Inuvo, Inc. (NYSE American: INUV), a leading provider of marketing

technology, today announced its financial results for the first

quarter ending March 31, 2021.

Richard Howe, CEO of Inuvo, stated, “We continued growing both

within the IntentKey platform, which was up 15% year-over-year, and

within the ValidClick platform which has grown 9% compounded

monthly since its pandemic low in May of 2020. The first quarter is

our seasonally soft quarter and as such we anticipate our overall

growth in Q2 to accelerate and exceed 50% year-over-year on the

back of this continued post-pandemic growth within both product

lines.” Mr. Howe added, “While we had a negative Adjusted EBITDA in

the quarter, it was a 36% year-over-year improvement, which

supports our projections that we should be back to producing

positive Adjusted EBITDA within the second half of the year. We

have a strong balance sheet with $17.8 million of cash and we

believe we could not be better positioned to capture market share

when the 3rd party cookie disappears in 2022.”

Operational Highlights During the First Quarter of 2021

to Date:

- Launched the Software-as-a-Service (SaaS) version of the

IntentKey with multiple clients now committed and/or already using

the solution.

- Signed multiple new clients for the IntentKey platform among

which included two of the most respected technology companies in

the world.

- Signed a Casino/Resort company where for the first time the

entire suite of IntentKey capabilities and channels were leveraged

concurrently.

- Renewed our largest ValidClick partner, one of the largest

companies in the world, for an additional 2-year term.

- Delivered results to IntentKey clients that exceeded their

goals by 48% and in at least one case delivered in excess of an

88:1 Return on Advertising Spend.

- Raised $14.25 million in additional capital bringing our cash

balance at the end of March 2021 to $17.8 million.

- Continued to successfully deliver cookieless campaigns that

position Inuvo well for the industry disruption coming in

2022.

- Expanded sales, sales support, and account management to 18

people, two of which were hired in Canada to support the

IntentKey’s expansion North.

Financial Results for the First Quarter Ended March 31,

2021:Net revenue for the first quarter ended March 31,

2021, totaled $10.6 million as compared to $14.9 million during the

same period in the year prior, a decrease of 28.9% year-over-year

predominately due to pandemic-induced lower revenue within the

ValidClick platform. Revenue for the month of March 2021 for

ValidClick was up 143% over its low revenue month in May 2020.

IntentKey revenue, which accounted for 20.1% of overall revenue

during the first quarter of 2021 as compared to 12.4% for the same

period the year prior, grew 15% year-over-year to $2.1 million for

the first quarter of 2021 as compared to $1.9 million for the first

quarter in 2020.

Cost of revenue for the first quarter ended March 31, 2021,

totaled $1.4 million as compared to $3.4 million during the same

period the year prior. The decrease in the cost of revenue for the

quarter ended March 31, 2021, compared to the same quarter in 2020

was due primarily to lower year-over-year revenues within

ValidClick as a result of the pandemic.

Gross profit margin for the first quarter of 2021 improved to

86.4% as compared to 77% for the same period the year prior. Gross

profit totaled $9.2 million for the first quarter ended March 31,

2021, as compared to $11.5 million for the same period the year

prior, a decrease of 20.2%.

Operating expenses decreased 16.1% to $11.8 million for the

first quarter of 2021 as compared to $14 million for the same

period the year prior.

Other income in the quarter included $420,000 dollars in

licensing obligations for the use of ValidClick associated with a

contract signed in March of 2020 that ended in March of 2021.

The net loss for the first quarter of 2021 totaled $2.2 million

or $0.02 per basic and diluted share as compared to the net loss of

$2.8 million or $0.05 per basic and diluted share for the same

period the year prior.

Adjusted EBITDA was a loss of $878 thousand in the first quarter

of 2021, an improvement of 36% year-over-year.

Liquidity and Capital Resources:On March 31,

2021, Inuvo had $17.8 million in cash, $16.8 million of working

capital, an unused working capital facility of $5 million and no

debt.

As of March 31, 2021, Inuvo had 118,518,445 common shares issued

and outstanding.

Conference Call Details:The Company will host a

conference call on Thursday, May 13, 2021 at 4:30 p.m. Eastern Time

(ET) to discuss its financial results for the first quarter ended

March 31, 2021 and provide a business update.

