Tech Shares Lead Major Indexes Higher Again

April 01 2021 - 12:02PM

Dow Jones News

By Joe Wallace and Paul Vigna

U.S. stocks resumed a familiar pattern Thursday, with tech

shares rising sharply and outpacing the rest of the market.

The Nasdaq Composite rose 1.4%, following a 1.5% gain on

Wednesday. The S&P 500 was up 0.8%, after the broad stocks

gauge closed out a fourth consecutive quarterly advance on

Wednesday, while the Dow Jones Industrial Average was up 0.4%.

Many investors are hopeful that stocks will continue to climb in

the second quarter. Their optimism is pegged to the prospect of a

surge in economic growth amid widespread vaccinations, fresh

spending programs from the Biden administration and earnings

expectations. Still, they point to risks stemming from rising bond

yields, new lockdowns in Europe and signs of excess in corners of

the market.

A year ago stocks rose sharply in expectation of an economic

rebound, said Shawn Snyder, a strategist at Citi U.S. Wealth

Management. Now that it appears to be here, investors have "Covid

jitters," he said, looking warily at inflation expectations and,

ultimately, a reversal of Federal Reserve policy.

"We're exiting this Goldilocks situation [for stocks] and

wondering if the porridge is too hot," he said.

Some are questioning whether this year's rotation out of

technology stocks and into economically sensitive sectors like

banks and energy has gone too far. Having powered the broad market

higher in 2020, the rally in tech stocks slowed in the first

quarter as investors bought into companies that stood to benefit

from the economic rebound.

That thinking was evident Thursday morning.

"We are entering a period of time when there is a bit more risk,

and for that I want to have a more balanced approach," said Lars

Skovgaard Andersen, investment strategist at Danske Bank Wealth

Management. Mr. Andersen thinks information-technology stocks such

as Microsoft and Salesforce.com would provide a cushion if cyclical

stocks lose momentum.

On the economic front, new claims for jobless benefits edged up

to 719,000 last week from 658,000 the previous week, data from the

Labor Department showed. Economists had expected unemployment

claims -- a proxy for layoffs -- to decline. The figures are

closely followed by investors seeking to gauge the pace of the

economic rebound.

The Institute for Supply Management's March survey of purchasing

managers at U.S. factories was better than expected, showing

another solid month for new orders, output and employment. The

March PMI came in at 64.7, higher than the projected 61.7.

That is another welcome sign for the economy. On Wednesday,

President Biden unveiled a $2.3 trillion infrastructure plan

centered on fixing roads and bridges, expanding broadband internet

access and boosting funding for research and development.

Semiconductor producers and others stand to benefit from President

Biden's infrastructure package, Mr. Anderson said.

Shares of electric vehicle makers got a boost Thursday, with

Tesla, Nikola and Materialise rising.

In corporate news, shares of Micron Technology rose 5% after The

Wall Street Journal reported that the memory-chip maker was

exploring a potential deal for Japan's Kioxia. Western Digital --

which the Journal also reported to be circling the Japanese

semiconductor company -- gained 4.8%.

The yield on 10-year Treasury notes slipped to 1.679% from

1.749% Wednesday. Yields posted their biggest one-quarter rise

since 2016 in the first three months of the year, unsettling tech

stocks whose valuations had been plumped up by low interest

rates.

Thursday's moves bolstered investors who think yields are

unlikely to keep rising at the same pace.

"The bond market has adjusted now and is at the level

appropriate for the coming inflation," said Hans Peterson, global

head of asset allocation at SEB Investment Management. "Bond

volatility is going down, which is part of feeling more confident

in seeing the opportunity in growth stocks."

Oil prices wavered after a meeting of ministers from members of

the Organization of the Petroleum Exporting Countries and its

partners, led by Russia, got under way. U.S. crude rose 0.8% to

$59.68. Analysts expect the cartel to keep significant output cuts

in place to bolster the oil market after a recent slide in

prices.

In overseas markets, the Stoxx Europe 600 rose 0.6%, led by tech

and real-estate stocks. Moving in the other direction, shares of

Atos slid 13% after the French IT company said its auditors had

found issues that caused accounting errors at two U.S.

subsidiaries.

China's Shanghai Composite Index and Japan's Nikkei 225 both

rose 0.7%.

Write to Joe Wallace at Joe.Wallace@wsj.com and Paul Vigna at

paul.vigna@wsj.com

(END) Dow Jones Newswires

April 01, 2021 11:47 ET (15:47 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

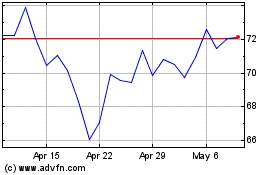

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

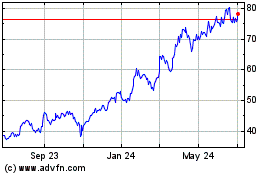

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024