UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

x

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

Intercept Pharmaceuticals, Inc.

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

April ____, 2021

To Our Stockholders:

We are pleased to invite you

to attend the 2021 Annual Meeting of Stockholders of Intercept Pharmaceuticals, Inc., which will be held on Thursday, May 27, 2021, at

10:30 a.m. (Eastern Time). In light of the public health concerns relating to the ongoing COVID-19 global pandemic, and government-recommended

limits on public gatherings, and to assist in protecting the health and well-being of Intercept’s stockholders and employees, the

Annual Meeting will be held virtually. You will be able to attend the Annual Meeting, ask questions, and vote your shares by visiting

www.virtualshareholdermeeting.com/ICPT2021. We have designed the format of the Annual Meeting to ensure that stockholders are afforded

similar rights and opportunities to participate as they would at an in-person meeting. Please note that to participate you will need the

16-digit control number included in your proxy materials or on your proxy card.

Details regarding the Annual

Meeting, the business to be conducted, and information about Intercept that you should consider when you vote your shares are described

in the proxy statement.

The Board of Directors recommends

that you vote “FOR” each of the proposals in the proxy statement (other than Proposal 4), and for “ONE YEAR” for

Proposal 4.

Whether or not you plan to

attend, it is important that your shares be represented and voted at the Annual Meeting. You are able to vote over the Internet as well

as by mail. After you have finished reading the proxy statement, we urge you to vote in accordance with the instructions set forth therein.

We encourage you to vote by proxy, so that your shares will be represented and voted at the Annual Meeting, whether or not you plan to

attend.

Thank you for your continued

support of Intercept. We look forward to seeing you at the Annual Meeting.

|

|

Sincerely,

|

|

|

|

|

|

Jerome Durso

President and Chief Executive Officer

|

INTERCEPT PHARMACEUTICALS, INC.

10 Hudson Yards, 37th Floor

New York, NY 10001

Notice of Annual Meeting of Stockholders

To Be Held on May 27, 2021

Dear Stockholder:

You are cordially invited to

attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Intercept Pharmaceuticals, Inc., a Delaware corporation

(“Intercept” or the “Company”). The Annual Meeting will be held on Thursday, May 27, 2021, at 10:30 a.m. (Eastern

Time). In light of the public health concerns relating to the ongoing COVID-19 global pandemic, and government-recommended limits on public

gatherings, and to assist in protecting the health and well-being of Intercept’s stockholders and employees, the Annual Meeting

will be held virtually. You will be able to attend the Annual Meeting, ask questions, and vote your shares by visiting www.virtualshareholdermeeting.com/ICPT2021.

We have designed the format of the Annual Meeting to ensure that stockholders are afforded similar rights and opportunities to participate

as they would at an in-person meeting. Please note that to participate you will need the 16-digit control number included in your proxy

materials or on your proxy card.

The purposes

of the Annual Meeting are:

|

|

1.

|

To elect, by separate resolutions, the following eleven nominees to serve on the Board of Directors until

the 2022 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified:

|

|

|

1A.

|

Paolo Fundarò

|

1B.

|

Jerome Durso

|

1C.

|

Srinivas Akkaraju, M.D., Ph.D.

|

|

|

1D.

|

Luca Benatti, Ph.D.

|

1E.

|

Daniel Bradbury

|

1F.

|

Keith Gottesdiener, M.D.

|

|

|

1G.

|

Nancy Miller-Rich

|

1H.

|

Mark Pruzanski, M.D.

|

1I.

|

Dagmar Rosa-Bjorkeson

|

|

|

1J.

|

Gino Santini

|

1K.

|

Glenn Sblendorio

|

|

|

|

|

2.

|

To approve a one-time stock option exchange program for non-executive employees.

|

|

|

3.

|

To approve, on a non-binding, advisory basis, the compensation of the Company’s named executive

officers.

|

|

|

4.

|

To vote, on a non-binding, advisory basis, as to whether the stockholder advisory vote to approve the

compensation of the Company’s named executive officers (i.e., Proposal 3), should occur every one, two, or three years.

|

|

|

5.

|

To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company

for the year ending December 31, 2021.

|

|

|

6.

|

To transact such other business as may properly come before the meeting or any adjournments thereof.

|

The foregoing items of business

are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders.

The close of business on April

6, 2021, is the record date for determining stockholders entitled to vote at the Annual Meeting. Only holders of the Company’s Common

Stock, par value $0.001 per share (the “shares”), as of the record date, are entitled to notice of, and to vote at, the Annual

Meeting or any adjournments thereof.

By Order of the Board of Directors,

Mary J. Grendell

Secretary

New York, New York

April ____, 2021

Important Notice Regarding

the Availability of Proxy Materials for the Annual Meeting to be held on May 27, 2021.

The Company’s Proxy

Statement for the Annual Meeting, and Annual Report on Form 10-K for the year ended December 31, 2020, are available at www.proxyvote.com.

Whether

or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting.

Holders of record may submit a proxy via the Internet or by completing, signing, and dating the enclosed proxy card and returning it as

promptly as possible in the enclosed envelope. Holders of record must vote in accordance with the instructions listed on the proxy card.

Beneficial holders whose shares are held in the name of a bank, broker, or other nominee must vote in accordance with the voting instructions

provided to them by their bank, broker, or other nominee. Such holders may be eligible to submit a proxy electronically.

The Company’s proxy statement

is dated April ____, 2021, and is being made available on or about April ____, 2021.

INTERCEPT PHARMACEUTICALS, INC.

Proxy Statement

Table of Contents

INTERCEPT PHARMACEUTICALS, INC.

Preliminary Proxy Statement Dated April 15, 2021

Subject to Completion

Proxy Statement

for

2021 Annual Meeting of Stockholders

To Be Held on May 27, 2021

Annual Meeting Matters

These proxy materials are provided

in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Intercept Pharmaceuticals, Inc.

(the “Company”), for the Company’s 2021 Annual Meeting of Stockholders (the “Annual Meeting”), to be held

on Thursday, May 27, 2021, at 10:30 a.m. (Eastern Time). In light of the public health concerns relating to the ongoing COVID-19 global

pandemic, and government-recommended limits on public gatherings, and to assist in protecting the health and well-being of Intercept’s

stockholders and employees, the Annual Meeting will be held virtually. You will be able to attend the Annual Meeting, ask questions, and

vote your shares by visiting www.virtualshareholdermeeting.com/ICPT2021. We have designed the format of the Annual Meeting to ensure that

stockholders are afforded similar rights and opportunities to participate as they would at an in-person meeting. Please note that to participate

you will need the 16-digit control number included in your proxy materials or on your proxy card.

Unless otherwise noted or the

context otherwise requires, references in this proxy statement to “we”, “us”, or “our” refer to Intercept

Pharmaceuticals, Inc.

General Information About the Annual Meeting

and Voting

General

This proxy statement contains

information about the Annual Meeting and was prepared by our management for the Board. This proxy statement and the Company’s Annual

Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”) are available at www.proxyvote.com. This

proxy statement is being made available on or about April ____, 2021.

Purpose of the Annual Meeting

The specific proposals to be

considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal

is described in more detail in this proxy statement.

Who can vote?

