Investor Presentation Common Stock Offering April 2021 This free writing prospectus relates to the proposed public offering of shares of common stock, par value $0.01 per share (“Common Stock”) of Medalist Diversified REIT, Inc. (“MDR” or the “Company”) that is being registered on a Registration Statement on Form S - 11 (No. 333 - 254504) (the “Registration Statement”). This free writing prospectus should be read together with the preliminary prospectus dated April 2, 2021 included in that Registration Statement which can be accessed through the following link: Medalist Diversified REIT, Inc. - Form S - 11 The Company has filed the Registration Statement (including a preliminary prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus in the Registration Statement (including the risk factors described therein) and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov . Alternatively, the issuer will arrange to send you the prospectus if you request it by emailing Tim Messier at tim.messier@medalistprop.com . Filed Pursuant to Rule 433 Issuer Free Writing Prospectus Dated April 5, 2021 To Preliminary Prospectus dated April 2, 2021 Registration Statement No. 333 - 254504

Disclaimers No Offer or Solicitation of Offer . This presentation is for informational purposes only . This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities of Medalist Diversified REIT, Inc . (“MDR” or the “Company”), which offer or solicitation shall only be made by means of a prospectus to be filed with the U . S . Securities and Exchange Commission (the “SEC”), nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . The Company has filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this presentation relates . Before you invest, you should read the prospectus in that registration statement and other documents that the Company has filed with the SEC for more complete information about the Company and the offering . You may get these documents for free by visiting EDGAR on the SEC’s website at www . sec . gov . Forward - Looking Statements . This presentation contains certain statements that may be deemed to be “forward looking statements” within the meaning of Section 27 A of the Securities Act and Section 21 E of the Securities Exchange Act of 1934 , as amended . To the extent that the information presented in this presentation discusses financial projections, information, or expectations about the Company’s business plans, results of operations, returns on equity, markets, or otherwise makes statements about future events, such statements are forward - looking . Such forward - looking statements can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,” and “proposes” or the negative of such terms and other comparable technology . Although the Company believes that the expectations reflected in these forward - looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward - looking statements . You should also read carefully the factors described in the “Risk Factors” section included in the Company’s Registration Statement of form S - 11 (No . 333 - 254504 ), in order to better understand the risks and uncertainties inherent in our business and underlying any forward - looking statements . As a result of these factors, we cannot assure you that the forward - looking statements in this presentation will prove to be accurate . Furthermore, if our forward - looking statements prove to be inaccurate, the inaccuracy may be material . In light of the significant uncertainties in these forward - looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all . Any forward - looking statements that we make in this presentation speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events . General Disclaimers . The offered shares are highly speculative and investing in the offered shares involves significant risks . The investment is suitable only for persons who can afford to lose their entire investment . Furthermore, potential investors must understand that such investment could be illiquid for an indefinite period of time . Currently, no market exists for the offered shares . We intend to file an application to have the offered shares listed on Nasdaq Capital Market or another national exchange . If the application is approved, we expect trading of the offered shares to commence 30 days following the issuance of the offered shares .

Offering Summary Issuer: Medalist Diversified REIT, Inc. Proposed Tickers / Exchange: MDRR / Nasdaq Capital Market Offering Type: Follow - on Offering Securities Issued: Common Stock Anticipated Gross Offering Proceeds: Up to $20,000,000 Over - allotment option: 15% Anticipated Use of Proceeds: Intend to use net proceeds to acquire additional properties, for working capital, for general corporate purposes, and, to the extent necessary, to pay acquisition fees to MDR’s Manager, to pay expenses, such as legal and accounting, to pay the asset management fee to MDR’s Manager, and to pay dividends to MDR’s shareholders Sole Bookrunner Kingswood Capital Markets, division of Benchmark Investments, Inc. Expected Close: Mid - April 2021 3

Investment Highlights • Management with 50+ years of combined experience in commercial real estate and Capital Markets • MDR’s management team has purchased and managed properties with a total asset value of approximately $200 million Experienced Management Team • Medalist Fund Manager, Inc., our manager, has identified market opportunities in commercial real estate in the secondary and tertiary markets • The availability of debt financing at historically low rates Market Opportunity Strategy of Opportunistic Investing • Extensive deal flow network in target markets due to long - standing relationships with brokers, owners and lenders • Focus on value creation through a “hands - on” management approach 4

