- Avenova® unit sales set record for second consecutive

quarter

- Net product revenue increased 51% for 2020

- Exited 2020 with $12.0 million in cash and equivalents

- Avenova access expanded to CVS stores and CVS online

Conference call begins at 4:30 p.m. Eastern

time today

NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) reports

financial results for the three and twelve months ended December

31, 2020 and provides a business update.

“Avenova unit sales for the fourth quarter reached a new record,

driven primarily by online orders as well as through our physician

dispensed channel,” said Justin Hall, President and CEO of NovaBay

Pharmaceuticals. “Product revenue for the fourth quarter increased

10% over the prior year quarter. For the full year 2020, product

revenue grew an impressive 51%, which included tapping our

international health supply network early in the pandemic to sell

personal protection equipment (PPE) while critically important

product was in short supply.

“Our focus in 2021 is on growing sales of Avenova and CelleRx®

Clinical Reset™, a breakthrough product in the beauty market, which

we launched late last year,” he added. “This year we have already

expanded access to Avenova, which is being rolled out to CVS stores

across the U.S. and was recently made available on CVS.com. We also

are introducing new digital marketing programs for Avenova and

CelleRx Clinical Reset that combine innovative storytelling through

multiple social channels, with real-time analytics, reporting and

optimization.

“Through various actions we took last year, we strengthened and

simplified our balance sheet, reduced our cash burn, raised

operating capital and eliminated all major debt instruments. As a

result, we believe our funds are sufficient to support current

operations into 2022, including our new digital marketing

programs,” Mr. Hall added. “In addition to organic growth, we

continue to evaluate opportunities for revenue accretion through

acquisition or licensing of ophthalmic and skincare products to

expand our presence in these key markets.”

Fourth Quarter Financial Results

Net product revenue for the fourth quarter of 2020 was $1.9

million, a 10% increase from $1.7 million for the fourth quarter of

2019. Avenova revenue for the fourth quarter of 2020 was $1.5

million compared with $1.7 million for the fourth quarter of 2019.

The decrease reflects a $0.4 million increase in a reserve for

expired prescription product returns. Net product revenue for the

fourth quarter of 2020 included $0.4 million in sales of

NeutroPhase®, with no comparable revenue in the prior-year

period.

Gross margin on total sales, net, was 57% for the fourth quarter

of 2020, compared with 65% for the fourth quarter of 2019, with the

decrease primarily due to the increase in the returns reserve.

Operating expenses for the fourth quarter of 2020 were $2.8

million, compared with $3.3 million for the fourth quarter of 2019.

Sales and marketing expenses for the fourth quarter of 2020 were

$1.5 million, compared with $2.2 million for the fourth quarter of

2019, with the decrease primarily due to lower headcount of sales

representatives in the 2020 period and lower travel and related

expenses due to the impact of COVID-19, partially offset by an

increase in Avenova digital advertising and costs associated with

the Company’s relaunch of CelleRx Clinical Reset. General and

administrative (“G&A”) expenses for the fourth quarter of 2020

were $1.3 million, up slightly from $1.2 million for the fourth

quarter of 2019. Research and development (“R&D”) expenses for

the fourth quarter of 2020 were $36 thousand, compared with $18

thousand for the fourth quarter of 2019.

Operating loss for the fourth quarter of 2020 was $1.8 million,

compared with an operating loss of $2.2 million for the fourth

quarter of 2019.

Non-cash gain on the change of fair value of warrant liability

for the fourth quarter of 2020 was $8 thousand, compared with a

non-cash loss of $0.2 million for the fourth quarter of 2019. As of

the end of 2020, the Company no longer held any warrants that will

be adjusted to fair value in future periods.

Other expense, net, for the fourth quarter of 2019 was $0.3

million, which was due primarily to interest expense recognized on

a convertible note. There was no comparable charge in the fourth

quarter of 2020 as the convertible note was settled prior to the

end of the third quarter of 2020.

The net loss attributable to common stockholders for the fourth

quarter of 2020 was $1.8 million, or $0.04 per share, compared with

a net loss attributable to common stockholders for the fourth

quarter of 2019 of $3.5 million, or $0.13 per share.

Full Year Financial Results

Net product revenue for 2020 was $9.9 million, a 51% increase

from $6.6 million for 2019. Gross margin on net product revenue for

2020 was 60%, compared with 74% for 2019.

For 2020, sales and marketing expenses decreased 30% to $6.2

million and G&A expenses increased 12% to $5.9 million. R&D

expenses were $0.3 million for 2020 compared with $0.2 million for

2019.