Conference Call Details:Date: Thursday, May 13,

2021Time: 4:30 p.m. Eastern TimeToll-free Dial-in Number:

1-800-289-0438International Dial-in Number:

1-323-794-2423Conference ID: 9502309Participant Link:

http://public.viavid.com/index.php?id=144549

A telephone replay will be available through Thursday, May 27,

2021. To access the replay, please dial 1-844-512-2921 (domestic)

or 1-412-317-6671 (international). At the system prompt, please

enter the code 9502309 followed by the # sign. You will then be

prompted for your name, company, and phone number. Playback will

then automatically begin.

About InuvoInuvo®, Inc. (NYSE American: INUV)

is a market leader in artificial intelligence, aligning and

delivering consumer-oriented product & brand messaging

strategies online based on powerful, anonymous, and proprietary

consumer intent data for agencies, advertisers, and partners. To

learn more, visit www.inuvo.com.

Safe Harbor / Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially,

including, without limitation risks detailed from time to time in

our filings with the Securities and Exchange Commission (the

“SEC”), and represent our views only as of the date they are made

and should not be relied upon as representing our views as of any

subsequent date. You are urged to carefully review and consider any

cautionary statements and other disclosures, including the

statements made under the heading "Risk Factors" in Inuvo, Inc.'s

Annual Report on Form 10-K for the fiscal year ended December 31,

2020 as filed on February 11, 2021, our Quarterly Reports on Form

10-Q, and our other filings with the SEC. Additionally,

forward looking statements are subject to certain risks, trends,

and uncertainties including the continued impact of Covid-19 on

Inuvo’s business and operations. Inuvo cannot provide assurances

that the assumptions upon which these forward-looking statements

are based will prove to have been correct. Should one of these

risks materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those expressed

or implied in any forward-looking statements, and investors are

cautioned not to place undue reliance on these forward-looking

statements, which are current only as of this date. Inuvo does not

intend to update or revise any forward-looking statements made

herein or any other forward-looking statements as a result of new

information, future events or otherwise. Inuvo further expressly

disclaims any written or oral statements made by a third party

regarding the subject matter of this press release. The

information, which appears on our websites and our social media

platforms is not part of this press release.

Inuvo Company Contact: Wally Ruiz Chief

Financial Officer Tel (501) 205-8397

wallace.ruiz@inuvo.com

Investor Relations: KCSA Strategic

CommunicationsValter Pinto, Managing DirectorTel (212)

