UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section

14(c) of

the Securities Exchange Act of 1934

Check the appropriate box:

|

☒

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☐

|

Definitive Information Statement

|

|

TD Holdings, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate

box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

THIS INFORMATION STATEMENT IS BEING PROVIDED

TO

YOU BY THE BOARD OF DIRECTORS OF TD HOLDINGS,

INC.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE

REQUESTED NOT TO

SEND US A PROXY

TD

Holdings, Inc.

25th Floor, Block C, Tairan Building

No. 31 Tairan 8th Road, Futian District

Shenzhen, Guangdong, PRC 518000

INFORMATION STATEMENT

(Preliminary)

March 15, 2021

NOTICE OF STOCKHOLDER ACTION BY WRITTEN

CONSENT

GENERAL INFORMATION

To the Holders of Common Stock of TD Holdings,

Inc.:

We are furnishing this

Information Statement to the stockholders of TD Holdings, Inc., a Delaware corporation (the “Company”, “we”,

“us” or “GLG”), under Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and Delaware law. This Information Statement advises the Company’s stockholders of actions taken and approved

on March 10, 2021, by unanimous written consent of the Company’s Board of Directors and the subsequent adoption of such corporate

action by the holders a majority of the Company’s outstanding shares of Common Stock (the “Majority Stockholders”),

to amend the Company’s Articles of Incorporation, as amended (the “Amendment”) to increase the total number of

authorized shares of common stock, par value $0.001 per share (the “Common Stock”) of the Company from 100,000,000

shares to 600,000,000 shares (the “Share Increase”).

STOCKHOLDERS ARE

NOT BEING ASKED FOR PROXIES TO VOTE THEIR SHARES WITH RESPECT TO THE AMENDMENT AND THE SHARE INCREASE. NO PROXY CARD HAS BEEN ENCLOSED

WITH THIS INFORMATION STATEMENT AND NO MEETING OF STOCKHOLDERS WILL BE HELD TO CONSIDER THE SHARE INCREASE.

The Share Increase

will not become effective until the filing with the Secretary of State of Delaware the Certificate of Amendment of Certificate

of Incorporation of the Company, as amended at least 20 days after the date of the mailing of this Information Statement to the

Company’s stockholders.

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement

contains a description of the Share Increase. We encourage you to read the Information Statement, including Appendix A, thoroughly.

It describes the essential terms of the action to be taken. Additional information about the Company is contained in its reports

filed with or furnished to the Securities and Exchange Commission (the “SEC”). These reports, their accompanying exhibits

and other documents filed with the SEC may be inspected without charge at the Public Reference Section of the SEC at 100 F Street,

N.E., Washington, D.C. 20549. Copies of such material may also be obtained from the SEC at prescribed rates. The SEC also maintains

a website that contains reports, proxy and information statements and other information regarding public companies that file reports

with the SEC. Copies of these reports may be obtained on the SEC’s website at www.sec.gov.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

/s/ Renmei Ouyang

|

|

|

Renmei Ouyang

|

|

|

Chief Executive Officer

|

|

|

March ●, 2021

|

TD

Holdings, Inc.

25th Floor, Block C, Tairan Building

No. 31 Tairan 8th Road, Futian District

Shenzhen, Guangdong, PRC 518000

NOTICE OF ADOPTION AND APPROVAL OF AMENDMENT

AND SHARE INCREASE

BY WRITTEN CONSENT OF STOCKHOLDERS

●, 2021

To the Stockholders of TD Holdings, Inc.:

NOTICE IS HEREBY GIVEN, under Delaware corporate law (“Delaware

Law”) that, on March 10, 2021, the holders of a majority of the outstanding shares of the common stock of TD Holdings, Inc.,

a Delaware corporation, entitled to vote thereon, acting by written consent without a meeting of stockholders, authorized, adopted

and approved the execution and delivery of the Amendment to the Certificate of Incorporation, as amended (the “Amendment”)

to increase the total number of authorized shares of common stock, par value $0.001 per share (the “Common Stock”)

of the Company from 100,000,000 shares to 600,000,000 shares (the “Share Increase”).

