The Bancorp, Inc. ("The Bancorp") (NASDAQ: TBBK), a financial

holding company, today reported financial results for the first

quarter of 2021.

Highlights

- For the quarter ended March 31, 2021, The Bancorp earned net

income of $26.1 million from continuing operations, and $0.44

diluted earnings per share from combined continuing and

discontinued operations.

- Return on assets and equity for the quarter ended March 31,

2021 amounted to 1.6% and 18%, respectively, compared to 1.6% and

17%, respectively, for the quarter ended December 31, 2020. (all

percentages “annualized”.)

- Net interest margin amounted to 3.34% for the quarter ended

March 31, 2021, compared to 3.34% for the quarter ended March 31,

2020 and 3.58% for the quarter ended December 31, 2020.

- Net interest income increased 25% to $53.8 million for the

quarter ended March 31, 2021, compared to $42.9 million for the

quarter ended March 31, 2020.

- Average loans and leases, including loans at fair value,

increased 37% to $4.48 billion for the quarter ended March 31,

2021, compared to $3.27 billion for the quarter ended March 31,

2020.

- Prepaid, debit card and related fees increased 4% to $19.2

million for the quarter ended March 31, 2021, compared to $18.5

million for the quarter ended March 31, 2020. Gross dollar volume

(GDV), representing total spend on cards, increased 23% period over

period.

- SBLOC (securities backed lines of credit), IBLOC (insurance

backed lines of credit) and advisor financing loans increased 45%

year over year and 5% quarter over quarter to $1.68 billion at

March 31, 2021.

- Small Business Loans, including those held at fair value,

increased 16% year over year to $692.1 million at March 31, 2021,

exclusive of $190.3 million of Paycheck Protection Program (PPP)

balances outstanding at that date. Those balances reflect payments

on previously outstanding PPP loans and $95 million of first

quarter 2021 PPP loans. There were 630 PPP loans made in first

quarter 2021, generating approximate fees of $3.4 million, with 90%

of such loans under $350,000. Those fees will be recognized

throughout full year 2021, which is the estimated period of

repayment by the U.S. government.

- Leasing increased 9% year over year to $484.3 million at March

31, 2021.

- The average interest rate on $6.04 billion of average deposits

and interest-bearing liabilities during the first quarter of 2021

was 0.21%. Average prepaid and debit card account deposits of $4.28

billion for first quarter 2021, reflected an increase of 36% over

the $3.15 billion for the quarter ended March 31, 2020.

- Consolidated and The Bancorp Bank (“the Bank”) leverage ratios

were 8.62% and 8.69%, respectively, at March 31, 2021. The Bancorp

and its subsidiary, The Bank, remain well capitalized.

- Book value per common share at March 31, 2021 was $10.42 per

share compared to $8.69 at March 31, 2020, an increase of 20%,

primarily as a result of retained earnings per share.

- The Bancorp repurchased 594,428 shares of its common stock at

an average cost of $16.82 per share during the three months ended

March 31, 2021.

Damian Kozlowski, The Bancorp’s Chief Executive Officer, said,

“Our business plan for 2021 is in full implementation. The main

focus continues to be product and platform expansion with a

rigorous focus on building the best payments ecosystem in the

financial services industry. Our plan includes a comprehensive and

integrated analysis of the market and competitors, and the needed

investments to build towards the future and create scalable core

competencies that our partners can use to innovate and grow. We

also continue to invest heavily in anti-money laundering and

compliance to have best-in-class capabilities to meet regulatory

guidance and expectations. We are currently on track to meet or

exceed our financial targets for 2021. We continue to closely watch

the impact of the full reopening of the US economy, Fed policy,

government stimulus, interest rates and the virtualization of

consumer spending to understand the likely impacts on TBBK.

Currently, those impacts are mostly positive for our business model

and should drive continued growth in business volumes and

profitability into 2022. Lastly, our guidance target for 2021

continues to be $1.70 a share or approximately $100 million in net

income. The earnings per share estimates do not include share

repurchases that have been previously announced.”

The Bancorp reported net income of $26.0 million, or $0.44 per

diluted share, for the quarter ended March 31, 2021, compared to

net income of $12.6 million, or $0.22 per diluted share, for the

quarter ended March 31, 2020. Tier one capital to assets

(leverage), tier one capital to risk-weighted assets, total capital

to risk-weighted assets and common equity-tier 1 to risk-weighted

assets ratios were 8.62%, 14.81%, 15.23% and 14.81%, respectively,

compared to well-capitalized minimums of 5%, 8%, 10% and 6.5%,

respectively.

Conference Call Webcast

You may access the LIVE webcast of The Bancorp's Quarterly

Earnings Conference Call at 8:00 AM ET Friday, April 30, 2021 by

clicking on the webcast link on The Bancorp's homepage at

www.thebancorp.com. Or, you may dial 844.775.2543, access code

5792244. You may listen to the replay of the webcast following the

live call on The Bancorp's investor relations website or

telephonically until Friday, May 7, 2021 by dialing 855.859.2056,

access code 5792244.