The close of business on April

6, 2021, is the record date for determining stockholders entitled to vote at the Annual Meeting. Only holders of the Company’s Common

Stock, par value $0.001 per share (the “shares”), as of the record date, are entitled to notice of, and to vote at, the Annual

Meeting or any adjournments thereof. Each such holder is entitled to one vote for each share that such holder held as of the record date.

On April 6, 2021, there were 33,162,066 of the

Company’s shares outstanding.

How do I vote?

Holders of Record

If on the record date, your

shares were registered directly in your name with our transfer agent, VStock Transfer, LLC, then you may vote your shares in one of the

following ways:

|

|

•

|

by voting over the Internet as instructed on the enclosed proxy card;

|

|

|

•

|

by mailing your completed, signed, and dated proxy card as instructed on the card; or

|

|

|

•

|

by attending the Annual Meeting online and voting during the meeting.

|

Beneficial Holders

If

on the record date, your shares were held in street name through a bank, broker, or other nominee, then you must vote in accordance with

the voting instructions provided to you by your bank, broker, or other nominee. If your shares are held in street name, you still may

be eligible to submit a proxy electronically. Beneficial holders whose shares are held in street name and who plan to vote during

the Annual Meeting must use the unique 16-digit control number included in their proxy materials or proxy card.

What am I being asked to vote on?

There are five

matters scheduled to be voted on at the Annual Meeting:

|

|

1.

|

To elect, by separate resolutions, the following eleven nominees to serve on the Board until the 2022

Annual Meeting of Stockholders or until their respective successors are duly elected and qualified:

|

|

|

(a)

|

Paolo Fundarò (Proposal 1A)

|

|

|

(b)

|

Jerome Durso (Proposal 1B)

|

|

|

(c)

|

Srinivas Akkaraju, M.D., Ph.D. (Proposal 1C)

|

|

|

(d)

|

Luca Benatti, Ph.D. (Proposal 1D)

|

|

|

(e)

|

Daniel Bradbury (Proposal 1E)

|

|

|

(f)

|

Keith Gottesdiener, M.D. (Proposal 1F)

|

|

|

(g)

|

Nancy Miller-Rich (Proposal 1G)

|

|

|

(h)

|

Mark Pruzanski, M.D. (Proposal 1H)

|

|

|

(i)

|

Dagmar Rosa-Bjorkeson (Proposal 1I)

|

|

|

(j)

|

Gino Santini (Proposal 1J)

|

|

|

(k)

|

Glenn Sblendorio (Proposal 1K)

|

|

|

2.

|

To approve a one-time stock option exchange program for non-executive employees (Proposal 2).

|

|

|

3.

|

To approve, on a non-binding, advisory basis, the compensation of the Company’s named executive

officers (Proposal 3).

|

|

|

4.

|

To vote, on a non-binding, advisory basis, as to whether the stockholder advisory vote to approve the

compensation of the Company’s named executive officers (i.e., Proposal 3), should occur every one, two, or three years (Proposal

4).

|

|

|

5.

|

To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting

firm for the year ending December 31, 2021 (Proposal 5).

|

Will any other matters be voted on at the

Annual Meeting?

As of the date of this proxy

statement, the Company’s management knows of no other matter that will be presented for consideration at the Annual Meeting other

than those matters discussed in this proxy statement. If any other matters properly come before the Annual Meeting and call for a vote

of stockholders, proxies properly submitted prior to the Annual Meeting will be voted in accordance with the judgment of the proxy holders.

How does the Board recommend that I vote

on the proposals?

The Board recommends

that you vote your shares as follows:

|

|

1.

|

FOR the election of each of the foregoing eleven nominees to serve on the Board until the 2022 Annual

Meeting of Stockholders or until their respective successors are duly elected and qualified (Proposals 1A through 1K).

|

|

|

2.

|

FOR the approval of a one-time stock option exchange program for non-executive employees (Proposal 2).

|

|

|

3.

|

FOR the approval, on a non-binding, advisory basis, of the compensation of the Company’s named executive

officers (Proposal 3).

|

|

|

4.

|

That the stockholder advisory vote on the compensation of the Company’s named executive officers

should occur every ONE YEAR (Proposal 4).

|

|

|

5.

|

FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public

accounting firm for the year ending December 31, 2021 (Proposal 5).

|

How can I vote on each proposal?

For Proposals 1A through 1K,

you may vote FOR the nominee, or WITHHOLD your vote.

For Proposals 2, 3, and 5,

you may vote FOR or AGAINST, or ABSTAIN.

For Proposal 4, you may vote

in favor of holding stockholder advisory votes on compensation every ONE YEAR, TWO YEARS, or THREE YEARS, or ABSTAIN.

How do I attend the Annual Meeting?

Attendance at the Annual Meeting

is limited to our stockholders as of the record date. To attend the virtual Annual Meeting, log in at www.virtualshareholdermeeting.com/ICPT2021.

You will need your unique 16-digit control number included in your proxy materials or on your proxy card. The Annual Meeting will begin

promptly at 10:30 a.m. (Eastern Time). Online check-in will begin at 10:00 a.m. (Eastern Time), and you should allow ample time for

the online check-in procedures. In the event that you do not have a control number, please contact your broker, bank, or other nominee

as soon as possible and no later than May 17, 2021, so that you can be provided with a control number and gain access to the Annual Meeting.

Beneficial holders whose shares are held in street name and who plan to vote during the Annual Meeting must use the unique 16-digit control

number included in their proxy materials or proxy card.

It is important that your shares

be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we encourage you to submit a proxy

over the Internet or by completing and returning the proxy card. You do not need to attend the Annual Meeting in order to vote.

How can I submit a question during the Annual

Meeting?

You may submit written questions online during the

Annual Meeting at www.virtualshareholdermeeting.com/ICPT2021. If you wish to submit a question during the Annual Meeting, log in to the

virtual meeting website using your unique 16-digit control number included in your proxy materials or on your proxy card, type your question

into the “Ask a Question” field, and click “Submit”.

We intend to answer written

questions submitted online during the Award Meeting that are relevant to the Annual Meeting and pertinent to matters properly before the

Annual Meeting, as time permits. Questions and answers may be grouped by topic, and substantially similar questions may be answered once.

What if I need technical assistance?

During

the virtual Annual Meeting (and beginning 15 minutes prior), we will have a support team ready to assist you with any technical difficulties

that you may have accessing or hearing the Annual Meeting. If you encounter any difficulties accessing or hearing the Annual Meeting

during this time, you should call the technical support telephone number that will be posted on the virtual Annual Meeting log-in page.

Can I vote during the Annual Meeting?

Yes. To log in and cast your

vote electronically during the Annual Meeting, you will need your unique 16-digit control number included in your proxy materials or on

your proxy card. In the event that you do not have a control number, please contact your broker, bank, or other nominee as soon as possible

and no later than May 17, 2021, so that you can be provided with a control number and cast your vote electronically during the Annual

Meeting.

Will a replay of the Annual Meeting be available?

A replay of the Annual Meeting

will be made publicly available 24 hours after the meeting at www.virtualshareholdermeeting.com/ICPT2021 and for two weeks thereafter.

Will a list of stockholders be made available?

Yes. A list of stockholders

of record will be available electronically during the Annual Meeting at www.virtualshareholdermeeting.com/ICPT2021, and, during the ten

days prior to the Annual Meeting, at our principal executive offices located at 10 Hudson Yards, 37th Floor, New York, NY 10001.

