityholders named

in the Combined Prospectus, comprising (a) 3,200,000 ordinary shares held by certain institutional investors that purchased in private

placements (including 2,600,000 ordinary shares underlying the units held by certain institutional investors that purchased in private

placements) that have requested such ordinary shares to be included in the registration statement of which this prospectus forms part,

(b) 34,870,947 ordinary shares held by certain shareholders who received ordinary shares in connection with the consummation of the Mergers

and became holders of our ordinary shares, (c) 3,660,000 warrants held by certain holders who received redeemable warrants in connection

with the consummation of the Mergers (the “Converted Warrants”), (d) 2,600,000 warrants underlying the units held by certain

institutional investors purchased in private placements (the “PIPE Warrants”) and that have requested such warrants to be

included in the registration statement of which this prospectus forms part, (e) 2,600,000 ordinary shares issuable upon exercise of the

PIPE Warrants held by certain institutional investors that purchased in private placements and that have requested such warrants to be

included in the registration statement of which this prospectus forms part and (f) 3,660,000 ordinary shares issuable upon exercise of

the Converted Warrants.

Upon

the sale or distribution of the PIPE Warrants as described herein, the PIPE Warrants will become fungible with our redeemable warrants

issued in the consummation of the Mergers. We expect these transferred PIPE Warrants (“Transferred Warrants”) will be quoted

on the Nasdaq Capital Market under the same ticker symbol as our redeemable warrants: “METXW.”

In

addition, this Post-effective Amendment relates to the issuance by us of up to 2,600,000 ordinary shares that are issuable upon the exercise

of the Transferred Warrants.

Deregistration

of Securities from the Registration Statement on Form F-4 (File No. 333-235859)

In connection with the Mergers, the Prior Registration Statement registered

up to a maximum number of securities specified in such Prior Registration Statement, not all of which were issued and sold in connection

with the consummation of the Mergers on March 30, 2020. Accordingly, in accordance with the undertakings made by the Registrant in the

Prior Registration Statement to remove from registration, by means of a post-effective amendment, any of the securities which remain unsold

at the termination of the offering, the Registrant deregistered the securities referred to below through the Registration Statement:

|

|

(1)

|

In

the Prior Registration Statement, the Registrant registered the issuance of 7,906,250 ordinary shares to be issued to holders of common

stock of EdtechX in connection with the Mergers. As a result of the exercise of redemption rights in respect of 5,974,745 shares of common

stock in connection with the consummation of the Mergers, 1,931,505 ordinary shares were issued to the holders of common stock in connection

with the consummation of the Mergers. Accordingly, through the Registration Statement, the Registrant deregistered 5,974,745 ordinary

shares that were registered on the Prior Registration Statement and were not issued and sold in connection with the consummation of the

Mergers.

|

|

|

|

|

|

|

(2)

|

In

the Prior Registration Statement, the Registrant registered the issuance of 59,391,607 ordinary shares to be issued to shareholders of

Meten in connection with the Mergers. As a result of certain shareholders’ election to receive cash consideration in an aggregate

amount of $2,810,818.35 in lieu of 270,271 ordinary shares, the Company deregistered 270,271 ordinary shares that were registered on

the Prior Registration Statement and were not issued and sold in connection with the consummation of the Mergers through the Registration

Statement.

|

The Prior Registration Statement was therefore

amended by the Registration Statement, as appropriate, to reflect the deregistration of the securities referred to above.

COMMONLY

USED DEFINED TERMS

Unless

otherwise indicated or the context requires otherwise, references in this prospectus or in a prospectus supplement to:

|

|

●

|

“after-school

language training” are to academic English language training services provided to K-12 students;

|

|

|

●

|

“we,”

“us,” “our Company,” “the Company” and “our” are to Meten EdtechX Education Group

Ltd. and its subsidiaries;

|

|

|

●

|

“China”

or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan

and the special administrative regions of Hong Kong and Macau;

|

|

|

●

|

“Code”

are to the U.S. Internal Revenue Code of 1986, as amended;

|

|

|

●

|

“ELT”

are to English language training;

|

|

|

●

|

“general

ELT” are to services that help students improve their English language skills, particularly English communication skills;

|

|

|

|

|

|

|

●

|

“gross

billings” are to the total amount of cash received for the sales of our products and services during a specific period of time,

net of the total amount of refunds for that period, which is not a measure under U.S. GAAP;

|

|

|

●

|

“learning

center” are to the physical establishment of an education facility providing general adult ELT, junior ELT and international

standardized test preparation under our overseas training services at a specific geographic location in the PRC, directly operated

by our VIEs and their respective subsidiaries or operated by franchise partners;

|

|

|

●

|

“offline

ELT” are to our offline services, which include general adult ELT, junior ELT and overseas training services;

|

|

|

●

|

“RMB”

and “Renminbi” are to the legal currency of China;

|

|

|

●

|

“student

enrollments” or “student enrollment” are to the number of actual new sales contracts entered into between Meten

and its students, excluding the number of refunded contracts and contracts with no revenue generated during a specified period of

time;

|

|

|

|

|

|

|

●

|

“test-oriented

ELT” are to services that help students achieve higher scores in specific standardize tests, including TOEFL, IELTS, GRE, SAT

and other international standardized examinations;

|

|

|

●

|

“tier

one cities” are to Beijing, Shanghai, Guangzhou and Shenzhen;

|

|

|

●

|

“tier

two cities” are to provincial capitals, regional centers or economically developed cities in China, including, among others,

Chengdu, Hangzhou, Chongqing, Wuhan and Tianjin;

|

|

|

●

|

“tier

three cities” and “tier four cities” are to small- to mid-sized cities in China that are strategically located

or have relatively developed or large local economy;

|

|

|

●

|

“dollars,”

“US$” and “U.S. dollars” are to the legal currency of the United States;

|

|

|

●

|

“U.S.

