SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2021

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

1

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

CERTIFICATE

MINUTES OF THE 891st MEETING OF THE

BOARD OF DIRECTORS OF CENTRAIS ELÉTRICAS BRASILEIRAS S.A. – ELETROBRAS

CNPJ/ME (Ministry of Economy’s Corporate Taxpayer

ID) No. 00001180/0001-26

NIRE (Company Registration ID) 53.3.00000859

On April 13, 2021, at 2:05 pm, the Board

of Directors of Centrais Elétricas Brasileiras S.A. – Eletrobras (“Company”), with its main office at

Rua da Quitanda, nº 196, 25th floor, Centro, Rio de Janeiro - RJ, opened its 891st videoconferencing meeting

in an exclusively remote environment – Cisco Webex Meetings, which was suspended at 3:30 pm on the same day. The meeting was called

by the Board’s Chairman, by means of electronic mail, on April 6, 2021, pursuant to the collective body’s Bylaws. The meeting

was remotely chaired by Director RUY FLAKS SCHNEIDER (RFS). Directors WILSON PINTO FERREIRA JR. (WFJ), MARCELO DE SIQUEIRA FREITAS (MSF),

LÚCIA MARIA MARTINS CASASANTA (LMC), DANIEL ALVES FERREIRA (DAF), ANA CAROLINA TANNURI LAFERTÉ MARINHO, LUIZ EDUARDO DOS

SANTOS MONTEIRO (LEM), FELIPE VILLELA DIAS (FVD) and BRUNO EUSTÁQUIO FERREIRA CASTRO DE CARVALHO (BEC) remotely attended the meeting.

There is no record of absences.

Resolution: DEL-063/2021. (i)

Approval of the third (3rd) issuance (“Issuance”) of Company’s ordinary unsecured debentures not convertible

into shares amounting to Two Billion and Seven Hundred Million Brazilian Reais (BRL 2,700,000,000.00) (“Debentures”),

to be distributed by means of a public distribution offering with restricted efforts, pursuant to Law 6385, dated December 07, 1976, as

amended (“Securities Market Act”), of CVM Instruction 476, dated January 16, 2009, as amended (“CVM Instruction

476”), and to other applicable legal and regulatory provisions, on a firm placement commitment (“Offering”),

in addition to its terms and conditions, as provided for in Article 62, Item I, and Article 289 of Law 6404, dated December 15, 1976,

as in force (“Brazilian Corporations Act”), and in Article 36, XIII, of the Company’s Articles of Incorporation;

(ii) approval of the instruments necessary to accomplish both Issuance and Offering, including, without limitation: (a)

“Private Deed of the 3rd (Third) Issuance of Ordinary Unsecured Debentures Not Convertible into Shares in 02 (Two) Series

for Public Distribution with Restricted Efforts, of Centrais Elétricas Brasileiras S.A. – ELETROBRAS ”(“Deed

of Issuance”), and relevant amendment to substantiate the outcome of the Bookbuilding Procedure (as defined below), regardless

of new resolution by this Board of Directors, as well as other amendments that may be necessary, subject to the limits set forth herein,

and (b) Distribution Agreement (as defined below), and any amendments that may be necessary; (iii) delegation of powers

for the Company’s Executive Board to accomplish all acts and sign all documents necessary to carry out both Issuance and Offering;

and (iv) ratification of all acts already accomplished by the Company’s Executive Board, aimed to effectuate the resolutions

herein established, including, without limitation, the engagement of financial institutions engaged in the securities distribution system

for placing the Debentures pertaining to Offering (“Coordinators,” given that one of them will be the Lead Coordinator),

as well as other service providers for the purposes of Offering, such as the trustee (“Trustee”), which represent the

whole of Debenture holders (“Debenture Holders”), the bookkeeper, the settlement bank, the risk rating agency for the

Debentures, B3 (“B3”refers to B3 S.A. – Brasil, Bolsa, Balcão or to B3 S.A. – Brasil, Bolsa, Balcão

– Balcão B3, as applicable), legal counsels, among others.

