Stock Futures Edge Higher Ahead of Jobless Data

May 06 2021 - 5:19AM

Dow Jones News

By Joe Wallace

U.S. stock futures ticked higher Thursday ahead of jobs data

that are expected to show the economic recovery gained more

momentum in recent weeks.

Futures for the S&P 500 ticked up 0.2%. Contracts for the

Dow Jones Industrial Average also edged up 0.2%, a day after the

blue-chip index closed at a record for the 22nd time this year.

Futures for the technology-focused Nasdaq-100 rose 0.4%.

Major U.S. indexes stand at or close to all-time highs,

bolstered by a surge of economic growth and corporate earnings as

restrictions on some activities are relaxed. Some investors say the

speed of the U.S. recovery, which stands in contrast to some other

regions where Covid-19 vaccines aren't as widespread, will keep

stocks on an upward trajectory.

"We should see cash flows and company cash flows really improve,

especially with the reopenings happening," said Mary Nicola, a fund

manager at PineBridge Investments. Although valuations are high,

stocks remain attractive compared with low-yielding bonds, she

added.

Data due at 8:30 a.m. ET are expected to show that filings for

jobless benefits, a proxy for layoffs, fell to 527,000 last week.

That would bring the four-week average to its lowest point since

the pandemic took hold, a signal the labor-market rebound is

gathering pace.

First-quarter results from Moderna, CBS, Blue Apron and Kellogg

are due before the opening bell. News Corp., The Wall Street

Journal's parent company, and Beyond Meat are scheduled to report

earnings after markets close.

Companies have blown past forecasts so far this earnings season.

Of the 381 companies on the S&P 500 that had reported through

Wednesday, 84% had topped analysts' expectations, according to

FactSet.

Yet many companies beating forecasts have seen a lackluster

response in their share price. Some investors say that is a sign,

alongside recent volatility in tech stocks, that the rally that

began last March is beginning to flag.

"Although the S&P is just 1% off its high, I think equity

markets are beginning to look very fatigued," said Paul O'Connor,

head of multiasset investments at Janus Henderson.

Indicators including surveys by the American Association of

Individual Investors suggest investors are almost uniformly

bullish, a setup that tends to precede a pullback in stocks,

according to Mr. O'Connor. "There are such high expectations

embedded in markets that we're going to need a steady stream of

good news just to maintain the current prices," he said.

In overseas markets, the Stoxx Europe 600 edged up 0.1% and is

hovering close to its record closing level. Gains for

food-and-beverage stocks offset losses for shares of travel,

leisure and tech companies.

Société Générale was among the best-performing stocks in the

region, gaining over 6% after the French bank reported the best

quarter for its markets business in years. Vestas Wind Systems fell

4% after the Danish wind-turbine maker posted a net loss for the

first quarter.

Copper prices continued to advance, climbing 0.8% to $10,006 a

metric ton on the London Metal Exchange. Rising commodity prices

have bolstered expectations for a pickup in inflation.

In Asia, Japan's Nikkei 225 rose 1.8% by the close and China's

Shanghai Composite slipped 0.2%.

Shares of Shanghai Fosun Pharmaceutical and other Asia-based

pharmaceutical companies tumbled after the U.S. said it would

support a temporary waiver of intellectual property rights of

Covid-19 vaccine makers. Hong Kong-listed shares of Shanghai Fosun

closed 14% lower.

--Ronnie Harui contributed to this article.

Write to Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

May 06, 2021 05:04 ET (09:04 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

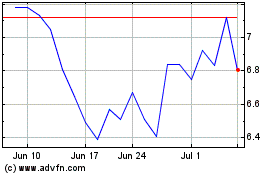

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2023 to Apr 2024