Sprouts Farmers Market, Inc. (Nasdaq: SFM) today reported results

for the 13-week first quarter ended April 4, 2021.

First Quarter Highlights:

- Net sales of $1.6 billion; a 4%

decrease from the same period in 2020

- Comparable store sales growth of -9.4%

and two-year comparable store sales growth of 2.2%

- Net income and adjusted net income(1)

of $83 million; compared to net income of $92 million and adjusted

net income of $93 million from the same period in 2020

- Diluted and adjusted diluted earnings

per share(1) of $0.70; compared to $0.78 diluted earnings per share

and adjusted diluted earnings per share of $0.79 from the same

period in 2020

“I am pleased with how Sprouts has navigated the current

environment as we begin to cycle the onset of the COVID-19 impact

from last year,” said Jack Sinclair, chief executive officer of

Sprouts Farmers Market. “Sprouts achieved strong financial results

in the first quarter, building on our successful strategic

improvements from 2020, which enhanced our profitability to support

our long-term growth. We continued to move our strategy forward

with the opening of our sixth fresh distribution center, providing

our customers with even more affordable, local and organic produce,

rooted in Sprouts’ unique farmer’s market heritage. As we look

forward, I am confident we will continue to enhance our position as

a fast-growing health-focused specialty retailer.”

| |

| 1 Adjusted net income and adjusted diluted earnings per share,

non-GAAP financial measures, exclude the impact of certain special

items. There were no such adjustments for the quarter ended April

4, 2021. See the “Non-GAAP Financial Measures” section of this

release for additional information about these items. |

| |

First Quarter 2021 Financial Results

Net sales for the first quarter of 2021 were $1.6 billion, a 4%

decrease compared to the same period in 2020. Net sales were driven

by solid performance in new stores opened, offset by a decrease of

9.4% in comparable store sales due to the impact from the onset of

COVID-19 during the first quarter of last year.

Gross profit for the quarter decreased 1.3% to $586 million,

resulting in a gross profit margin of 37.2%, an increase of 114

basis points compared to the same period in 2020.This increase is

attributed to sustainable strategic changes, including promotional

activities and shrink initiatives.

Selling, general and administrative expenses for the quarter

increased $3 million to $440 million, or 27.9% of sales, a

deleverage of 141 basis points compared to the same period in 2020.

This primarily reflects sales deleverage and increased ecommerce

fees due to higher omni channel sales as more customer have

continued to rely on home delivery and curbside pickup. This was

partially offset by lower bonus expense due to COVID-19 in the

prior

year.

Depreciation and amortization for the quarter decreased 0.7% to

$31 million, or 2.0% of sales, an increase of 10 basis points

compared to the same period in 2020.

Store closure and other costs, net for the quarter were $2

million compared to a credit of $1 million in the same period of

2020.

Net income for the quarter was $83 million and diluted earnings

per share (“EPS”) was $0.70, compared with $92 million and $0.78,

respectively, in 2020. Diluted EPS in 2020 included an estimated

$0.22 benefit from the COVID-19 impact.

Unit Growth and Development

As planned, Sprouts did not open any new stores in the first

quarter of 2021, ending the quarter with a total of 362 stores in

23 states.

Leverage and Liquidity

Sprouts generated cash from operations of $105 million in the

first quarter of 2021 and invested $9 million in capital

expenditures net of landlord reimbursement, primarily for new

stores. Sprouts ended the quarter with a $250 million balance on

its revolving credit facility, $39 million of letters of credit

outstanding under the facility, $256 million in cash and cash

equivalents, and $297 million available under our current share

repurchase authorization. Through April 4, 2021, we have

repurchased 130,000 shares of common stock under this authorization

for a total investment of $3 million.

Full Year 2021 Outlook

The impact that the COVID-19 pandemic will have on the U.S.

economy and the company’s fiscal 2021 results is still uncertain.