Resolution: Items (i), (ii),

(iii) and (iv) of the Resolutions were unanimously approved by Directors, which extends to both Issuance and Offering, with the

following main characteristics and conditions, as herein detailed and regulated by means of Deed of Issuance: (a) Allocation of Funds:

The net funds raised by Company by way of the Issuance of Non-Incentivized

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

2

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

Debentures (as defined below) will be

used for the replenishment of cash to be used in the Company’s regular business course. Pursuant to Article 2, Paragraph 1, of Law

12431, dated June 24, 2011, as amended (“Law 12431”), of Decree 8874, dated October 11, 2016, as amended, and of National

Monetary Council’s Resolution (“CMN”) 3947, dated January 27, 2011 (“CMN Resolution 3947”),

the net funds raised by Company by way of the Issuance of Incentivized Debentures (as defined below), will be used exclusively for future

payments or reimbursement of expenditure or debts connected to deploying Angra 3 Thermal Power Plant, with 1,405 MW of installed capacity

and 1,214.2 MW of assured energy, registered with the Single Generation Enterprise Code - CEG - UTN.UR.RJ.030150-7.01. Authorizing Act

Decree 75870, dated June 13, 1975, and CNPE Resolution 3, dated June 25, 2007, held by Eletrobras Eletronuclear (“Project”),

as detailed in the Deed of Issuance. (b) Issuance Number: Deed of Issuance establishes the third (3rd) issuance of debentures

by the Company. (c) Total Amount of Issuance: The total amount of Issuance is BRL 2,700,000,000.00 (Two Billion and Seven Hundred

Million Brazilian Reais), on the Date of Issuance (as defined below). (d) Par Value per Unit: The par value per unit of Debentures

will be BRL 1,000.00 (One Thousand Brazilian Reais), on the Date of Issuance (“Par Value per Unit”). (e) Number

of Debentures: Two Million and Seven Hundred Thousand (2,700,000) Debentures will be issued, of which: (i) One Million and Two Hundred

Thousand (1,200,000) Debentures of the first series (“First Series Debentures” or “Non-Incentivized Debentures”);

and (ii) One Million and Five Hundred Thousand (1,500,000) Debentures of the second series (“Second Series Debentures”

or “Incentivized Debentures”). (f) Number of Series: The Issuance will be carried out in two (02) series. (g)

Convertibility, Type and Form: Debentures will be ordinary, that is, not convertible into shares issued by the Company. Debentures

will be book-entry and registered, without issuing provisory certificates or certificates. (h) Type: Debentures will be unsecured,

pursuant to Article 58, head provision, of the Brazilian Corporations Act. (i) Proof of Ownership and Assignment of Debentures: Company

will not issue certificates of Debentures. For all legal purposes, the ownership of Debentures will be proven by the deposit account statement

issued by the bookkeeping financial institution in which the names of the relevant Debenture Holders will be registered. In addition,

as concerns the Debentures which are electronically held in custody by B3, the statement issued by B3, in the name of the relevant Debenture

holder, will be recognized as proof of ownership of Debentures. (j) Date of Issuance: For all legal purposes and effects, the Issuance

date will be April 15, 2021 (“Date of Issuance”). (k) Term and Maturity Date: Except

for the events of (i) optional purchase and related cancellation of all Debentures, Purchase Offer, and Early Redemption Offer (as defined

below), and consequent cancellation, of the Debentures as long as allowed by applicable laws, under the terms of the Deed of Issuance;

and (ii) early maturity of the obligations stemming from the Debentures covered by the Date of Issuance, events in which the Company undertakes

to proceed with the payment of Debentures, as provided for in the Date of Issuance, accordingly, the maturity term: (a ) of the First

Series Debentures will be five (05) years as of the Date of Issuance, thus, their maturity will occur on April [15], 2026 (“First

Series Maturity Date”); and (b) of the Second Series Debentures will be for ten (10) years, as of the Date of Issuance, thus,

their maturity will occur on April [15], 2031 (“Second Series Maturity Date” and, when referred to jointly with the