The Bancorp, Inc. (NASDAQ: TBBK) is dedicated to serving the

unique needs of non-bank financial service companies, ranging from

entrepreneurial start-ups to those on the Fortune 500. The

company’s only subsidiary, The Bancorp Bank (Member FDIC, Equal

Housing Lender), has been repeatedly recognized in the payments

industry as the Top Issuer of Prepaid Cards (US), a top merchant

sponsor bank and a top ACH originator. Specialized lending

distinctions include National Preferred SBA Lender, a leading

provider of securities backed lines of credit, and one of the few

bank-owned commercial vehicle leasing groups in the nation. For

more information please visit www.thebancorp.com.

Forward-Looking Statements

Statements in this earnings release regarding The Bancorp’s

business which are not historical facts are "forward-looking

statements." These statements may be identified by the use of

forward-looking terminology, including but not limited to the words

“may,” “believe,” “will,” “expect,” “look,” “anticipate,” “plan,”

“estimate,” “continue,” or similar words , and are based on current

expectations about important economic, political, and technological

factors, among others, and are subject to risks and uncertainties,

which could cause the actual results, events or achievements to

differ materially from those set forth in or implied by the

forward-looking statements and related assumptions. These risks and

uncertainties include those relating to the on-going COVID-19

pandemic, the impact it will have on our business and the industry

as a whole, and the resulting governmental and societal responses.

For further discussion of the risks and uncertainties to which

these forward-looking statements may be subject, see The Bancorp’s

filings with the Securities Exchange Commission, including the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of those

filings. The forward-looking statements speak only as of the date

of this press release. The Bancorp does not undertake to publicly

revise or update forward-looking statements in this press release

to reflect events or circumstances that arise after the date of

this earnings release, except as may be required under applicable

law.

The Bancorp, Inc.

Financial highlights

Three months ended

Year ended

March 31,

December,

Condensed income statement

2021 (unaudited)

2020 (unaudited)

2020

(dollars in thousands, except per

share data)

Net interest income

$

53,757

$

42,911

$

194,866

Provision for credit losses

822

3,579

6,352

Non-interest income

ACH, card and other payment processing

fees

1,796

1,846

7,101

Prepaid, debit card and related fees

19,208

18,540

74,465

Net realized and unrealized gains (losses)

on commercial

loans originated for sale

1,996

(5,156)

(3,874)

Change in value of investment in

unconsolidated entity

—

(45)

(45)

Leasing related income

965

833

3,294

Other non-interest income

109

581

3,676

Total non-interest income

24,074

16,599

84,617

Non-interest expense

Salaries and employee benefits

25,658

22,741

101,737

Data processing expense

1,126

1,169

4,712

Legal expense

2,054

913

5,141

FDIC insurance

2,380

2,589

9,808

Software

3,684

3,477

14,028

Other non-interest expense

6,981

7,529

29,421

Total non-interest expense

41,883

38,418

164,847

Income from continuing operations before

income taxes

35,126

17,513

108,284

Income tax expense

9,066

4,352

27,688

Net income from continuing operations

26,060

13,161

80,596

Discontinued operations

Loss from discontinued operations before

income taxes

(124)

(775)

(3,816)

Income tax benefit

(29)

(205)

(3,304)

Net loss from discontinued operations, net

of tax

(95)

(570)

(512)

Net income

$

25,965

$

12,591

$

80,084

Net income per share from continuing

operations - basic

$

0.45

$

0.23

$

1.40

Net loss per share from discontinued

operations - basic

$

—

$

(0.01)

$

(0.01)

Net income per share - basic

$

0.45

$

0.22

$

1.39

Net income per share from continuing

operations - diluted

$

0.44

$

0.23

$

1.38

Net loss per share from discontinued

operations - diluted

$

—

$

(0.01)

$

(0.01)

Net income per share - diluted

$

0.44

$

0.22

$

1.37

Weighted average shares - basic

57,372,337

57,220,844

57,474,612

Weighted average shares - diluted

59,294,081

57,926,785

58,411,222

Balance sheet

March 31,

December 31,

September 30,

March 31,

2021 (unaudited)

2020

2020 (unaudited)

2020 (unaudited)

(dollars in thousands)

Assets:

Cash and cash equivalents

Cash and due from banks

$

7,838

$

5,984

$

6,220

$

13,610

Interest earning deposits at Federal

Reserve Bank

1,738,749

339,531

294,758

105,978

Total cash and cash equivalents

1,746,587

345,515

300,978

119,588

Investment securities, available-for-sale,

at fair value

1,128,459

1,206,164

1,264,903

1,353,278

Commercial loans, at fair value

(held-for-sale at March 31, 2020)

1,780,762

1,810,812

1,849,947

1,716,450

Loans, net of deferred fees and costs

2,827,076

2,652,323

2,488,760

1,985,755

Allowance for credit losses

(16,419)

(16,082)

(15,727)

(14,883)