As permitted by Delaware

Law, no meeting of the stockholders of the Company is being held to vote on the approval of the Amendment and Share Increase. The

Amendment and Share Increase are described in detail in the enclosed Information Statement.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

/s/ Renmei Ouyang

|

|

|

Renmei Ouyang

|

|

|

Chief Executive Officer

|

TD HOLDINGS, INC.

INFORMATION STATEMENT

Introduction

This Information Statement

is being furnished to the stockholders of TD Holdings, Inc. a Delaware corporation (“GLG” or the “Company”),

in connection with the prior approval of our Board of Directors of, and receipt of approval by written consent of holders of the

majority of the Company’s issued and outstanding common stock for, the execution and filing of the Amendment to the Certificate

of Incorporation, as amended (the “Amendment”) to increase the total number of authorized shares of common stock, par

value $0.001 per share (the “Common Stock”) of the Company from 100,000,000 shares to 600,000,000 shares (the “Share

Increase”). A copy of Amendment is included as Appendix A to this Information Statement.

The Board of Directors

believes that the approval of the Share Increase is in the best interest of the Company and its stockholders and will allow the

Company to have sufficient authorized shares for future issuance, including for public or private offerings, conversions of convertible

securities, issuance of stock or stock options to employees, acquisition transactions and other general corporate purposes. Accordingly,

on March 9, 2021, the Board approved the Amendment, and directed that the Amendment be presented to stockholders holding a majority

of the issued and outstanding shares of our capital stock.

Under Delaware Law and

our Bylaws, the affirmative vote of a majority of the issued and outstanding shares of our Common Stock, as of the close of business

on March 10, 2021, the record date, is required to approve the Amendment. As of March 10, 2021, there were issued and outstanding

96,033,893 shares of Common Stock. As permitted by Delaware Law, on March 10, 2021, we received a written consent in lieu of a

meeting of stockholders from holders of 50,491,213 shares of Common Stock representing 52.58% of the total issued and outstanding

shares of our voting stock approving the Amendment (the “Consent Action”).

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. NO PROXY CARD HAS BEEN ENCLOSED AND NO MEETING OF STOCKHOLDERS WILL

BE HELD TO CONSIDER THE AMENDMENT AND SHARE INCREASE.

The Amendment and the

Share Increase will not become effective until the filing with the Secretary of State of Delaware of the Amendment at least 20

calendar days following the date of mailing of this Information Statement to our stockholders.

This Information Statement is furnished for the purposes of

informing stockholders of the Consent Action prior to the effectiveness of the Amendment in the manner required under the Securities

Exchange Act of 1934, as amended, and under Delaware Law. This Information Statement is first being mailed on or about ●,

2021 to holders of record of Common Stock as of the close of business on March 10, 2021 (the “Record Date”).

Voting Securities and Principal Holders Thereof

As of March 10, 2021, there

were outstanding 96,033,893 shares of Common Stock.

The following table

sets forth, as of March 10, 2021, certain information with respect to the beneficial ownership of the Company’s voting securities

by (i) any person (including any “group” as set forth in Section 13(d)(3) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) known by us to be the beneficial owner of five percent (5%) or more of

any class of our voting securities, (ii) each director, (iii) each of the named executive officers, and (iv) all

of our directors and named executive officers as a group. Shares which the person or group has the right to acquire within 60 days

of March 10, 2021, are deemed to be outstanding in calculating the percentage ownership of such person or group, but are not deemed

to be outstanding as to any other person or group.

Unless otherwise indicated

in the footnotes, the principal address of each of the stockholders, named executive officers, and directors below is c/o TD Holdings,

Inc., 25th Floor, Block C, Tairan Building, No. 31 Tairan 8th Road, Futian District, Shenzhen, Guangdong, PRC 518000.