What vote is required to approve each proposal?

|

|

1.

|

Approval of Proposals 1A through 1K each requires a plurality of the votes cast in person or by proxy

at the Annual Meeting.

|

|

|

2.

|

Approval of Proposal 2 requires the affirmative vote of a majority of the shares cast affirmatively or

negatively in person or by proxy at the Annual Meeting.

|

|

|

3.

|

Approval of Proposal 3 requires the affirmative vote of a majority of the shares cast affirmatively or

negatively in person or by proxy at the Annual Meeting.

|

|

|

4.

|

For Proposal 4, the frequency (every one, two, or three years) that receives the most votes will be considered

approved.

|

|

|

5.

|

Approval of Proposal 5 requires the affirmative vote of a majority of the shares cast affirmatively or

negatively in person or by proxy at the Annual Meeting.

|

Abstentions may be specified

for Proposals 2, 3, 4, and 5.

For Proposals 1A through 1K,

broker non-votes, if any, have no effects on the results of the relevant votes.

For Proposals 2, 3, 4, and

5, abstentions and broker non-votes, if any, have no effects on the results of the relevant votes.

What is the quorum requirement?

A “quorum” must

be present for the Annual Meeting to be held. A quorum will be present if the holders of a majority of the voting power of all of the

shares entitled to vote at the Annual Meeting are present or represented by proxy at the Annual Meeting. Shares present or represented

by proxy at the Annual Meeting, including broker non-votes and shares that abstain or do not vote with respect to one or more of the proposals,

will be counted for purposes of determining a quorum. If there is no quorum, the Annual Meeting may be adjourned, from time to time, by

the chairman of the Annual Meeting.

Will my shares be voted if I do not provide

a proxy?

If your shares are registered

directly in your name with our transfer agent, they will not be counted if you do not vote as described above under “How do I vote?”

If your shares are held in

street name, your shares may be voted even if you do not provide voting instructions to the bank, broker, or other nominee through which

the shares are held. These entities have the authority, under applicable regulations, to vote shares for which their customers do not

provide voting instructions, on certain “routine” matters. Proposal 5 is considered a “routine” matter for which

these entities may vote unvoted shares.

Proposals 1A through 1K, 2,

3, and 4 are not considered “routine” matters for which these entities may vote unvoted shares. Accordingly, if you hold your

shares in street name and have not provided voting instructions, the bank, broker, or other nominee through which the shares are held

is not permitted to vote your shares with respect to the election of directors; the approval of the one-time stock option exchange program

for non-executive employees; the approval, on a non-binding, advisory basis, of the compensation of the Company’s named executive

officers; or the frequency of votes on named executive officer compensation. Such failure to vote is called a “broker non-vote”.

We strongly encourage you to submit your proxy and exercise your right to vote as a stockholder.

What if I return a proxy card or otherwise

submit a proxy but do not make specific choices?

If you return a signed and

dated proxy card or otherwise submit a proxy without voting on a proposal, your shares will be voted on such proposal in the manner set

forth below:

|

|

1.

|

FOR the election of each of the eleven nominees to serve on the Board until the 2022 Annual Meeting of

Stockholders or until their respective successors are duly elected and qualified (Proposals 1A through 1K).

|

|

|

2.

|

FOR the approval of a one-time stock option exchange program for non-executive employees (Proposal 2).

|

|

|

3.

|

FOR the approval of the compensation of the Company’s named executive officers (Proposal 3).

|

|

|

4.

|

That the stockholder advisory vote on the compensation of the Company’s named executive officers

should occur every ONE YEAR (Proposal 4).

|

|

|

5.

|

FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public

accounting firm for the year ending December 31, 2021 (Proposal 5).

|

|

|

6.

|

In the manner that the proxy holders deem appropriate for any other proposal to be considered at the Annual

Meeting.

|

May I revoke my proxy?

If you are a holder of record,

you may revoke your proxy before it is voted at the Annual Meeting by:

|

|

•

|

Submitting another properly completed proxy card with a later date and returning it as instructed on the

card so that it is received by the Company at least one hour prior to the commencement of the Annual Meeting;

|

|

|

•

|

Submitting a new proxy via the Internet prior to the deadline listed on the proxy card;

|

|

|

•

|

Providing written notice received by the Secretary of the Company at least one hour prior to the commencement

of the Annual Meeting; or

|

|

|

•

|

Attending the Annual Meeting and voting in accordance with the requirements described in this proxy statement.

|

If you are a beneficial holder

whose shares are held in street name, you may submit new voting instructions by contacting the bank, broker, or other nominee through

which you hold your shares. You may also vote at the Annual Meeting using your unique 16-digit control number included in your proxy materials

or on your proxy card.

Who is making and paying for this proxy

solicitation?

This proxy is solicited on

behalf of the Board. The Company will pay the cost of distributing this proxy statement and related materials. Upon request, the Company

will reimburse banks, brokers, and other nominees for reasonable expenses they incur in forwarding proxy materials to beneficial owners

of the Company’s shares. The Company has retained Innisfree M&A Incorporated to assist in the solicitation of proxies for a

fee of approximately $17,500, plus out-of-pocket expenses. Certain of the Company’s directors, officers, and employees may participate

in the solicitation of proxies, including electronically or by mail or telephone, without additional compensation.

What does it mean if I receive more than

one set of proxy materials?

If you receive more than one

set of proxy materials, your shares may be registered in more than one name or in different accounts. Please submit proxies for all of

your shares.

I share an address with another stockholder

and we received only one Annual Report and one proxy statement. How may I obtain an additional copy of the Annual Report and proxy statement?

We have adopted a procedure

called “householding” under which only one Annual Report and one proxy statement will be mailed to multiple stockholders sharing

an address unless the Company receives contrary instructions from one or more of the stockholders sharing an address. If your household

has received only one Annual Report and one proxy statement and you wish to receive separate copies of these documents, please follow

the instructions set forth under “Householding”.

How can I find out the results of the voting

at the Annual Meeting?

We will publish the voting

results of the Annual Meeting in a Current Report on Form 8-K within four business days after the Annual Meeting.

Cautionary Note Regarding Forward-Looking

Statements

This proxy statement contains

forward-looking statements, including, but not limited to, statements regarding the progress, timing and results of our clinical trials,

including our clinical trials for the treatment of nonalcoholic steatohepatitis (“NASH”), the safety and efficacy of our approved

product, Ocaliva (obeticholic acid or “OCA”) for primary biliary cholangitis (“PBC”), and our product candidates,

including OCA for liver fibrosis due to NASH, the timing and acceptance of our regulatory filings and the potential approval of OCA for

liver fibrosis due to NASH, the review of our New Drug Application for OCA for the treatment of liver fibrosis due to NASH by the U.S.

Food and Drug Administration (the “FDA”), our intent to work with the FDA to address the issues raised in a complete response

letter (“CRL”), the potential commercial success of OCA, as well as our strategy, future operations, future financial position,

future revenue, projected costs, financial guidance, prospects, plans and objectives.

These statements constitute

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “target,” “potential,” “will,” “would,” “could,” “should,”

“possible,” “continue” and similar expressions are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this proxy statement, and we undertake no obligation to update any forward-looking statement

except as required by law. These forward-looking statements are based on estimates and assumptions by our management that, although believed

to be reasonable, are inherently uncertain and subject to a number of risks.