Loans, net

2,810,657

2,636,241

2,473,033

1,970,872

Federal Home Loan Bank and Atlantic

Central Bankers Bank stock

1,368

1,368

1,368

1,142

Premises and equipment, net

17,196

17,608

15,849

17,148

Accrued interest receivable

20,164

20,458

18,852

15,660

Intangible assets, net

2,746

2,845

2,563

2,857

Deferred tax asset, net

10,900

9,757

7,952

12,797

Investment in unconsolidated entity, at

fair value

31,047

31,294

31,783

34,273

Assets held-for-sale from discontinued

operations

106,925

113,650

122,253

134,118

Other assets

90,530

81,129

79,821

79,925

Total assets

$

7,747,341

$

6,276,841

$

6,169,302

$

5,458,108

Liabilities:

Deposits

Demand and interest checking

$

6,231,220

$

5,205,010

$

4,882,834

$

4,512,949

Savings and money market

690,281

257,050

505,928

178,174

Total deposits

6,921,501

5,462,060

5,388,762

4,691,123

Securities sold under agreements to

repurchase

42

42

42

42

Short-term borrowings

—

—

—

140,000

Senior debt

98,406

98,314

98,222

—

Subordinated debenture

13,401

13,401

13,401

13,401

Other long-term borrowings

40,085

40,277

40,462

40,813

Other liabilities

77,142

81,583

69,954

74,625

Total liabilities

$

7,150,577

$

5,695,677

$

5,610,843

$

4,960,004

Shareholders' equity:

Common stock - authorized, 75,000,000

shares of $1.00 par value; 57,247,913 and 57,325,556 shares issued

and outstanding at March 31, 2021 and 2020, respectively

57,248

57,551

57,491

57,326

Additional paid-in capital

370,481

377,452

375,985

372,218

Retained earnings

154,418

128,453

104,282

60,960

Accumulated other comprehensive income

14,617

17,708

20,701

7,600

Total shareholders' equity

596,764

581,164

558,459

498,104

Total liabilities and shareholders'

equity

$

7,747,341

$

6,276,841

$

6,169,302

$

5,458,108

Average balance sheet and net interest

income

Three months ended March 31,

2021

Three months ended March 31,

2020

(dollars in thousands;

unaudited)

Average

Average

Average

Average

Assets:

Balance

Interest

Rate

Balance

Interest

Rate

Interest earning assets:

Loans, net of deferred fees and

costs**

$

4,476,617

$

47,811

4.27%

$

3,262,378

$

39,159

4.80%

Leases-bank qualified*

6,982

118

6.76%

10,975

200

7.29%

Investment securities-taxable

1,193,009

8,808

2.95%

1,395,545

10,495

3.01%

Investment securities-nontaxable*

4,042

35

3.46%

5,174

39

3.02%

Interest earning deposits at Federal

Reserve Bank

747,845

183

0.10%

493,876

1,623

1.31%

Net interest earning assets

6,428,495

56,955

3.54%

5,167,948

51,516

3.99%

Allowance for credit losses

(16,069)

(10,176)

Assets held-for-sale from discontinued

operations

109,128

853

3.13%

137,286

1,275

3.71%

Other assets

214,171

226,881

$

6,735,725

$

5,521,939

Liabilities and Shareholders'

Equity:

Deposits:

Demand and interest checking

$

5,501,697

$

1,617

0.12%

$

4,353,690

$

6,695

0.62%

Savings and money market

407,186

149

0.15%

173,575

50

0.12%

Time deposits

—

—

—

319,505

1,483

1.86%

Total deposits

5,908,883

1,766

0.12%

4,846,770

8,228

0.68%

Short-term borrowings

13,055

8

0.25%

56,813

165

1.16%

Repurchase agreements

41

—

—

72

—

—

Subordinated debentures

13,401

113

3.37%

13,401

162

4.84%

Senior debt

100,140

1,279

5.11%

—

—

—

Total deposits and liabilities

6,035,520

3,166

0.21%

4,917,056

8,555

0.70%

Other liabilities

111,241

113,582

Total liabilities

6,146,761

5,030,638

Shareholders' equity

588,964

491,301

$

6,735,725

$

5,521,939

Net interest income on tax equivalent

basis*

$

54,642

$

44,236

Tax equivalent adjustment

32

50

Net interest income

$

54,610

$

44,186

Net interest margin *

3.34%

3.34%

* Full taxable equivalent basis, using a statutory Federal tax rate

of 21% for 2021 and 2020. ** Includes loans held-for-sale at March

31, 2020. All periods include commercial loans, at fair value and

non-accrual loans. NOTE: In the table above, the 2021 interest on

loans reflects $1.4 million of fees which are not expected to

recur. The fees were earned on a short-term line of credit to

another institution to initially fund PPP loans, which did not

significantly increase average loans or assets. Interest on loans

also includes $2.4 million of interest and fees on PPP loans, which

represents the remaining recognition of fees on PPP loans made in

2020, and the initial recognition of fees on PPP loans made in

2021. Approximately $3.4 million of fees on the 2021 PPP loans is

being recognized throughout full year 2021. Increases in interest

earning deposits at the Federal Reserve Bank reflect increased

deposits resulting from stimulus payments distributed to a large

segment of the population, resulting from December 2020 federal

legislation.