We have adjusted our fiscal 2021 outlook, reflecting our

year-to-date performance and our expectations for the remainder of

the year:

|

|

|

| |

|

| |

Full-year 2021 Guidance |

|

|

52-week

to 52-week |

| Net sales growth |

Flat to up slightly |

| Unit growth |

Approximately 20 new

stores |

| Comparable store sales

growth |

Down low to mid-single

digits |

| Adjusted EBIT |

$305M to $325M |

| Adjusted diluted earnings per

share |

$1.87 to $2.00 |

| Effective tax rate |

Approximately 25% |

| Capital expenditures |

$140M to $160M |

| (net of landlord

reimbursements) |

|

First Quarter 2021 Conference Call

Sprouts will hold a conference call at 2 p.m. Pacific Daylight

Time (5 p.m. Eastern Daylight Time) on Thursday, May 6, 2021,

during which Sprouts executives will further discuss first quarter

2021 financial results.

A webcast of the conference call will be available through

Sprouts’ investor relations webpage located at

investors.sprouts.com. Participants should register on the website

approximately 15 minutes prior to the start of the webcast.

The conference call will be available via the following dial-in

numbers:

- U.S. Participants: 877-398-9481

- International Participants: Dial

+1-408-337-0130

- Conference ID: 9758223

The audio replay will remain available for 72 hours and can be

accessed by dialing 855-859-2056 (toll-free) or 404-537-3406

(international) and entering the confirmation code: 9758223.

Important Information Regarding Outlook

There is no guarantee that Sprouts will achieve its projected

financial expectations, which are based on management estimates,

currently available information and assumptions that management

believes to be reasonable. These expectations are inherently

subject to significant economic, competitive and other

uncertainties and contingencies, many of which are beyond the

control of management. See “Forward-Looking Statements” below.

Forward-Looking Statements

Certain statements in this press release are forward-looking as

defined in the Private Securities Litigation Reform Act of 1995.

Any statements contained herein that are not statements of

historical fact (including, but not limited to, statements to the

effect that Sprouts Farmers Market or its management "anticipates,"

"plans," "estimates," "expects," or "believes," or the negative of

these terms and other similar expressions) should be considered

forward-looking statements, including, without limitation,

statements regarding the company’s outlook, growth, opportunities

and long-term strategy. These statements involve certain risks and

uncertainties that may cause actual results to differ materially

from expectations as of the date of this release. These risks and

uncertainties include, without limitation, risks associated with

the impact of the COVID-19 pandemic; the company’s ability to

execute on its long-term strategy; the company’s ability to

successfully compete in its competitive industry; the company’s

ability to successfully open new stores; the company’s ability to

manage its growth; the company’s ability to maintain or improve its

operating margins; the company’s ability to identify and react to

trends in consumer preferences; product supply disruptions; general

economic conditions; accounting standard changes; and other factors

as set forth from time to time in the company’s Securities and

Exchange Commission filings, including, without limitation, the

company’s Annual Report on Form 10-K and Quarterly Reports on Form

10-Q. The company intends these forward-looking statements to speak

only as of the time of this release and does not undertake to

update or revise them as more information becomes available, except

as required by law.

Corporate Profile

Sprouts is the place where goodness grows. True to its

farm-stand heritage, Sprouts offers a unique grocery experience

featuring an open layout with fresh produce at the heart of the

store. Sprouts inspires wellness naturally with a carefully curated

assortment of better-for-you products paired with purpose-driven

people. The healthy grocer continues to bring the latest in

wholesome, innovative products made with lifestyle-friendly

ingredients such as organic, plant-based and gluten-free.

