Current Report Filing (8-k)

April 19 2021 - 7:38AM

Edgar (US Regulatory)

000155507412/31false00015550742021-04-162021-04-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 19, 2021 (April 16, 2021)

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Virgin Islands

|

|

001-36063

|

|

66-0783125

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(704) 275-9113

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

AAMC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02

On April 16, 2021, the Board of Directors (the “Board”) of Altisource Asset Management Corporation (the “Company”) terminated the Company’s Chief Executive Officer, Indroneel Chatterjee, for cause, effective immediately, for violations of the Company’s Equal Employment Opportunity, Prevention Against Harassment, and Conduct on the Job Policies. This action reflects the results of an independent inquiry by counsel to the Board into Mr. Chatterjee’s conduct. Under Mr. Chatterjee’s employment agreement with the Company, he was also deemed to have simultaneously resigned from his positions as Chairman of the Board and a director of the Company, and the Board accepted his resignations.

Information concerning the payments and benefits due to Mr. Chatterjee from, and the obligations imposed on Mr. Chatterjee as a result of, a termination for cause are set forth in Exhibit 10.7 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 3, 2021.

The Board expects to promptly commence a search for its next Chief Executive Officer and has appointed Mr. Thomas K. McCarthy as interim Chief Executive Officer during the search period. Mr. McCarthy and the Company anticipate entering into an employment agreement pursuant to which Mr. McCarthy will receive an initial annual base salary of $675,000 and will serve for an initial term of 120 days, subject to a mutual right to terminate upon 30 days’ prior notice, and will continue on a month-to-month basis thereafter.

Mr. McCarthy, age 65, has served as a consultant and advisor to various businesses since 2016, including a national risk management and private investigation firm, a provider of real estate services to mortgage servicing companies, and other real estate and finance related businesses. He previously served as Senior Vice President, Business Development, for National General Lender Services, and as Senior Vice President, Business Development, of Altisource Portfolio Solutions, Inc. Mr. McCarthy was also a Managing Director and Co-Head of the Loan Sale Advisory Practice at Carlton Advisory Services, Inc., a real estate investment bank, for 8 years, and a Senior Vice President for Ocwen Financial Corporation for over 11 years prior to that. The Board and Mr. McCarthy are committed to and look forward to executing on potential new business initiatives for the Company.

Item 5.03

Effective on April 19, 2021, the Board of the Company approved the amendment and restatement of the Company’s Third Amended and Restated Bylaws (as amended and restated, such bylaws are the Company’s Fourth Amended and Restated Bylaws) to permit a non-executive Chairman during the pending search for a permanent Chief Executive officer and also took action to reduce the size of the Board from four to three during the search period. The Board has appointed Governor John de Jongh as interim Chairman of the Board for the duration of the search period.

Item 8.01

On April 19, 2021, the Company issued a press release announcing the termination of Mr. Chatterjee, and the appointment of Mr. Thomas K. McCarthy as interim Chief Executive Officer. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Amended and Restated Bylaws (marked to show changes from the Third Amended and Restated Bylaws).

|

|

|

|

Press Release of Altisource Asset Management Corporation, dated April 19, 2021.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

|

|

|

|

|

|

|

Forward Looking Statements.

Statements in this Form 8-K, or made by officers, directors or authorized persons of the Company, concerning the search process for a new President and Chief Executive Officer and the timing of that search as well as the Company’s

implementation of new business initiatives are forward-looking statements under the safe-harbor provisions of the federal securities laws. The actual results and timing of the search process may differ possibly materially from that contemplated by those statements due to, among other things, the ability of the Board to find eligible candidates, delays due to the COVID-19 pandemic the performance of the Company and the other factors set forth under Item 1A Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and the Company’s implementation of new business initiatives is subject to the risks associated with starting up any new business, including the ability to retain and hire qualified personnel to run the new businesses, the Company’s ability to effectively compete with established businesses, the challenges of commencing a new business during the COVID-19 pandemic and the other factors set forth under Item 1A Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. The Company undertakes no obligation to update forward-looking statements as a result of changes in circumstances, new information or otherwise.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Altisource Asset Management Corporation

|

|

April 19, 2021

|

By:

|

/s/ P. Graham Singer

|

|

|

|

P. Graham Singer

General Counsel and Secretary

|

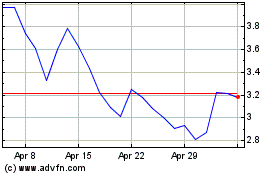

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

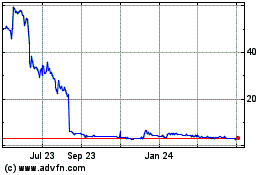

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Apr 2023 to Apr 2024