Allowance for credit losses

Three months ended

Year ended

March 31,

March 31,

December 31,

2021 (unaudited)

2020 (unaudited)

2020

(dollars in thousands)

Balance in the allowance for credit losses

at beginning of period (1)

$

16,082

$

12,875

$

12,875

Loans charged-off:

SBA non-real estate

144

265

1,350

Direct lease financing

97

1,193

2,243

SBLOC

15

–

–

Total

256

1,458

3,593

Recoveries:

SBA non-real estate

4

19

103

Direct lease financing

2

84

570

Total

6

103

673

Net charge-offs

250

1,355

2,920

Provision credited to allowance, excluding

commitment provision

587

3,363

6,127

Balance in allowance for credit losses at

end of period

$

16,419

$

14,883

$

16,082

Net charge-offs/average loans

0.01%

0.04%

0.07%

Net charge-offs/average assets

—

0.02%

0.05%

(1)

Excludes activity from assets held-for-sale from

discontinued operations.

Loan portfolio

March 31,

December 31,

September 30,

March 31,

2021

2020

2020

2020

(in thousands)

SBL non-real estate

$

305,446

$

255,318

$

293,488

$

84,946

SBL commercial mortgage

320,013

300,817

270,264

233,220

SBL construction

20,692

20,273

27,169

48,823

Small business loans *

646,151

576,408

590,921

366,989

Direct lease financing

484,316

462,182

430,675

445,967

SBLOC / IBLOC**

1,622,359

1,550,086

1,428,253

1,156,433

Advisor financing ***

58,919

48,282

26,600

–

Other specialty lending

2,251

2,179

2,194

2,711

Other consumer loans ****

4,201

4,247

3,809

4,023

2,818,197

2,643,384

2,482,452

1,976,123

Unamortized loan fees and costs

8,879

8,939

6,308

9,632

Total loans, net of unamortized fees and

costs

$

2,827,076

$

2,652,323

$

2,488,760

$

1,985,755

Small business portfolio

March 31,

December 31,

September 30,

March 31,

2021

2020

2020

2020

(in thousands)

SBL, including unamortized fees and

costs

$

647,445

$

577,944

$

590,314

$

371,072

SBL, included in commercial loans, at fair

value

234,908

243,562

250,958

223,987

Total small business loans

$

882,353

$

821,506

$

841,272

$

595,059

* The preceding table shows small business loans and small business

loans held at fair value. The small business loans held at fair

value are comprised of the government guaranteed portion of SBA 7a

loans at the dates indicated. An increase in SBL non-real estate

loans from $255.3 million to $305.4 million in the first quarter of

2021 reflected an increase of $24.5 million of PPP loans authorized

by The Consolidated Appropriations Act, 2021. PPP loans totaled

$190.3 million at March 31, 2021 and $165.7 million at December 31,

2020. In addition, the Bank provided a short-term line of credit to

another institution at March 31, 2021 in the amount of $14.6

million to initially fund PPP loans, which is included in the SBL

non-real estate category. ** Securities Backed Lines of Credit

(SBLOC) are collateralized by marketable securities, while

Insurance Backed Lines of Credit (IBLOC) are collateralized by the

cash surrender value of insurance policies. *** In 2020, we began

originating loans to investment advisors for purposes of debt

refinance, acquisition of another firm or internal succession.

Maximum loan amounts are subject to loan to value ratios of 70%,

based on third party business appraisals, but may be increased

depending upon the debt service coverage ratio. Personal guarantees

and blanket business liens are obtained as appropriate. ****

Included in the table above under Other consumer loans are demand

deposit overdrafts reclassified as loan balances totaling $932,000

and $663,000 at March 31, 2021 and December 31, 2020, respectively.

Estimated overdraft charge-offs and recoveries are reflected in the

allowance for credit losses and have been immaterial.

Small business loans as of March 31,

2021

Loan principal

(in millions)

U.S. government guaranteed portion of SBA

loans (a)

$

349

Paycheck Protection Program loans (a)

190

Commercial mortgage SBA (b)

180

Construction SBA (c)

14

Unguaranteed portion of U.S. government

guaranteed loans (d)

105

Non-SBA small business loans (e)

34

Total principal

$

872

Unamortized fees and costs

10

Total small business loans

$

882

(a) This is the portion of SBA 7a loans (7a) and PPP loans which

have been guaranteed by the U.S. government, and therefore are

assumed to have no credit risk. (b) Substantially all these loans

are made under the SBA 504 Fixed Asset Financing program (504)

which dictates origination date loan to value percentages (LTV),

generally 50-60%, to which the Bank adheres. (c) Of the $14 million

in Construction SBA loans, $11 million are 504 first mortgages with

an origination date LTV of 50-60% and $3 million are SBA interim

loans with an approved SBA post-construction full takeout/payoff.