The following represent some,

but not necessarily all, of the factors that could cause actual results to differ materially from historical results or those anticipated

or predicted by our forward-looking statements:

|

|

●

|

our ability to successfully commercialize Ocaliva for PBC;

|

|

|

●

|

our ability to maintain our regulatory approval of Ocaliva for PBC in the United States, Europe, Canada,

Israel, Australia and other jurisdictions in which we have or may receive marketing authorization;

|

|

|

●

|

our ability to timely and cost-effectively file for and obtain regulatory approval of our product candidates

on an accelerated basis or at all, including OCA for liver fibrosis due to NASH following the issuance of the CRL by the FDA; any advisory

committee recommendation or dispute resolution determination that our product candidates, including OCA for liver fibrosis due to NASH,

should not be approved or approved only under certain conditions; or any future determination that the regulatory applications and subsequent

information we submit for our product candidates, including OCA for liver fibrosis due to NASH, do not contain adequate clinical or other

data or meet applicable regulatory requirements for approval;

|

|

|

●

|

conditions that may be imposed by regulatory authorities on our marketing approvals for our products and

product candidates, including OCA for liver fibrosis due to NASH, such as the need for clinical outcomes data (and not just results based

on achievement of a surrogate endpoint), any risk mitigation programs such as a REMS, and any related restrictions, limitations and/or

warnings contained in the label of any of our products or product candidates;

|

|

|

●

|

any potential side effects associated with Ocaliva for PBC, OCA for liver fibrosis due to NASH or our

other product candidates that could delay or prevent approval, require that an approved product be taken off the market, require the inclusion

of safety warnings or precautions, or otherwise limit the sale of such product or product candidate, including in connection with the

newly identified safety signal (“NISS”) relating to Ocaliva identified by the FDA in May 2020;

|

|

|

●

|

the initiation, timing, cost, conduct, progress and results of our research and development activities,

preclinical studies and clinical trials, including any issues, delays or failures in identifying patients, enrolling patients, treating

patients, retaining patients, meeting specific endpoints in the jurisdictions in which we intend to seek approval or completing and timely

reporting the results of our NASH or PBC clinical trials;

|

|

|

●

|

the outcomes of ongoing discussions with the FDA and the European Medicines Agency (“EMA”)

regarding the feasibility of the COBALT and 401 trials;

|

|

|

●

|

our ability to establish and maintain relationships with, and the performance of, third-party manufacturers,

contract research organizations and other vendors upon whom we are substantially dependent for, among other things, the manufacture and supply

of our products, including Ocaliva for PBC and, if approved, OCA for liver fibrosis due to NASH, and our clinical trial activities;

|

|

|

●

|

our ability to identify, develop and successfully commercialize our products and product candidates, including

our ability to successfully launch OCA for liver fibrosis due to NASH, if approved;

|

|

|

●

|

our ability to obtain and maintain intellectual property protection for our products and product candidates,

including our ability to cost-effectively file, prosecute, defend and enforce any patent claims or other intellectual property rights;

|

|

|

●

|

the size and growth of the markets for our products and product candidates and our ability to serve those

markets;

|

|

|

●

|

the degree of market acceptance of Ocaliva for PBC and, if approved, OCA for liver fibrosis due to NASH

or our other product candidates among physicians, patients and healthcare payors;

|

|

|

●

|

the availability of adequate coverage and reimbursement from governmental and private healthcare payors

for our products, including Ocaliva for PBC and, if approved, OCA for liver fibrosis due to NASH, and our ability to obtain adequate pricing

for such products;

|

|

|

●

|

our ability to establish and maintain effective sales, marketing and distribution capabilities, either

directly or through collaborations with third parties;

|

|

|

●

|

competition from existing drugs or new drugs that become available;

|

|

|

●

|

our ability to attract and retain key personnel to manage our business effectively;

|

|

|

●

|

our ability to prevent system failures, data breaches or violations of data protection laws;

|

|

|

●

|

costs and outcomes relating to any disputes, governmental inquiries or investigations, regulatory proceedings,

legal proceedings or litigation, including any securities, intellectual property, employment, product liability or other litigation;

|

|

|

●

|

our collaborators’ election to pursue research, development and commercialization activities;

|

|

|

●

|

our ability to establish and maintain relationships with collaborators with development, regulatory and

commercialization expertise;

|

|

|

●

|

our need for and ability to generate or obtain additional financing;

|

|

|

●

|

our estimates regarding future expenses, revenues and capital requirements and the accuracy thereof;

|

|

|

●

|

our use of cash and short-term investments;

|

|

|

●

|

our ability to acquire, license and invest in businesses, technologies, product candidates and products;

|

|

|

●

|

our ability to manage the growth of our operations, infrastructure, personnel, systems and controls;

|

|

|

●

|

our ability to obtain and maintain adequate insurance coverage;

|

|

|

●

|

the impact of COVID-19, including any impact on our results of operations or financial position, related

quarantines and government actions, delays relating to our regulatory applications, disruptions relating to our ongoing clinical trials

or involving our contract research organizations, study sites or other clinical partners, disruptions relating to our supply chain or

involving our third-party manufacturers, distributors or other distribution partners, facility closures or other restrictions, and the

extent and duration thereof;

|

|

|

●

|

the impact of general U.S. and foreign economic, industry, market, regulatory or political conditions,

including the potential impact of Brexit; and

|

|

|

●

|

the other risks and uncertainties identified in our periodic filings filed with the U.S. Securities and

Exchange Commission (the “SEC”), including our Annual Report.

|

Proposals

Under Vote

Proposals 1A Through 1K:

Election of Directors

The Board currently consists

of twelve directors. Our directors are elected annually to serve one-year terms. Each of our directors is standing for election at the

Annual Meeting, other than Daniel Welch, who is retiring from the Board.

The following table sets forth

the names, ages, tenures, and committee memberships of our directors as of April ____, 2021, except for Mr. Welch.

|

Director

|

|

Age

|

|

Director Since

|

|

Paolo Fundarò(1)

|

|

47

|

|

2006

|

|

Jerome Durso

|

|

53

|

|

2021

|

|

Srinivas Akkaraju, M.D., Ph.D.(2)

|

|

53

|

|

2012

|

|

Luca Benatti, Ph.D.(2)(3)

|

|

60

|

|

2014

|

|

Daniel Bradbury(3)(4)

|

|

60

|

|

2016

|

|

Keith Gottesdiener, M.D.(2)

|

|

67

|

|

2016

|

|

Nancy Miller-Rich(5)

|

|

62

|

|

2018

|

|

Mark Pruzanski, M.D.

|

|

53

|

|

2002

|

|

Dagmar Rosa-Bjorkeson

|

|

57

|

|

2021

|

|

Gino Santini(4)(5)(6)

|

|

64

|

|

2015

|

|

Glenn Sblendorio(4)

|

|

65

|

|

2014

|

|

(1)

|

Chairman of the Board.

|

|

(2)

|

Member of the Research and Development Committee.

|

|

(3)

|

Member of the Nominating and Governance Committee.

|

|

(4)

|

Member of the Audit Committee.

|

|

(5)

|

Member of the Compensation Committee.

|

|

(6)

|

Lead Independent Director.

|

The Board has nominated each

of the individuals set forth in the table above for election as directors at the Annual Meeting. The election of each of the nominees

recommended for election as directors requires a plurality of the votes cast in person or by proxy at the Annual Meeting. If elected,

each of these individuals will serve on the Board until the 2022 Annual Meeting of Stockholders or until his or her respective successor

is duly elected and qualified. If any of these individuals should become unable to accept election, the persons named as proxies may vote

for a substitute nominee selected by the Board or the named proxies, unless the Board chooses to reduce the number of directors serving

on the Board. Each of these individuals has agreed to serve if elected, and the Company’s management has no reason to believe that

any nominee will be unable to serve.