First Series Maturity Date, “Maturity Date(s)”). (l) Bookbuilding Procedure: The procedure for collecting investment

intentions will be adopted, without receiving reservations, without minimum or maximum lots (“Bookbuilding Procedure”),

organized by Coordinators, aimed to check among Professional Investors the demand for Debentures, thus allowing to set the final rate

of Compensatory Interests for Incentivized Debentures, subject to the provisions under Distribution Agreement and Deed of Issuance. (m)

Amortization of Debentures: The Par Value per Unit of the First Series Debentures will be amortized in a single installment on the

First Series Maturity Date. The Adjusted Par Value of Second Series Debentures will be amortized in a single installment on the Second

Series Maturity Date. (n) Inflation Adjustment and Compensatory Interest on Debentures: Inflation Adjustment of First Series Debentures:

The Par Value per Unit of First Series Debentures or

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

3

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

the balance of the Par Value per Unit

of First Series Debentures, accordingly, will not be adjusted for inflation. Compensatory Interest on First Series Debentures:

On the Par Value per Unit of First Series Debentures or balance of the Par Value per Unit of First Series Debentures will be levied interest

amounting to One Hundred Percent (100%) of the accumulated variation of the daily average rates of DI – Interbank Deposits of one

day, “over extragrupo,” expressed as a percentage per year, on the basis of Two Hundred and Fifty-Two (252) Business

Days, calculated and daily published by B3 on the daily newsletter available at its website (http://www.b3.com.br)

(“DI Rate”), plus a surcharge of 1.80% (One Integer and Eighty Hundredths Percent) per year, on the basis of 252 (Two

Hundred and Fifty-Two) Business Days (“Surcharge - First Series Debentures”, and, jointly with DI Rate, “Compensatory

Interest on First Series Debentures”), calculated exponentially and cumulatively pro rata temporis for Business Days elapsed

in the Capitalization Period of Debentures (as defined in the Deed of Issuance), based on the formula stated in the Deed of Issuance.

Inflation Adjustment of Second Series Debentures: The Par Value per Unit of Second Series Debentures or the balance of Par Value

per Unit of Second Series Debentures, as the case may be, will be adjusted by the accumulated variation of the National Broad Consumer

Price Index (“IPCA”), monthly released by the Brazilian Institute of Geography and Statistics, as of the Date of First

Payment of Second Series Debentures until the date of their actual settlement (“Inflation Adjustment”), the proceeds

of the Inflation Adjustment automatically incorporated into the Par Value per Unit of Second Series Debentures or, if applicable, to the

balance of Par Value per Unit of Second Series Debentures (“Adjusted Par Value of Second Series Debentures”), calculated

on a pro rata temporis basis for Business Days based on to the formula stated in the Deed of Issuance. Compensatory Interest of Second

Series Debentures: On the Adjusted

Par Value of Second Series Debentures, will be levied previously set compensatory interests, to be defined based on the Bookbuilding Procedure,

equivalent to the higher between (i) the percentage corresponding to the internal rate of return of IPCA+ Treasury with Half-Year Interest

(current denomination of the former National Treasury Bond, series B – NTN B), with maturity to occur in 2030 (“NTN-B 2030”),

based on the indicative quotation published by ANBIMA at its website (http://www.anbima.com.br), to be ascertained on the Business Day

immediately prior to the Bookbuilding Procedure date (excluding the date of performance of Bookbuilding Procedure), exponentially increased

by a spread equivalent to Eighty Hundredths Percent (0.80%) per year, on the basis of Two Hundred and Fifty-Two (252) Business Days, or

(ii) Four Integers and Twenty Hundredths Percent (4.20%) per year, on the basis of Two Hundred and Fifty-Two (252) Business Days (“Compensatory

Interest for Incentivized Debentures” and, jointly with Compensatory Interest on First Series Debentures, “Compensatory

Interest”). The Compensatory Interest for Incentivized Debentures will be levied on the Adjusted Par Value of Second Series