(d) The $105 million represents the unguaranteed portion of 7a

loans which are 70% or more guaranteed by the U.S. government. 7a

loans are not made on the basis of real estate LTV; however, they

are subject to SBA's "All Available Collateral" rule which mandates

that to the extent a borrower or its 20% or greater principals have

available collateral (including personal residences), the

collateral must be pledged to fully collateralize the loan, after

applying SBA-determined liquidation rates. In addition, all 7a and

504 loans require the personal guaranty of all 20% or greater

owners. (e) The $34 million of non-SBA loans is comprised of a $15

million short-term line of credit to initially fund PPP loans with

the remaining $19 million mainly comprised of approximately 20

conventional coffee/doughnut/carryout franchisee note purchases.

The majority of purchased notes were made to multi-unit operators,

are considered seasoned and have performed as agreed. A $2 million

guaranty by the seller, for an 11% first loss piece, is in place

until August 2021. Additionally, the CARES Act of 2020 (“the

CARES Act”) provided for six months of principal and interest

payments on 7a loans which generally ended in fourth quarter 2020

or in first quarter 2021. The Consolidated Appropriations Act,

2021, became law in December 2020 and provides for at least an

additional two months of such payments on SBA 7a loans, with up to

five months of payments on hotel, restaurant and other more highly

impacted loans. Unlike the six months of CARES Act payments, these

additional payments are capped at $9,000 per month.

Small business loans by type as of

March 31, 2021

(Excludes government guaranteed portion of

SBA 7a loans, PPP loans, and a line of credit to initially fund PPP

loans)

SBL commercial mortgage*

SBL construction*

SBL non-real estate

Total

% Total

(in millions)

Hotels

$

66

$

3

$

—

$

69

22%

Full-service restaurants

15

1

3

19

5%

Baked goods stores

4

—

12

16

5%

Child day care services

15

—

1

16

5%

Car washes

10

1

—

11

5%

Offices of lawyers

10

—

—

10

3%

Assisted living facilities for the

elderly

1

8

—

9

3%

Limited-service restaurants

4

1

4

9

3%

Funeral homes and funeral services

8

—

—

8

2%

Fitness and recreational sports

centers

5

1

2

8

2%

Lessors of nonresidential buildings

(except miniwarehouses)

8

—

—

8

2%

General warehousing and storage

7

—

1

8

2%

All other amusement and recreation

industries

5

—

—

5

1%

Outpatient mental health and substance

abuse centers

5

—

—

5

1%

Gasoline stations with convenience

stores

4

—

—

4

1%

Offices of dentists

3

—

—

3

1%

Other warehousing and storage

3

—

—

3

1%

New car dealers

3

—

—

3

1%

Offices of physicians (except mental

health specialists)

3

—

—

3

1%

All other miscellaneous general purpose

machinery manufacturing

3

—

—

3

1%

Automotive body, paint, and interior

repair and maintenance

2

—

1

3

1%

All other specialty trade contractors

1

—

1

2

1%

Pet care (except veterinary) services

2

—

—

2

1%

Sewing, needlework, and piece goods

stores

2

—

—

2

1%

Caterers

2

—

—

2

1%

Amusement arcades

2

—

1

3

1%

Plumbing, heating, and air- conditioning

contractors

2

—

—

2

1%

Offices of real estate agents and

brokers

2

—

—

2

1%

Landscaping services

—

—

2

2

1%

Independent artists, writers, and

performers

2

—

—

2

1%

Drinking places (alcoholic beverages)

1

—

1

2

1%

All other miscellaneous food

manufacturing

1

—

1

2

1%

Sports and recreation instruction

—

—

2

2

1%

Other**

45

1

24

70

20%

Total

$

246

$

16

$

56

$

318

100%

* Of the SBL commercial mortgage and SBL construction loans, $63.5

million represents the total of the non-guaranteed portion of SBA

7a loans and non-SBA loans. The balance of those categories

represents SBA 504 loans with 50%-60% origination date

loan-to-values. **Loan types less than $1.5 million are spread over

a hundred different classifications such as Commercial Printing,

Pet and Pet Supplies Stores, Securities Brokerage, etc.

State diversification as of March 31,

2021

(Excludes government guaranteed portion of

SBA 7a loans, PPP loans, and a line of credit to initially fund PPP

loans)

SBL commercial mortgage*

SBL construction*

SBL non-real estate

Total

% Total

(in millions)

Florida

$

45

$

8

$

8

$

61

19%

California

40

1

5

46

14%

Pennsylvania

30

—

4

34

11%

Illinois

23

—

3

26

8%

North Carolina

22

1

3

26

8%

New York

15

3

5

23

7%

Texas

12

—

5

17

5%

Tennessee

11

—

1

12

4%

New Jersey

4

—

7

11

3%

Virginia

9

—

2

11

3%

Georgia

7

—

2

9

3%

Colorado

3

2

1

6

2%

Michigan

3

—

1

4

1%

Washington

3

—

—

3

1%

Ohio

3

—

—

3

1%

Other States

16

1

9

26

10%

Total

$

246

$

16

$

56

$

318

100%

* Of the SBL commercial mortgage and SBL construction loans, $63.5

million represents the total of the non-guaranteed portion of SBA

7a loans and non-SBA loans. The balance of those categories

represents SBA 504 loans with 50%-60% origination date

loan-to-values.