The names, principal occupations,

and other information concerning the nominees are set forth below, including the specific experience, qualifications, attributes, and

skills that led the Board to determine that the nominees should serve as directors. There are no family relationships between or among

any of our directors or executive officers. For more information regarding the independence of our directors, please see “Board

of Directors and Governance—Independence”.

Paolo

Fundarò has served as our Chairman since October 2015 and as a member of our Board since 2006.

Mr. Fundarò has been the Chief Executive Officer of Genextra S.p.A., an investment firm focused on the life sciences

industry, since July 2019 and previously served as the Chief Financial Officer of Genextra S.p.A. from its inception in 2004 until

2019. Mr. Fundarò also has served as Managing Director of certain of Genextra’s portfolio companies, including Congenia

S.r.l. since 2004, Dac S.r.l. from 2004 until December 2016, and Tethis S.p.A. from 2004 until July 2016. Before joining Genextra,

Mr. Fundarò was Director of Finance and Strategic Planning for the Fastweb Group from 2000 to 2004. Earlier in his career,

Mr. Fundarò worked for investment banks Salomon Smith Barney (now Citigroup) and Donaldson, Lufkin & Jenrette (now Credit

Suisse). Mr. Fundarò serves on the board of directors of a number of private companies, including Genextra S.p.A. Mr.

Fundarò received a degree in Business Management from Bocconi University in Milan, Italy.

Mr. Fundarò’s

significant experience in corporate finance and strategic planning, as well as his expertise in building, investing in, and growing companies

in diverse industries, including the biopharmaceutical industry, contributed to the Board’s determination that he should be nominated

to serve as a director.

Jerome

Durso has been our President and Chief Executive Officer, and a director, since January 2021. Prior to becoming Chief Executive

Officer, Mr. Durso served as Chief Operating Officer since joining Intercept in February 2017. Mr. Durso has over 25 years of experience

in building and leading commercial and business operations at life sciences companies both in the United States and abroad. Prior to joining

the Company, Mr. Durso served as a consultant to the biopharmaceutical industry from September 2015 to February 2017. Mr. Durso spent

the majority of his career at Sanofi, a global pharmaceutical company, where he most recently served as Senior Vice President, Chief Commercial

Officer of the Global Diabetes Division from June 2011 to April 2015. From 2010 to 2011, Mr. Durso was Senior Vice President, Chief Commercial

Officer of Sanofi’s U.S. pharmaceuticals business. Prior to that, he served in a number of commercial leadership roles of increasing

responsibility in business unit and brand management, marketing, and sales since he first joined Sanofi in 1993. Mr. Durso earned his

bachelor’s degree in marketing from the University of Notre Dame.

Mr. Durso’s detailed

business understanding of the pharmaceutical industry, and of the Company in particular, including from operating, managerial, marketing,

and sales perspectives, contributed to the Board’s determination that he should be nominated to serve as a director.

Srinivas

Akkaraju, M.D., Ph.D. has served as a member of our Board since October 2012. Since March 2017, Dr. Akkaraju has been the

Managing General Partner of Samsara BioCapital, a venture capital firm that he founded. From April 2013 to March 2017, Dr. Akkaraju was

a General Partner and then a Senior Advisor of Sofinnova Ventures, a venture capital firm focused on the life sciences industry. From

January 2009 until April 2013, Dr. Akkaraju was a Managing Director of New Leaf Venture Partners, an investment firm focused on the healthcare

technology sector. From 2006 to 2008, Dr. Akkaraju served as a Managing Director of Panorama Capital, a venture capital firm that he co-founded

along with other members of the former venture capital investment team of J.P. Morgan Partners, a private equity division of JPMorgan

Chase & Co. Prior to co-founding Panorama Capital, Dr. Akkaraju was with J.P. Morgan Partners, which he joined in 2001 and of which

he became a partner in 2005. From 1998 to 2001, Dr. Akkaraju worked in business and corporate development at Genentech, Inc. (now a member

of the Roche Group), a biotechnology company. Dr. Akkaraju has been a director of Jiya Acquisition Corp. (where he also serves as Chairman)

since November 2020, and Syros Pharmaceuticals, Inc. since June 2017. Dr. Akkaraju also serves on the board of directors of a number of

private companies. During the past five years, Dr. Akkaraju previously served as a director of Aravive, Inc. (formerly Versartis, Inc.),

aTyr Pharma, Inc., Principia Biopharma Inc., and Seattle Genetics, Inc. (now Seagen Inc.). Dr. Akkaraju received his M.D. and a Ph.D.

in Immunology from Stanford University. He received his undergraduate degrees in Biochemistry and Computer Science from Rice University.

Dr. Akkaraju’s extensive

experience in venture capital, in-depth knowledge of life sciences companies, and financial expertise, as well as his scientific background

and public company board experience, contributed to the Board’s determination that he should be nominated to serve as a director.

Luca

Benatti, Ph.D. has served as a member of our Board since July 2014. Dr. Benatti has over 30 years of experience in

the pharmaceutical and biotechnology industries. Since June 2012, Dr. Benatti has served as the Chief Executive Officer and a

director of EryDel S.p.A., a private biotechnology company focused on rare diseases. From 1998 until May 2012, Dr. Benatti was Chief

Executive Officer of Newron Pharmaceuticals S.p.A., a publicly traded biopharmaceutical company that Dr. Benatti co-founded. Under

Dr. Benatti’s leadership, Newron developed a pipeline of innovative therapies including Xadago, approved worldwide for the

treatment of Parkinson’s disease. From 1985 to 1998, Dr. Benatti held various research and development positions at Pharmacia

& Upjohn and its predecessor companies. Dr. Benatti has authored several scientific publications and holds a number of patents.

Dr. Benatti currently serves as a director of Newron Pharmaceuticals S.p.A. and Metis Precision Medicine. Dr. Benatti also serves as

chairman of Italian Angels for Biotech, a member of the Advisory Board of the Sofinnova Telethon Fund, and a member of the Strategic

Advisory Board of Zambon S.p.A. Dr. Benatti graduated from and performed his post-doctoral training at the Milano Genetics

Institute.

Dr. Benatti’s significant

experience in the pharmaceutical and biotechnology industries; business development, financial, and strategic leadership expertise; and

thorough understanding of pharmaceutical drug discovery and development, contributed to the Board’s determination that he should

be nominated to serve as a director.

