SUPPLEMENT NO 2. TO

TO REGULATION A OFFERING CIRCULAR

WEED, INC.

WEED, Inc.

4920 N. Post Trail, Tucson, AZ 85750

(520) 818-8582

www.WEEDincUSA.com.

March 8, 2021

This Supplement amends and

supplements the Offering Circular of WEED, Inc. (the

“Company”)

dated “December __ 2020” which forms a part of the

offering statement on Form 1-A qualified on January 15, 2021, as

the same may be amended or supplemented from time to time (the

“Offering

Circular”) by (i) dating the

Offering Circular for March 8, 2021, (ii) announcing the

Company’s entry into an Investment Banking Agreement with

Great Point Capital, LLC (“GPC”), (iii) updating

“Risk Disclosures” to reflect the risks related to lack

of certain insurances, and (iv) revising the amount of commissions

and proceeds to the Company as a result of the Investment Banking

Agreement.

A complete Offering Circular, containing language

encompassing items (i)-(iv) above, is attached hereto as

Exhibit

A. Except as described above,

this Supplement to the Offering Circular does not modify or update

disclosure in, or exhibits to, the original Offering Circular. This

Supplement to the Offering Circular should be read in conjunction

with the Offering Circular and is qualified by reference to the

Offering Circular except to the extent that the information

contained herein supplements the information contained in the

Offering Circular.

Date of Offering Circular

The

Offering Circular is dated March 8, 2021.

Description of Investment Banking Agreement With GPC

The

following is a summary of the material terms of the Investment

Banking Agreement with GPC:

On

March 3, 2021, WEED, Inc. (the “Company”) and Great

Point Capital, LLC (“GPC”) entered into an Investment

Banking Agreement (the “Agreement”) whereby GPC shall

serve as a nonexclusive investment banker for the Company in

connection with the identification of investors who may be

interested in funding the Company’s capital needs via the

Company’s qualified Reg A+ offering (the

“Raise”). GPC is an independent contractor for the

purposes of the Agreement.

The

Term of the Agreement shall be for the duration of the Raise or

until 15 days after effective notice of termination has been

received by either party. Company may not terminate until 45 days

from the Effective Date, March 3, 2021.

In

consideration of GPC’s services, the Company will pay to GPC

2% of gross proceeds of funds raised by GPC during the term of the

Agreement and a one-time payment of 120,000 shares of the

Company’s common stock, which shares are Restricted

Securities under Rule 144. Company shall reimburse all expenses of

GPC up to an aggregate of $2,500, after which approval is required.

The Company has significant indemnification obligations pursuant to

the Agreement, whereby GPC is indemnified from most actions falling

short of intentional misconduct. Company’s recovery for any

liability is also strictly limited.

SEC Disclaimer

An

offering statement regarding the offering described in the Offering

Circular has been filed with the Commission. The Commission has

qualified that offering statement, which only means that the

Company may make sales of the securities described by that offering

statement. It does not mean that the Commission has approved,

passed upon the merits or passed upon the accuracy or completeness

of the information in the offering statement. You should read the

offering circular before making any investment.

SIGNATURES

Pursuant to the requirements of Regulation A, the Issuer certifies

that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form 1-A and has duly caused this

Supplement No. 2 to Regulation A Offering Statement to be signed on

its behalf by the undersigned, thereunto duly authorized, in the

City of Tucson, Arizona, on March 8, 2021.

|

|

WEED, Inc.

|

|

|

|

|

|

By:

|

/s/

Glenn E. Martin

|

|

|

Name:

|

Glenn

E. Martin

|

|

|

Title:

|

Chief

Executive Officer and Chief Financial Officer

|

This offering statement has been signed by the following persons in

the capacities and on the dates indicated.

|

Signature

|

Title

|

Date

|

|

/s/

Glenn E. Martin

|

Director

|

March

8, 2021

|

|

Glenn

E. Martin

|

|

|

|

|

|

|

/s/

Nicole M. Breen

|

Director

|

|

|

Nicole

M. Breen

|

March

8, 2021

|

Exhibit A

Offering Circular

REGULATION

A OFFERING CIRCULAR

Dated

March 8, 2021

WEED,

INC.