Top 10 loans as of March 31,

2021

Type*

State

SBL commercial mortgage*

SBL construction*

Total

(in millions)

Lawyers office

CA

$

9

$

—

$

9

Hotel

FL

9

—

9

General warehouse and storage

PA

7

—

7

Hotel

NC

6

—

6

Assisted living facility

FL

—

5

5

Outpatient mental health and substance

abuse center

FL

5

—

5

Hotel

NC

5

—

5

Fitness and recreation sports center

PA

4

—

4

Hotel

PA

4

—

4

Hotel

TN

4

—

4

Total

$

53

$

5

$

58

* All the top 10 loans are 504 SBA loans with 50%-60% origination

date loan-to-values. The top 10 loan table above does not include

loans to the extent that they are U.S. government guaranteed.

Commercial real estate loans, at fair

value, excluding SBA loans, are as follows including LTV at

origination:

Type as of March 31, 2021

Type

# Loans

Balance

Weighted average origination date

LTV

Weighted average minimum interest

rate

(dollars in millions)

Multifamily (apartments)

155

$

1,405

76%

4.77%

Hospitality (hotels and lodging)

11

71

65%

5.75%

Retail

7

48

71%

4.55%

Other

7

27

70%

5.23%

180

$

1,551

76%

4.82%

Fair value adjustment

(5)

Total

$

1,546

State diversification as of March

31, 2021

15 largest loans (all

multifamily) as of March 31, 2021

State

Balance

Origination date LTV

State

Balance

Origination date LTV

(in millions)

(in millions)

Texas

$

432

77%

North Carolina

$

44

78%

Georgia

211

77%

Texas

38

79%

North Carolina

114

77%

Texas

36

80%

Arizona

112

76%

Pennsylvania

34

77%

Alabama

57

76%

Texas

30

75%

Ohio

56

69%

Nevada

29

80%

Other states each <$50 million

569

73%

Texas

27

77%

Total

$

1,551

76%

Arizona

27

79%

Mississippi

26

79%

North Carolina

25

77%

Texas

25

77%

Texas

24

77%

Georgia

23

79%

Alabama

23

77%

Georgia

20

79%

15 Largest loans

$

431

78%

Institutional banking loans outstanding

at March 31, 2021

Type

Principal

% of total

(in millions)

Securities backed lines of credit

(SBLOC)

$

1,117

66%

Insurance backed lines of credit

(IBLOC)

505

30%

Advisor financing

59

4%

Total

$

1,681

100%

For SBLOC, we generally lend up to 50% of the value of equities and

80% for investment grade securities. While equities have fallen in

excess of 30% in recent periods, the reduction in collateral value

of brokerage accounts collateralizing SBLOCs generally has been

less, for two reasons. First, many collateral accounts are

“balanced” and accordingly have a component of debt securities,

which have either not decreased in value as much as equities, or in

some cases may have increased in value. Secondly, many of these

accounts have the benefit of professional investment advisors who

provided some protection against market downturns, through

diversification and other means. Additionally, borrowers often

utilize only a portion of collateral value, which lowers the

percentage of principal to collateral.

Top 10 SBLOC loans at March 31,

2021

Principal amount

% Principal to collateral

(in millions)

$

60

43%

17

38%

14

27%

12

29%

10

40%

10

20%

10

32%

8

72%

8

23%

8

34%

Total and weighted average

$

157

35%

Insurance backed lines of credit (IBLOC) IBLOC loans are

backed by the cash value of life insurance policies which have been

assigned to us. We lend up to 100% of such cash value. Our

underwriting standards require approval of the insurance companies

which carry the policies backing these loans. Currently, seven

insurance companies have been approved and, as of April 17, 2021,

all were rated Superior (A+ or better) by AM BEST.

Direct lease financing* by type as of

March 31, 2021

Principal balance

% Total

(in millions)

Government agencies and public

institutions**

$

79

16%

Construction

75

16%

Waste management and remediation

services

63

13%

Real estate, rental and leasing

56

12%

Retail trade

46

9%

Transportation and warehousing

29

6%

Health care and social assistance

26

5%

Professional, scientific, and technical

services

18

4%

Wholesale trade

15

3%

Manufacturing

11

2%

Educational services

8

2%

Arts, entertainment, and recreation

6

1%

Other

52

11%

Total

$

484

100%

* Of the total $484 million of direct lease financing, $447 million

consisted of vehicle leases with the remaining balance consisting

of equipment leases. ** Includes public universities and school

districts.

Direct lease financing by state as of

March 31, 2021

State

Principal balance

% Total

(in millions)

Florida

$

83

17%

California

44

9%

New Jersey

34

7%

New York

31

6%

Pennsylvania

25

5%

Utah

25

5%

North Carolina

24

5%

Maryland

23

5%

Washington

15

3%

Connecticut

15

3%

Texas

13

3%

Missouri

12

2%

Georgia

10

2%

Alabama

9

2%

Idaho

9

2%

Other states

112

24%

Total

$

484

100%

Capital ratios

Tier 1 capital

Tier 1 capital

Total capital

Common equity

to average

to risk-weighted

to risk-weighted

tier 1 to risk

assets ratio

assets ratio

assets ratio

weighted assets

As of March 31, 2021

The Bancorp, Inc.

