TIDMVCP

RNS Number : 0585V

Victoria PLC

12 April 2021

12 April 2021

For Immediate Release

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Victoria PLC

('Victoria,' the 'Company,' or the 'Group')

Full Year Trading Update

Record Results

Victoria PLC, (LSE: VCP) the international designers,

manufacturers and distributors of innovative flooring, provides the

following trading update for the financial year ended 3 April 2021

("FY21").

The Board is pleased to announce that, in spite of the on-going

COVID-19 related challenges in our markets, the Group has achieved

record results for FY21, reflecting the resilience of the

commercial and operational performance of the business. The Group

expects, subject to finalisation of the accounts and audit, FY21

revenues to be in excess of GBP640 million (FY20: GBP621.5m) -

despite the impact of the April-May 2020 lockdowns, which saw over

GBP50 million of revenue reduction in those two months compared to

the prior year - and underlying EBITDA to be in excess of GBP120

million (2020: GBP118.1m).

Operational Performance

This was a year in which we completed no major acquisitions and

therefore the record trading results were driven by organic

performance. Victoria has invested heavily over the past five years

in building the pre-eminent management team in the European

flooring industry. Their collective deep operational experience,

entrepreneurial initiative, sense of ownership (almost all managers

are shareholders), and, most importantly, their ability to execute

have delivered significant value for shareholders over an extremely

challenging 12 months.

To briefly recap on some key operational achievements:

-- Minimised negative operating cash flow to just GBP6 million

in Q1, during total lockdown in all our main markets - protecting

the business and therefore shareholders by maintaining strong

liquidity and avoiding any requirement for a value-destroying

discounted equity issuance.

-- Capitalised on strong consumer demand by restarting

manufacturing and logistics operations as soon as lawfully

permitted - ahead of competitors. The result was a post-lockdown

double-digit growth in revenues.

-- Completed the integration of Ascot Gruppo Ceramiche providing

production capacity and brands that enabled the annual revenue from

our Italian business to exceed EUR100 million from just EUR28

million four years ago.

-- Sustainable c.200+bps margin expansion. The various

initiatives in logistics and factory productivity, which were

completed on time and on budget, have delivered as exactly planned

and driven meaningful and sustainable margin expansion post

lockdown.

Acquisitions Update

As previously announced, the Board of Victoria has invested a

significant amount of management focus during the past year

identifying additional suitable acquisition opportunities and, more

recently, the Company has reorganised its financing arrangements to

provide it with a significant amount of capital for acquisitions,

as well as extending its debt financing maturities and reducing

interest rates.

The various, and constantly changing, Covid-19 related travel

restrictions that have been in place in the UK and across Europe

during the first three months of the year have impacted the pace of

due diligence. However, recent easing of restrictions in key

geographies have reduced or eliminated this constraint and the

Board anticipates being able to report further acquisition-led

growth in the near future.

Outlook

The trading outlook for the current FY22 financial year is very

encouraging in terms of both revenue and margins.

The Group continues to experience strong, ongoing consumer

demand across its key markets. Furthermore, housing transactions, a

key 12-18 month leading indicator of flooring sales, are at very

high levels - not only in the UK, but across our markets (more than

70% of the Group's earnings are now generated from outside the UK),

which suggests demand will be maintained for some period.

More importantly, the post-lockdown uplift in margin observed in

the interim results published in November 2020 is structural due to

completed synergy projects and therefore sustainable. There have

been some increases in raw material prices in recent months, but

the Group has been able to successfully mitigate these.

However, it clearly remains difficult to forecast accurately

given the ongoing impact of, and uncertainty caused by, government

actions in response to COVID-19 and therefore we will continue to

keep re-instatement of formal earnings guidance under review and

will comment further as soon as we feel it is prudent to do so.

Victoria remains focused on its mission to create wealth for

shareholders.

For more information contact:

Victoria PLC

Geoff Wilding, Executive Chairman

Philippe Hamers, Group Chief Executive

Michael Scott, Group Finance Director +44 (0) 1562 749 610

N+1 Singer (Nominated Adviser and Joint

Broker)

Rick Thompson, Phil Davies, Alex Bond +44 (0) 207 496 3095

Berenberg (Joint Broker)

Ben Wright, Mark Whitmore, Tejas Padalkar +44 (0) 203 207 7800

Peel Hunt (Joint Broker)

Adrian Trimmings, Andrew Clark +44 (0) 207 418 8900

Buchanan Communications (Financial PR)

Charles Ryland, Chris Lane, Tilly Abraham +44 (0) 20 7466 5000

About Victoria

Established in 1895 and listed since 1963

and on AIM since 2013 (VCP.L), Victoria

PLC, is an international manufacturer and

distributor of innovative flooring products.

The Group, which is headquartered in Kidderminster,

UK, designs, manufactures and distributes

a range of carpet, flooring underlay, ceramic

tiles, LVT (luxury vinyl tile), artificial

grass and flooring accessories.

Victoria has operations in the UK, Spain,

Italy, Belgium, the Netherlands and Australia

and employs approximately 3,400 people

across more than 20 sites. Victoria is

the UK's largest carpet manufacturer and

the second largest in Australia, as well

as the largest manufacturer of underlay

in both regions.

The Group's strategy is designed to create

value for its shareholders and is focused

on consistently increasing earnings and

cash flow per share via acquisitions and

sustainable organic growth. (Further information

about Victoria can be found on its website,

www.victoriaplc.com.)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUARWRAOUSAAR

(END) Dow Jones Newswires

April 12, 2021 02:00 ET (06:00 GMT)

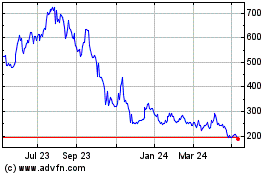

Victoria (LSE:VCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

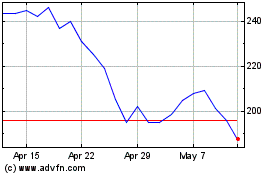

Victoria (LSE:VCP)

Historical Stock Chart

From Apr 2023 to Apr 2024