Additional Proxy Soliciting Materials (definitive) (defa14a)

May 07 2021 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 90549

SCHEDULE

14A

(RULE

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

|

Filed

by the Registrant

|

[X]

|

|

Filed

by a Party other than the Registrant

|

[ ]

|

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

For Use of the Commission Only (as permitted by Rule 14a–6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[X]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material under Rule 14a-12

|

ADVAXIS,

INC.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transactions applies:

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction.

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials:

|

|

|

|

|

|

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

(1)

|

Amount

previously paid:

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

|

|

May

7, 2021

Dear

Stockholders:

I

write to reiterate the recommendation of our Board of Directors that our stockholders approve the proposed reverse stock split

as outlined in our Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 21, 2021

(the “Stock Split Proposal”). We believe the Stock Split Proposal is a critically important item to Advaxis, Inc.

(the “Company”), and we encourage all stockholders to read the proposal in its entirety. It is the unanimous recommendation

of the Board of Directors that stockholders vote FOR the Stock Split Proposal.

We

believe that a vote FOR the Stock Split Proposal will enhance the Company’s ability to regain compliance with the

Nasdaq listing standards by enabling the Company to meet the Nasdaq minimum bid price requirement for continued listing in the

near term. The Company expects that retaining our Nasdaq listing and increasing the market price per share of our common stock

by effecting a reverse stock split would increase the attractiveness of the Company’s shares to a broader set of institutional

investors, while protecting the liquidity for all stockholders. Further, we believe that maintaining the listing of our common

stock on the Nasdaq Capital Market will further attract investor support, which is of utmost importance in order to continue our

work to advance cancer care through the continued development of our HOT program.

Conversely,

the delisting of our common stock from the Nasdaq Capital Market may result in decreased liquidity and increased volatility of

our common stock, a loss of current or future coverage by certain sell-side analysts and/or a diminution of institutional investor

interest. Delisting could also cause our collaborators, vendors, and employees to lose confidence in the Company, which could

harm our business and future prospects. We also believe that the current low market price of our common stock impairs its acceptability

to important segments of the institutional investor community and the investing public.

As

stated in our Definitive Proxy Statement on Schedule 14A, the proposed reverse stock split is for a ratio range between 1 for

5 and 1 for 15, to be determined at the discretion of the Board of Directors. This range has been carefully selected and is designed

to provide our Board of Directors with the necessary flexibility to effect the reverse stock split in a manner that would best

enable the Company to regain compliance with the Nasdaq minimum bid price requirements. As the Company has previously disclosed,

the Company must regain compliance with the $1 minimum bid price per share requirement by June 21, 2021 or Nasdaq will provide

written notification to the Company that its common stock will be subject to delisting.

For

these reasons, we believe the proposed reverse stock split is in the best, long-term interest of the Company’s stockholders,

and on behalf of Advaxis’ management team and Board of Directors, I am seeking your support by voting FOR the Stock

Split Proposal so we can continue to build Advaxis into a leading biotechnology company.

Sincerely,

Kenneth

A. Berlin

President

and Chief Executive Officer

and

Interim Chief Financial Officer

Advaxis,

Inc. / 9 Deer Park Drive, Suite K-1 / Monmouth Junction, NJ 08852

T:

609-452-9813 / F: 609-452-9818

www.advaxis.com

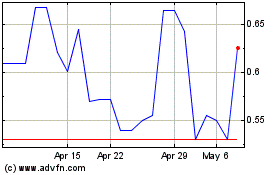

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024