8.62%

14.81%

15.23%

14.81%

The Bancorp Bank

8.69%

14.95%

15.37%

14.95%

"Well capitalized" institution (under FDIC

regulations-Basel III)

5.00%

8.00%

10.00%

6.50%

As of December 31, 2020

The Bancorp, Inc.

9.20%

14.43%

14.84%

14.43%

The Bancorp Bank

9.11%

14.27%

14.68%

14.27%

"Well capitalized" institution (under FDIC

regulations-Basel III)

5.00%

8.00%

10.00%

6.50%

Three months ended

Year ended

March 31,

December

2021

2020

2020

Selected operating ratios

Return on average assets (1)

1.56%

0.91%

1.34%

Return on average equity (1)

17.88%

10.28%

15.08%

Net interest margin

3.34%

3.34%

3.45%

(1)

Annualized

Book value per share table

March 31,

December 31,

September 30,

March 31,

2021

2020

2020

2020

Book value per share

$

10.42

$

10.10

$

9.71

$

8.69

Loan quality table

March 31,

December 31,

September 30,

March 31,

2021

2020

2020

2020

(dollars in thousands)

Nonperforming loans to total loans

0.49%

0.48%

0.49%

0.40%

Nonperforming assets to total assets

0.18%

0.20%

0.20%

0.14%

Allowance for credit losses

0.58%

0.61%

0.63%

0.75%

Nonaccrual loans

$

11,961

$

12,227

$

12,275

$

5,645

Loans 90 days past due still accruing

interest

1,762

497

24

2,245

Other real estate owned

—

—

—

—

Total nonperforming assets

$

13,723

$

12,724

$

12,299

$

7,890

Gross dollar volume (GDV) (1)

Three months ended

March 31,

December 31,

September 30,

March 31,

2021

2020

2020

2020

(in thousands)

Prepaid and debit card GDV

$

28,094,930

$

22,523,855

$

23,964,508

$

22,752,931

(1)

Gross dollar volume represents the total dollar amount spent on

prepaid and debit cards issued by The Bancorp Bank.

Business line quarterly summary

Quarter ended March 31, 2021

(dollars in millions)

Balances

% Growth

Major business lines

Average approximate rates *

Balances **

Year over year

Linked quarter annualized

Loans

Institutional banking ***

2.5%

$ 1,681

45%

21%

Small Business Lending****

5.0%

882

16%

22%

Leasing

6.4%

484

9%

19%

Commercial real estate (non-SBA at fair

value)

4.8%

1,546

nm

nm

Weighted average yield

4.2%

$ 4,593

Non-interest income

% Growth

Deposits

Current quarter

Year over year

Payment solutions (prepaid and debit card

issuance)

0.1%

$ 4,281

36%

nm

$ 19.2

4%

Card payment and ACH processing

0.2%

$ 1,048

32%

nm

$ 1.8

nm

* Average rates are for the quarter ended March 31, 2021. **

Loan and deposit categories are respectively based on period-end

and average quarterly balances. *** Institutional Banking loans are

comprised of Securities Backed Lines of Credit (SBLOC),

collateralized by marketable securities, Insurance Backed Lines of

Credit (IBLOC), collateralized by the cash surrender value of

insurance policies, and Advisor financing. **** Small Business

Lending is substantially comprised of SBA loans. Loan growth

percentages exclude short-term PPP loans.

Analysis of Walnut Street*

marks

Loan activity

Marks

(dollars in millions)

Original Walnut Street loan balance,

December 31, 2014

$

267

Marks through December 31, 2014 sale

date

(58)

$

(58)

Sales price of Walnut Street

209

Equity investment from independent

investor

(16)

December 31, 2014 Bancorp book value

193

Additional marks 2015 - 2020

(46)

(46)

2021 Marks

—

Payments received

(116)

March 31, 2021 Bancorp book value**

$

31

Total marks

$

(104)

Divided by:

Original Walnut Street loan balance

$

267

Percentage of total mark to original

balance

39%

* Walnut Street is the investment in unconsolidated entity on the

balance sheet which reflects the investment in a securitization of

certain loans from the Bank's discontinued loan portfolio. **

Approximately 34% of expected principal recoveries were from loans

and properties pending liquidation or other resolution as of March

31, 2021.

