Current Report Filing (8-k)

March 26 2021 - 11:14AM

Edgar (US Regulatory)

PILGRIMS PRIDE CORP0000802481false00008024812021-03-242021-03-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 24, 2021

PILGRIM'S PRIDE CORPORATION

(Exact Name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

1-9273

|

75-1285071

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

1770 Promontory Circle

|

|

80634-9038

|

|

Greeley

|

CO

|

|

(Zip Code)

|

|

(Address of principal executive offices)

|

|

|

|

Registrant's telephone number, including area code: (970) 506-8000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of Exchange on Which Registered

|

|

Common Stock, Par Value $0.01

|

|

PPC

|

|

The Nasdaq Stock Market LLC

|

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 24, 2021, Ajay Menon was appointed to the Board of Directors (the “Board”) of Pilgrim’s Pride Corporation (the “Company”), effectively immediately, to fill the vacancy left on the Board following the passing of longtime Board member Charles Macaluso. Mr. Menon, who will serve as an Equity Director on the Board and as a member of the Equity Nominating Committee, will be nominated for election by our stockholders at the 2021 Annual Meeting of Stockholders.

Mr. Menon is currently the President and CEO of Colorado State University Research Foundation (“CSURF”), and has been in this role since October 2019, where he is responsible for the protection, management and commercialization of intellectual property resulting from research at Colorado State University (“CSU”) and oversees the services that CSURF provides to both CSU and its affiliated institutions. He is also a current board member of Liberty Media Acquisition Company, a newly incorporated company formed for the purpose of effecting business combinations with one or more businesses. Mr. Menon served as Dean at CSU Colleges of Agricultural Sciences from July 2015 to October 2019 and Business from July 2002 to June 2015. In both these roles, he served as the chief administrative and academic officer shaping each College’s strategic direction, academic programs, budgets, and external relationships. He served as Colorado’s first Chief Innovation Officer under then-Governor John Hickenlooper from November 2011 to August 2013, where he helped established and lead the Colorado Innovation Network to develop an ecosystem that cultivates entrepreneurial and innovative activities. Mr. Menon holds a Ph.D. in Marketing and joined CSU in 1991 as a member of the Marketing Department faculty.

Mr. Menon will receive the standard director compensation arrangement for service on the Board received by our non-employee directors and disclosed in our annual meeting proxy statement.

Also on March 24, 2021, the Board approved a compensation package and certain equity grants for Matthew Galvanoni, the Company’s Chief Financial Officer. The Board approved a compensation package for Mr. Galvanoni that includes (i) a base salary of $500,000, (ii) after 60 days of employment, eligibility to participate in the Company’s benefits programs including group medical, vision and dental plans, life and long-term disability insurance and a 401(k) plan; (iii) a homeowner relocation package through CARTUS relocation services; (iv) eligibility to participate in the Company’s annual incentive program with an individual annual bonus target equal to 100% of base salary and a maximum payment of 200% of base salary, with such bonus pro-rated for any partial year of service; and (v) reimbursement for 60 days of COBRA premiums incurred by Mr. Galvanoni prior to his becoming a participant in the Company’s group health plans. In the event that Mr. Galvanoni voluntarily resigns his employment or is terminated for cause before the second anniversary of the commencement of his employment, he will be required to repay the relocation package and COBRA reimbursement amounts described above. As part of the compensation package, the Board also approved two grants of equity to Mr. Galvanoni:

a.a grant of fully vested shares of the Company on April 1, 2021 equal to the number of shares with a fair market value of $200,000 on the date of grant; and

b.a grant of performance vesting awards under the Company’s 2021 Long-Term Incentive Program equal to 27,350 performance stock units at target, with a maximum award size of 200% of target. Following a performance period ending December 26, 2021, the RSUs earned based on 2021 performance will vest over a three-year service period and settle on each of December 31, 2022, December 31, 2023 and December 31, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PILGRIM’S PRIDE CORPORATION

|

|

|

|

|

|

|

Date:

|

March 26, 2021

|

|

/s/ Fabio Sandri

|

|

|

|

|

Fabio Sandri

|

|

|

|

|

President and Chief Executive Officer

|

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

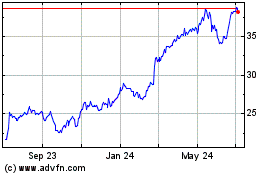

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Apr 2023 to Apr 2024