Headquartered in Phoenix, and one of the fastest growing retailers

in the country, Sprouts employs approximately 35,000 team members

and operates more than 360 stores in 23 states nationwide. To learn

more about Sprouts, and the good it brings communities, visit

about.sprouts.com.

| Investor

Contact: |

Media

Contact: |

|

| Susannah Livingston |

Diego Romero |

|

| (602) 682-1584 |

(602) 682-3173 |

|

|

susannahlivingston@sprouts.com |

media@sprouts.com |

|

SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

INCOME(UNAUDITED)(IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

|

|

|

ThirteenWeeks Ended |

|

|

ThirteenWeeks Ended |

|

|

|

|

April 4, 2021 |

|

|

March 29, 2020 |

|

|

Net sales |

|

$ |

1,575,447 |

|

|

$ |

1,646,539 |

|

| Cost of sales |

|

|

989,273 |

|

|

|

1,052,707 |

|

|

Gross profit |

|

|

586,174 |

|

|

|

593,832 |

|

| Selling, general and

administrative expenses |

|

|

439,662 |

|

|

|

436,304 |

|

| Depreciation and amortization

(exclusive of depreciation included in cost of sales) |

|

|

31,229 |

|

|

|

31,021 |

|

| Store closure and other costs,

net |

|

|

2,048 |

|

|

|

(1,082 |

) |

|

Income from operations |

|

|

113,235 |

|

|

|

127,589 |

|

| Interest expense, net |

|

|

2,991 |

|

|

|

4,827 |

|

|

Income before income taxes |

|

|

110,244 |

|

|

|

122,762 |

|

| Income tax provision |

|

|

27,196 |

|

|

|

30,952 |

|

|

Net income |

|

$ |

83,048 |

|

|

$ |

91,810 |

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.70 |

|

|

$ |

0.78 |

|

|

Diluted |

|

$ |

0.70 |

|

|

$ |

0.78 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

118,044 |

|

|

|

117,545 |

|

|

Diluted |

|

|

118,607 |

|

|

|

117,748 |

|

SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(UNAUDITED)(IN THOUSANDS,

EXCEPT SHARE AND PER SHARE AMOUNTS)

|

|

|

April 4, 2021 |

|

|

January 3, 2021 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

256,019 |

|

|

$ |

169,697 |

|

|

Accounts receivable, net |

|

|

14,488 |

|

|

|

14,815 |

|

|

Inventories |

|

|

270,958 |

|

|

|

254,224 |

|

|

Prepaid expenses and other current assets |

|

|

35,862 |

|

|

|

27,224 |

|

| Total current assets |

|

|

577,327 |

|

|

|

465,960 |

|

| Property and equipment, net of

accumulated depreciation |

|

|

707,039 |

|

|

|

726,500 |

|

| Operating lease assets,

net |

|

|

1,043,455 |

|

|

|

1,045,408 |

|

| Intangible assets, net of

accumulated amortization |

|

|

184,960 |

|

|

|

184,960 |

|

| Goodwill |

|

|

368,878 |

|

|

|

368,878 |

|

| Other assets |

|

|

15,079 |

|

|

|

14,698 |

|

|

Total assets |

|

$ |

2,896,738 |

|

|

$ |

2,806,404 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

160,596 |

|

|

$ |

139,337 |

|

|

Accrued liabilities |

|

|

133,026 |

|

|

|

143,402 |

|

|

Accrued salaries and benefits |

|

|

43,735 |

|

|

|

76,695 |

|

|

Accrued income tax |

|

|

16,251 |

|

|

|

— |

|

|

Current portion of operating lease liabilities |

|

|

135,797 |

|

|

|

135,739 |

|

|

Current portion of finance lease liabilities |

|

|

968 |

|

|

|

959 |

|

| Total current liabilities |

|

|

490,373 |

|

|

|

496,132 |

|

| Long-term operating lease

liabilities |

|

|

1,072,897 |

|

|

|

1,069,535 |

|

| Long-term debt and finance

lease liabilities |

|

|

260,287 |

|

|

|

260,459 |

|

| Other long-term

liabilities |

|

|

45,481 |

|

|

|

40,912 |

|

| Deferred income tax

liability |

|

|

60,830 |

|

|

|

58,073 |

|

|

Total liabilities |

|

|

1,929,868 |

|

|

|

1,925,111 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Undesignated preferred stock; $0.001 par value; 10,000,000

sharesauthorized, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 200,000,000 shares authorized,