Debentures, as of the Date of First Payment of Second Series Debentures or the Date of Payment of Incentivized Debentures immediately

preceding, accordingly, and paid, at the end of each Capitalization Period of Debentures, calculated on a compound capitalization basis

pro rata temporis for Business Days, based on the formula stated in the Deed of Issuance. (o) Payment of Compensatory Interest of Debentures:

Compensatory Interest will be paid semiannually, always on April and October [Fifteen] ([15]) of each year, with the first payment

occurring on [October] [15], 2021 and the last one on the respective Maturity Dates (“Date of Payment of Compensatory Interest on

First Series Debentures” and “Date of Payment of Compensatory Interest on Second Series Debentures,” respectively, when

jointly referred to, together and in a generic way, each of these dates, a “Date Payment of Compensatory Interest”). Those

who hold Debentures by the end of the Business Day immediately prior to the Date of Payment of Compensatory Interest will be entitled

to such Compensatory Interest. (p) Term and Form of Subscription and Payment: Debentures will be subscribed and paid in cash, in

domestic currency, upon subscription, over the Debentures’ distribution period pursuant to Articles 7-A and 8 of CVM Instruction

476, in accordance with the settlement rules applicable to B3, at its Par Value per Unit (“Subscription Price”), provided

that “Date of First Payment,” for purposes of the Deed of Issuance, will be the same as the date of first subscription and

payment

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

4

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

of the First Series Debentures and/or

Second Series Debentures, accordingly. In the event of the subscription and payment of the Debentures, as the case may be, on more than

one date, the subscription price for the Debentures that were paid in after the Date of First Payment will be, (i) for the Non-Incentivized

Debentures, the Par Value per Unit plus the Compensatory Interest for Non-Incentivized Debentures, calculated pro rata temporis as of

the Date of First Payment of First Series Debentures (including such date) until the date of their full payment (excluding said) and (ii)

for Incentivized Debentures, the Adjusted Par Value of Second Series Debentures plus the Compensatory Interest for Incentivized Debentures,

calculated, in both cases, pro rata temporis as of the Date of First Payment of Second Series Debentures (including such date) until the

date of their full payment (excluding such date). The Subscription Price may be increased by premium or discount on the payment date,

provided that they are offered under equal conditions to investors of the same series, subject to the provisions in this regard in the

Distribution Agreement. (q) Scheduled Renegotiation: There will be no scheduled renegotiation of Debentures. (r) Optional Early

Redemption of Debentures: Debentures will not be subject to the early optional redemption by the Company, either fully or partially.

(s) Optional Extraordinary Amortization of Debentures: Debentures will not be subject to optional extraordinary amortization by

the Company. (t) Optional Purchase: In compliance with CVM Instruction 620, dated March 17, 2020, the Company may, at its sole

discretion and subject to the acceptance of the respective selling debenture holder, purchase Debentures for an amount equal to or lower

than the Par Value per Unit or Adjusted Par Value, accordingly, and this fact should be recorded in the Company’s management report

and financial statements, or at a value higher than the Par Value per Unit or Adjusted Par Value, accordingly, in keeping with the provisions

of Article 55, Paragraph 3, of the Brazilian Corporations Act, and the following terms: (i) with respect to Non-Incentivized Debentures,

at any time as of the Date of Issuance; and (ii) as concerns the Incentivized Debentures, as of the Twenty-Fifth (25th) month

(including such month) counted from the Date of Issuance, that is, as of May [15], 2023, excluding such date, under the terms of Article

1, Paragraph 1, Item II, of Law 12431, and provided that the weighted average term exceeds Four (04) years, pursuant to Article 1, Paragraph

1, item I, of Law 12431. The Incentivized Debentures acquired by the Company by way of an optional purchase, under the terms of the Deed

of Issuance may, at the discretion of the Company, remain in treasury or be placed on the market again, and may only be canceled, as this

may be regulated by CMN, and if said regulation is applicable to said Incentivized Debentures, pursuant to Article 1, Paragraph 1, Item

II, and Article 2, Paragraph 1 of Law 12431, provided that, on the date of execution of the Deed of Issuance, said cancellation is not

permitted by Law 12431. The Non-Incentivized Debentures acquired by the Company by way of an optional purchase, under the terms of the