4920

N. Post Trail

Tucson,

AZ 85750

(520)

818-8582

www.WEEDincUSA.com

Up

to $40,000,000

Units

Consisting of 1 Share of Common Stock and

A

Warrant to Purchase 1 Share of Common Stock

Price:

$1.00

per

Unit

Minimum

Investment Amount: $1,000

WEED, Inc., a Nevada corporation (the Company,

WEED, we, or our) is offering (the “Offering”) up to a

maximum of 40,000,000 units (“Units”), with each Unit

consisting of one (1) share of our common stock, par value $0.001

(“Common Stock”) and one (1) warrant to purchase (1)

share of our common stock, at a purchase price of $1.00 per Unit.

The exercise price on the warrant will be 150% of the price of the

Unit sold to the investor and

cannot be exercised by the holder until at least twelve months

after issuance.

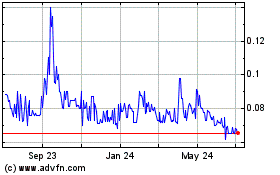

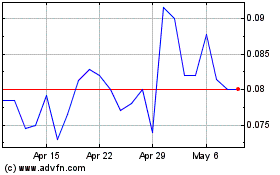

Our Common Stock currently trades on the

OTCQB-tier of OTC Markets under the symbol “BUDZ” and

the closing price of our Common Stock on November 30, 2020 was

$0.27. Our Common Stock currently trades on a sporadic and limited

basis. The Units and warrants

offered hereunder will not be quoted on any OTC

market.

No Escrow

The

proceeds of this offering will not be placed into an escrow

account. We will offer the Units on a best effort’s basis. As

there is no minimum offering, upon the approval of any subscription

to this Offering Circular, we will immediately deposit said

proceeds into our bank account and may dispose of the proceeds in

accordance with the Use of Proceeds.

Subscriptions are irrevocable and the purchase

price is non-refundable as expressly stated in this Offering

Circular. We, by determination

of our Board of Directors, in its sole discretion, may issue the

Securities under this Offering for cash, promissory notes,

services, and/or other consideration without notice to

subscribers. All proceeds

received by us from subscribers for this Offering will be available

for use by us upon acceptance of subscriptions for the Securities

by us.

Sale

of these shares will commence within two calendar days of the

qualification date (the “Qualification Date”) and it

will be a continuous Offering pursuant to Rule

251(d)(3)(i)(F).

We are

selling the Units on a “best efforts” basis through a

Tier 2 offering pursuant to Regulation A (Regulation A+) under the

Securities Act of 1933, as amended (the “Securities

Act”), and we intend to sell the Shares either directly to

investors or through registered broker-dealers who are paid

commissions. This Offering will terminate on the earlier of (i)

November 30, 2021, (ii) the date on which the Maximum Amount is

sold, or (iii) when the Board of Directors of the Company elects to

terminate the Offering (in each such case, the Termination Date).

There is no escrow established for this Offering. We will hold

closings upon the receipt of investors’ subscriptions and

acceptance of such subscriptions by the Company. If, on the initial

closing date, we have sold less than the Maximum Amount, then we

may hold one or more additional closings for additional sales,

until the earlier of: (i) the sale of the Maximum Amount or (ii)

the Termination Date. There is no aggregate minimum requirement for

the Offering to become effective, therefore, we reserve the right,

subject to applicable securities laws, to begin applying

“dollar one” of the proceeds from the Offering towards

our business strategy, including without limitation, research and

development expenses, offering expenses, acquisitions and joint

ventures, working capital and general corporate purposes and other

uses as more specifically set forth in the “Use of

Proceeds” section of this Offering Circular. The minimum

investment amount from an investor is $1,000; however, we expressly

reserve the right to waive this minimum in the sole discretion of

our management. See “Securities Being Offered”

beginning on page 26 for a discussion of certain items required by

Item 14 of Part II of Form 1-A.

Investing

in the Units involves a high degree of risk. These are speculative

securities. You should purchase these securities only if you can

afford a complete loss of your investment. See Risk Factors”

starting on page 7 for a discussion of certain risks that you

should consider in connection with an investment in the

Shares.

