Securities Registration (foreign Private Issuer) (f-3/a)

April 07 2021 - 9:14AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on April 7, 2021

Registration No. 333-254910

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-effective Amendment No.1 to

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CLPS Incorporation

(Exact name of registrant as specified in its charter)

|

Cayman Islands

|

|

Not applicable

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

c/o Unit 1102, 11th Floor, Millennium City III

370 Kwun Tong Road, Kwun Tong, Kowloon

Hong Kong SAR

Tel: (852) 37073600

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Corporation Service Company

251 Little Falls Drive

Wilmington, DE 19808

Telephone: (800) 927-9800

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Mitchell Nussbaum, Esq.

Andrei Sirabionian, Esq.

James Zhang, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

(212) 407-4000

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

† The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of each Class of Security being Registered

|

|

Amount

being

Registered(1)

|

|

|

Proposed

Maximum

Offering Price

Per Security

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration

Fee

|

|

|

Common Share, $0.0001 par value per share (2)

|

|

|

2,666,666

|

|

|

$

|

6.00

|

(3)

|

|

$

|

15,999,996

|

|

|

$

|

1,745.60

|

(4)

|

|

(1)

|

Pursuant to Rule 416 of the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder also include such presently indeterminate number of shares of the registrant’s Common Share as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

We are registering for resale by the Selling Shareholders named herein 2,666,666 common shares issuable upon the exercise of certain warrants issued on March 3, 2021 to the Selling Shareholders, each of whom is an accredited investor, in a private placement pursuant to a Securities Purchase Agreement dated as of February 28, 2021 by and among the registrant and the purchasers named therein.

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(g) under the Securities Act and is based on the exercise price of the warrants pursuant to which such shares are issuable.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to

said Section 8(a), may determine.

EXPLANATORY NOTE

The sole purpose of this Pre-effective Amendment

No. 1 to Registration Statement on Form F-3 (File No. 333-254910) (“Amendment No. 1”) is being made to include Rui Yang, the

Company’s Chief Financial Officer (Principal Accounting and Financial Officer) as a signatory. Accordingly, this Amendment No. 1

consists only of the facing page, this explanatory note, and the signature page. The prospectus and the balance of Part II of the Registration

Statement are unchanged and have been omitted.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form F-3 and the Pre-effective Amendment No. 1 thereto and has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized, in Hong Kong SAR on April 7, 2021.

|

|

CLPS Incorporation

|

|

|

|

|

|

Date: April 7, 2021

|

By:

|

/s/ Raymond Ming Hui Lin

|

|

|

|

Raymond Ming Hui Lin

|

|

|

|

Chief Executive Officer, Director

|

|

|

|

(Principal Executive Officer)

|

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates

indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

|

|

Chairman and Director

|

|

April 7, 2021

|

|

Xiao Feng Yang

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Raymond Ming Hui Lin

|

|

Chief Executive Officer and Director

|

|

April 7, 2021

|

|

Raymond Ming Hui Lin

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Rui Yang

|

|

Chief Financial Officer

|

|

April 7, 2021

|

|

Rui Yang

|

|

(Principal Accounting and Financial Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Director

|

|

April 7, 2021

|

|

Zhaohui Feng

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Director

|

|

April 7, 2021

|

|

Chong Seng Kee

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Director

|

|

April 7, 2021

|

|

Jin He Shao

|

|

|

|

|

|

|

*By:

|

/s/ Raymond Ming Hui Lin

|

|

|

|

Raymond Ming Hui Lin

|

|

|

|

Attorney-in-Fact

|

AUTHORIZED UNITED

STATES REPRESENTATIVE

Pursuant

to the requirement of the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of the aforementioned

Registrant, has signed this registration statement in the City of Newark, State of Delaware, on April 7, 2021.

|

PUGLISI & ASSOCIATES

|

|

|

|

|

|

|

By:

|

/s/ Donald J. Puglisi

|

|

|

|

Name:

|

Donald J. Puglisi

|

|

|

|

Title:

|

Managing Director

|

|

3

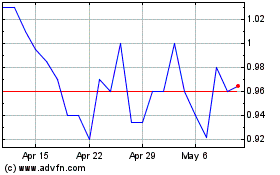

CLPS Incorporation (NASDAQ:CLPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

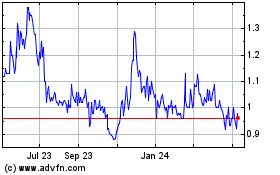

CLPS Incorporation (NASDAQ:CLPS)

Historical Stock Chart

From Apr 2023 to Apr 2024