Experienced Team Management Thomas Messier Director Chairman & CEO William Elliott Director Vice Chairman & President Brent Winn Chief Financial Officer ▪ 30+ years of experience in fixed income capital markets and CRE ▪ Extensive experience in real estate acquisition, financing, asset management, and investor relations ▪ Former Director of Global Capital Markets at First Union/Wachovia Bank, Senior VP of Capital Markets at Bank of America ▪ 38+ years of commercial real estate experience, sourcing, acquiring and managing investment properties ▪ Former Managing Partner of Prudential Commercial Real Estate, President of Virginia Realty and Development Company, President of the Central Virginia Region of Goodman Segar Hogan Hoffler, and Managing Director of GVA Advantis ▪ Licensed Real Estate Broker, Certified Property Manager (one - time CPM of the Year), Certified Value Engineer ▪ CFO of Medalist Diversified REIT for 3 years ▪ 20+ years of institutional real estate experience in real estate finance, development and asset management ▪ Licensed real estate broker Independent Board of Directors Neil Farmer Director Charles Polk Director Charles Pearson Director ▪ 30+ years of experience in real estate development ▪ Founded Farmer Properties, Inc., a real estate development company located in Richmond, VA ▪ 29+ years of experience in real estate brokerage ▪ Has served as Managing Director for JLL since 2009 ▪ Mr. Polk specializes in offering comprehensive real estate services ▪ Mr. Polk leads JLL’s tenant representation and brokerage practices for the Richmond office ▪ 30+ years of accounting, tax and consulting services ▪ Mr. Pearson began his career with Deloitte and Touche in 1978, rising to Senior Manager before leaving the firm to open his own practice in 1989 ▪ Mr. Pearson is a member of the American Institute of Certified Public Accountants (AICPA) and the Virginia Society of Certified Public Accountants 5

About Medalist Our Property Managers ▪ Medalist Fund Manager Inc. (“Medalist”) manages Medalist Diversified REIT that invests in value - add commercial real estate located in the Southeast ▪ Medalist Properties was founded in 2002 as a private equity firm by Bill Elliott. Tim Messier joined the firm in 2003 as an equal partner. Medalist is headquartered in Richmond, VA ▪ Since inception, Medalist has sourced and managed properties with a total asset value of approximately $200 million ▪ Asset types sourced and managed include: Industrial/Flex, Retail, Multifamily, and Hospitality ▪ Medalist uses full - service property management firms – Dodson Companies and Marshall Hotels & Resorts Dodson Companies ▪ Dodson Companies, is a full - service real estate property management firm with over 30 years of management experience ▪ MDR’s Bill Elliott became a Partner in Dodson Companies in 2003 and maintains a 6.32% ownership stake ▪ Dodson is the property manager for all of Medalist’s and MDR’s non - hotel properties Marshall Hotels & Resorts ▪ Marshall Hotels & Resorts is a full - service hotel property management firm ▪ The firm was founded in 1980 and currently manages 55 hotels with an average of 120 keys per hotel & resorts ▪ Medalist has been working with Marshall Hotels & Resorts for over 10 years Over 50 years of combined real estate investment and management experience Company Overview 6

Medalist Diversified REIT Objectives: Cash Flow and Appreciation Proprietary Investment Sourcing Rigorous Due Diligence Appropriate Exit Strategy Hands - On Portfolio Management Disciplined Pricing and Leverage Focus on Value - Add Properties ▪ Medalist believes that its focus on value - add and opportunistic commercial real estate provides an attractive balance of risk and returns ▪ Medalist intends to use the following strategies to enhance performance, quality and value of our investments: ▪ Proprietary investment sourcing ▪ Consistent and replicable process for sourcing and conducting due diligence ▪ Appropriate exit strategy ▪ Hands - on portfolio management ▪ Focusing on opportunistic properties Management has a proven track record with the following philosophies and strategies Core Philosophies & Investment Strategies 7

