TIDMGRP

RNS Number : 0997X

Greencoat Renewables PLC

29 April 2021

Greencoat Renewables PLC AGM Result

Dublin, London, 29 April 2021: Greencoat Renewables PLC

("Greencoat Renewables" or the "Company") the renewable

infrastructure company invested in euro-dominated assets, is

pleased to announce that at the Company's AGM held at 9.00 am

today, 29 April 2021, each of the Resolutions were duly passed

without amendment.

All resolutions as set out in the Notice of AGM were voted on by

way of poll and the results were as follows:

In Favour

(including discretionary) Against Withheld*

Resolution Votes % Votes % Votes

1 252,111,489 100 0 0 0

2 (a) 252,105,589 100 5,900 0 0

2 (b) 252,105,589 100 5,900 0 0

2 (c) 252,105,589 100 5,900 0 0

2 (d) 252,105,589 100 5,900 0 0

3 252,105,589 100 5,900 0 0

4 252,111,489 100 0 0 0

5 252,111,489 100 0 0 0

6 252,106,989 100 4,500 0 0

7 252,111,489 100 0 0 0

8 252,111,489 100 0 0 0

9 251,973,989 100 0 0 137,500

*A vote withheld is not a vote in law and is therefore not

counted towards the proportion of votes "in favour" or "against"

the Resolution.

The full wording of the resolutions, that were not ordinary

business of the AGM can be found below:-

To consider and, if thought fit, to pass the following

resolutions as ordinary resolutions:

5. That the Directors be and are hereby generally and

unconditionally authorised, pursuant to Section 1021 of the

Companies Act 2014, to exercise all of the powers of the Company to

allot relevant securities (within the meaning of the said Section

1021) up to an aggregate nominal amount equal to EUR2,470,796. The

authority hereby conferred shall expire at the conclusion of the

next annual general meeting of the Company after the date of

passing of this resolution or at the close of business on the date

which is 15 calendar months after the date of passing of this

resolution, whichever is earlier, unless previously renewed, varied

or revoked; provided that the Company may make an offer or

agreement before the expiry of the authority conferred by this

Resolution which would or might require relevant securities to be

allotted after such authority has expired, and the Directors may

allot relevant securities in pursuance of such an offer or

agreement as if the power conferred by this resolution had not

expired.

To consider and, if thought fit, to pass the following

resolutions as special resolutions:

6. That the Directors be and are hereby empowered, pursuant to

Sections 1022 and 1023(3) of the Companies Act 2014, to allot

equity securities (within the meaning of the said Section 1023(1))

for cash pursuant to the authority to allot relevant securities

conferred on the Directors by Resolution 5 of this Notice of AGM as

if Section 1022(1) did not apply to any such allotment, such power

being limited to:

(a) the allotment of equity securities in connection with any

offer of securities, open for a period fixed by the Directors, by

way of rights issue, open offer or otherwise in favour of the

holders of equity securities and/or any persons having or who may

acquire a right to subscribe for equity securities in the capital

of the Company where the equity securities respectively

attributable to the interests of such holders are proportional (as

nearly as may reasonably be) to the respective number of equity

securities held by them, and subject thereto, the allotment by way

of placing or otherwise of any equity securities not taken up in

such issue or offer to such persons as the Directors may determine;

and, generally, subject to such exclusions or other arrangements as

the Directors may deem necessary or expedient in relation to legal

or practical problems (including dealing with any fractional

entitlements and/or arising in respect of any oversees

shareholders) under the laws of, or the requirements of any

regulatory body or stock exchange in, any territory; and

(b) the allotment of equity securities (otherwise than pursuant

to sub-paragraph (a) above) up to a nominal aggregate amount equal

to EUR741,238.

provided that such power shall expire at the conclusion of the

next annual general meeting of the Company after the date of

passing of this resolution, or at the close of business on the date

which is 15 calendar months after the date of passing of this

resolution, whichever is the earlier, unless previously varied,

revoked or renewed, and provided further that the Company may

before such expiry make an offer or agreement which would or might

require equity securities to be allotted after such expiry and the

Directors may allot equity securities in pursuance of such offer or

agreement as if the power conferred hereby had not expired.