GAAP” are to generally accepted accounting principles in the United States;

|

|

|

●

|

“variable

interest entities” or “VIEs” are to Shenzhen Meten International Education Co., Ltd., or Shenzhen Meten,

and Shenzhen Likeshuo Education Co., Ltd., or Shenzhen Likeshuo, which are PRC companies in which Meten does not have equity interests

but whose financial results have been consolidated by Meten in accordance with U.S. GAAP due to Meten having effective control over,

and being the primary beneficiary of, these companies; and “affiliated entities” refers to VIEs, the VIEs’ direct

and indirect subsidiaries, and the VIEs’ affiliated entities that are registered as private non-enterprise institutions under

the PRC laws; and

|

|

|

|

|

|

|

●

|

years

are to the calendar year from January 1 to December 31 and references to our fiscal year or years are to the fiscal year or years

ended December 31.

|

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, an applicable prospectus supplement, and our SEC filings that are incorporated by reference into this prospectus contain

or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). Many of the forward-looking statements contained in this

prospectus can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,”

“expect,” “should,” “plan,” “intend,” “estimate,” and “potential,”

among others.

Forward-looking

statements appear in a number of places in this prospectus, an applicable prospectus supplement, and our SEC filings that are incorporated

by reference into this prospectus. These forward-looking statements include, but are not limited to, statements regarding our intent,

belief, or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information

currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially

from those expressed or implied in the forward-looking statements due to of various factors, including, but not limited to, those identified

under the section entitled “Item 3. Key Information—3.D. Risk Factors” in our annual report on Form 20-F for the fiscal

year ended December 31, 2020. These risks and uncertainties include factors relating to:

|

|

●

|

our

goals and growth strategies;

|

|

|

●

|

our

future prospects and market acceptance of our courses and other products and services;

|

|

|

●

|

our

future business development, results of operations, and financial condition;

|

|

|

●

|

expected

changes in our revenue, costs or expenditures;

|

|

|

●

|

our

plans to expand and enhance our courses and other products and services;

|

|

|

●

|

our

ability to retain and increase our student enrollment;

|

|

|

●

|

our

plans to expand and enhance our courses and other products and services;

|

|

|

●

|

our

ability to engage, train and retain new teachers and consultants;

|

|

|

●

|

our

ability to maintain and improve technology infrastructure necessary to operate our online platform;

|

|

|

●

|

our

expectations regarding the demand for, and market acceptance of, our services and our brands;

|

|

|

●

|

relevant

government policies and regulations relating to our business and industry;

|

|

|

●

|

general

economic and business condition in the markets where we operate;

|

|

|

●

|

growth

and competition in the ELT markets;

|

|

|

●

|

assumptions

underlying or related to any of the foregoing;

|

|

|

●

|

the

length and severity of the recent COVID-19 outbreak and its impact on our business and industry;

|

|

|

●

|

legislative

and regulatory developments related to U.S.-listed China-based companies due to lack of PCAOB inspection;

|

|

|

●

|

other

factors that may affect our financial condition, liquidity, and results of operations; and

|

|

|

●

|

other

risk factors discussed under “Item 3. Key Information—3.D. Risk Factors” in our annual report on Form 20-F for

the fiscal year ended December 31, 2020.

|

Forward-looking

statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information

or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or

to reflect the occurrence of unanticipated events.

OUR

COMPANY

Business

Overview

We

are one of the leading ELT service providers in China. China’s ELT market is segmented into general ELT, test-oriented ELT and

after-school language training sectors. We offer a comprehensive ELT service portfolio comprising of general adult ELT, junior ELT, overseas

training services, online ELT and other English language-related services to students from a wide range of age groups. We conduct our

business through our offline-online business model designed to maximize compatibility within our business segments in order to scale

up at relatively low costs.

As

of December 31, 2020, we had a nationwide offline learning center network of 105 self-operated learning centers (including 20 learning

centers under the “ABC” brand of ABC Education Group, which we acquired in June 2018) covering 28 cities in 15 provinces,

autonomous regions and municipalities in China, and 13 franchised learning centers (including four franchised learning centers under

the “ABC” brand) covering 12 cities in 11 provinces and municipalities in China. Leveraging our experience gained from operating

offline learning centers, we launched our online English learning platform “Likeshuo” in 2014 to further expand our service

reach to a larger student base. As of December 31, 2020, we had approximately 1.79 million registered users on our “Likeshuo”

platform and cumulatively over 320,000 paying users who purchased our online ELT courses or trial lessons. As of the same date, the cumulative

number of student enrollments for our online ELT courses since 2014 was approximately 180,000 and we had delivered over 5.35 million

accumulated course hours to our students online. We also have opened five experiential marketing stores in China to enable our prospective

students to obtain in-person experience of live streaming online ELT courses delivered on our “Likeshuo” platform. We take

advantage of our business model of combining our offline learning center network and online platform to deepen our market penetration

and further develop our business.

