GM to Restart Work at Several Plants Idled by Computer-Chip Shortage -- 2nd Update

May 27 2021 - 3:04PM

Dow Jones News

By Nora Naughton

General Motors Co. said Thursday it is restarting production at

a handful of factories that were previously idled because of a

global shortage of semiconductors.

The Detroit-based auto maker plans to resume some production at

a factory in Michigan next month, after halting work at the

facility in early May. It also plans to restart several auto

factories in Canada, Mexico and South Korea within the next several

weeks that make models such as the Chevrolet Equinox and GMC

Terrain crossover vehicles.

Despite the reopening of these facilities, GM Chief Executive

Mary Barra has said the company expects the second quarter to be

the auto maker's weakest of 2021 in terms of reduced production

before some recovery occurs in the back half of the year.

The computer-chip shortage continues to cloud an otherwise

robust new-vehicle market, more than a year after the Covid-19

health crisis led to a collapse in U.S. auto sales and production

last spring.

The lack of semiconductors, used in engines, braking systems and

other vehicle components, has led to factory disruptions across the

auto industry and left dealers with nearly bare new-car lots. It is

also prompting companies to reduce their manufacturing and earnings

forecasts for the year.

Rival Ford Motor Co. has also said it expects the effects of the

chip shortage to ease later this year. The company said in April

the shortage would force it to cut production by half in the second

quarter and shave $2.5 billion from its bottom line this year.

Stellantis NV, which owns the Jeep and Ram brands, has warned that

disruptions caused by the chip scarcity could last into 2022.

As the computer-chip crisis continues to squeeze new-vehicle

inventories, analysts are projecting a softer sales month in May

for the U.S. car business. The industry's annualized selling rate,

which hit a blistering pace in March and April, is expected to

return to more normal levels this month, according to research firm

Cox Automotive.

GM has tried to preserve factory output of its higher-margin

vehicles by giving priority to truck and sport-utility-vehicle

production, while scaling back work at factories that build

slower-selling models. Ms. Barra has said that despite these

disruptions, she is confident that GM can still deliver on its

earlier guidance of $10 billion to $11 billion in pretax profit for

2021.

Write to Nora Naughton at Nora.Naughton@wsj.com

(END) Dow Jones Newswires

May 27, 2021 14:59 ET (18:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

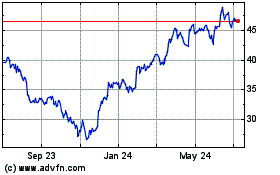

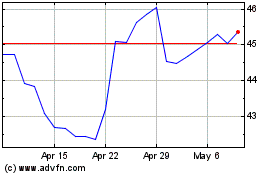

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024