By Joe Wallace and Paul Vigna

The S&P 500 closed above 4000 for the first time in its

history, setting a record to begin the second quarter.

The broad stock gauge jumped 46.98 points, or 1.2%, to 4019.87,

after closing out a fourth consecutive quarterly advance on

Wednesday. It took just 434 trading days for the index to set its

latest 1,000-point milestone, far fewer than the 1,227 trading it

needed to climb to 3000 from 2000.

The Nasdaq Composite rose 233.23 points, or 1.8%, to 13480.11.

The Dow Jones Industrial Average added 171.66 points, or 0.5%, to

33153.21.

"There's always some excitement starting a new quarter," said

Lindsey Bell, the chief investment strategist at Ally Invest, and

having the S&P cross a milestone is another confidence booster.

She cautioned, however, that the market can get stuck on these

numbers, too. "Lots of times the market has to test that level a

few times before it can go higher."

Many investors are hopeful that stocks will continue to climb in

the second quarter. Their optimism is pegged to the prospect of a

surge in economic growth amid widespread vaccinations, fresh

spending programs from the Biden administration and earnings

expectations. Still, they point to risks stemming from rising bond

yields, new lockdowns in Europe and signs of excess in corners of

the market.

Over the past year, stocks have risen sharply in expectation of

an economic rebound, said Shawn Snyder, a strategist at Citi U.S.

Wealth Management. Now that it appears to be here, investors have

"Covid jitters," he said, looking warily at inflation expectations

and, ultimately, a reversal of Federal Reserve policy.

"We're exiting this Goldilocks situation [for stocks] and

wondering if the porridge is too hot," he said.

Some are questioning whether this year's rotation out of

technology stocks and into economically sensitive sectors like

banks and energy has gone too far. Having powered the broad market

higher in 2020, the rally in tech stocks slowed in the first

quarter as investors bought into companies that stood to benefit

from the economic rebound.

That thinking was evident Thursday.

"We are entering a period of time when there is a bit more risk,

and for that I want to have a more balanced approach," said Lars

Skovgaard Andersen, investment strategist at Danske Bank Wealth

Management. Mr. Andersen said he thinks information-technology

stocks such as Microsoft and Salesforce.com would provide a cushion

if cyclical stocks lose momentum.

Despite the sector rotation in the stock market this year, tech

stocks were the biggest drivers of the S&P 500's latest

1,000-point milestone. Five stocks -- Apple, Microsoft, Amazon.com,

Facebook and Alphabet -- contributed 44% of the gains, according to

S&P Dow Jones Indices.

On the economic front, new claims for jobless benefits edged up

to 719,000 last week from 658,000 the previous week, data from the

Labor Department showed. Economists had expected unemployment

claims -- a proxy for layoffs -- to decline. The figures are

closely followed by investors seeking to gauge the pace of the

economic rebound.

Although U.S. investors will also been eager to see the March

payrolls report Friday morning, they won't be able to trade on the

data until Monday, as the equities markets will be closed for Good

Friday.

The Institute for Supply Management's March survey of purchasing

managers at U.S. factories was better than expected, showing

another solid month for new orders, output and employment. The

March PMI came in at 64.7, higher than the projected 61.7.

That is another welcome sign for the economy. On Wednesday,

President Biden unveiled a $2.3 trillion infrastructure plan

centered on fixing roads and bridges, expanding broadband internet

access and boosting funding for research and development.

Semiconductor producers and others stand to benefit from President

Biden's infrastructure package, Mr. Andersen said.

In corporate news, shares of Micron Technology rose $4.20, or

4.8%, to $92.41 after The Wall Street Journal reported that the

memory-chip maker was exploring a potential deal for Japan's

Kioxia. Western Digital -- which the Journal also reported to be

circling the Japanese semiconductor company -- gained $4.62, or

6.9%, to $71.37

The yield on 10-year Treasury notes slipped to 1.680% from

1.749% Wednesday, its largest one-day drop since November. Yields

posted their biggest one-quarter rise since 2016 in the first three

months of the year, unsettling tech stocks whose valuations had

been plumped up by low interest rates.

Thursday's moves bolstered investors who think yields are

unlikely to keep rising at the same pace.

"The bond market has adjusted now and is at the level

appropriate for the coming inflation," said Hans Peterson, global

head of asset allocation at SEB Investment Management. "Bond

volatility is going down, which is part of feeling more confident

in seeing the opportunity in growth stocks."

Oil prices rose after the Organization of the Petroleum

Exporting Countries and a group of other big producers led by

Russia agreed Thursday to add about 350,000 barrels a day in

production, with more loosening later this year.

U.S. crude rose 3.9% to $61.45. Analysts expected the cartel to

keep output cuts in place to bolster the oil market after a recent

slide in prices.

In overseas markets, the Stoxx Europe 600 rose 0.6%, led by tech

and real-estate stocks. China's Shanghai Composite Index and

Japan's Nikkei 225 both rose 0.7%.

Write to Joe Wallace at Joe.Wallace@wsj.com and Paul Vigna at

paul.vigna@wsj.com

(END) Dow Jones Newswires

April 01, 2021 16:58 ET (20:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

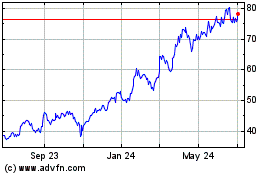

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

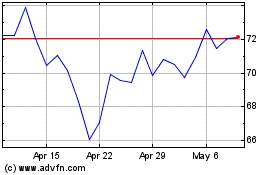

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024