THE

SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY

SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS

UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER

SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN

EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE

COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE

SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

|

Title

of each

class

of

Securities

|

Maximum

Number of Units to be Offered

|

Proposed

offering

price

per

Unit (1)(2)

|

Proposed

aggregate

offering

proceeds (1)

|

Broker-Dealer

discount and commissions (2) (5)

|

Proceeds

to Company(3)(4)(5)

|

|

Units

consisting of shares of Common Stock, $0.001 par value, and a

Warrant to purchase Common Stock offered by the

Company

|

40,000,000

|

$1.00

|

$40,000,000

|

$1,200,000

|

$38,800,000

|

(1)

We

are offering on a continuous basis starting on the Qualification

Date.

(2)

We are offering the

Units without an underwriter. However, we have engaged Dalmore Group, LLC, a registered

FINRA/SIPC broker-dealer (“Dalmore”), to perform

administrative and technology related functions in connection with

the Offering, but not for underwriting or placement agent services.

This includes a 1% commission, but it does not include the one-time

set-up fees payable to Dalmore of $31,500. We may

pay other broker-dealers

and finders as well, but

information as to the finder or brokers must be disclosed in an

amendment to this offering circular. See “Plan of Distribution” for more

detail.

(3)

This is a

“best efforts” offering. The proceeds of this offering

will not be placed into an escrow account. We will offer the Units

on a “best efforts” basis primarily through our

management and/or an online platform. Any subscription to this

Offering Circular meeting the Minimum Investment Amount ($1,000),

shall be immediately deposited into the bank account of the Company

and we may dispose of the proceeds in accordance with the Use of

Proceeds. See “Use of Proceeds.”

(4)

Excludes estimated

total offering expenses, not including underwriting discount and

commissions, will be approximately $75,000. See “Use of

Proceeds.”

(5)

We engaged Great Point Capital

LLC pursuant to an Investment Banking Agreement to assist in

identification and qualification of identification of investors who

may be interested in funding the Company’s capital needs via

the Company’s qualified Reg A+ offering. Their fee include a

2% commission of all funds raised through their introductions, as

well as a one-time payment of 120,000 shares of the

Company’s common stock which shares are Restricted Securities

under Rule 14. We may pay other

broker-dealers and finders as well, but information as to the finder

or brokers must be disclosed in an amendment to this offering

circular. See

“Plan of Distribution” for more

detail.”

This

Offering Circular relates to the sale of Units by WEED, Inc., a

Nevada corporation (“we” or the “Company”)

to certain investors at $1.00 per Unit, up to 40,000,000

Units.

Our

Common Shares are quoted on OTC Market’s “OTCQB”

tier under the ticker symbol “BUDZ.” The Units and

warrants offered hereunder will not be quoted on any OTC

market.

Investing

in the securities involves risks. WEED, Inc., currently has limited

operations, limited income, and limited assets, is in unsound

financial condition, and you should not invest unless you can

afford to lose your entire investment. See “Risk

Factors” beginning on page 7. Neither the Securities and

Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

OFFERING

CIRCULAR SUMMARY

You should read the following summary together with the more

detailed information and the financial statements appearing

elsewhere in this Offering Circular. This Offering Circular

contains forward-looking statements that involve risks and

uncertainties. Our actual results could differ materially from

those anticipated in these forward-looking statements as a result

of certain factors, including those set forth under “Risk

Factors” and elsewhere in this Offering Circular. Unless the

context indicates or suggests otherwise, references to

“we,” “our,” “us,” the

“Company,” or the “Registrant” refer to

WEED, Inc., a Nevada corporation.

WEED,

INC.

We are

a USA-based fully reporting public company currently specializing

in the medicinal cannabis, adult-use cannabis & hemp space. We

are a multi-national, multi-faceted, vertically-integrated

organization. We are structured as a holding company doing business

through our divisions, wholly-owned subsidiaries, and strategically

placed collaborative partners to achieve and promote a global

brand. We are dedicated to global goals and outreach across the

full spectrum of the cannabis and hemp industry to find treatments,

therapies and medical cures utilizing the Cannabaceae plant family.