Shares Beneficially Owned

|

Name of Beneficial Owner

|

|

Number

|

|

|

Percent

|

|

|

Directors and Named Executive Officers

|

|

|

|

|

|

|

|

Renmei Ouyang

|

|

|

10,167,275

|

|

|

|

10.65

|

%

|

|

Wei Sun

|

|

|

-

|

|

|

|

-

|

|

|

Qun Xie

|

|

|

-

|

|

|

|

-

|

|

|

Siyuan Zhu

|

|

|

-

|

|

|

|

-

|

|

|

Weicheng Pan

|

|

|

-

|

|

|

|

-

|

|

|

Kecen Liu

|

|

|

160,000

|

|

|

|

0.17

|

%

|

|

Xiangjun Wang

|

|

|

-

|

|

|

|

-

|

|

|

Donghong Xiong

|

|

|

-

|

|

|

|

-

|

|

|

All current directors and name executive officers as a group (8 persons)

|

|

|

10,327,275

|

|

|

|

10.82

|

%

|

|

5% or Greater Stockholders

|

|

|

|

|

|

|

|

|

|

Shuxiang Zhang

|

|

|

17,170,000

|

|

|

|

17.98

|

%

|

|

All 5% or Greater stockholders

|

|

|

17,170,000

|

|

|

|

17.98

|

%

|

On March 9, 2021, the Board

approved the Share Increase and Amendment, and recommended that the Company’s stockholders approve the same. On March 10,

2021, stockholders holding an aggregate of 50,491,213 shares of our issued and outstanding Common Stock approved the Share Increase

and Amendment by written consent. Those stockholders included Renmei Ouyang and Shuxiang Zhang and other stockholders that hold

less than 5% of our shares of common stock (the “Majority Stockholders”), which collectively hold 52.58% of the Company’s

Common Stock as of March 10, 2021, the record date.

No Appraisal Rights

Under Delaware Law,

our stockholders are not entitled to appraisal rights in connection with the authorized shares Increase.

Effective Date and Effects of the Share

Increase

Pursuant to Rule 14c-2

promulgated pursuant to the Exchange Act, the Amendment and Share Increase will not be effective until at least twenty (20) days

after the date on which this Information Statement is filed with the Commission and a copy hereof has been mailed to each of our

stockholders. The Company anticipates that this Information Statement will be mailed or furnished to our stockholders on or about

●, 2021. Therefore, the Company anticipates that the Amendment and Share Increase will be effective on or about

●, 2021, or such later date as all conditions and requirements to effectuate the Amendment and Share Increase are satisfied.

Potential uses of the

additional authorized shares of Common Stock may include public or private offerings, conversions of convertible securities, issuance

of stock or stock options to employees, acquisition transactions and other general corporate purposes. Increasing the authorized

number of shares of the Common Stock will give us greater flexibility and will allow the Company to issue such shares, in most

cases, without the expense or delay of seeking stockholders approval. The Company may issue shares of its Common Stock in connection

with financing transactions and other corporate purposes which the Board of Directors believes will be in the best interest of

the Company’s stockholders. The additional shares of Common Stock will have the same rights as the presently authorized shares,

including the right to cast one vote per share of Common Stock. Although the authorization of additional shares will not, in itself,

have any effect on the rights of any holder of our Common Stock, the future issuance of additional shares of Common Stock (other

than by way of a stock split or dividend) would have the effect of diluting the voting rights, and could have the effect of diluting

earnings per share and book value per share, of existing stockholders.

Householding of Materials

The SEC has adopted

rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for information statements

with respect to two or more security holders sharing the same address by delivering a single information statement addressed to

those security holders. This process, which is commonly referred to as “householding,” potentially means extra convenience

for security holders and cost savings for companies.

Brokers with account

holders who are TD Holdings, Inc. stockholders may be “householding” our Information Statement. A single Information

Statement may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the

affected stockholders. If, at any time, you no longer wish to participate in “householding” and would prefer to receive

a separate Information Statement, please notify your broker and direct your request to TD Holdings, Inc., Attention: Secretary,

25th Floor, Block C, Tairan Building, No. 31 Tairan 8th Road, Futian District, Shenzhen, Guangdong, PRC 518000. The telephone number

of our principal offices is +86 (0755) 88898711. Upon written or oral request to the Company’s secretary, the Company will

promptly provide a separate copy of the Information Statement. If you wish to receive a single copy of the Information Statement

instead of multiple copies, please direct your request to the same address above.

