NetworkNewsWire

Editorial Coverage: Identifying and staying in front of market

trends and emerging sectors has always been a challenge for

everyone from “big money” to the retail investor. Two of the most

bullish market segments in the last couple years have been

cryptocurrency and telehealth, both with tailwinds that were fanned

by the pandemic to accelerate consumer adoption and magnified

market awareness. Institutional money has been pouring into each,

further adding to the momentum and validating investment

theses. It’s difficult to get exposure to both from a single

company, but diversification is the mantra of ISW Holdings

Inc. (OTC: ISWH) (Profile), which has

been actively growing its portfolio in both cryptocurrency and

healthcare, which complements its logistics and supply chain

management division. There are only a select few public companies

that offer such diverse opportunity under one umbrella. CleanSpark Inc. (NASDAQ: CLSK)

operates in software and technology in addition to its Bitcoin

mining fleet. Others have diversified outside crypto such as

Marathon Digital

Holdings Inc. (NASDAQ: MARA), HIVE

Blockchain Technologies Ltd (OTCQX: HVBTF) and

Canaan Inc.

(NASDAQ: CAN).

- Cryptocurrency market forecast to reach $5.2 billion by 2026

while at-home healthcare market rises to $515.6 billion by

2027.

- ISW Holdings recently tripled its cryptocurrency mining

capacity with second and third Proceso POD5IVE datacenters.

- The company just launched TeleCare Home Health subsidiary,

filling a void in the telehealth industry, and upped revenue share

in a JV with Paradigm Home Health.

- ISWH is negotiating an acquisition that will deepen its

footprint in the telehealth market by addressing unmet need in

autism care.

Click here to view

the custom infographic of the ISWH editorial.

Bitcoin & Telehealth: The Places to Be

A look at the numbers quickly ferrets out why Bitcoin keeps

appreciating in value. There are about 18.7 million Bitcoin in

circulation out of the total of only 21 million that will ever be

released. According to Glassnode, an analysis firm that tracks

blockchain data, there are actually only about four million Bitcoin

freely circulating, and the number is shrinking as people hold on

tightly. With the Bitcoin supply chain drying up, Glassnode

believes a massive short

squeeze could be in the works because there is only so much to

go around. Bobby Lee, CEO of crypto wallet company Ballet, sees

2021 as the continuation of the bull cycle for Bitcoin, which he

thinks could reach $100,000 this summer and $300,000 by

the end of the year. John Willock, CEO at digital-asset exchange

Blocktane, sees institutional

investors only buying “clean” tokens from reputable exchanges

such as Coinbase Pro against the backdrop of a supply shortfall as

a driver undergirding further upside for Bitcoin prices.

As noted on Crunchbase,

venture capital has also broken the mold with its new patterns

investing in telehealth. In short, VCs can’t get enough, making

big investments

at all stages of development across the complete market spectrum

from postcard urine tests to digital health clinics. Anyone that

didn’t recognize the trend towards healthcare from the home got a

to see it on full display during the COVID-19 pandemic that saw

more people than ever before, including seniors,

seeing a doctor from their kitchen table.

Relevant Nascency, Unique Approach

For global brand management company ISW Holdings

Inc. (OTC: ISWH), these are two attractive markets due to their

relative nascency, yet incredible scale and disruptive nature. Las

Vegas-based ISW Holdings has taken a unique approach to

cryptocurrency through mining operations and turnkey mining

solutions, aligning the company for a durable footprint in a global

cryptocurrency market that Facts and Factors forecasts to

reach $5.2 billion by

2026.

In the home healthcare space, ISW Holdings just launched a new

wholly owned subsidiary branded TeleCare Home Health, LLC. TeleCare

fits into the company’s health and wellness unit that also includes

cannabidiol (CBD) wellness products. The launch of TeleCare

positions ISW Holdings to penetrate the global home healthcare

market currently valued around $300 billion and expected by Grand

View Research to reach $515.6 billion

by 2027.

Coming at Crypto Two Ways

ISW Holdings has expertise in guiding its companies through

critical stages of market development, which includes

conceptualization, go-to-market strategies, engineering, product

integration, and distribution efficiency. This model means

leveraging a network of partners in order to achieve goals,

including operating the lowest-energy-cost Bitcoin mining

facilities at scale in America. This is accomplished through

strategic partnerships with industry leaders and through securing

advantageous power purchase agreements in the top 10 markets.

In the turnkey facility space, the name to know is ISW’s partner

Bit5ive. ISW is on the cusp of energizing its initial Proceso

POD5IVE crypto mining unit and earlier this month tripled its fleet

by adding two new mining datacenters to its fleet. The

state-of-the-art pods include hundreds of high-performance mining

rigs and are environmentally friendly facilities utilizing

renewable energy resources for efficient electricity and lower

operational costs compared to traditional utilities. Going forward,

ISW will not only mine cryptocurrency from its own 8’ x 40’ pods,

but also sell the POD5IVE as a turnkey solution at a price of

$168,000 each.