We do not grow, harvest, produce, or sell any substance in

violation of US Federal law under The Federal Controlled Substances

Act, and we meet all standards of international law for WEED, Inc.

and its subsidiaries in foreign locations.

Currently, we are

either working or planning for several different business

opportunities in the cannabis and hemp space. Our first business

opportunity is through our wholly-owned subsidiary, Sangre AT, LLC

(“Sangre”), where we are focused on the development and

application of cannabis-derived compounds for the treatment of

human disease. To that end Sangre, is working on a planned

five-year Cannabis Genomic Study to complete a genetic blueprint of

the Cannabis plant genus, by creating a global genomic

classification of the entire plant. Second, we are under contract

to purchase a golf course property located in Westfield, New York.

We own the “unlimited water extraction rights” from

Lake Erie to the property already, but need to raise at least

$500,000 to acquire the property. If we are successful in acquiring

the property we plan to utilize the property to gain access to the

HEMP and infused beverage industry to establish a foothold for the

New York marketplace. Third, we have established WEED Australia

Ltd. and The Cannabis Institute of Australia (C.I.A.) in Australia

for the purpose of conducting cannabis and hemp research and

potentially developing products in Australia. C.I.A. is a

non-profit entity formed for the purpose of conducting cannabis and

hemp research and potentially developing products in Australia for

domestic research and development of products, services and

educational purposes to all 7 States and territories including

Tasmania. Fourth, we have an arrangement with Professor Elka

Touitou to assist us with cannabis research and studies in Israel.

Professor Touitou was the Head of the Innovative Dermal,

Transdermal and Transmucosal Delivery Lab at the Institute of Drug

Research, The School of Pharmacy, HUJ, now retired but still has

HUJ clinical trial & independent studies/lab privileges.

Professor Touitou is an internationally renowned authority in the

field of drug delivery and design of new technologies for efficient

administration of drugs and development of new products. Professor

Touitou has been involved in cannabinoid research since 1988 at The

Hebrew University of Jerusalem, (HUJ) Jerusalem,

Israel.

Through

these business divisions and subsidiaries, we plan to advance our

research and development of cannabis-related compounds for the

treatment of human and animal disease, as well as potentially

commercialize other cannabis-related products, both pharmaceutical

and non-pharmaceutical. The business segments are detailed

herein.

By targeting

cannabis-derived molecules that stimulate the endocannabinoid

system, Sangre’s research team plans to develop

scientifically-valid and evidence-based cannabis strains for the

production of disease-specific medicines. The goal of the research

is to identify, collect, patent, and archive a collection of

highly-active medicinal strains. We plan to conduct this study in

accordance with U.S. and state laws and regulations, as well as in

foreign locations where it is legal, such as Israel (including at

The Ministry of Health in Israel) and Australia (at the Therapeutic

Drug Administration (TGA) & Office of Drug Control (ODC).

Although we have had discussions with these organizations we have

not contracted with any of these organizations to conduct our study

and will not be able to do so until we raise sufficient funding.

Israel allows medical research on cannabis, and actually funds

certain research clinics and studies. The Federal Government of

Australia has recently amended the Narcotic Drugs Act of 1967 to

allow cultivation of cannabis for medicinal or scientific

purposes.

Using

annotated genomic data and newly generated phenotypic data, Sangre

plans to identify and isolate regions of the plant genome which are

related to growth, synthesis of desired molecules, and drought,

heavy metals and pest resistance. This complex data set would then

be utilized in a breeding program to generate and establish new

hybrid cultivars which exemplify the traits that are desired by the

medical and patient community. This breeding program would produce

new seed stocks, clones, and tissue cultures which we plan on

patenting. If successful this intellectual property should generate

immense value for the Company. After developing a comprehensive

understanding of the annotated genome of a variety of cannabis

strains and obtaining intellectual property protection over the

most promising strains, we plan to move forward either

independently or with strategic partners to develop medicinal

products for the treatment of a multitude of human and animal

diseases.

