Newmont Corp. Executes Sustainability-Linked Revolving Credit Facility

March 30 2021 - 7:09PM

Dow Jones News

By Stephen Nakrosis

Newmont Corp. on Tuesday said it executed a $3 billion

sustainability-linked revolving credit facility which "includes a

pricing feature based upon third-party sustainability performance

measures and includes overall improved pricing from the previous

facility."

The mining company said it will incur positive or negative

pricing adjustments on drawn balances, "based on certain

sustainability performance criteria," which will be measured

through independent ratings published by MSCI and S&P

Global.

Tom Palmer, the company's president and chief executive, said,

"Our sustainability-linked credit facility further demonstrates

Newmont's unwavering commitment to industry-leading environmental,

social and governance practices." He added, "By aligning our

financial performance and our ESG performance, we are holding

ourselves accountable to delivering on our purpose to create value

and improve lives through responsible and sustainable mining."

The new credit facility expires in March 2026, Newmont said.

--Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

March 30, 2021 18:54 ET (22:54 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

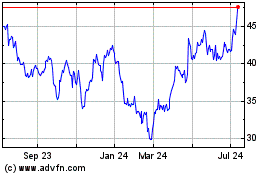

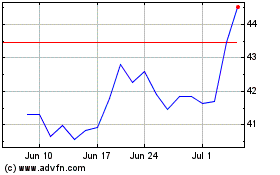

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024