TeleCare Launched, JV Deal Reworked

For its healthcare division, the company, in the words of ISWH

president and chairman Alonzo Pierce, is proceeding “full-steam

ahead” in filling gaps where digital healthcare meets the home

setting. The company is addressing a major barrier to entry holding

back mainstream adoption post-coronavirus by enabling continuity of

care beyond the virtual visit. The aging population embraced remote

technology as a means to be able to see their doctors from the

safety of home, but the process is not comprehensive without

requisite follow up at-home care, which is the strength of the

newly launched TeleCare Home Health division.

Teleare is making efficient use of its resources while it awaits

Medicare/Medicaid accreditation, including hiring a full-time

director of nursing and reaching the qualifying number of patients.

The company has also restructured the relationship with its

telehealth and home healthcare joint venture partner, Paradigm Home

Health. Per the new deal, ISW will book 70% of all sales from the

joint venture, up from the 50% ISW had been receiving.

Polishing the Edges

Concurrent with the positive developments with the Proceso

POD5IVE datacenters and TeleCare, ISW Holdings is reviewing the

books to build and store value. More precisely, the company

negotiated the cancellation of a looming convertible note that

strengthened the balance sheet and preserved shareholders

value.

The company also recently teased that it is evaluating a

potential acquisition that would further widen ISW’s footprint in

telehealth by serving the autism community, particularly rural and

disadvantaged populations. According to Marketresearchfuture.com,

the autism services market is estimated to generate approximately

$7.05 billion in revenue annually by 2023. With negotiations still

in the early stages, the company couldn’t provide much more clarity

on the opportunity just yet.

The Amalgamation of Technology

Seems like most investors want some level of exposure to

cryptocurrency and there are different ways to achieve this. The

most straight forward path is obviously buying Bitcoin or any other

of the thousands of digital coins and tokens available today, but

self-directed investors might want to take cues from institutions

and stick to only reputable exchanges. There are also a bevy of

companies that have their business entrenched in cryptos that can

provide upside and other pathways such as funds and diversified

public companies that spread risk across multiple assets.

CleanSpark Inc.

(NASDAQ: CLSK) is in the business of providing advanced

software, controls and technology solutions to solve modern energy

challenges, offering a suite of products that provides end-to-end

microgrid energy modeling, energy market communications, and energy

management solutions. While primarily billed as a software and

controls technology company, CleanSpark

actually generated one-third of its $2.25 million in revenue during

the fourth quarter of 2020 from its Bitcoin mining subsidiaries in

Atlanta, Georgia.

Marathon Digital

Holdings Inc. (NASDAQ: MARA) is one of the largest enterprise

Bitcoin self-mining companies in North America. Marathon operates a proprietary datacenter in

Hardin, Montana with maximum power capacity of 105 Megawatts and

also owns 2,060 advanced ASIC (application-specific integrated

circuit) Bitcoin Miners at a co-hosted facility in North Dakota.

Once fully deployed, Marathon’s mining fleet will consist of more

than 103,000 miners capable of producing 10.36 EH/, or 10.36

quintillion hashes per second.

HIVE Blockchain

Technologies Ltd (OTCQX: HVBTF) owns state-of-the-art, green

energy-powered datacenter facilities in Canada, Sweden and Iceland,

which produce newly minted digital currencies such as Bitcoin and

Ethereum continuously on the cloud. HIVE’s deployments provide shareholders with

exposure to the operating margins of digital currency mining as

well as a portfolio of crypto coins. On March 25, the company

disclosed a share swap with DeFi Technologies for the purpose of

partnering for the purpose of creating a partnership surrounding

the decentralized finance ecosystem with specific applications

around Ethereum and Miner Extractable Value.

Canaan Inc.

(NASDAQ: CAN), a leading provider of supercomputing solutions,

is renown in crypto circles globally for inventing the world’s

first ASIC-powered Bitcoin mining machine in 2013, radically

catalyzing the growth of a computationally advanced Bitcoin mining

sector. Today, the company remains distinguished for superior

cost-efficiencies and performance while pushing the limits of

today’s computing hardware. Last month, Canaan supplied 6,000 of its A1246 AvalonMiners to

Core Scientific.

Cryptocurrencies and telehealth aren’t hot sectors for no

reason. They’re paradigm shifting, re-shaping the financial and

healthcare markets. It’s no wonder that so-called “smart” money

(read as institutions, funds, family offices, etc.) are

aggressively targeting these industries for what they mean today,

tomorrow and years down the road.

For more information about ISW Holdings Inc., please visit

ISW

Holdings.

About NetworkNewsWire

NetworkNewsWire

(“NNW”) is a financial news and content distribution company, one

of 50+ brands within the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to

reach all target markets, industries and demographics in the most

effective manner possible; (2) article and

editorial syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

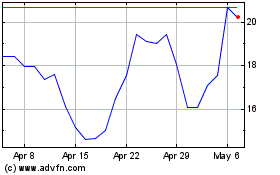

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024