Currently, we do

not have the money or funding to achieve the above goals and we

will not be able to achieve our goals unless we are successful in

obtaining additional funding, likely through sales of our

securities, all which may serve to dilute the ownership position of

our current and future shareholders.

Corporate

Information

We were

originally incorporated under the name Plae, Inc., in the State of

Arizona on August 20, 1999. At the time we operated under the name

Plae, Inc., no business was conducted. No books or records were

maintained and no meetings were held. In essence, nothing was done

after incorporation until Glenn E. Martin took possession of Plae,

Inc. in January 2005. On February 18, 2005, the corporate name was

changed to King Mines, Inc. and then subsequently changed to its

current name, United Mines, Inc., on March 30, 2005. No shares were

issued until the Company became United Mines, Inc. From 2005 until

2015, we were an exploration stage mineral exploration company that

owned a number of unpatented BLM mining claims and Arizona State

Land Department exploration leases.

On

November 26, 2014, our Board of Directors approved the

redomestication of our company from Arizona to Nevada (the

“Articles of Domestication”), and approved Articles of

Incorporation in Nevada, which differed from then-Articles of

Incorporation in Arizona, primarily by (a) changing our name from

United Mines, Inc. to WEED, Inc., (b) authorizing Twenty Million

(20,000,000) shares of preferred stock, with blank check rights

granted to our Board of Directors, and (c) authorizing Two Hundred

Million (200,000,000) shares of common stock (the “Nevada

Articles of Incorporation”). On December 19, 2014, the

holders of a majority of our outstanding common stock approved the

Articles of Domestication and the Nevada Articles of Incorporation

at a Special Meeting of Shareholders. On January 16, 2015, the

Articles of Domestication and the Nevada Articles of Incorporation

went effective with the Secretary of State of the State of Nevada.

On February 2, 2015, our name change to WEED, Inc., and a

corresponding ticker symbol change to “BUDZ” went

effective with FINRA and was reflected on the quotation of our

common stock on OTC Markets.

These

changes were effected in order to make our corporate name and

ticker symbol better align with our short-term and long-term

business focus, which in the short-term is to conduct

Sangre’s Cannabis Genomic Study over the next 5 years,

process those results, and in the long-term to be an international

cannabis and hemp research and product development company, with a

globally-recognized brand focusing on building and purchasing labs,

land and building commercial grade “Cultivation

Centers” to consult, assist, manage & lease to

universities, state governments, licensed dispensary owners and

worldwide organic grow operators on a contract basis, with a

concentration on the legal and medical Cannabis sector. Our

long-term plan is to become a True “Seed-to-Sale”

global holding company providing infrastructure, financial

solutions, product development and real estate options in this new

emerging market. Our long term plans may also include acquisitions

of synergistic businesses, such as distilleries to make infused

beverages and/or super oxygenated water with CBD and THC. We have

also formed WEED Australia Ltd., registered as an unlisted public

company in Australia, to address future global demand, however the

entity has been essentially dormant other than building

relationships and speaking at The Pharmaceutical Guild of Australia

conference event in Sydney Australia, September 2019, since its

inception.

Our

corporate offices are located at 4920 N. Post Trail, Tucson, AZ

85750, telephone number (520) 818-8582.

SUMMARY

OF THE OFFERING

|

Units offered by Company

|

|

40,000,000 Units,

with each Unit consisting of one (1) share of our Common Stock and

one (1) warrant to purchase (1) share of our Common Stock, at a

purchase price of $1.00 per Unit. The exercise price on the warrant

included in each Unit will be $1.50 and the warrant cannot be

exercised by the holder for at least twelve months from the date of

issuance. The warrants will expire two years from the issuance

date.

|

|

|

|

|

|

Common Shares outstanding before the offering

|

|

112,972,685

Common Shares as of the date hereof.

|

|

|

|

|

|

Common Shares outstanding after the offering (not including the

exercise of any warrants that are part of the Units)

|

|

152,972,685 Common Shares.

|

|

|

|

|

|

Common Shares outstanding after the offering (including the

exercise of all warrants that are part of the Units)

|

|

192,972,685 Common Shares.