Date of Issuance may, at the Company’s discretion, be canceled, remain in treasury, or be placed on the market again. The Debentures

acquired by the Company to remain in treasury, pursuant to the Deed of Issuance, if and when replaced on the market, will be entitled

to the same values of Inflation Adjustment and Compensatory Interest as the other Debentures, as applicable. (u) Purchase

Offer: In the event of a Risk Change Event (as defined below) as a result of a Change of Control (as defined below), within the Change

of Control Period (as defined below) and/or after the completion of a Change of Control (without remediation of the Risk Change Event

by the end of Change of Control Period) (“Purchase Event”), the Company undertakes to make an offer to purchase the

Debentures from the Debenture Holders who choose to dispose of their respective Debentures for an amount equivalent to the Par Value per

Unit of Non-Incentivized Debentures or the Adjusted Par Value of Second Series Debentures, accordingly, plus the applicable Compensatory

Interest owed up to the Purchase Date (excluding such date) (jointly, the “Purchase Offer” and “Purchase Obligation,”

respectively). For the purposes of the Purchase Offer, (i) “Change of Control” means a change in the direct or indirect

controlling interest of the Company, as defined under the terms of Article 116 of Brazilian Corporations Act, as a result of an operation

of (a) sale of control, including the Company’s privatization, directly or indirectly and/or dilution of the current controlling

interest that results in the loss of control by the

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

5

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

Company and/or other forms that may be

provided under the law; or (b) corporate reorganization involving the Company, provided that a Change of Control will not be regarded

for the purposes of the Purchase Obligation if the risk rating of Issuance remains equal to AAA, in keeping with the obligation to prepare

the Rating Report – Change of Control (as defined below), provided for in the Deed of Issuance); (ii) “Risk Change Event”

will be considered to have occurred in relation to a Change of Control: (a) over the Change of Control Period; or (b) after the completion

of the Change of Control; in both cases if the risk rating of Debentures, attributed by the Risk Rating Agency, is removed or reduced

in one or more categories by the Risk Rating Agency, in relation to the risk rating initially obtained, and such removal or reduction

does not expressly stem from any factor other than the Change of Control; (iii) “Change of Control Period” means the

period starting on the date (“Announcement Date”) that firstly occurs between (A) the first public announcement by

or on behalf of the Company, by any bidder, or by any advisor appointed, on the Change of Control; or (B) the date of the first Potential

Change of Control Announcement, and ending Ninety (90) days after the Announcement Date, provided that, if the Risk Rating Agency publicly

announces, at any time over the period, that it has subjected the risk rating of Debentures under full or partial review owing to the

public announcement of Change of Control or Announcement of Potential Change of Control, the Period of Change of Control will be extended

to the date that corresponds to Sixty (60) days after the date on which the Risk Rating Agency attributed a new risk rating or reaffirms

the existing rating; and (iv) “Announcement of Potential Change of Control” means any public announcement or statement

by the Company, of by any bidder, either potential or otherwise, or by any appointed advisor, regarding a potential Change of Control

in the short term (provided that short term means (a) a reasonably probable potential Change of Control, or, alternatively, (b) a public

statement by the Company, any bidder, either potential or otherwise, or any appointed advisor, stating that such Change of Control is

intended to occur within One Hundred and Eighty (180) days as of the date of announcement of such statement). (v) Early Redemption

Offer: Company may make, at its sole discretion and at any time (subject to the limitations under the applicable laws at the time

of the Early Redemption Offer), an early redemption offer for the total or partial First Series Debentures and/or Second Series Debentures,

accordingly (“Early Redemption Offer”), provided that, as concerns (a) the First Series Debentures, carrying out an

Early Redemption Offer for Debentures will be allowed at any time; and (b) the Second Series Debentures, the limitations provided for

in the applicable laws at the time of Early Redemption Offer should be fulfilled, given that, for clarification purposes, on the date

of execution of the Deed of Issuance, limitations apply as provided for in Law 12431 and CMN Resolution 3947. The

