Current Report Filing (8-k)

May 18 2021 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): May

12, 2021

CANNABIS GLOBAL, INC

(Name of registrant in its charter)

|

Nevada

|

|

333-146404

|

|

83-1754057

|

|

(State or jurisdiction of

|

|

(Commission File

|

|

(IRS Employer

|

|

incorporation or organization)

|

|

Number)

|

|

Identification No.)

|

520 S. Grand Avenue, Suite 320, Los Angeles, CA 90071

(Address of principal executive offices)

(310) 986-4929

(Registrant’s telephone number)

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instructions

A.2 below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act: None.

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Section 1 - Registrant’s Business

and Operations

Item 1.01 Entry into a Material Definitive

Agreement.

On May 12, 2021, the Registrant entered into

a material definitive agreement not made in the ordinary course of its business. The parties to the material definitive agreement are

the Registrant and Marijuana Company of America, Inc., a Utah corporation (“MCOA”).

Prior Relationship

Previously, on September 30, 2020, the Registrant

and MCOA entered into a Share Exchange Agreement whereby the Registrant acquired that number of shares of MCOA’s common stock, par

value $0.001, equal in value to $650,000 based on the closing price for the trading day immediately preceding the effective date, in exchange

for the number of shares of the Registrant’s common stock, par value $0.001, equal in value to $650,000 based on the closing price

for the trading day immediately preceding the effective date. For both parties, the Share Exchange Agreement contained a “true-up”

provision requiring the issuance of additional common stock in the event that a decline in the market value of the parties’ common

stock should cause the aggregate value of the stock acquired pursuant to the Share Exchange Agreement to fall below $650,000.

Complementary to the Share Exchange Agreement,

Registrant and MCOA entered into a Lock-Up Agreement dated September 30, 2020 (the “Lock-Up Agreement”), providing that the

shares of common stock acquired pursuant to the Share Exchange Agreement shall be subject to a lock-up period preventing its sale for

a period of 12 months following issuance, and limiting the subsequent sale to aggregate maximum sale value of $20,000 per week, or $80,000

per month.

Summary of the May 12, 2021 Material

Definitive Agreement

The parties agreed to operate a joint venture

through a new Nevada corporation named MCOA Lynwood Services, Inc. The parties agreed to finance a regulated and licensed laboratory to

produce various cannabis products under the legal framework outlined by the City of Lynwood, California, Los Angeles County and the State

of California. The Registrant owns a controlling interest in Natural Plant Extract of California, Inc., which operates a licensed cannabis

manufacturing operation in Lynwood, California.

As its contribution the joint venture, MCOA

agreed to purchase and install equipment for joint venture operations, which will then be rented to the joint venture, and also provide

funding relating to marketing the products produced by the capital equipment. The Registrant agreed to provide use of its manufacturing

and distribution licenses; access to its Lynwood, California facility; use of the specific areas within the Lynwood Facility suitable

for the types of manufacturing selected by the joint venture; and, management expertise require to carry on the joint venture’s

operations.

Ownership of the joint venture was agreed to

be 60% in the Registrant and 40% with MCOA. Royalties from profits realized as the result of sales of products from the joint venture

was also agreed to be distributed as 60% to the Registrant and 40% to MCOA.

Section 9 – Financial Statement and

Exhibits

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CANNABIS GLOBAL, INC.

|

|

|

|

|

|

Date: May 18, 2021

|

By:

|

/s/ Arman Tabatabaei

|

|

|

|

Arman Tabatabaei

(Principal Executive Officer)

|

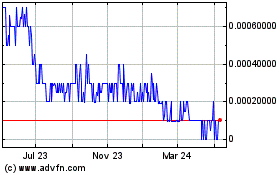

Cannabis Global (PK) (USOTC:CBGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

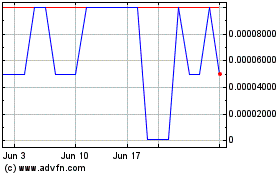

Cannabis Global (PK) (USOTC:CBGL)

Historical Stock Chart

From Apr 2023 to Apr 2024