|

|

|

|

|

|

Price per Unit

|

|

$1.00 per Unit.

|

|

|

|

|

|

Use of proceeds

|

|

If

we sell all the Units for the Maximum Price Per Unit, our proceeds

will be $40,000,000 less fees and commissions. We intend to use

these proceeds primarily for:

- Acquisition

and Build-Out of New York Property

- Completion

of 5-Year Genomic Sequencing Study

- Research

and Development in United States, Australia and Israel

See

“Use of Proceeds” on page 12 of this Offering

Circular.

|

|

|

|

|

|

Offering Amount

|

|

$40,000,000

|

|

|

|

|

|

Quotation of Common Shares

|

|

Our

Common Shares are quoted on the OTCQB-tier of OTC Markets under the

ticker symbol “BUDZ”. The

Units and warrants offered hereunder will not be quoted on any OTC

market.

|

|

|

|

|

|

Risk Factors

|

|

The

Units offered hereby involves a high degree of risk and should not

be purchased by investors who cannot afford the loss of their

entire investment. See “Risk Factors”.

|

RISK

FACTORS

Investing in the Units involves a high degree of risk. In

evaluating WEED, Inc. and investing in the Units, careful

consideration should be given to the following risk factors, in

addition to the other information included in this Offering

Circular. Each of these risk factors could materially adversely

affect WEED, Inc.’s business, operating results or financial

condition, as well as adversely affect the value of an investment

in our Units. The following is a summary of the most significant

factors that make this Offering speculative or substantially risky.

We are still subject to all the same risks that all companies in

our industry, and all companies in the economy, are exposed to.

These include risks relating to economic downturns, political and

economic events and technological developments. You should consider

general risks as well as specific risks when deciding whether to

invest.

We have a limited operating history and historical financial

information upon which you may evaluate our

performance.

You

should consider, among other factors, our prospects for success in

light of the risks and uncertainties encountered by companies that,

like us, are in their early stages of development. We may not

successfully address these risks and uncertainties or successfully

complete our studies and/or implement our existing and new

products. If we fail to do so, it could materially harm our

business and impair the value of our common stock. Even if we

accomplish these objectives, we may not generate the positive cash

flows or profits we anticipate in the future. We were incorporated

in the State of Arizona on August 20, 1999. From 2005 until 2015,

we were an exploration stage mineral exploration company that owned

a number of unpatented mining claims and Arizona State Land

Department claims. On November 26, 2014, our Board of Directors

approved the redomestication of our company from Arizona to Nevada

and we shifted our business focus to a company concentrating on the

development and application of cannabis-derived compounds for the

treatment of human disease. Although our subsidiary, Sangre, has

begun its planned five-year Cannabis Genomic Study to complete a

global genomic classification of the Cannabis plant genus the

completion of the study is likely years away. Unanticipated

problems, expenses and delays are frequently encountered in

establishing a new business, conducting research, and developing

new products. These include, but are not limited to, inadequate

funding, unforeseen research issues, lack of consumer acceptance,

competition, product development, and inadequate sales and

marketing. The failure by us to meet any of these conditions would

have a materially adverse effect upon us and may force us to reduce

or curtail operations. No assurance can be given that we can or

will ever operate profitably.

We may not be able to meet our future capital needs.

To

date, we have not generated any revenue and we have limited cash

liquidity and capital resources. Our

future capital requirements will depend on many factors, including

the progress and results of our Cannabis Genomic Study, our ability

to develop products, cash flow from operations, and competing

market developments. We anticipate the Cannabis Genomic Study will

cost approximately $15,000,000 to complete. We will need additional

capital in the near future. Any equity financings will result in

dilution to our then-existing stockholders. Although we currently

do not have any debt financing, any sources of debt financing in

the future may result in a high interest expense. Any financing, if

available, may be on unfavorable terms. If adequate funds are not

obtained, we will be required to reduce or curtail

operations.

If we cannot obtain additional funding, our research and

development efforts may be reduced or discontinued and we may not

be able to continue operations.