Early Redemption Offer will be addressed to all Debenture Holders of the respective series, without distinction, with all Debenture Holders

of the respective series being entitled to the prerogative of accepting or not the early redemption of Debentures held, in keeping with

the terms and conditions established in the Deed of Issuance and applicable laws. The amount to be paid in relation to each of the Debentures

of the relevant series will be equivalent (1) (i) to the Par Value per Unit or the balance of the Par Value per Unit plus the Compensatory

Interest of the First Series calculated pro rata temporis, as of the Date of First Payment or the date of payment of the First Series

Compensatory Interest immediately prior (including such date), accordingly, up to the date of the actual redemption (excluding such date),

in the case of the First Series Debentures; or (ii) the Adjusted Par Value of Second Series Debentures plus the Second Series Compensatory

Interest calculated pro rata temporis as of the Date of First Payment or the date of payment of the Second Series Compensatory Interest

immediately prior (including such date), accordingly, until the actual redemption date (excluding such date); and (2) in both cases, if

applicable, the redemption premium stated in the Notice of Early Redemption Offer. If the Early Redemption Offer refers to the portion

of the Debentures of a given series and the number of Debentures of the respective Debenture holders of such series that expressed their

interest in participating in the Early Redemption Offer (i) exceeds the maximum amount of Debentures to which the Early Redemption Offer

was originally intended, the Company may choose to (a) redeem all

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

6

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

Debentures that adhere to the Early Redemption

Offer or (b) cancel the Early Redemption Offer; or (ii) is lower than the minimum number of Debentures to which the Early Redemption Offer

was originally intended, the Company may (a) redeem all Debentures that have adhered to the Early Redemption Offer; or (b) cancel the

Early Redemption Offer. (w) Place of Payment: The payments to which the Debentures are entitled will be made by the Company using,

as the case may be: (a) the procedures adopted by B3 for the Debentures held in electronic custody at B3; or (b) the procedures adopted

by the settling financial institution, for Debentures that may not be held in electronic custody at B3, or, as the case may be, by the

financial institution engaged for such purpose, or at the Company’s headquarters, accordingly. (x) Late Payment Charges: Without

prejudice to the Inflation Adjustment and the relevant Compensatory Interest, with the payment of any amount owed to the Debenture Holders

being untimely, the debts overdue will be subject, from the date of default until the date of actual payment, regardless of court or out-of-court

notice, summons, or notification, to: (i) default interest at the rate of One Percent (1%) per month on the due amount calculated pro

rata temporis; and (ii) conventional, irreducible, and non-compensatory fine of Two Percent (2%) on the amount due and unpaid (“Late

Payment Charges”). (y) Early Maturity: In compliance with the provisions of the Deed of Issuance, Trustee will state

in advance all obligations arising from the Debentures and demand the immediate payment, by the Company, to the Debenture Holders, of

the Par Value per Unit of Non-Incentivized Debentures; or the Adjusted Par Value of Second Series Debentures, as the case may be, plus

the Compensatory Interest due, calculated pro rata temporis as of the Date of First Payment of the respective series or the last payment

date of the Compensatory Interest applicable, accordingly, and of Late Payment Charges and fines, if any, levied up to the date of their

actual payment, in the occurrence of any of the events provided for in the Deed of Issuance (each of these events,

a “Default Event”). (z) Placement and Distribution Procedure: The Debentures will be the object of Restricted

Offering, which will be accomplished on a firm placement commitment, to be provided by the Coordinators, in accordance with the terms

and conditions of the “Agreement of Coordination, Placement and Public Distribution with Restricted Efforts, on a Firm Commitment,

of the Third (3rd) Issuance of Ordinary Unsecured Debentures Not Convertible into Shares, in Two (02) Series, of Centrais Elétricas

Brasileiras S.A. - ELETROBRAS,” to be executed between the Coordinators and the Company (“Distribution Agreement”).