Our

qualified personnel, centralized management system driven by artificial intelligence, and technical expertise enable us to create a learning

environment that caters to the specific learning demands of our students. We have experienced teaching staff and development team members,

who are supported by our centralized teaching and management systems to optimize our students’ learning experiences. As of December

31, 2020, we had a team of 1,824 full-time teachers, study advisors and teaching service staff, of which 826 were study advisors and

teaching service staff for our offline and online businesses. As of the same date, we also had 163 full-time and part-time foreign teachers

from English-speaking countries for our offline ELT services. We have a dedicated content development team focusing on developing practical

and innovative education materials independently and in collaboration with our strategic partners. We have built highly centralized and

scalable management systems to manage our teaching, marketing, finance and human resources activities across our offline and online businesses.

In addition to our management systems, we have made significant investments in developing platforms and systems to support our teaching

activities. For example, we utilize the intelligent tracking and learning coaching function of our artificial intelligence-driven teaching

management systems to record and analyze our students’ real-time learning process and personalize the course content to address

their learning needs.

Corporate

Information

Our

principal executive office is located at 3rd Floor, Tower A, Tagen Knowledge & Innovation Center, 2nd Shenyun

West Road, Nanshan District, Shenzhen, Guangdong Province 518000, the People’s Republic of China. Our telephone number at this

address is +86 755 8294-5250. Our registered office in the Cayman Islands is located at Cricket Square, Hutchins Drive, PO Box 2681,

Grand Cayman, KY1-1111, Cayman Islands. Our agent for service of process in the United States is Puglisi & Associates, located at

850 Library Avenue, Suite 204, Newark, Delaware 19711. Our corporate website is www.investor.metenedu-edtechx.com. The information contained

in our website is not a part of this prospectus.

SUMMARY

OF THE OFFERING

The

summary below describes the principal terms of this offering. The “Description of Share Capital” section of this prospectus

contains a more detailed description of our securities.

The

offering of an aggregate of 51,025,947 ordinary shares, 6,260,000 warrants and 250,000 units are being offered hereby, comprising:

|

Securities

Issuable upon Exercise of

Outstanding Warrants and Unit Purchase Options:

|

The

offering of 250,000 units (including the underlying 250,000 warrants and 250,000 ordinary

shares) issuable upon exercise of the unit purchase options and 10,355,000 ordinary shares

issuable upon exercise of the warrants (including warrants underlying the units purchasable

upon exercise of the unit purchase options). The offering of such warrants, the units (including

underlying ordinary shares and warrants) issuable upon exercise of unit purchase options,

and the ordinary shares issuable upon exercise of such warrants (including warrants underlying

the units purchasable upon exercise of the unit purchase options) was registered on the Prior

Registration Statement. Upon exercise and issuance, such ordinary shares and warrants (including

those underlying the units issuable upon exercise of unit purchase options) will be freely

tradable under U.S. securities laws, unless held by our affiliates(which securities shall

be freely tradable under the U.S. securities laws if the related resales are also registered

under the Registration Statement).

The

issuance by us of up to 2,600,000 ordinary shares that are issuable upon the exercise of Transferred Warrants.

|

|

|

|

Securities

Offered by Selling

Shareholders:

|

The

resale of up to 44,330,947 of our ordinary shares and 6,260,000 warrants, which may be offered for sale from time to time by the

selling securityholders named in this prospectus, comprising:

|

|

|

|

|

|

●

|

3,200,000

ordinary shares held by certain institutional investors that purchased in private placements (including 2,600,000 ordinary shares

underlying the units held by certain institutional investors that purchased in private placements) and that have, through to the

date hereof, requested such ordinary shares to be included in the registration statement of which this prospectus forms part;

|

|

|

|

|

|

|

●

|

34,870,947

ordinary shares held by certain shareholders who received ordinary shares in connection with the consummation of the Mergers and

became a shareholder;

|

|

|

|

|

|

|

●

|

3,660,000

Converted Warrants held by certain holders who received redeemable warrants in connection with the consummation of the Mergers;

|

|

|

●

|

2,600,000

warrants underlying the units held by certain institutional investors purchased in private placements (the “PIPE Warrants”)

that have requested such warrants to be included in the registration statement of which this prospectus forms part;

|

|

|

|

|

|

|

●

|

2,600,000

ordinary shares issuable upon exercise of the PIPE Warrants underlying the units held by certain institutional investors that purchased

in private placements and that have requested such warrants to be included in the registration statement of which this prospectus

forms part

|

|

|

|

|

|

|

●

|

3,660,000

ordinary shares issuable upon exercise of the Converted Warrants.

|

|

|

|

|

|

|

Ordinary

Shares Outstanding

|

As

of the date of this prospectus, our issued share capital consists of 104,325,637 ordinary shares issued and outstanding.

|

|

|

|

|

Warrants

Outstanding

|

As

of the date of this prospectus there are 5,316,125 warrants outstanding.

|

|

|

|

|

|

The

warrants are exercisable on a one-for-one basis for ordinary shares. Each warrant is currently exercisable for one ordinary share

at a price of US$1.00 per ordinary share, which exercise price is payable to us.

|

|

|

|

|

Unit

Purchase Options Outstanding

|

As

of the date of this prospectus there are options outstanding for the purchase of 250,000 units.

|

|

|

|

|

|

The

options relate to the purchase of one of our units consisting of one ordinary share and one warrant to purchase and ordinary share.