MDR’s Investment Criteria HEADQUARTERS MDR TARGET MARKETS Target Investment Criteria ▪ Average target property value between $5MM - $30MM ▪ Focus on VA, NC, SC, GA, FL and AL ▪ Target asset types include – Industrial/Flex, Multifamily, Retail, and Hospitality ▪ Value - add investment opportunities (under - managed, under - capitalized, and or under - performing assets) MDR is targeting value - add investments in markets where its executive team maintains deep industry relationships and local market knowledge . 8

1) DEAL NOTIFICATION 2) INITIAL ANALYSIS 3) DESKTOP UNDERWRITING 4) PROPERTY SITE VISIT 5) INVESTMENT COMMITTEE 6) FINAL DUE DILIGENCE 7) CLOSE Acquisition Stage Acquisition Procedures 1) Identify deal through proprietary relationships, brokers, and other proven sources 2) Does property meet REIT criteria? - Does property meet asset criteria? - Is property located in favorable geographic location? - What are the economic drivers in the region? 3) Review market studies from nationally recognized firms - Receive preliminary mortgage quote from mortgage banker - Develop preliminary pro - forma - Generate preliminary pricing assessment 4) Assess physical property and expectations for capital expenditures - Assess surrounding areas, visibility - Meet with local market experts and personal contacts 5) Discuss property with advisory board to determine if bid should be made - Submit Letter of Intent consistent with REIT objectives - If included in initial “Final Group of Buyers”, submit best and final offer at request of seller 6) Go to contract - 3 rd party formal due diligence (engineering, environmental, appraisal) - Develop business plan with property manager - Solicit bids and identify financing - Refine property pro - forma for expected holding period 7) Acquire property and implement business plan Medalist’s Acquisition Sourcing and Due Diligence 9

Medalist Diversified REIT Inc. ▪ Approximately $45mm in equity raised from high net worth, small institutions and retail investors ▪ Currently invested in 368,000 square feet of retail, 66,000 square feet of flex/industrial and two hotels with a total of 273 rooms - purchased to date REIT Information 10

Provides Market Access to Ownership of Portfolio Asset Transparency ▪ Public SEC filer ▪ Corporate governance, required to comply with Sarbanes - Oxley Act and Nasdaq Capital Market requirements Liquidity ▪ Ability to buy/sell MDR stock on the Nasdaq Capital Market ▪ MDR stock is listed under the symbol MDRR Dividends Requirement to distribute 90% of its taxable income Publicly – Traded REIT Benefits 11

Asset Overview: MDR’s Prospective and Current Properties

▪ MDR’s first acquisition, Franklin Square is a 134,299 square foot shopping center located in Gastonia, North Carolina, which is in the Charlotte, North Carolina MSA ▪ Current tenants include, Ashley Furniture, Sprint PCS, T - Mobile, 6 other national tenants and 3 local tenants Property Summary Property Name Franklin Square Location Gastonia, NC Property Type Retail Net Rentable SF 134,299 Gross SF 134,299 # Units 22 Occupancy 1 83% Total Purchase Price $20,500,000 Medalist Diversified REIT, Inc. – Franklin Square 1 1 As of December 31, 2020 14

▪ The Greensboro Hampton Inn is a 125 - key hotel strategically located 10 minutes from the Piedmont Triad International Airport that serves The Triangle, encompassing Greensboro, Winston Salem, and High Point, North Carolina ▪ It is also adjacent to several international office parks. This property was the second acquisition by MDR ▪ MDR owns an undivided 78% tenant - in - common interest in the Greensboro Hampton Inn; a third party owns the remaining 22% interest in the Greensboro Hampton Inn ▪ Currently under contract for sale; this potential sale remains subject to various conditions, including the successful completion of the buyer’s due diligence, and there can be no assurance that we will sell this property on the terms or timing we expect, if at all Property Summary Property Name Hampton Inn – Airport Location Greensboro, NC Property Type Hotel # Rooms 125 2020 Occupancy 1 44.4% Purchase Price $15,100,000 Medalist Diversified REIT, Inc. – Hampton Inn 1 1 Average occupancy for 12 months ended December 31, 2020 15