7. That pursuant to Section 1074 of the Companies Act 2014, the

Company and any subsidiary of the Company be and they are each

hereby generally authorised to make market purchases or overseas

market purchases (as defined by Section 1072 of that Act) of

ordinary shares of EUR0.01 each in the capital of the Company

("Ordinary Shares") on such terms and conditions and in such manner

as the Directors may determine from time to time; but subject

however to the provisions of that Act and to the following

restrictions and provisions:

(a) the maximum number of Ordinary Shares authorised to be

acquired shall not exceed 14.99 per cent. of the ordinary share

capital in issue in the Company as at close of business on the date

on which this resolution is passed;

(b) the minimum price (excluding expenses) which may be paid for

any Ordinary Share shall

be an amount equal to the nominal value thereof;

(c) the maximum price (excluding expenses) which may be paid for

any Ordinary Share (a "Relevant Share") shall be the higher of:

(i) 5 per cent. above the average market price of an Ordinary

Share as determined in accordance with this sub-paragraph (c);

and

(ii) the amount stipulated by Article 5(6) of Regulation No.

596/2014 of the European Parliament and Council (or by any

corresponding provision of legislation replacing that

regulation);

where the average market value of an Ordinary Share for the

purpose of sub-paragraph (i) shall be the amount equal to the

average of the five amounts resulting from determining whichever of

the following ((A), (B) or (C) specified below) in respect of

Ordinary Shares shall be appropriate for each of the five business

days immediately preceding the day on which the Relevant Share is

purchased as determined from the information published by the

trading venue where the purchase will be carried out reporting the

business done on each of those five days:

(A) if there shall be more than one dealing reported for the

day, the average of the prices at which such dealings took place;

or

(B) if there shall be only one dealing reported for the day, the

price at which such dealing took place; or

(C) if there shall not be any dealing reported for the day, the

average of the closing bid and offer prices for the day,

and if there shall be only a bid (but not an offer) price or an

offer (but not a bid) price reported, or if there shall not be any

bid or offer price reported, for any particular day, that day shall

not be treated as a business day for the purposes of this

sub-paragraph (c); provided that, if for any reason it shall be

impossible or impracticable to determine an appropriate amount for

any of those five days on the above basis, the Directors may, if

they think fit and having taken into account the prices at which

recent dealings in such shares have taken place, determine an

amount for such day and the amount so determined shall be deemed to

be appropriate for that day for the purposes of calculating the

maximum price; and if the means of providing the foregoing

information as to dealings and prices by reference to which the

maximum price is to be determined is altered or is replaced by some

other means, then the maximum price shall be determined on the

basis of the equivalent information published by the relevant

authority in relation to dealings on the Euronext Dublin or its

equivalent; and

(d) the authority conferred by this resolution shall expire on

close of business on the date of the next annual general meeting of

the Company after the date of passing this resolution or the date

which is 15 calendar months after the date of passing of this

resolution (whichever is earlier), unless previously varied,

revoked or renewed in accordance with the provisions of Section

1074 of the Companies Act 2014. The Company or any subsidiary may,

before such expiry, enter into a contract for the purchase of

Ordinary Shares which would or might be executed wholly or partly

after such expiry and may complete any such contract as if the

authority conferred hereby had not expired.

8. That:

(a) subject to the passing of Resolution No. 7 above, for the

purposes of section 1078 of the Companies Act, the re-allotment

price range at which any treasury shares (as defined by the said

Companies Act) for the time being held by the Company may be

re-allotted off-market as ordinary shares of EUR0.01 each of the

Company ("Ordinary Shares") shall be as follows:

(i) the maximum price at which a treasury share may be

re-allotted off-market shall be an amount equal to 120 per cent. of

the Appropriate Price; and

(ii) the minimum price at which a treasury share may be

re-allotted off-market shall be an amount equal to 95 per cent. of

the Appropriate Price;