Daniel

Bradbury has served as a member of our Board since July 2016. Mr. Bradbury has over 35 years of experience leading global,

fast-growing life sciences companies. Mr. Bradbury has served as Executive Chairman of Equillium, Inc., a biopharmaceutical company that

Mr. Bradbury co-founded, since January 2020 and served as Chairman of Equillium, Inc. from March 2018 through December 2019. Mr. Bradbury

also previously served as Chief Executive Officer of Equillium, Inc., from June 2018 through December 2019 and as President of Equillium,

Inc. from March 2017 until June 2018. In addition, Mr. Bradbury has been Managing Member of BioBrit, LLC, a life sciences consulting and

investment firm, since 2012. Previously, Mr. Bradbury held several senior positions at Amylin Pharmaceuticals, Inc., a biopharmaceutical

company focused on diabetes and metabolic disorders, including President and Chief Executive Officer from March 2007 until its acquisition

by Bristol-Myers Squibb Company in August 2012, President and Chief Operating Officer from 2006 to 2007, Chief Operating Officer from

2003 to 2006, Executive Vice President from 2000 to 2003 and Senior Vice President, Corporate Development from 1998 to 2000. Mr. Bradbury

also served as a director of Amylin from June 2006 to August 2012. Prior to joining Amylin in 1994, Mr. Bradbury worked at SmithKline

Beecham Pharmaceuticals and its predecessor companies for ten years in various sales and marketing positions. Mr. Bradbury has been a

director of Castle Biosciences, Inc. since September 2012 and serves on the board of directors of a number of private companies and philanthropic

organizations. During the past five years, Mr. Bradbury previously served as a director of Panacea Acquisition Corp. (now Nuvation Bio

Inc.), Geron Corporation, Corcept Therapeutics Incorporated, Illumina, Inc. and BioMed Realty Trust, Inc. In addition, Mr. Bradbury serves

on the Keck Graduate Institute’s Board of Trustees and the University of California San Diego’s Rady School of Management

Dean’s Advisory Council. Mr. Bradbury received a Bachelor of Pharmacy from Nottingham University and a Diploma in Management Studies

from Harrow and Ealing Colleges of Higher Education in the United Kingdom.

Mr. Bradbury has extensive

experience in the biopharmaceutical industry, has demonstrated leadership and operational skills, and possesses significant research,

development, and commercialization expertise, as well as public company board experience. These factors contributed to the Board’s

determination that he should be nominated to serve as a director.

Keith

Gottesdiener, M.D. has served as a member of our Board since July 2016. Since July 2020, Dr. Gottesdiener has served as

the Chief Executive Officer and as a director of Prime Medicine, Inc., a private biopharmaceutical company based in Cambridge, Massachusetts.

Prior to that, from October 2011 until March 2020, Dr. Gottesdiener served as the Chief Executive Officer and a director of Rhythm Pharmaceuticals,

Inc., a biopharmaceutical company. Dr. Gottesdiener joined Rhythm after 16 years at Merck Research Laboratories, where he held positions

of increasing responsibility, including serving as a leader of Merck’s late clinical development organization from 2006 to 2011

and leading Merck’s early clinical development across all therapeutic areas from 2001 through early 2006. In such roles, Dr. Gottesdiener

oversaw the development of Merck’s infectious diseases and vaccine products through pivotal trials, registration, and life cycle

management, including GardasilTM (HPV Vaccine), RotateqTM (rotavirus vaccine), ZostavaxTM (zoster vaccine)

and IsentressTM (HIV integrase inhibitor), among others. In 2008, Dr. Gottesdiener was appointed Late Stage Therapeutic Group

Leader, and in that role led Merck’s late-stage clinical development efforts (from Phase 2 through patent expiry) across all therapeutic

areas. After Merck’s merger with Schering-Plough Corporation in 2009, he continued as Co-Head of Late Development. Dr. Gottesdiener

received his B.A. from Harvard College and his M.D. from the University of Pennsylvania. He completed his residency and fellowship at

the Brigham and Women’s Hospital-Beth Israel Medical Center-Dana Farber Cancer Institute Children’s Hospital programs. After

his fellowship, Dr. Gottesdiener did postdoctoral research in the laboratory of Dr. Jack Strominger at Dana Farber Cancer Institute working

on the molecular immunology of the T-cell receptor. In 1986, he joined the faculty as an assistant professor at Columbia University, started

an independent research laboratory with NIH RO-1 funding, focusing on gene transcription, and was Associate Clinical Professor of Medicine

at the time he left to join Merck in 1995.

Dr. Gottesdiener’s extensive

experience as a senior executive in the pharmaceutical industry, drug development and regulatory affairs expertise, and research work

for both medical and academic institutions, as well as his public company experience, contributed to the Board’s determination that

he should be nominated to serve as a director.

Nancy

Miller-Rich has served as a member of our Board since April 2018. Ms. Miller-Rich has 35 years of experience in the healthcare

industry, with significant expertise in business development and commercial strategy. Since September 2017, Ms. Miller-Rich has served

as a consultant to the pharmaceutical industry. Previously, Ms. Miller-Rich served in a number of leadership roles at Merck & Co.,

Inc. and, prior to the merger of the two companies, at Schering-Plough Corporation, including most recently as Senior Vice President,

Global Human Health Business Development & Licensing, Strategy and Commercial Support from November 2013 to September 2017 and as

Group Vice President, Consumer Care Global New Ventures and Strategic Commercial Development from January 2007 to November 2013. Prior

to joining Schering-Plough in 1990, Ms. Miller-Rich served in a variety of commercial and marketing roles at Sandoz Pharmaceuticals and

Sterling Drug, Inc. She is currently a director of Aldeyra Therapeutics, Inc., Kadmon Holdings, Inc., and 4D Molecular Therapeutics, Inc.,

as well as a board member of a number of private and not-for-profit entities. During the past five years, Ms. Miller-Rich previously served

as a director of UDG Healthcare plc. She received her B.S. in Business Administration, Marketing from Ithaca College in Ithaca, New York.

Ms. Miller-Rich’s significant

experience in the healthcare industry, as well as her business development and commercial strategy expertise, contributed to the Board’s

determination that she should be nominated to serve as a director.

Mark

Pruzanski, M.D. is one of our co-founders and has served as a member of our Board since its inception in 2002. Dr. Pruzanski

served as Intercept’s President and Chief Executive Officer until 2021. Dr. Pruzanski has over 20 years of experience in life sciences

company management, venture capital and strategic consulting. Prior to co-founding Intercept, Dr. Pruzanski was a venture partner at Apple

Tree Partners, an early stage life sciences venture capital firm that he co-founded, and an entrepreneur-in-residence at Oak Investment

Partners, a venture capital firm. Dr. Pruzanski is a co-author of a number of scientific publications and is named as an inventor on several

of our patents. Since January 2021, Dr. Pruzanski has been the Managing Member of Figurati LLC, a life sciences investment and consulting

firm. Dr. Pruzanski has been a director of Equillium, Inc. since September 2018. Dr. Pruzanski also currently serves on the boards of

the Emerging Companies Section of the Biotechnology Innovation Organization (BIO), a biotechnology-focused trade association, and the

Foundation for Defense of Democracies, a non-profit policy institute focusing on foreign policy and national security. Dr. Pruzanski received

his M.D. from McMaster University in Hamilton, Canada, a M.A. degree in International Affairs from the Johns Hopkins University School

of Advanced International Studies in Bologna, Italy and Washington, D.C., and a bachelor’s degree from McGill University in Montreal,

Canada.

Dr. Pruzanski’s comprehensive

knowledge of the Company and both its business and scientific aspects, and his general experience with managing, advising, and investing

in life sciences companies, contributed to the Board’s determination that he should be nominated to serve as a director.