Each option is currently exercisable for one unit at a price of US$12.00 per unit, which exercise price is payable to us.

|

|

Lock-up

|

27,619,622

ordinary shares held by certain shareholders who are pre-merger shareholders of Meten and

received ordinary shares in connection with the consummation of the Mergers are subject to

certain lock-up agreement (the “Founder Lock-up Agreement”), pursuant to which

they agree not to transfer such shares, until (i) with respect to 50% of such ordinary shares,

the earlier of the date that is six months after the closing of the Mergers and the date

on which the closing price of Company’s ordinary shares equals or exceeds $12.50 per

share (as adjusted for share splits, share capitalizations, reorganizations and recapitalizations)

for any 20 trading days within any 30-trading day period after closing and (ii) with respect

to the remaining 50% of such ordinary shares, one year after closing, or earlier, in either

case, if, subsequent to the closing, the Company consummates a liquidation, merger, stock

exchange or other similar transaction which results in all holders of the Company’s

ordinary shares ceasing to hold more than fifty percent (50%) of the then outstanding Company

ordinary shares or having the right to exchange their ordinary shares for cash or freely

tradable securities.

1,543,750

ordinary shares and 3,660,000 warrants held by certain securityholders who are pre-merger EdtechX securityholders and received ordinary

shares and/or warrants in connection with the consummation of the Mergers are subject to an amended and restated stock escrow agreement

(the “Amended Stock Escrow Agreement”) and a lock-up agreement (the “Warrant Lock-up Agreement), pursuant to which

they will agree not to transfer such ordinary shares and warrants until, with respect to 50% of such ordinary shares and warrants,

the earlier of the date that is six months after the closing of the Mergers and the date on which the closing price of the Holdco

Ordinary Shares equals or exceeds $12.50 per share (as adjusted for share splits, share capitalizations, reorganizations and recapitalizations)

for any 20 trading days within any 30-trading day period after closing, and with respect to the remaining 50% of such Holdco Ordinary

Shares and Holdco Warrants, six months after the closing of the Mergers, subject in each case to earlier release of the shares if

certain conditions are met.

In

connection with the 2021 Equity Offering (as defined herein), we and each of our directors and executive officers have agreed for

a period of 120 days after May 24, 2021, the date of the lock-up agreements, subject to certain exceptions, without the prior written

consent of the underwriter, not to directly or indirectly:

● issue

(in the case of us), offer, sell, or otherwise transfer or dispose of, directly or indirectly, any shares of the Company or any securities

convertible into or exercisable or exchangeable for the shares of the Company; or

|

|

|

● in

the case of us, file or caused to be filed any registration statement with the SEC relating to the offering of any shares of the

Company or any securities convertible into or exercisable or exchangeable for shares of the Company except for (i) the adoption of

an equity incentive plan and the grant of awards or equity pursuant to any equity incentive plan, and the filing of a registration

statement on Form S-8; provided, however, that any sales by parties to the lock-ups shall be subject to the lock-up agreements and

(ii) this issuance of shares in connection with an acquisition or a strategic relationship which may include the sale of equity securities;

provided, that none of such shares shall be saleable in the public market until the expiration of the 120 day period described above.

See “Selling Securityholders” for details.

|

|

|

|

|

Use

of Proceeds

|

We

do not know whether the holders of the warrants or unit purchase options will exercise any of the warrants or options. If all of the

outstanding warrants (including the Transferred Warrants) described in this prospectus are exercised in full, we will issue a total of

11,439,700 ordinary shares and we will receive aggregate gross proceeds of approximately US$12.3 million, assuming all the remaining

outstanding warrants as of the date of this prospectus are exercised at the current exercise price of $1.00 per share and prior to the

termination of Second Reduction Period. An additional US$3 million potentially could be received from the exercise of the unit purchase

options and US$250,000 from the exercise of the warrants included in the units issued thereby, assuming the warrants included in the

units are exercise at the current exercise price of $1.00 per share and prior to the termination of Second Reduction Period. We intend

to use the proceeds from any exercise of the warrants or unit purchase options for general corporate purposes.

|

|

|

The

selling securityholders will receive all of the proceeds from the sale of any ordinary shares and warrants sold by them pursuant

to this prospectus. We will not receive any proceeds from these sales. See “Use of Proceeds” in this prospectus.

|

|

|

|

|

Voting

Rights

|

Holders

of our ordinary shares are entitled to one vote per ordinary share at all shareholder meetings. See “Description of Share Capital.”

|

|

|

|

|

Dividend

Policy

|

Other

than as disclosed elsewhere in this prospectus, we currently expect to retain all future earnings for use in the operation and expansion

of our business and do not plan to pay any dividends on our ordinary shares in the near future. The declaration and payment of any

dividends in the future will be determined by our board of directors in its discretion, and will depend on a number of factors, including

our earnings, capital requirements, overall financial condition, applicable law and contractual restrictions. See “Description

of Share Capital — Ordinary Shares — Dividends.”

|

|

|

|

|

Market

for our Ordinary Shares and Warrants

|

Our

ordinary shares are currently listed on the Nasdaq Capital Market under the symbol “METX.”

|

|

|

|

|

|

Our

warrants are currently quoted on the Nasdaq Capital Market under the symbol “METXW.”

|

|

|

|

|

Risk

Factors

|

Investing

in our ordinary shares involves substantial risks. See “Risk Factors” for a description of certain of the risks you should

consider before investing in our ordinary shares.

|

RISK

FACTORS

Investing

in our securities involves risks. Before making an investment decision, you should carefully consider the risks described under “Risk

Factors” in the applicable prospectus supplement and under the heading “Item 3. Key Information—3.D. Risk Factors”

in our annual report on Form 20-F for the fiscal year ended December 31, 2020, which is incorporated in this prospectus by reference,

as updated by our subsequent filings under the Exchange Act that are incorporated herein by reference, together with all of the other

information appearing in this prospectus or incorporated by reference into this prospectus and any applicable prospectus supplement,

in light of your particular investment objectives and financial circumstances. In addition to those risk factors, there may be additional

risks and uncertainties of which management is not aware or focused on or that management deems immaterial. Our business, financial condition,

or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline

due to any of these risks, and you may lose all or part of your investment.