Operating loss for 2020 was $6.4 million, a 32% improvement from

the operating loss of $9.4 million for 2019.

Non-cash loss on the change of fair value of warrant liability

for 2020 was $5.2 million, compared with a non-cash gain of $0.7

million for 2019.

Non-cash gain from adjustments to the fair value of an embedded

derivative liability for 2020 was $3 thousand, compared with $0.4

million for 2019. The embedded derivative liability was related to

a convertible note which was fully settled in September 2020.

Other income, net, for 2020 was $0.6 million, compared with

other expense, net, for 2019 of $1.4 million.

The net loss attributable to common stockholders for 2020 was

$11.0 million, or $0.31 per share, compared with a net loss

attributable to common stockholders for 2019 of $10.5 million, or

$0.48 per share.

NovaBay reported cash and cash equivalents of $12.0 million as

of December 31, 2020, compared with $6.9 million as of December 31,

2019. The Company raised net proceeds of $5.2 million from the sale

of common stock through an ATM agreement during the quarter ended

June 30, 2020 and $6.4 million from the renegotiation of warrants

during the quarter ended September 30, 2020.

Conference Call

NovaBay management will host an investment community conference

call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) to discuss the Company’s financial and operational results

and to answer questions. Shareholders and other interested parties

may participate in the conference call by dialing 866-777-2509 from

within the U.S. or 412-317-5413 from outside the U.S., and

requesting the NovaBay Pharmaceuticals call.

A live webcast of the call will be available at

http://novabay.com/investors/events and will be archived for 90

days. A replay of the call will be available beginning two hours

after the call ends through April 15, 2021 by dialing 877-344-7529

from within the U.S., 855-669-9658 from Canada, or 412-317-0088

from outside the U.S., and entering the conference identification

number 10152832.

About NovaBay Pharmaceuticals, Inc.: Going Beyond

Antibiotics®

NovaBay Pharmaceuticals, Inc. is a biopharmaceutical company

focusing on high-quality, differentiated, anti-infective consumer

products: Avenova®, the premier antimicrobial lid and lash spray,

CelleRx® Clinical Reset™, a breakthrough product in the beauty

category, and NeutroPhase® Skin and Wound Cleanser for wound

healing. NovaBay’s products are formulated with its patented, pure,

stable, pharmaceutical grade hypochlorous acid that replicates the

antimicrobial chemicals used by white blood cells to fight

infection. NovaBay’s hypochlorous acid products do not cause

stinging or irritation, are non-toxic and non-sensitizing, making

them completely safe for regular use. Avenova is the only

commercial hypochlorous acid lid and lash spray product clinically

proven to reduce bacterial load on ocular skin surfaces, thus

effectively addressing the underlying cause of bacterial dry

eye.

Forward-Looking Statements

Except for historical information herein, matters set forth in

this press release are forward-looking within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995, including statements about the commercial

progress and future financial performance of NovaBay

Pharmaceuticals, Inc. This release contains forward-looking

statements that are based upon management’s current expectations,

assumptions, estimates, projections and beliefs. These statements

include, but are not limited to, statements regarding our business

strategies and current product offerings, potential future product

offerings, expanded access to our products, possible regulatory

clearance of any of our products or future products, and any future

revenue that may result from selling these products, as well as

generally the Company’s expected future financial results. These

forward-looking statements are identified by the use of words such

as “launch,” “grow,” “expand,” and “continue,” among others. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or achievements to be

materially different and adverse from those expressed in or implied

by the forward-looking statements. Factors that might cause or

contribute to such differences include, but are not limited to,

risks and uncertainties relating to the size of the potential

market for our products, the possibility that the available market

for the Company’s products will not be as large as expected, the

Company’s products will not be able to penetrate one or more

targeted markets, and revenues will not be sufficient to meet the

Company’s cash needs. Other risks relating to NovaBay’s business,

including risks that could cause results to differ materially from

those projected in the forward-looking statements in this press

release, are detailed in NovaBay’s latest Form 10-Q/K filings with

the Securities and Exchange Commission, especially under the

heading “Risk Factors.” The forward-looking statements in this

release speak only as of this date, and NovaBay disclaims any

intent or obligation to revise or update publicly any

forward-looking statement except as required by law.

