Current Report Filing (8-k)

May 17 2021 - 5:01PM

Edgar (US Regulatory)

0000805928false00008059282021-05-172021-05-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2021

AXOGEN, INC.

(Exact Name of Registrant as Specified in Charter)

Minnesota

(State or Other Jurisdiction of

Incorporation or Organization)

001-36046

(Commission File Number)

41-1301878

(I.R.S. Employer Identification No.)

13631 Progress Boulevard, Suite 400 Alachua, Florida

(Address of principal executive offices)

(386) 462-6800

(Registrant's telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, $0.01 par value

|

AXGN

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosures.

Axogen Will Suspend Market Availability of Avive® Soft Tissue Membrane Pending Regulatory Classification by FDA; Reiterates full-year 2021 financial guidance

On May 17, 2021 the Company announced that it will suspend market availability of Avive® Soft Tissue Membrane (Avive) effective June 1, 2021 pending ongoing discussions with the U.S. Food and Drug Administration (FDA) regarding the regulatory classification of Avive. Avive product purchased on or before May 31, 2021 is not affected by this decision and may continue to be used at health care facilities subsequent to May 31, 2021.

This announcement applies only to Avive which represents approximately 5% of Company revenue and has no impact on any other Axogen product including the Avance Nerve Graft (Avance). A 2010 written agreement between the FDA and Axogen allows the company to continue legally marketing Avance as a tissue product under the U.S. FDA requirements for Human Cellular and Tissue-based Products (HCT/Ps) while taking the necessary steps to file a Biologics License Application (BLA). Avance received FDA’s Regenerative Medicine Advanced Therapy (RMAT) Designation in 2018, and the Company plans to submit a BLA for Avance in 2023.

Avive is a processed human umbilical cord intended for surgical use as a resorbable soft tissue barrier and is currently processed and distributed in accordance with U.S. FDA requirements as a 361 HCT/P tissue product. In November 2017, the FDA outlined a regenerative medicine policy framework including guidance on the regulatory considerations for HCT/Ps and the potential for relevant products to be classified as a drug, device or biological product subject to premarket approval requirements. The policy requires manufacturers to confirm the classification and regulatory approval requirements for relevant products allowing a compliance and enforcement discretion period through May 31, 2021. During this timeframe, Axogen has been in dialogue with the FDA to determine the appropriate regulatory classification and requirements for Avive. The Company will continue discussions with the FDA with the goal of returning Avive to the market, however, the Company is unable to provide an estimate of the time frame or provide assurance that a return of Avive will be achievable.

The decision to suspend market availability of Avive was made following a communication with the FDA on May 14, 2021 regarding the appropriate classification and regulatory approval requirements for Avive. The suspension of market availability is not based on any patient safety or product performance issues or concerns associated with Avive Soft Tissue Membrane, a product that has been marketed by Axogen and routinely used by surgeons for patient care since 2016.

Reiterating Full-year 2021 Financial Guidance

Management is reiterating its financial guidance provided on May 5, 2021 and believes that full-year 2021 revenue will be in the range of $133 million to $136 million. Additionally, full-year 2021 gross margin is expected to remain above 80%.

Further, pending the outcome with the FDA, the Company may be required to record a write down of Avive inventory of up to $1.5 million which would negatively impact gross margin in the period recorded, and which is also contemplated in our full-year financial guidance.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

(d) Exhibits.

Exhibit No.

|

|

Description of Exhibit

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

AXOGEN, INC.

|

|

|

|

|

Date: May 17, 2021

|

By:

|

/s/ Brad Ottinger

|

|

|

|

Brad Ottinger

|

|

|

|

General Counsel and Chief Compliance Officer

|

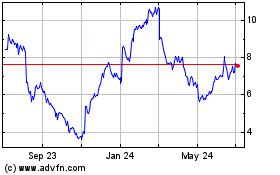

Axogen (NASDAQ:AXGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

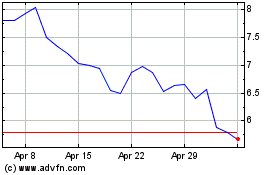

Axogen (NASDAQ:AXGN)

Historical Stock Chart

From Apr 2023 to Apr 2024