USE

OF PROCEEDS

On

December 7, 2020, we filed a tender offer statement on Schedule TO, as amended (File number: 005-91479) in relation to our offer to the

holders of outstanding warrants to purchase 12,705,000 ordinary shares, each with an exercise price of $11.50 per share, the opportunity

to exercise the warrants at a temporarily reduced price of $1.40 per ordinary share. The tender offer for warrants terminated on January

5, 2021. Upon completion of the offer to exercise, 4,423,062 warrants had been validly tendered for cash exercise. In addition, 2,629,812

warrants had been validly tendered for cashless exercise, resulting in the issuance of 1,364,512 ordinary shares. Accordingly, we issued

an aggregate of 5,787,574 ordinary shares in this offer to exercise. Following the issuance of ordinary shares, we had 5,652,126 warrants

outstanding.

Effective

January 6, 2021, we temporarily reduced the exercise price of all outstanding warrants to $2.50 per share, and has added a “full-ratchet”

anti-dilution protection with respect to subsequent equity sales in which any person will be entitled to acquire ordinary shares at an

effective price per share that is lower than the then exercise price of the warrants, subject to customary exceptions (the “Second

Reduction Period”). The Second Reduction Period will terminate on the later to occur of (i) the date following which the closing

price of the Ordinary Shares has been equal to or greater than $3.00 per share for at least twenty (20) trading days during the preceding

thirty (30) trading day period or (ii) Monday, March 7, 2021.

On

May 26, 2021, we closed the offering of 40,000,000 ordinary shares at an offering price of $1.00 per share (the “2021 Equity

Offering”) under our registration statement on Form F-3 (File No. 333-256087), filed with the Securities and Exchange Commission

on May 13, 2021 and was declared effective on May 21, 2021 (the “Form F-3 Registration Statement”). A final prospectus supplement

to the Form F-3 Registration Statement was filed with the Securities and Exchange Commission on May 25, 2021 (the “Final Prospectus

Supplement”). As the offering price of $1.00 per share was lower than $2.50, the then exercise price of our outstanding warrants,

the exercise price for our outstanding warrants was reset to $1.00 per share, effective May 26, 2021. Upon any termination of the Second

Reduction Period, the exercise price of the outstanding Warrants will be reset to $11.50 per share and such exercise price will no longer

be subject to the “full-ratchet” anti-dilution protection. As of the date of this prospectus, the Second Reduction

Period has not been terminated.

We do not know whether the holders of the warrants

or unit purchase options will exercise any of the warrants or options. If all of the outstanding warrants described in this prospectus

are exercised in full, we will issue 11,439,700 ordinary shares in aggregate and we will receive aggregate gross proceeds of approximately

US$12.3 million, assuming that all warrants are exercised at the current exercise price of $1.00 and prior to the termination of Second

Reduction Period. An additional US$3,000,000 potentially could be received from the exercise of the unit purchase options and US$250,000

from the exercise of the warrants included in the units issued thereby, assuming the warrants included in the units are exercised at the

current exercise price of $1.00 and prior to the termination of Second Reduction Period. We intend to use the proceeds from any exercise

of the warrants for general corporate purposes.

The selling securityholders will receive all

of the proceeds from the sale of any ordinary shares and warrants sold by them pursuant to this prospectus. We will not receive any proceeds

from these sales. However, we will receive up to an aggregate of approximately $2.60 million from the exercise of Transferred Warrants,

assuming the exercise in full of all of the Transferred Warrants for cash, and that assuming the Transferred Warrants are exercised at

the current exercise price of $1.00 and prior to the termination of Second Reduction Period. There is no assurance that any of the Transferred

Warrants will be exercised. We expect to use the net proceeds from the exercise of the Transferred Warrants for general corporate purposes.

DESCRIPTION

OF SHARE CAPITAL

We

are an exempted company incorporated under the laws of the Cayman Islands and our affairs are governed by our Amended and Restated Memorandum

and Articles of Association, as amended and restated from time to time, and Companies Act (Revised) of the Cayman Islands (the “Companies

Act”), and the common law of the Cayman Islands.

As

of the date of this prospectus, our authorized share capital was US$50,000 divided into 500,000,000 ordinary shares each with a par value

of US$0.0001. As of the date of this prospectus, there are 104,325,637 ordinary shares issued and outstanding.

.

Our

Amended and Restated Memorandum and Articles of Association

The

following are summaries of material provisions of our Amended and Restated Memorandum and Articles of Association and the Companies Act

insofar as they relate to the material terms of our ordinary shares and warrants.

Ordinary

Shares

General.