896-1254Valter@KCSA.com

|

|

|

|

INUVO, INC. |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

March 31 |

|

December 31, |

|

| |

|

2021 |

|

2020 |

|

| Assets |

|

|

|

|

|

| |

|

|

|

|

|

| Cash |

|

$17,805,324 |

|

$7,890,665 |

|

| Accounts

receivable, net |

|

|

5,749,261 |

|

|

6,227,610 |

|

| Prepaid expenses

and other current assets |

|

|

534,471 |

|

|

413,435 |

|

| Total current

assets |

|

|

24,089,056 |

|

|

14,531,710 |

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

1,292,933 |

|

|

1,187,061 |

|

|

|

|

|

|

|

|

| Goodwill |

|

|

9,853,342 |

|

|

9,853,342 |

|

| Intangible assets,

net |

|

|

8,119,713 |

|

|

8,586,089 |

|

| Other assets |

|

|

1,194,551 |

|

|

1,023,369 |

|

| Total other

assets |

|

|

19,167,606 |

|

|

19,462,800 |

|

| Total assets |

|

$44,549,595 |

|

$35,181,571 |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

| |

|

|

|

|

|

| Accrued expenses

and other current liabilities |

|

$4,508,861 |

|

$4,680,912 |

|

| Accounts

payable |

|

|

2,790,432 |

|

|

4,048,260 |

|

| Total current

liabilities |

|

|

7,299,293 |

|

|

8,729,172 |

|

|

|

|

|

|

|

|

| Deferred tax

liability |

|

|

107,000 |

|

|

107,000 |

|

| Other long-term

liabilities |

|

|

628,761 |

|

|

1,056,285 |

|

| Total long-term

liabilities |

|

|

735,761 |

|

|

1,163,285 |

|

|

|

|

|

|

|

|

| Total

stockholders' equity |

|

|

36,514,541 |

|

|

25,289,114 |

|

| Total liabilities

and stockholders' equity |

|

$44,549,595 |

|

$35,181,571 |

|

|

|

|

| |

|

|

|

|

|

|

INUVO, INC. |

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

|

|

March 31 |

|

March 31 |

|

|

|

|

|

|

|

2021 |

|

2020 |

|

|

|

|

|

Net revenue |

|

$10,617,809 |

|

|

$14,932,983 |

|

|

|

|

|

|

Cost of revenue |

|

|

1,444,059 |

|

|

|

3,439,501 |

|

|

|

|

|

| Gross profit |

|

|

9,173,750 |

|

|

|

11,493,482 |

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Marketing costs |

|

|

7,305,784 |

|

|

|

9,622,823 |

|

|

|

|

|

| Compensation |

|

|

2,737,867 |

|

|

|

2,344,235 |

|

|

|

|

|

| Selling, general and

administrative |

|

|

1,724,978 |

|

|

|

2,058,842 |

|

|

|

|

|

| Total operating expenses |

|

|

11,768,629 |

|

|

|

14,025,900 |

|

|

|

|

|

| Operating loss |

|

|

(2,594,879 |

) |

|

|

(2,532,418 |

) |

|

|

|

|

| Interest expense, net |

|

|

(22,389 |

) |

|

|

(152,511 |

) |

|

|

|

|

| Other income (expense),

net |

|

|

470,000 |

|

|

|

(140,307 |

) |

|

|

|

|

| Net loss before taxes |

|

|

(2,147,268 |

) |

|

|

(2,825,236 |

) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

|

(2,147,268 |

) |

|

|

(2,825,236 |

) |

|

|

|

|

| Earnings per share, basic and

diluted |

|

|

|

|

|

|

|

|

| Net loss income |

|

($0.02 |

) |

|

($0.05 |

) |

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

| Basic |

|

|

114,430,201 |

|

|

|

53,642,787 |

|

|

|

|

|

| Diluted |

|

|

114,430,201 |

|

|

|

53,642,787 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF LOSS FROM CONTINUING OPERATIONS BEFORE

TAXES TO ADJUSTED EBITDA |

|

(unaudited) |

| |

|

|

|

|

|

| |

|

Three Months Ended |

|

|

| |

|

March 31 |

|

March 31 |

|

|

| |

|

2021 |

|

2020 |

|

|

| Operating loss |

|

($2,147,268 |

) |

|

($2,825,236 |

) |

|

|

| Interest Expense |

|

$22,389 |

|

|

$152,511 |

|

|

|

| Depreciation |

|

|

305,528 |

|

|

|

369,372 |

|

|

|

| Amortization |

|

|

546,493 |

|

|

|

572,054 |

|

|

|

| EBITDA |

|

|

(1,272,858 |

) |

|

|

(1,731,299 |

) |

|

|

| Stock-based compensation |

|

|

394,870 |

|

|

|

208,897 |

|

|

|

| Non-recurring items: |

|

|

|

|

|

|

| Adjustment to derivative

liability accounts |

|

|

- |

|

|

|

140,307 |

|

|

|

| |

|

|

|

|

|

|

| Adjusted EBITDA |

|

($877,988 |

) |

|

($1,382,095 |

) |

|

|

Reconciliation of Loss from Continuing Operations before

Taxes to EBITDA and Adjusted EBITDAWe present EBITDA and

Adjusted EBITDA as a supplemental measure of our performance. We

defined EBITDA as net loss from continuing operations before taxes

plus (i) interest expense, net, (ii) depreciation, and (iii)

amortization. We further define Adjusted EBITDA as EBITDA plus (iv)

stock-based compensation and (v) certain identified expenses that

are not expected to recur or be representative of future ongoing

operation of the business. These adjustments are itemized above.

You are encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

EBITDA and Adjusted EBITDA, you should be aware that in the future

we may incur expenses that are the same or similar to some of the

adjustments in the presentation. Our presentation of EBITDA and

Adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by unusual or non-recurring

items.

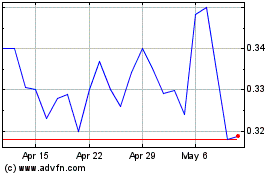

Inuvo (AMEX:INUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

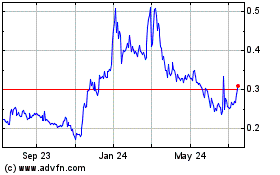

Inuvo (AMEX:INUV)

Historical Stock Chart

From Apr 2023 to Apr 2024