Dagmar

Rosa-Bjorkeson has served as a member of our Board since April 2021. She has more than 25 years of global experience

in the pharmaceutical industry, including executive leadership positions in corporate and product strategy, market development, and

operational execution. Since 2020, she has been the Chief Operating Officer of Mesoblast Limited. From 2017 to 2019, she worked at

Mallinckrodt Pharmaceuticals, where she was Executive Vice President and Chief Strategy and Development Officer, responsible for

corporate and therapeutic area strategy, business development, and new product commercialization, and also served as Senior Vice

President of new product commercialization. From 2015 to 2016, she was Executive Vice President and President, Biosimilars, at

Baxalta (now a wholly owned subsidiary of Takeda Pharmaceutical Company), where she developed a biosimilars strategy, managed post

spin-off efforts from Baxter International, and oversaw a fully integrated unit including program management, research, clinical

development, manufacturing, commercialization and business development. From 1997 to 2014, she held various roles of increasing

responsibility at Novartis, including Vice President and Head of its multiple sclerosis business unit; Vice President, Business

Development and Licensing in the United States; Vice President, Respiratory in the United States; and Country Head and President for

Novartis Sweden. Throughout her 17 years at Novartis, Ms. Rosa-Bjorkeson’s experience spanned sales, marketing, general

management, and country operations. She has led multiple successful product launches, including Gilenya® for multiple sclerosis

at Novartis. She serves on the board of directors of Xencor, Inc., as well as the New Jersey City University Foundation and

Deirdre’s House. Ms. Rosa-Bjorkeson earned an M.B.A., an M.S. in chemistry, and a B.S. in chemistry from the University of

Texas, Austin.

Ms. Rosa-Bjorkeson has deep

experience in the pharmaceutical industry, including in the areas of management, operations, strategy, and product commercialization,

contributing to the Board’s determination that she should be nominated to serve as a director.

Gino

Santini has served as our Lead Independent Director since February 2018 and as a member of our Board since November 2015.

From 1983 to 2010, Mr. Santini held a variety of commercial, operational and leadership roles of increasing responsibility at Eli Lilly

and Company, including Senior Vice President, Corporate Strategy and Business Development from 2007 to 2010, Senior Vice President of

Corporate Strategy and Policy from 2004 to 2007, President of U.S. Operations from 1999 to 2004 and President of the Women’s Health

Franchise from 1997 to 1999. Mr. Santini has been a director of Allena Pharmaceuticals, Inc. since February 2012, Horizon Therapeutics

plc since March 2012, and Collegium Pharmaceutical, Inc. since July 2012. Mr. Santini also serves on the board of directors of a number

of private companies. During the past five years, Mr. Santini previously served as a director of AMAG Pharmaceuticals, Inc., and Vitae

Pharmaceuticals, Inc. Mr. Santini holds an undergraduate degree in mechanical engineering from the University of Bologna and an M.B.A.

from the Simon School of Business, University of Rochester.

Mr. Santini has extensive experience

in the pharmaceutical industry, has demonstrated leadership and operational skills, and possesses significant domestic and international

commercial, corporate strategy, business development, and transactional experience, as well as public company board experience. These

factors contributed to the Board’s determination that he should be nominated to serve as a director.

Glenn

Sblendorio has served as a member of our Board since February 2014. Mr. Sblendorio has over 30 years of experience in the

pharmaceutical and biotechnology industries. Mr. Sblendorio has been Chief Executive Officer, President and a director of IVERIC bio,

Inc. (formerly Ophthotech Corporation) since July 2017, January 2017 and May 2017, respectively. Mr. Sblendorio also previously served

at IVERIC bio, Inc. as Executive Vice President and Chief Operating Officer from April 2016 to January 2017, Chief Financial Officer and

Treasurer from April 2016 until April 2017 and a director from July 2013 through March 2016. Prior to joining IVERIC bio, Inc., Mr. Sblendorio

served as the President and Chief Financial Officer of The Medicines Company from March 2006 until December 2015. Mr. Sblendorio served

as Executive Vice President and Chief Financial Officer of Eyetech Pharmaceuticals, Inc. from February 2002 until it was acquired by OSI

Pharmaceuticals, Inc. in November 2005. From July 2000 to February 2002, Mr. Sblendorio served as Senior Vice President of Business Development

at The Medicines Company. Prior to joining The Medicines Company in 2000, Mr. Sblendorio served as a managing director at MPM Capital

Advisors, LLC and held a variety of senior financial positions at Hoffman-La Roche, Inc. Mr. Sblendorio has been a director of Amicus

Therapeutics, Inc. since June 2006. Mr. Sblendorio received a B.B.A. from Pace University and an M.B.A. from Fairleigh Dickinson University.

Mr. Sblendorio’s extensive

experience in the pharmaceutical and biotechnology industries, leadership skills, operational and strategic expertise, and financial knowledge

(which enables him to serve as a financial expert on our Audit Committee), as well as his public company board experience, and strong

record of dedication to service on our Board, contributed to the Board’s determination that he should be nominated to serve as a

director.

Vote Required for Approval

The election, by separate resolutions,

of each of the foregoing eleven nominees to serve on the Board of Directors until the 2022 Annual Meeting of Stockholders, or until their

respective successors are duly elected and qualified, requires a plurality of the votes cast in person or by proxy at the Annual Meeting.

The Board recommends a vote “for”

the election of each of the nominees set forth above.

Proposal 2:

Approval of a One-Time Stock Option Exchange Program for Non-Executive Employees

Introduction

We have decided to seek stockholder

approval of a one-time stock option exchange program for current non-executive employees of the Company that would allow these non-executive

employees to exchange certain significantly “out-of-the-money” stock options (meaning outstanding stock options that have

an exercise price that is greater than the current market price for our stock) (also known as “underwater” stock options)

for new stock options that will be exercisable for fewer shares of our common stock and will have an exercise price equal to the fair

market value of our common stock on the new grant date, as well as having new vesting requirements and a new expiration date.

Stockholder-Friendly Design

In discussing strategies

to address our out-of-the-money stock options, we were particularly focused on creating a strategy that is compatible with the interests

of our stockholders. We believe that the option exchange program that is being proposed meets that objective by providing a more cost-effective

and stockholder-friendly retention and incentive tool than simply issuing additional equity awards or paying cash compensation in order

to effectively retain and motivate our non-executive employees. We believe that the benefits of the proposed exchange program, including

reducing our overhang (meaning potential shares committed but unissued), and approximate value-neutrality (i.e., keeping the aggregate

value of the old versus replacement awards approximately consistent), contribute to an alignment of the program with the interests of

our stockholders. In particular (and as discussed in more detail below):

|

|

·

|

We believe that the option exchange program would result in a net reduction of the overhang from our equity

compensation program (up to 12.7% of our overhang on account of stock options, and 1.0% of our fully diluted share count, depending upon

the level of participation in the program).

|

|

|

·

|

Exchange ratios for the exchange are intended to result in a “value for value” exchange, meaning

that the accounting fair value of replacement options granted will be approximately equal to the fair value of the options that are surrendered,

so that from that perspective the exchange does not result in a windfall to participants.

|

|

|

·

|

Shares from exchanged options that are in excess of the shares needed to issue replacement grants will

not be returned to the plan pool, limiting the future dilution that could otherwise have resulted from the program.

|

We believe that these design

features, among others, mean that the proposed exchange program is aligned with the interests of our stockholders.