▪ The shops at Hanover Square North is a 73,440 SF retail center located in Mechanicsville, Virginia, which is located within Hanover County, a growth market in the MSA of Richmond, Virginia ▪ Currently occupied by national tenants including Marshalls, Old Navy, Buffalo Wild Wings and the Armed Forces Recruitment Center as well as regional and local tenants ▪ MDR owns an undivided 84% tenant - in - common interest in Hanover Square North; a third party owns the remaining 16% interest in Hanover Square North Property Summary Property Name Hanover Square North Location Mechanicsville, VA Property Type Retail Gross SF 73,440 # Units 12 In - Place Occupancy 1 100% Purchase Price $12,173,000 Medalist Diversified REIT, Inc. – Hanover Square North 1 1 As of December 31, 2020 16

▪ Ashley Plaza is a 160,356 square foot retail center located in Goldsboro, North Carolina, less than an hour from Raleigh, North Carolina, one of the largest cities in the state. It is an attractive shopping center and is situated in the area’s main retail corridor ▪ It is currently occupancy rate is 88.2% and is occupied by tenants such as Hobby Lobby, Planet Fitness, Ashley Home Store, and Harbor Freight Tools as well as some regional and local tenants Property Summary Property Name Ashley Plaza Location Goldsboro, NC Property Type Retail Gross SF 160,356 # Units 14 In - Place Occupancy 1 88.2% Purchase Price $15,200,000 Medalist Diversified REIT, Inc. – Ashley Plaza 1 1 As of December 31, 2020 17

▪ The Clemson Best Western Hotel is a 148 - room hotel located in Clemson, South Carolina, less than a mile from Clemson University. The hotel also includes a restaurant, bar and conference facility. The property was fully renovated in 2017 ▪ Clemson University has over 24,000 students and over 5,000 faculty and staff. ▪ We intend to maximize the use of the restaurant, bar and conference facility to complement the overall revenues generated by the hotel Property Summary Property Name Clemson Best Western Hotel Location Clemson, SC Property Type Hotel # Rooms 148 2020 Occupancy 1 47.2% Purchase Price $9,750,000 Medalist Diversified REIT, Inc. – Clemson Best Western Hotel 1 1 Average occupancy for 12 months ended December 31, 2020 18

▪ Brookfield Center is a 66,000 square foot flex/industrial property located in Greenville, South Carolina. Greenville is one of America’s emerging destinations and fastest growing cities. It is located off I - 85 between Charlotte, North Carolina and Atlanta, Georgia. ▪ The property is occupied by national and regional tenants. Among them are Gravitopia (the largest developer, operator and owner of trampoline parks in the world), ENR (top 100 engineering firm), and Schindler elevator. 74% of the tenants are corporate or have corporate guarantees Property Summary Property Name Brookfield Center Location Greenville, SC Property Type Flex/Industrial Gross SF 66,000 # Units 6 In - Place Occupancy 1 93.8% Purchase Price $6,700,000 Medalist Diversified REIT, Inc. – Brookfield Center 1 1 As of December 31, 2020 19

13 ▪ MDR is under contract to purchase Lancer Center, located in Lancaster, SC ▪ Lancer Center is a 178,626 SF regional grocery - anchored center ▪ Current tenants include KJ’s Market, Badcock Furniture, Big Lots!, and Harbor Freight Tools Property Summary Property Name Lancaster Center Location Lancaster, SC Property Type Retail Gross SF 178,626 # Units 22 Occupancy 1 97% Total Purchase Price $10,100,000 Pending Acquisition Under Contract – Lancer Center 1,2 1 As of January 22, 2021 2 The closing of the acquisition is contingent upon our company obtaining a final, approved and firm commitment for a loan to b e u sed by our company to acquire Lancer center. The potential acquisition remains subject to this financing contingency and various other conditions and there can be no assurance that our co mpany will complete this acquisition on the terms or timing we expect, if at all.

Experienced Management Team Strategy of Opportunistic Investing Market Opportunity Investment Highlights 20

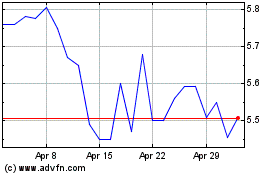

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Apr 2023 to Apr 2024