Current Report Filing (8-k)

April 12 2021 - 4:45PM

Edgar (US Regulatory)

RADIAN GROUP INC false 0000890926 0000890926 2021-04-09 2021-04-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 9, 2021

Radian Group Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-11356

|

|

23-2691170

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1500 Market Street,

Philadelphia, Pennsylvania 19102

(Address of Principal Executive Offices, and Zip Code)

(215) 231-1000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.001 par value per share

|

|

RDN

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This report is being filed to supplement the information contained in the proxy statement filed by Radian Group Inc. (“we,” “our,” or the “Company”) on April 9, 2021 (the “Proxy Statement”) in connection with the Annual Meeting of Stockholders to be held on May 12, 2021.

We are providing this supplementary information to correct an inadvertent formatting error that resulted in the misnumbering of the footnotes following the “2020 Director Compensation” table on pages 64 and 65 of our Proxy Statement. The amounts reported in the table are correct and remain unchanged. The table with the corrected footnotes is below and replaces the original table in the Proxy Statement in its entirety.

2020 Director Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned or

Paid in Cash

($)

|

|

|

Stock

Awards (1)

($)

|

|

|

Change to

Nonqualified

Deferred

Compensation

Earnings (2)

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Herbert Wender

|

|

|

250,000

|

|

|

|

252,949

|

|

|

|

—

|

|

|

|

—

|

|

|

|

502,949

|

|

|

David C. Carney (3)

|

|

|

83,468

|

|

|

|

1,557

|

|

|

|

—

|

|

|

|

10,000

|

(4)

|

|

|

95,025

|

|

|

Brad L. Conner

|

|

|

69,493

|

|

|

|

130,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

199,493

|

|

|

Howard B. Culang

|

|

|

135,000

|

|

|

|

131,557

|

|

|

|

—

|

|

|

|

—

|

|

|

|

266,557

|

|

|

Debra Hess

|

|

|

110,000

|

|

|

|

130,692

|

|

|

|

—

|

|

|

|

—

|

|

|

|

240,692

|

|

|

Lisa W. Hess

|

|

|

125,000

|

(5)

|

|

|

131,557

|

|

|

|

—

|

|

|

|

—

|

|

|

|

256,557

|

|

|

Lisa Mumford

|

|

|

69,493

|

|

|

|

130,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

199,493

|

|

|

Gaetano Muzio

|

|

|

135,000

|

|

|

|

131,557

|

|

|

|

—

|

|

|

|

—

|

|

|

|

266,557

|

|

|

Gregory V. Serio

|

|

|

125,000

|

|

|

|

131,557

|

|

|

|

—

|

|

|

|

—

|

|

|

|

256,557

|

|

|

Noel J. Spiegel

|

|

|

119,543

|

|

|

|

131,557

|

|

|

|

—

|

|

|

|

—

|

|

|

|

251,100

|

|

|

(1)

|

Grant Date Fair Value of 2020 Equity Awards. Represents the grant date fair value of awards computed in accordance with the accounting standard regarding share-based compensation payments. Each non-executive director who was elected at our 2020 Annual Meeting of Stockholders was awarded 9,962 RSUs (stock settled) on May 13, 2020, with a grant date fair value of $130,000. In addition, Mr. Wender received an additional award of 9,196 RSUs (stock settled) with a grant date fair value of $120,000 for his service as non-executive Chairman. For a discussion of the assumptions used in calculating the grant date fair values, see Note 17, “Share-Based Compensation and Other Benefit Programs,” of Notes to Consolidated Financial Statements in our 2020 Annual Report on Form 10-K.

|

Incremental Fair Value of Outstanding Equity Awards. The amounts in this column also include the incremental fair value, computed in accordance with FASB Topic 718, associated with an amendment to the non-executive directors’ outstanding equity compensation awards as of February 2020 to add dividend equivalent rights to these awards. See “Equity Compensation—Dividends” above for more information regarding this amendment. This incremental fair value with respect to each director is as follows: Mr. Wender - $2,949; Mr. Carney - $1,557; Mr. Conner - $0; Mr. Culang - $1,557; Ms. Debra Hess - $692; Ms. Lisa Hess - $1,557; Ms. Mumford - $0; Mr. Muzio - $1,557; Mr. Serio - $1,557; and Mr. Spiegel - $1,557. No incremental fair value is reflected for Mr. Conner or Ms. Mumford, who each joined our Board in February 2020 and therefore did not have any outstanding equity compensation awards at the time of the amendment.

As of December 31, 2020, each of our current non-executive directors held the following number of shares of phantom stock and RSUs:

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Shares of

Phantom Stock*

(#)

|

|

|

Restricted

Stock Units

(#)

|

|

|

Mr. Wender

|

|

|

59,365

|

|

|

|

343,241

|

|

|

Mr. Conner

|

|

|

—

|

|

|

|

9,962

|

|

|

Mr. Culang

|

|

|

60,667

|

|

|

|

183,436

|

|

|

Ms. Debra Hess

|

|

|

—

|

|

|

|

15,730

|

|

|

Ms. Lisa Hess

|

|

|

—

|

|

|

|

129,490

|

|

|

Ms. Mumford

|

|

|

—

|

|

|

|

9,962

|

|

|

Mr. Muzio

|

|

|

—

|

|

|

|

108,694

|

|

|

Mr. Serio

|

|

|

—

|

|

|

|

108,694

|

|

|

Mr. Spiegel

|

|

|

—

|

|

|

|

129,490

|

|

|

*

|

Includes dividend equivalents to be issued in stock upon conversion of the phantom shares accrued through March 10, 2020.

|

|

(2)

|

We do not pay above-market or preferential interest or earnings on amounts deferred under the Radian Director Deferred Compensation Plan.

|

|

(3)

|

Mr. Carney retired from the Board on May 13, 2020.

|

|

(4)

|

Represents a charitable contribution made by the Company to the Tucson Symphony Orchestra on behalf of Mr. Carney upon his retirement in recognition of his service to the Company.

|

|

(5)

|

Of this amount, Ms. Lisa Hess deferred $93,750, or 100% of her cash compensation paid during 2020 for meetings held during 2020, pursuant to the Radian Voluntary Deferred Compensation Plan for Directors. The remaining amount represents fees paid in arrears for meetings held during the fourth quarter of 2019.

|

Except as described above, this information does not modify, amend, supplement, or otherwise affect the Proxy Statement.

If you have already voted, you do not need to vote again unless you would like to change or revoke your prior vote on any proposal. If you would like to change or revoke your prior vote on any proposal, please refer to the Proxy Statement for instructions on how to do so.

The Proxy Statement, this notice, and our 2020 Annual Report to security holders are available at www.radian.com/StockholderReports.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

RADIAN GROUP INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: April 12, 2021

|

|

|

|

By:

|

|

/s/ Edward J. Hoffman

|

|

|

|

|

|

|

|

Edward J. Hoffman

|

|

|

|

|

|

|

|

General Counsel and Corporate Secretary

|

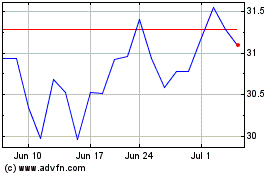

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

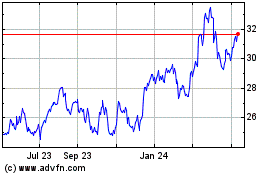

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024