Socialize and Stay informed on

NovaBay’s progress

Like us on Facebook Follow us on Twitter Connect with NovaBay on

LinkedIn Visit NovaBay’s Website

Avenova Purchasing

Information

For NovaBay Avenova purchasing information: Please call

800-890-0329 or email sales@avenova.com. Avenova.com

CelleRx Clinical Reset Purchasing

Information

For NovaBay CelleRx Clinical Reset purchasing information Please

call 877-CELLERX www.CelleRx.com

Financial tables to follow

NOVABAY PHARMACEUTICALS,

INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands except par value

amounts)

December

31,

December

31,

2020

2019

ASSETS

Current assets:

Cash and cash equivalents

$

11,952

$

6,937

Accounts receivable, net of allowance for

doubtful accounts ($0 and $51 at December 31, 2020 and December 31,

2019, respectively)

1,106

1,066

Inventory, net of allowance for excess and

obsolete inventory and lower of cost or estimated net realizable

value adjustments ($236 and $247 at December 31, 2020 and December

31, 2019, respectively)

608

492

Prepaid expenses and other current

assets

576

886

Total current assets

14,242

9,381

Operating lease right-of-use assets

436

1,252

Property and equipment, net

84

110

Other assets

476

477

TOTAL ASSETS

$

15,238

$

11,220

LIABILITIES AND STOCKHOLDERS'

EQUITY

Liabilities:

Current liabilities:

Accounts payable

$

302

$

331

Accrued liabilities

2,115

1,778

Operating lease liabilities

416

930

Note payable, related party

—

1,202

Convertible note

—

1,409

Embedded derivative liability

—

3

Warrant liability

—

34

Total current liabilities

2,833

5,687

Operating lease

liabilities-non-current

87

505

Warrant liability

—

4,055

Total liabilities

2,920

10,247

Stockholders' equity:

Preferred stock: 5,000 shares authorized;

none outstanding at December 31, 2020 and December 31, 2019

—

—

Common stock, $0.01 par value; 75,000 and

50,000 shares authorized, 41,782 and 27,938 shares issued and

outstanding at December 31, 2020 and December 31, 2019,

respectively

418

279

Additional paid-in capital

147,963

125,718

Accumulated deficit

(136,063

)

(125,024

)

Total stockholders' equity

12,318

973

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

15,238

$

11,220

NOVABAY PHARMACEUTICALS,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(in thousands except per share

data)

Three Months Ended

December 31,

Year Ended December

31,

2020

2019

2020

2019

Sales:

Product revenue, net

$

1,878

$

1,702

$

9,916

$

6,556

Other revenue, net

10

2

18

43

Total sales, net

1,888

1,704

9,934

6,599

Cost of goods sold

813

593

3,970

1,738

Gross profit

1,075

1,111

5,964

4,861

Research and development

36

18

285

184

Sales and marketing

1,498

2,157

6,173

8,767

General and administrative

1,299

1,174

5,932

5,310

Total operating expenses

2,833

3,349

12,390

14,261

Operating loss

(1,758

)

(2,238

)

(6,426

)

(9,400

)

Non-cash gain (loss) on changes in fair

value of warrant liability

8

(187

)

(5,216

)

749

Non-cash gain on changes in fair value of

embedded derivative liability

—

1

3

424

Other (expense) income, net

—

(259

)

605

(1,425

)

Loss before provision for income taxes

(1,750

)

(2,683

)

(11,034

)

(9,652

)

Provision for income taxes

(4

)

(3

)

(5

)

(6

)

Net loss and comprehensive loss

$

(1,754

)

$

(2,686

)

$

(11,039

)

$

(9,658

)

Less: Preferred deemed dividend

—

800

—

800

Less: Retained earnings reduction related

to warrants down round feature triggered

—

—

—

29

Net loss attributable to common

stockholders

$

(1,754

)

$

(3,486

)

$

(11,039

)

$

(10,487

)

Net loss per share attributable to common

stockholders (basic)

$

(0.04

)

$

(0.13

)

$

(0.31

)

$

(0.48

)

Net loss per share attributable to common

stockholders (diluted)

$

(0.04

)

$

(0.13

)

$

(0.31

)

$

(0.48

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock

(basic)

41,776

27,630

35,076

21,641

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock

(diluted)

41,776

27,630

35,076

21,641

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210325005736/en/

NovaBay Contact Justin Hall

Chief Executive Officer and General Counsel 510-899-8800

jhall@novabay.com

Investor Contact LHA

Investor Relations Jody Cain 310-691-7100 jcain@lhai.com

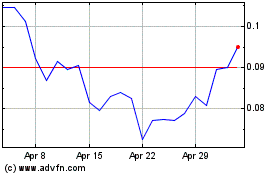

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Apr 2023 to Apr 2024