Our ordinary shares are fully paid and non-assessable. Shareholders who are non-residents of the Cayman Islands may freely hold

and transfer their ordinary shares.

Dividends.

The holders of our ordinary shares are entitled to such dividends as may be declared by our board of directors and our shareholders,

but no dividend may exceed the amount recommended by our board of directors. Dividends may be declared and paid out of the funds legally

available therefor. Dividends may also be declared and paid out of share premium account or any other fund or account which can be authorized

for this purpose in accordance with the Companies Act.

Classes

of Ordinary Shares. We have only one class of ordinary shares with all shares carrying equal rights and ranking pari passu with

one another

Voting

Rights. In respect of all matters subject to a shareholders’ vote, holders of ordinary shares shall, at all times, vote

together as one class on all matters submitted to a vote by the members at any such general meeting. Each ordinary share shall be entitled

to one vote on all matters subject to the vote at our general meetings. Voting at any meeting of shareholders is by show of hands unless

a poll is demanded. A poll may be demanded by the chairman of such meeting or any one or more shareholders representing not less than

10% of the total voting rights of all the shareholders present in person or by proxy entitled to vote.

An

ordinary resolution to be passed at a meeting by the shareholders requires the affirmative vote of a simple majority of the votes attaching

to the ordinary shares cast at a meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the

votes cast attaching to the outstanding ordinary shares at a meeting and includes a unanimous written resolution. A special resolution

will be required for important matters such as a change of name, reducing the share capital or making changes to our amended and restated

memorandum and articles of association to be in effect assuming approval of all of the charter proposals and upon consummation of the

Mergers.

Transfer

of Ordinary Shares. Subject to the restrictions contained in our amended and restated articles of association, any of our shareholders

may transfer all or any of his or her ordinary shares by an instrument of transfer in the usual or common form or any other form approved

by our board of directors.

Our

board of directors may, in its absolute discretion, decline to register any transfer of any ordinary share which is not fully paid up

or on which we have a lien. Our board of directors may also decline to register any transfer of any ordinary share unless:

|

|

●

|

the

instrument of transfer is lodged at the registered office of us or such other place at which the principal register is kept in accordance

with the law or the registration office (as the case may be) accompanied by the relevant share certificate(s) and such other evidence

as the board of directors may reasonably require to show the right of the transferor to make the transfer (and, if the instrument of

transfer is executed by some other person on his behalf, the authority of that person so to do);

|

|

|

●

|

the

instrument of transfer is in respect of only one class of shares;

|

|

|

|

|

|

|

●

|

the

instrument of transfer is properly stamped, if required; and

|

|

|

●

|

a

fee of such maximum sum as Nasdaq may determine to be payable or such lesser sum as our directors may from time to time require is

paid to us in respect thereof.

|

If

our directors refuse to register a transfer, they shall, within three months after the date on which the instrument of transfer was lodged,

send to each of the transferor and the transferee notice of such refusal.

The

registration of transfers may, after compliance with any notice required of Nasdaq, be suspended and the register of members closed at

such times and for such periods as our board of directors may from time to time determine, provided, however, that the registration of

transfers shall not be suspended nor the register of members closed for more than 30 days in any year as our board may determine.

Liquidation.

On a return of capital on winding-up or otherwise (other than on conversion, redemption or purchase of ordinary shares), assets

available for distribution among the holders of ordinary shares shall be distributed among the holders of the ordinary shares on a pro

rata basis. If our assets available for distribution are insufficient to repay all of the paid-up capital, the assets will be distributed

so that the losses are borne by our shareholders proportionately.

Calls

on Ordinary Shares and Forfeiture of Ordinary Shares. Our board of directors may from time to time make calls upon shareholders

for any amounts unpaid on their ordinary shares in a notice served to such shareholders at least 14 clear days prior to the specified

time of payment. The ordinary shares that have been called upon and remain unpaid are subject to forfeiture.

Redemption

of Ordinary Shares. The Companies Act and our amended and restated articles of association permit us to purchase our own shares.

In accordance with our amended and restated articles of association and provided the necessary shareholders or board approval have been

obtained, we may issue shares on terms that are subject to redemption, at our option or at the option of the holders of these shares,

on such terms and in such manner, including out of capital, as may be determined by our board of directors.

Variations

of Rights of Shares. All or any of the special rights attached to any class of shares may, subject to the provisions of the Companies

Act, be varied with the consent in writing of the holders of not less than two-thirds of the issued shares of that class, or with the

sanction of a resolution passed by at least a two-thirds majority of the holders of shares of the class present in person or by proxy

at a separate general meeting of the holders of the shares of that class. The rights conferred upon the holders of the shares of any

class issued shall not, unless otherwise expressly provided by the terms of issue of the shares of that class, be deemed to be materially

adversely varied by or abrogated by, inter alia, the creation or allotment or issue of further shares ranking pari passu with

or subsequent to such existing class of shares.