(b) for the purposes of this resolution the expression

"Appropriate Price" shall mean the average of the five amounts

resulting from determining whichever of the following ((i), (ii) or

(iii) specified below) in respect of Ordinary Shares shall be

appropriate for each of the five business days immediately

preceding the day on which such treasury share is re-allotted, as

determined from information published in the Euronext Dublin Daily

Official List (or any successor publication thereto or any

equivalent publication for securities admitted to trading on the

Euronext Growth Market) reporting the business done on each of

those five business days:

(i) if there shall be more than one dealing reported for the

day, the average of the prices at which such dealings took place;

or

(ii) if there shall be only one dealing reported for the day,

the price at which such dealing took place; or

(iii) if there shall not be any dealing reported for the day,

the average of the closing bid and offer prices for the day:

and if there shall be only a bid (but not an offer) price or an

offer (but not a bid) price reported, or if there shall not be any

bid or offer price reported, for any particular day, then that day

shall not be treated as a business day for the purposes of this

sub-paragraph (b); provided that if for any reason it shall be

impossible or impracticable to determine an appropriate amount for

any of those five days on the above basis, the Directors may, if

they think fit and having taken into account the prices at which

recent dealings in such shares have taken place, determine an

amount for such day and the amount so determined shall be deemed to

be appropriate for that day for the purposes of calculating the

Appropriate Price; and if the means of providing the foregoing

information as to dealings and prices by reference to which the

Appropriate Price is to be determined is altered or is replaced by

some other means, then the Appropriate Price shall be determined on

the basis of the equivalent information published by the relevant

authority in relation to dealings on the Euronext Dublin or its

equivalent; and

(c) the authority hereby conferred shall expire on close of

business on the date of the next annual general meeting of the

Company after the date of passing this resolution or the date which

is 15 calendar months after the date of passing of this resolution

(whichever is earlier).

To consider and, if thought fit, to pass the following

resolution as an ordinary resolution:

9. That the Company be and is hereby generally and

unconditionally authorised to amend its investment policy as set

out at paragraph 3.1 of Part 1 of the admission document issued by

the Company on 25 July 2017 and as amended by the Annual General

Meeting on 29 April 2020 (the "Investment Policy") so that the

Company can invest in aggregate, up to 40 per cent. of the Gross

Asset Value (calculated immediately following each investment) in

operational wind energy assets or operational solar PV assets in

not only Other Relevant Countries but also Ireland.

The full text of each resolution and a summary of proxy votes

received will shortly be available on the Company's website and

will also be submitted to the National Storage Mechanism for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

--- ENDS ---

For further information on the Announcement, please contact:

Greencoat Renewables PLC: +44 20 7832 9400

Bertrand Gautier

Paul O'Donnell

Tom Rayner

Davy (Joint Broker, Nomad and

Euronext Growth Adviser) +353 1 6796363

Fergal Meegan

Ronan Veale

Barry Murphy

RBC (Joint Broker) +44 20 7653 4000

Matthew Coakes

Duncan Smith

Elizabeth Evans

FTI Consulting (Media Enquiries) +353 1 765 0886

Jonathan Neilan

Melanie Farrell

About Greencoat Renewables PLC

Greencoat Renewables PLC is an investor in euro-denominated

renewable energy infrastructure assets. Initially focused solely on

the acquisition and management of operating wind farms in Ireland,

the Company is now also investing in wind and solar assets in

certain other Northern European countries with stable and robust

renewable energy frameworks. It is managed by Greencoat Capital

LLP, an experienced investment manager in the listed renewable

energy infrastructure sector.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGSESFFUEFSEDL

(END) Dow Jones Newswires

April 29, 2021 09:00 ET (13:00 GMT)

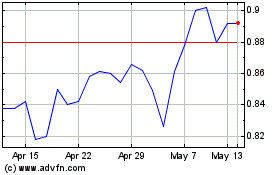

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

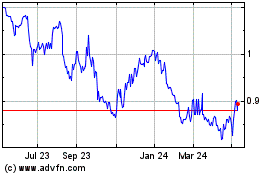

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Apr 2023 to Apr 2024