118,194,576 shares issued and outstanding, April 4, 2021;

117,953,435 shares issued and outstanding, January 3, 2021 |

|

|

118 |

|

|

|

118 |

|

|

Additional paid-in capital |

|

|

691,142 |

|

|

|

686,648 |

|

|

Accumulated other comprehensive income (loss) |

|

|

(7,230 |

) |

|

|

(8,474 |

) |

|

Retained earnings |

|

|

282,840 |

|

|

|

203,001 |

|

| Total stockholders'

equity |

|

|

966,870 |

|

|

|

881,293 |

|

|

Total liabilities and stockholders' equity |

|

$ |

2,896,738 |

|

|

$ |

2,806,404 |

|

SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED)(IN

THOUSANDS)

|

|

|

ThirteenWeeks Ended |

|

|

ThirteenWeeks Ended |

|

|

|

|

April 4, 2021 |

|

|

March 29, 2020 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

83,048 |

|

|

$ |

91,810 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

31,841 |

|

|

|

31,600 |

|

|

Operating lease asset amortization |

|

|

25,816 |

|

|

|

23,137 |

|

|

Share-based compensation |

|

|

3,613 |

|

|

|

2,400 |

|

|

Deferred income taxes |

|

|

2,757 |

|

|

|

232 |

|

|

Other non-cash items |

|

|

207 |

|

|

|

(768 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

8,795 |

|

|

|

12,652 |

|

|

Inventories |

|

|

(16,733 |

) |

|

|

22,787 |

|

|

Prepaid expenses and other current assets |

|

|

(7,747 |

) |

|

|

(8,652 |

) |

|

Other assets |

|

|

(1,078 |

) |

|

|

656 |

|

|

Accounts payable |

|

|

27,004 |

|

|

|

80,669 |

|

|

Accrued liabilities |

|

|

(10,568 |

) |

|

|

16,492 |

|

|

Accrued salaries and benefits |

|

|

(32,959 |

) |

|

|

2,984 |

|

|

Accrued income tax |

|

|

16,251 |

|

|

|

28,906 |

|

|

Operating lease liabilities |

|

|

(28,719 |

) |

|

|

(30,107 |

) |

|

Other long-term liabilities |

|

|

3,910 |

|

|

|

2,274 |

|

|

Cash flows from operating activities |

|

|

105,438 |

|

|

|

277,072 |

|

| Cash flows used in

investing activities |

|

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(16,605 |

) |

|

|

(28,036 |

) |

|

Cash flows used in investing activities |

|

|

(16,605 |

) |

|

|

(28,036 |

) |

| Cash flows used in

financing activities |

|

|

|

|

|

|

|

|

| Payments on revolving credit

facilities |

|

|

— |

|

|

|

(87,000 |

) |

| Payments on finance lease

obligations |

|

|

(163 |

) |

|

|

(154 |

) |

| Repurchase of common

stock |

|

|

(3,209 |

) |

|

|

— |

|

| Proceeds from exercise of

stock options |

|

|

881 |

|

|

|

— |

|

|

Cash flows used in financing activities |

|

|

(2,491 |

) |

|

|

(87,154 |

) |

|

Increase in cash, cash equivalents, and restricted

cash |

|

|

86,342 |

|

|

|

161,882 |

|

| Cash, cash equivalents, and

restricted cash at beginning of the period |

|

|

171,441 |

|

|

|

86,785 |

|

| Cash, cash equivalents, and

restricted cash at the end of the period |

|

$ |

257,783 |

|

|

$ |

248,667 |

|

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”), the company presents EBITDA, adjusted EBITDA, adjusted

EBIT, adjusted net income and adjusted diluted earnings per share.