General

Meetings of Shareholders. Shareholders’ meetings may be convened by a majority of the board of directors or the chairman

of the board of directors, and they shall on a member’s requisition forthwith proceed to convene a general meeting. A member’s

requisition is a requisition of shareholders holding at the date of deposit of the requisition shares which carry in aggregate not less

than one-third (1/3) of all votes attaching to all issued and outstanding shares that as at the date of the deposit carry the right to

vote at our general meetings. Advance notice of at least ten calendar days is required for the convening of our annual general shareholders’

meeting and any other general meeting of shareholders, provided that a general meeting or our shareholders shall be deemed to have been

duly convened if it is so agreed:

|

|

(i)

|

in

the case of an annual general meeting by all the shareholders (or their proxies) entitled to attend and vote thereat; and

|

|

|

(ii)

|

in

the case of an extraordinary general meeting, by two-thirds (2/3) of the shareholders having a right to attend and vote at the meeting,

present in person or by proxy or, in the case of a corporation or other non-natural person, by its duly authorized representative

or proxy.

|

Any

action required or permitted to be taken at any annual or extraordinary general meetings may be taken only upon the vote of the shareholders

at an annual or extraordinary general meeting duly noticed and convened in accordance with our articles of association and the Companies

Act and may not be taken by written resolution of shareholders without a meeting.

Voting

Rights Attaching to the Shares. Subject to any rights and restrictions for the time being attached to any ordinary share, on

a show of hands every shareholder present in person and every person representing a shareholder by proxy shall, at a shareholders’

meeting, each have one vote and on a poll every shareholder and every person representing a shareholder by proxy shall have one vote

for each share of which he or the person represented by proxy is the holder.

Inspection

of Books and Records. Holders of our ordinary shares will have no general right under Cayman Islands law to inspect or obtain

copies of our list of shareholders or corporate records. However, we will in provide shareholders with the right to inspect the list

of shareholders and to receive annual audited financial statements. See “Where You Can Find More Information.”

Changes

in Capital. We may from time to time by ordinary resolution:

|

|

●

|

increase

the share capital by such sum, to be divided into shares of such amount, as the resolution shall prescribe;

|

|

|

●

|

divide

the shares into several classes and without prejudice to any special rights previously conferred on the holders of existing shares

attach thereto respectively any preferential, deferred, qualified or special rights, privileges, conditions or such restrictions

which in the absence of any such determination by our shareholders, as the board of directors may determine

|

|

|

●

|

consolidate

and divide all or any of the share capital into shares of a larger amount than the existing shares;

|

|

|

●

|

subdivide

the existing shares, or any of them into shares of a smaller amount; or

|

|

|

●

|

cancel

any shares which, at the date of the passing of the resolution, have not been taken or agreed to be taken by any person.

|

We

may by special resolution, subject to any confirmation or consent required by the Companies Act, reduce our share capital or any capital

redemption reserve in any manner permitted by law.

Indemnification

of Directors and Officers. Cayman Islands law does not limit the extent to which a company’s memorandum and articles of

association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the Cayman

Islands courts to be contrary to public policy, such as to provide indemnification against willful default, willful neglect, civil fraud

or the consequences of committing a crime. Our memorandum and articles of association will provide for indemnification of our officers

and directors to the maximum extent permitted by law, including for any liability incurred in their capacities as such, except through

their fraud or dishonesty.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us

pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy

as expressed in the Securities Act and is theretofore unenforceable.

Warrants

Each warrant is exercisable to purchase one ordinary share of the Company

at a current exercise price of $1.00 per share, reset from $2.50 as a result of the “full-ratchet” anti-dilution protection

during the Second Reduction Period (as defined herein), which had been adjusted from an original exercise price of $11.50. The warrants

expire on March 30, 2025. No fraction of a share will be issued upon any exercise of a warrant. The exercise price and number of ordinary

shares issuable upon exercise of the warrants may be adjusted in certain circumstances including in the event of a share dividend, or

recapitalization, reorganization, merger or consolidation. However, the warrants will not be adjusted for issuance of ordinary shares

at a price below its exercise price.

No

warrants will be exercisable for cash unless the Company has an effective and current registration statement covering the ordinary shares

issuable upon exercise of the warrants and a current prospectus relating to such ordinary shares is available, and such shares are registered,

qualified or exempt from registration under the securities laws of the state of residence of the holder.

The

Company may redeem the outstanding warrants in whole and not in part, at a price of $0.01 per warrant, upon not less than 30 days’

prior written notice of redemption (the “30-day redemption period”) to each warrant holder, and if, and only if, the reported

last sale price of the ordinary shares (or the closing bid price of ordinary shares in the event the ordinary shares are not traded on

any specific day) equals or exceeds $16.50 per share, subject to adjustment, for any 20 trading days within a 30 trading day period ending

three business days before the redemption notice is sent to the warrant holders. The Company will not redeem the warrants unless an effective

registration statement covering the ordinary shares issuable upon exercise of the warrants is current and available throughout the 30-day

redemption period.

If

the Company calls the warrants for redemption as described above, the Company will have the option to require all holders that wish to

exercise warrants to do so on a “cashless basis.” In such event, each holder would pay the exercise price by surrendering

the warrants for that number of ordinary shares equal to the quotient obtained by dividing (x) the product of the number of ordinary

shares underlying the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value”

(defined below) by (y) the fair market value. In this case, the “fair market value” shall mean the average reported last

sale price of the ordinary shares for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption

is sent to the holders of warrants.

The

warrants that were issued in exchange for those warrants initially issued by EdtechX in private placements (the “Placement Warrants”)

are identical to the other warrants of the Company, except that such Placement Warrants will be exercisable for cash or on a cashless

basis, at the holder’s option, and will not be redeemable by the Company, in each case so long as they are still held by the initial

purchasers or their permitted transferees.