We

have historically experienced negative cash flows from operations

since our inception and we expect the negative cash flows from

operations to continue for the foreseeable future. Unless and until

we are able to generate revenues, we expect such losses to continue

for the foreseeable future. As discussed in our financial

statements, there exists substantial doubt regarding our ability to

continue as a going concern.

Research

and development efforts are highly dependent on the amount of cash

and cash equivalents on hand combined with our ability to raise

additional capital to support our future operations through one or

more methods, including but not limited to, issuing additional

equity or debt.

In

addition, we may also raise additional capital through additional

equity offerings and licensing our

research and/or future products in development. While we will

continue to explore these potential opportunities, there can be no

assurances that we will be successful in raising sufficient capital

on terms acceptable to us, or at all, or that we will be successful

in licensing our future products. Based on our current projections,

we believe we have insufficient cash on hand to meet our

obligations as they become due based on current assumptions. The

uncertainties surrounding our future cash inflows have raised

substantial doubt regarding our ability to continue as a going

concern.

One of our current projects is our 5-year cannabis genomic study

being conducted by Sangre. In the event that we are unable to

complete that study for any reason, such as inability to complete

our human clinical trials, or if those trials are not successful,

then it could significantly impact our business.

Although

we have plans to be a company with a multitude of business

segments, one of our first foray into medical cannabis research is

the 5-year cannabis genomic study being conducted by Sangre. In the

event that we are unable to complete the 5-year study for any

reason, such as the inability to complete our planned human

clinical trials in phases 2 and 3 of the study, or if those trials

are not successful, then it could significantly impact our

business.

Our research plan, which is focused on the development and

application of cannabis-derived compounds for the treatment of

human disease, and includes our 5-year cannabis genomic study being

conducted by Sangre, is dependent upon our ability to complete the

necessary research and clinical human trials.

Our

research plan, which is focused on the development and application

of cannabis-derived compounds for the treatment of human disease,

and includes our 5-year cannabis genomic study being conducted by

Sangre, is dependent upon our ability to complete the necessary

research and clinical human trials. In the event that we are unable

to complete those research and/or human clinical trials, or if

those trials are not successful, then it could significantly,

negatively impact all phases of our research plan and significantly

impact our business.

Current economic conditions and capital markets are in a period of

disruption and instability which could adversely affect our ability

to access the capital markets, and thus adversely affect our

business and liquidity.

The

current economic conditions largely caused by the coronavirus

pandemic have had, and likely will continue to have for the

foreseeable future, a negative impact on our ability to access the

capital markets, and thus have a negative impact on our business

and liquidity. The recent, substantial losses in worldwide equity

markets could lead to an extended worldwide recession. We may face

significant challenges if conditions in the capital markets do not

improve. Our ability to access the capital markets has been and

continues to be severely restricted at a time when we need to

access such markets, which could have a negative impact on our

business plans. Even if we are able to raise capital, it may not be

at a price or on terms that are favorable to us. We cannot predict

the occurrence of future disruptions or how long the current

conditions may continue.

The coronavirus pandemic is causing disruptions in the workplace,

which will have negative repercussions on our business if they

continue for an extended period time.

We

are closely monitoring the coronavirus pandemic and the directives

from federal and local authorities regarding not only our

workforce, but how it impacts companies we work with for our

various projects. As more states and localities continue with

social distancing and “work from home” regulations more

and more companies will be forced to either shut down, slow down or

alter their work routines. This could have a negative impact our

business going forward if these conditions persist for an extended

period of time.

Our proposed business is dependent on laws pertaining to the

cannabis industry.

Continued

development of the cannabis industry is dependent upon continued

legislative authorization of marijuana at the state level. Any

number of factors could slow or halt progress in this area.

Further, progress for the industry, while encouraging, is not

assured. While there may be ample public support for legislative

action, numerous factors impact the legislative process. Any one of

these factors could slow or halt use of marijuana, which would

negatively impact our business.