Background and Reasons

for the Option Exchange Program

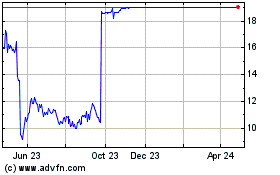

Since 2015, when our stock

closed as high as $313.98 (on May 18, 2015), declines in our stock price have steadily eroded the retentive and incentive value of stock

options granted. For example, on December 31, 2019, our stock closed at $123.92. The decline dramatically accelerated following the issuance

of the CRL from the FDA in June 2020, after which our stock price declined to levels last seen in 2012.

During the course of 2020,

the Compensation Committee began considering, with input from Radford, which is part of the Rewards Solution practice at Aon plc (“Radford”),

and serves as the Compensation Committee's independent compensation consultant, whether conducting an option exchange program would assist

with our retention efforts. These discussions were undertaken in the context of this sustained decline in the trading price of the Company’s

shares, which has resulted in a situation where, as of April 6, 2021, the Company has a total of approximately 2.7 million outstanding

options, 98.0% of which were underwater at a stock price of $23.53.

The Company has heard

from employees that they view their existing underwater stock options as having little or no value due to the difference between the

exercise prices of those options and the current trading price of our stock. With the uncertainty around the Company created by a

number of factors, of which the stock price is one, we have seen a meaningful uplift in staff turnover since receipt of the CRL, and

we believe that the exchange of underwater stock options would help reduce the level of turnover in both the short and medium terms.

The Board of Directors and the Compensation Committee believe that the underwater options no longer function as the retention and

incentive tool that they believe is necessary to retain employees and to motivate them to increase long-term stockholder value.

In addition to the benefits

for employees, if the option exchange is approved by our stockholders, we expect that it will meaningfully reduce our equity overhang,

by eliminating a sizable number of outstanding options that, under their current terms and conditions, are likely to remain unexercised

for the foreseeable future. Under the ratios included in the terms of the proposed exchange, these current options would be replaced by

a smaller number of new options, thus meaningfully reducing the total number of outstanding options included in our overhang.

Other Alternatives Considered

When considering how best

to continue to incentivize and reward our employees who have out-of-the-money stock options, the Compensation Committee engaged Radford

to review and evaluate strategies to address this issue. These strategies included the stock option exchange program, as well as other

alternatives, including the following:

|

|

·

|

Increase cash compensation. To replace equity incentives, we considered whether we could substantially

increase bonus cash compensation. However, significant increases in cash compensation would substantially increase our compensation expenses

and reduce the cash available for other initiatives, which could adversely affect our business and operating results.

|

|

|

·

|

Grant additional equity awards. We also considered special grants of additional stock options at current

market prices or another form of equity award such as restricted stock units. However, these additional grants could substantially increase

our overhang and the dilution to our stockholders.

|

|

|

·

|

Exchange options for cash. We also considered implementing a program to exchange underwater options for

cash payments. However, an exchange program for cash would also increase our compensation expenses and reduce our cash flow from operations,

which could adversely affect our business and operating results. In addition, we do not believe that such a program would have significant

long-term retention value.

|

|

|

·

|

Exchange options for restricted stock units. We also considered implementing a program to exchange underwater

options for restricted stock units. However, in order to keep the aggregate value of the old versus replacement awards approximately consistent,

the exchange ratios for an options-for-restricted stock units exchange program would need to be substantially higher than for an options-for-options

exchange program (i.e., fewer replacement awards would be granted in the exchange). Thus, we believe that employee participation in an

options-for-restricted stock units exchange program would be lower than with an options-for-options exchange program, reducing the retention

and incentive value of the program.

|

Reasons for Proposing the

Option Exchange

Taking into account the advice

of Radford and other relevant considerations, the Compensation Committee determined that a program under which current non-executive employees

could exchange stock options with an exercise price greater than the “Threshold Exercise Price” (described below) was most

attractive for a number of reasons, summarized below. The Threshold Exercise Price will be the greater of the 52-week high trading price

of our shares and 1.5x the then-current current stock price, in each case as of a date shortly prior to the commencement date of the offer.

The following considerations recommended proposing this approach:

|

|

·

|

Reasonable, balanced incentives. We believe that the opportunity to exchange existing eligible stock options

for new options with respect to fewer shares, together with a new vesting requirement and term, represents a reasonable and balanced exchange

program with the potential for a significant positive impact on employee retention, motivation and performance. We believe that the new

options issued in the exchange program will provide a meaningful retention period for employees during the next two years, at a time when

the Company expects to continue to experience retention challenges.

|

|

|

·

|

Reduction of the number of shares subject to outstanding options. In addition to the out-of-the-money

options having little or no retention value, they also contribute to our stock option overhang until they are exercised or expire unexercised.

As of April 6, 2021, there were approximately 967,000 outstanding stock options with an exercise price equal to or greater than $55.59

per share, with a weighted average exercise price of $103.83, that would have been eligible to participate in the option exchange program

if it had commenced on that day.

|

If approved by our stockholders, the

option exchange program is expected to reduce our overhang of outstanding stock options by eliminating the ineffective options that are

currently outstanding and issued to our non-executive employees. Under the proposed option exchange program, eligible participants will

receive stock options covering fewer shares than the exchanged options. Based on the number of outstanding stock options as of April 6,

2021, and assuming that all eligible options were exchanged in the program, options to purchase approximately 967,000 shares would have

been exchanged and cancelled, while new options covering approximately 626,000 shares would have been issued. This would have resulted

in a net reduction in the overhang of our equity awards by approximately 341,000 shares, or approximately 12.7% of our total overhang

on account of stock options (from approximately 2.7 million to approximately 2.35 million shares), and approximately 1.0% of our total

fully diluted share count as of April 6, 2021. The actual reduction in our overhang that may result from the option exchange program could

vary significantly and is dependent upon a number of factors, including the commencement date of the program, the actual level of participation

in the program and the actual exchange ratios. All eligible options that are not exchanged will remain outstanding and in effect in accordance

with their existing terms.

|

|

·

|

Reduced pressure for additional grants. If we are unable to implement the option exchange program, we

may find it necessary to issue additional options to our employees at current market prices, increasing our overhang. These grants would

deplete the current pool of options available for future grants under our 2012 Equity Incentive Plan and would also result in increased

stock compensation expense, which could negatively impact our stock price.

|

|

|

·

|

Impact on accounting expense. Under applicable accounting rules, we are required to continue to recognize

compensation expense related to these underwater stock options as they vest, even if they are never exercised because they remain underwater.

We believe the option exchange program will allow us to recapture retentive and incentive value from the compensation expense that we

have recorded and will continue to record in our financial statements with respect to our eligible options. The new options are not expected

to result in significant additional compensation expense and therefore will not have a material adverse impact on our reported earnings.

|

|

|

·

|

In April 2021, the Compensation Committee authorized that we pursue a stock option exchange program for

current employees (excluding former employees, members of our Board, our executive officers and consultants). Although stockholder

approval is not required for this proposal under the terms of the 2012 Equity Incentive Plan, the Company does not intend to undertake

the option exchange program unless stockholders approve this proposal. If stockholders approve this proposal, the Company intends

to commence the exchange program during the third or fourth quarter of 2021. The Board or the Compensation Committee will determine the