Where You Can Find Additional Information

We file annual, quarterly

and current reports, proxy and information statements and other information with the Securities and Exchange Commission under the

Securities Exchange Act of 1934, as amended. You may read and copy this information at the Public Reference Section at the Securities

and Exchange Commission at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-732-0330. The SEC maintains an Internet site that contains reports, proxy and information

statements, and other information about issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

Conclusion

As a matter of regulatory

compliance, we are sending you this Information Statement, which describes the purpose and effect of the above action. Your

consent to the above action is not required and is not being solicited in connection with this action. This Information

Statement is intended to provide our stockholders information required by the rules and regulations of the Securities Exchange

Act of 1934. Please carefully read this Information Statement.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ Renmei Ouyang

|

|

|

By: Renmei Ouyang

|

|

|

Chief Executive Officer

|

Dated: March ●, 2021

Appendix A

CERTIFICATE OF AMENDMENT OF

CERTIFICATE OF INCORPORATION OF

TD HOLDINGS, INC.

Adopted in accordance with the provisions

of Section 242 of the General Corporation Law of the State of Delaware

The undersigned, being a duly authorized

officer of Bat Group, Inc. (the “Corporation’’), a corporation existing under the laws of the

State of Delaware, does hereby certify as follows:

The Certificate of Incorporation of the

Corporation is hereby amended by deleting Article FOURTH thereof in its entirety and inserting the following in lieu thereof:

“Fourth: The

total number of shares which the Corporation shall have the authority to issue is Six Hundred and Ten Million (610,000,000) shares

of two classes of capital stock to be designated respectively preferred stock (“Preferred Stock”) and common stock

(“Common Stock”). The total number of shares of Common Stock the Corporation shall have authority to issue is

600,000,000 shares, par value $0.001 per share. The total number of shares of Preferred Stock the Corporation shall have authority

to issue is 10,000,000 shares, par value $0.001 per share. The Preferred Stock authorized by this Certificate of Incorporation

may be issued in series. The Board of Directors is authorized to establish series of Preferred Stock and to fix, in the manner

and to the full extent provided and permitted by law, the rights, preferences and limitations of each series of the Preferred Stock

and the relative rights, preferences and limitations between or among such series including, but not limited to:

(1) the designation

of each series and the number of shares that shall constitute the series;

(2) the rate of dividends,

if any, payable on the shares of each series, the time and manner of payment and whether or not such dividends shall be cumulative;

(3) whether shares

of each series may be redeemed and, if so, the redemption price and the terms and conditions of redemption;

(4) sinking fund provisions,

if any, for the redemption or purchase of shares of each series which is redeemable;

(5) the amount, if

any, payable upon shares of each series in the event of the voluntary or involuntary liquidation, dissolution or winding up of

the corporation, and the manner and preference of such payment; and

(6) the voting rights,

if any, in the shares of each series and any conditions upon the exercising of such rights.”

The foregoing amendment

was duly adopted in accordance with the provisions of Section 242 and 228 (by the written consent of the stockholders of the Corporation)

of the General Corporation Law of the State of Delaware.

|

|

TD HOLDINGS, INC.

|

|

|

|

|

|

Date: March _____, 2021

|

By:

|

|

|

|

Name:

|

Renmei Ouyang

|

|

|

Title:

|

Chief Executive Officer

|

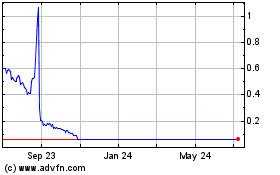

TD (NASDAQ:GLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

TD (NASDAQ:GLG)

Historical Stock Chart

From Apr 2023 to Apr 2024