On

December 7, 2020, we filed a tender offer statement on Schedule TO, as amended (File number: 005-91479) in relation to our offer to the

holders of outstanding warrants to purchase 12,705,000 ordinary shares, each with an exercise price of $11.50 per share, the opportunity

to exercise the warrants at a temporarily reduced price of $1.40 per ordinary share. The tender offer for warrants terminated on January

5, 2021. Upon completion of the offer to exercise, 4,423,062 warrants had been validly tendered for cash exercise. In addition, 2,629,812

warrants had been validly tendered for cashless exercise, resulting in the issuance of 1,364,512 ordinary shares. Accordingly, we issued

an aggregate of 5,787,574 ordinary shares in this offer to exercise. Following the issuance of ordinary shares, we had 5,652,126 warrants

outstanding.

Effective

January 6, 2021, we temporarily reduced the exercise price of all outstanding warrants to $2.50 per share, and has added a “full-ratchet”

anti-dilution protection with respect to subsequent equity sales in which any person will be entitled to acquire ordinary shares at an

effective price per share that is lower than the then exercise price of the warrants, subject to customary exceptions (the “Second

Reduction Period”). The Second Reduction Period will terminate on the later to occur of (i) the date following which the closing

price of the Ordinary Shares has been equal to or greater than $3.00 per share for at least twenty (20) trading days during the preceding

thirty (30) trading day period or (ii) Monday, March 7, 2021.

On May 26, 2021, we closed the offering of 40,000,000 ordinary shares

at an offering price of $1.00 per share under our registration statement on Form F-3 (File No. 333-256087), filed with the Securities

and Exchange Commission on May 13, 2021 and was declared effective on May 21, 2021 (the “Form F-3 Registration Statement”).

A final prospectus supplement to the Form F-3 Registration Statement was filed with the Securities and Exchange Commission on May 25,

2021. As the offering price of $1.00 per share was lower than $2.50, the then exercise price of the outstanding warrants, the exercise

price for our outstanding warrants was reset to $1.00 per share, effective May 26, 2021. Upon any termination of the Second Reduction

Period, the exercise price of the outstanding Warrants will be reset to $11.50 per share and such exercise price will no longer be subject

to the “full-ratchet” anti-dilution protection. As of the date of this prospectus, the Second Reduction Period has not been

terminated.

Transfer

Agent and Registrar

The

transfer agent and registrar for our ordinary shares in the United States is Continental Stock Transfer & Trust Company.

Listing

Our

ordinary shares and warrants are quoted on the Nasdaq under the symbols “METX” and “METXW,” respectively.

Differences

in Corporate Law

The

Companies Act is derived, to a large extent, from the older Companies Acts of England, but does not follow many recent English law statutory

enactments. In addition, the Companies Act differs from laws applicable to United States corporations and their shareholders. Set forth

below is a summary of the significant differences between the provisions of the Companies Act applicable to us and the laws applicable

to companies incorporated in the State of Delaware. This discussion does not purport to be a complete statement of the rights of our

shareholders under applicable law in the Cayman Islands and our Amended and Restated Memorandum and Articles of Association nor the rights

of holders of the common stock of a typical corporation under applicable Delaware law and a typical certificate of incorporation and

bylaws.

Mergers

and Similar Arrangements. The Companies Act permits mergers and consolidations between Cayman Islands companies and between Cayman

Islands companies and non-Cayman Islands companies. For these purposes, (a) “merger” means the merging of two or more constituent

companies and the vesting of their undertaking, property and liabilities in one of such companies as the surviving company, and (b) a

“consolidation” means the combination of two or more constituent companies into a consolidated company and the vesting of

the undertaking, property and liabilities of such companies to the consolidated company. In order to effect such a merger or consolidation,

the directors of each constituent company must approve a written plan of merger or consolidation, which must then be authorized by (a)

a special resolution of the shareholders of each constituent company, and (b) such other authorization, if any, as may be specified in

such constituent company’s articles of association. The written plan of merger or consolidation must be filed with the Registrar

of Companies of the Cayman Islands together with a declaration as to the solvency of the consolidated or surviving company, a declaration

as to the assets and liabilities of each constituent company and an undertaking that a copy of the certificate of merger or consolidation

will be given to the members and creditors of each constituent company and that notification of the merger or consolidation will be published

in the Cayman Islands Gazette. Court approval is not required for a merger or consolidation which is effected in compliance with these

statutory procedures.

A

merger between a Cayman parent company and its Cayman subsidiary or subsidiaries does not require authorization by a resolution of shareholders

of that Cayman subsidiary if a copy of the plan of merger is given to every member of that Cayman subsidiary to be merged unless that

member agrees otherwise. For this purpose, a company is a “parent” of a subsidiary if it holds issued shares that together

represent at least ninety percent (90%) of the votes at a general meeting of the subsidiary.

The

consent of each holder of a fixed or floating security interest over a constituent company is required unless this requirement is waived

by a court in the Cayman Islands.

Save

in certain limited circumstances, a shareholder of a Cayman constituent company who dissents from the merger or consolidation is entitled

to payment of the fair value of his shares (which, if not agreed between the parties, will be determined by the Cayman Islands court)

upon dissenting to the merger or consolidation, provide the dissenting shareholder complies strictly with the procedures set out in the

Companies Act. The exercise of dissenter rights will preclude the exercise by the dissenting shareholder of any other rights to which

he or she might otherwise be entitled by virtue of holding shares, save for the right to seek relief on the grounds that the merger or

consolidation is void or unlawful.

Separate