These measures are not in accordance with, and are not intended as

alternatives to, GAAP. The company's management believes that this

presentation provides useful information to management, analysts

and investors regarding certain additional financial and business

trends relating to its results of operations and financial

condition. In addition, management uses these measures for

reviewing the financial results of the company, and certain of

these measures may be used as components of incentive

compensation.

The company defines EBITDA as net income before interest

expense, provision for income tax, and depreciation, amortization

and accretion and adjusted EBITDA as EBITDA excluding the impact of

special items. The company defines adjusted EBIT, adjusted net

income and adjusted diluted earnings per share by adjusting the

applicable GAAP measure to remove the impact of special items.

Non-GAAP measures are intended to provide additional information

only and do not have any standard meanings prescribed by GAAP. Use

of these terms may differ from similar measures reported by other

companies. Because of their limitations, non-GAAP measures should

not be considered as a measure of discretionary cash available to

use to reinvest in the growth of the company’s business, or as a

measure of cash that will be available to meet the company’s

obligations. Each non-GAAP measure has its limitations as an

analytical tool, and they should not be considered in isolation or

as a substitute for analysis of the company’s results as reported

under GAAP.

The following table shows a reconciliation of adjusted EBITDA to

net income for the thirteen weeks ended April 4, 2021 and March 29,

2020 and a reconciliation of EBIT, net income and diluted earnings

per share to adjusted EBIT, adjusted net income and adjusted

diluted earnings per share for the thirteen weeks ended April 4,

2021 and March 29, 2020:

SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIESNON-GAAP MEASURE

RECONCILIATION(UNAUDITED)(IN

THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

|

ThirteenWeeks Ended |

|

ThirteenWeeks Ended |

|

|

|

April 4, 2021 |

|

March 29, 2020 |

|

Net income |

|

$ |

83,048 |

|

$ |

91,810 |

| Income tax provision |

|

|

27,196 |

|

|

30,952 |

| Interest expense, net |

|

|

2,991 |

|

|

4,827 |

| Earnings before interest and

taxes (EBIT) |

|

|

113,235 |

|

|

127,589 |

| Special items: |

|

|

|

|

|

|

|

Strategic initiatives (1) |

|

|

— |

|

|

1,200 |

| Adjusted EBIT |

|

|

113,235 |

|

|

128,789 |

| |

|

|

|

|

|

|

| Depreciation, amortization and

accretion |

|

|

31,841 |

|

|

31,600 |

| Adjusted EBITDA |

|

$ |

145,076 |

|

$ |

160,389 |

| |

|

|

|

|

|

|

| Net income |

|

$ |

83,048 |

|

$ |

91,810 |

| Special Items: |

|

|

|

|

|

|

|

Strategic initiatives, net of tax (1) |

|

|

— |

|

|

892 |

| Adjusted Net income |

|

$ |

83,048 |

|

$ |

92,702 |

| Diluted earnings per

share |

|

$ |

0.70 |

|

$ |

0.78 |

| Adjusted diluted earnings per

share |

|

$ |

0.70 |

|

$ |

0.79 |

| |

|

|

|

|

|

|

| Diluted weighted average

shares outstanding |

|

|

118,607 |

|

|

117,748 |

(1) Includes professional fees related to strategic

initiatives. After-tax impact includes the tax benefit on the

pre-tax charge.

Source: Sprouts Farmers Market, IncPhoenix, AZ5/6/21

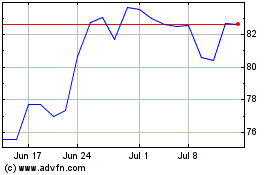

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

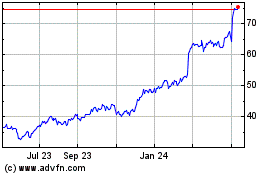

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Apr 2023 to Apr 2024