The public distribution plan for the Debentures will follow the procedure described in CVM Instruction 476 as provided in the Distribution

Agreement. For this purpose, Coordinators will be able to access a maximum of Seventy-Five (75) Professional Investors (as defined in

the Deed of Issuance), given that the subscription or purchase of Debentures may be performed by a maximum of Fifty (50) Professional

Investors, in keeping with Article 3 of CVM Instruction 476, provided that investment funds and managed securities portfolios whose investment

decisions are made by the same manager will be considered as a single investor for the purposes of the above limits. (aa) Filing for

Distribution and Trading: Debentures will be filed for (i) public distribution in the primary market by way of MDA – Asset Distribution

Module, managed and operated by B3, and distribution will be financially settled by way of B3; and (ii) trading, subject to the provisions

of the Deed of Issuance, in the secondary market by way of CETIP 21 – Securities, managed and operated by B3, with the negotiations

being financially settled and the Debentures held in electronic custody at B3. Debentures may only be traded on the regulated securities

markets between Qualified Investors (as defined in the Deed of Issuance) Ninety (90) days after each subscription or purchase by a Professional

Investor (as defined in the Deed of Issuance), as provided for in Articles 13 and 15 of CVM Instruction 476, except in the case of lot

object of firm placement commitment by Coordinators, given that, in the subsequent negotiation, the limits and conditions provided in

Articles 2 and 3 of CVM Instruction 476 should be fulfilled, and, in all cases, subject to compliance by the Company with Article 17 of

CVM Instruction 476, and the negotiation of the Debentures will always meet the applicable legal and regulatory provisions. (bb) Other

Features: The other characteristics of Debentures, Issuance and Offer

|

CA/CAAS

Rua da Quitanda, nº 196, 25º andar

22210-030 Rio de Janeiro – RJ

Phone: (21) 2514-5641

7

Extract of DEL-063/2021

RCA 891, dated April 13, 2021.

|

will be described in the Deed of Issuance,

in the Distribution Agreement, and in the other documents pertaining to Offer and Issuance.

Adjournment and Execution of Certificate

of Minutes: It is hereby recorded that the material relating to the matters resolved in this Board of Directors’ Meeting is

filed at the Company’s head office. Without further issues to consider about DEL-063/2021, Chief Executive Officer RFS suspended

the meeting and determined the execution of this Certificate by the Board’s Governance Secretary, which, after being read and approved,

is signed by the Board of Directors’ Chairman. The other resolutions which were passed at this meeting were omitted in this certificate,

since they stand as merely internal interests of the Company, thus being a legitimate cautionary measure grounded on the Management’s

duty of confidentiality, pursuant to the head provision under Article 155 of Law 6404/76, therefore out of the scope of the rule set forth

under Paragraph 1 of Article 142 of said Law. Attendees: Chief Executive Officer RUY FLAKS SCHNEIDER (RFS); Directors WILSON PINTO FERREIRA

JR. (WFJ), MARCELO DE SIQUEIRA FREITAS (MSF), LÚCIA MARIA MARTINS CASASANTA (LMC), DANIEL ALVES FERREIRA (DAF), ANA CAROLINA TANNURI

LAFERTÉ MARINHO, LUIZ EDUARDO DOS SANTOS MONTEIRO (LEM), FELIPE VILLELA DIAS (FVD) and BRUNO EUSTÁQUIO FERREIRA CASTRO DE

CARVALHO (BEC); Governance Secretary BRUNO KLAPPER LOPES (BKL); Board of Directors’ Advisor: FERNANDO KHOURY FRANCISCO JUNIOR (FKJ).

Rio de Janeiro, April 13, 2021.

_________________________________

RUY FLAKS SCHNEIDER

Chairman of the Board of Directors

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: April 15, 2021

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

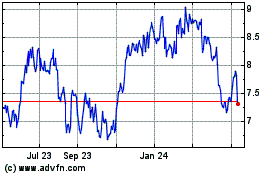

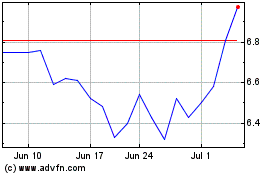

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Apr 2023 to Apr 2024