Walnut Street portfolio composition as

of March 31, 2021

Collateral type

% of Portfolio

Commercial real estate non-owner occupied

- Retail

67.4%

Construction and land

24.3%

Other

8.3%

Total

100.0%

Cumulative analysis of marks on

discontinued commercial loan principal as of March 31, 2021

Discontinued

Cumulative

% to original

loan principal

marks

principal

(dollars in millions)

Commercial loan discontinued principal

before marks

$

61

Florida mall held in discontinued other

real estate owned

42

$

(27)

Mark at March 31, 2021

(4)

Cumulative mark at March 31, 2021

$

103

$

(31)

30%

Analysis of discontinued commercial

loan relationships as of March 31, 2021

Performing

Nonperforming

Total

Performing

Nonperforming

Total

loan principal

loan principal

loan principal

loan marks

loan marks

marks

(in millions)

5 loan relationships > $5 million

$

39

$

—

$

39

$

(3)

$

—

$

(3)

Loan relationships < $5 million

9

9

18

—

(1)

(1)

$

48

$

9

$

57

$

(3)

$

(1)

$

(4)

Quarterly activity for commercial loan

discontinued principal

Commercial

loan principal

(in millions)

Commercial loan discontinued principal

December 31, 2020 before marks

$

64

Quarterly paydowns and other

reductions

(3)

Commercial loan discontinued principal

March 31, 2021 before marks

61

Marks March 31, 2021

(4)

Net commercial loan exposure March 31,

2021

57

Residential mortgages

29

Net loans

86

Florida mall in other real estate

owned

15

6 properties in other real estate

owned

6

Total discontinued assets at March 31,

2021

$

107

Discontinued commercial loan

composition as of March 31, 2021

Collateral type

Unpaid principal balance

Mark at March 31, 2021

Mark as % of portfolio

(in millions)

Commercial real estate - non-owner

occupied:

Retail

$

4

$

(0.6)

15%

Office

2

—

—

Other

18

(0.1)

1%

Construction and land

10

(0.1)

1%

Commercial non-real estate and

industrial

3

(0.1)

3%

1 to 4 family construction

7

(2.5)

36%

First mortgage residential non-owner

occupied

8

—

—

Commercial real estate owner occupied:

Retail

7

(0.7)

10%

Residential junior mortgage

1

—

—

Other

1

—

—

Total

$

61

$

(4.1)

7%

Less: mark

(4)

Net commercial loan exposure March 31,

2021

$

57

$

(4.1)

Loan payment deferrals as of March 31,

2021

Cumulative months deferred

(1)

Total loan balance deferrals

Total non- guaranteed loan

balance deferrals

Total loan balances

% of total loan balances with

deferrals

% of total non- guaranteed loan

balances with deferrals

(dollars in millions)

Commercial real estate loans held at fair

value (excluding SBA loans shown below)

6.0

$

19

$

19

$

1,546

1.2%

1.2%

Securities backed lines of credit,

insurance backed lines of credit & advisor financing

—

—

—

1,681

—

—

SBL commercial mortgage

8.6

44

24

437

10.1%

5.5%

SBL construction

—

—

—

21

—

—

SBL non-real estate and PPP

7.6

15

4

424

3.5%

0.9%

Direct lease financing

—

—

—

484

—

—

Discontinued operations

8.5

1

1

90

1.1%

1.1%

Other consumer loans and specialty

lending

—

—

—

7

—

—

Total

7.8

$

79

$

48

$

4,690

1.7%

1.0%

(1)

Weighted average of cumulative months deferred for loan

payments currently on deferral.

Note: SBL balances above include loans

reported in commercial loans, at fair value, in the balance

sheet.

Note: At March 31, 2021, SBA 7a loans, included in the three SBL

loan balance categories above, totaled $454.0 million of which

$105.0 million was not U.S. government guaranteed. The CARES Act

provided SBA 7a borrowers six months of principal and interest

payments. The Consolidated Appropriations Act, 2021, became law in

December 2020 and provided for at least an additional two months of

such payments on SBA 7a loans, with up to five months of payments

on hotel, restaurant and other more highly impacted loans which

began on February 1, 2021.

SBA 7a deferral distribution by type as

of March 31, 2021 (comprised of the unguaranteed portion of SBA

7a loans)

Total

% Total

(in thousands)

Full-service restaurants

$

3,115

30%

Hotels*

1,535

15%

Sports and recreation instruction

1,157

11%

Services for the elderly and persons with

disabilities

947

9%

Offices of dentists

829

8%

Drinking places (alcoholic beverages)

726

7%

All other amusement and recreation

industries

580

6%

Administrative management services

334

3%

Commercial printing

333

3%

Automotive glass replacement shops

315

3%

Cosmetology and barber schools

244

2%

Clothing and furnishings merchant

wholesalers

220

2%

Janitorial services

184

1%

Total

$

10,519

100%

* At March 31, 2021, SBA 7a loans, included in SBL, totaled $454.0

million of which $105.0 million was not U.S. government guaranteed.

The CARES Act provided SBA 7a borrowers six months of principal and

interest payments. The Consolidated Appropriations Act, 2021,

became law in December 2020 and provided for at least an additional

two months of such payments on SBA 7a loans, with up to five months

of payments on hotel, restaurant and other more highly impacted

loans which began on February 1, 2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210429006055/en/

The Bancorp, Inc. Andres Viroslav Director, Investor

Relations 215-861-7990 aviroslav@thebancorp.com

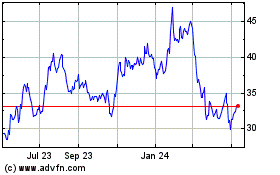

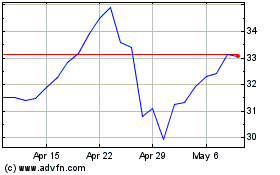

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024