As

of the end of February 2019, 33 states and the District of Columbia

allow its citizens to use medical marijuana. Voters in the states

of Colorado, Washington, Alaska, Oregon and the District of

Columbia have approved ballot measures to legalize cannabis for

adult use. Currently as of the date of this Offering, there are 11

states that have legalized adult recreational use. The state laws

are in conflict with the Federal Controlled Substances Act, which

makes cannabis use and possession illegal on a national level. The

prior administration (President Obama) effectively stated that it

is not an efficient use of resources to direct law federal law

enforcement agencies to prosecute those lawfully abiding by

state-designated laws allowing the use and distribution of medical

cannabis. However, the Trump administration has indicated the

potential for stricter enforcement of the cannabis industry at the

federal level, but to date there has been very little in terms of

action. There is no guarantee that the Trump administration or

future administrations will maintain the low-priority enforcement

of federal laws in the cannabis industry that was adopted by the

Obama administration. The Trump administration or any new

administration that follows could change this policy and decide to

enforce the federal laws strongly. Any such change in the federal

government’s enforcement of current federal laws could cause

significant financial damage to our business and our

shareholders.

Further,

and while we do not intend to harvest, distribute or sell cannabis,

if we conduct research with the cannabis plant or lease buildings

to growers of cannabis, etc., we could be deemed to be

participating in cannabis cultivation, which remains illegal under

federal law, and exposes us to potential criminal liability, with

the additional risk that our properties could be subject to civil

forfeiture proceedings.

The

cannabis industry faces strong opposition.

It

is believed by many that large well-funded businesses may have a

strong economic opposition to the cannabis industry. We believe

that the pharmaceutical industry clearly does not want to cede

control of any product that could generate significant revenue. For

example, medical cannabis will likely adversely impact the existing

market for the current “marijuana pill” sold by

mainstream pharmaceutical companies. Further, the medical cannabis

industry could face a material threat from the pharmaceutical

industry, should cannabis displace other drugs or encroach upon the

pharmaceutical industry’s products. The pharmaceutical

industry is well funded with a strong and experienced lobby that

eclipses the funding of the medical cannabis movement. Any inroads

the pharmaceutical industry could make in halting or impeding the

cannabis industry could have a detrimental impact on our proposed

business.

Cannabis

remains illegal under Federal law.

Cannabis

is a schedule-I controlled substance and is illegal under federal

law. Even in those states in which the use of cannabis has been

legalized, its production and use remains a violation of federal

law. Since federal law criminalizing the use of cannabis preempts

state laws that legalize its use, strict enforcement of federal law

regarding cannabis would likely result in our inability to proceed

with our business plan.

Laws and regulations affecting the medical cannabis industry are

constantly changing, which could detrimentally affect our proposed

operations.

Local,

state and federal medical cannabis laws and regulations are broad

in scope and subject to evolving interpretations, which could

require us to incur substantial costs associated with compliance or

alter our business plan. In addition, violations of these laws, or

allegations of such violations, could disrupt our business and

result in a material adverse effect on our operations. In addition,

it is possible that regulations may be enacted in the future that

will be directly applicable to our proposed business. We cannot

predict the nature of any future laws, regulations, interpretations

or applications, nor can we determine what effect additional

governmental regulations or administrative policies and procedures,

when and if promulgated, could have on our business.

If we are unable to recruit and retain qualified personnel, our

business could be harmed.

Our

growth and success highly depend on qualified personnel.

Competition in the industry could cause us difficulty in recruiting

or retaining a sufficient number of qualified technical personnel,

which could harm our ability to develop new products. Also, the

fact cannabis remains illegal at the federal level may dissuade

qualified personnel from working in the cannabis industry, thus

limiting the pool of qualified individuals to run our business. If

we are unable to attract and retain necessary key talents, it would

harm our ability to develop competitive product and retain good

customers and could adversely affect our business and operating

results.

We may be unable to adequately protect our proprietary

rights.

Our

ability to compete partly depends on the superiority, uniqueness

and value of our intellectual property. To protect our proprietary

rights, we will rely on a combination of patent, copyright and

trade secret laws, confidentiality agreements with our employees

and third parties, and protective contractual provisions. Despite

these efforts, any of the following occurrences may reduce the

value of our intellectual property:

●

Our applications for patents relating to our business may not be

granted and, if granted, may be challenged or

invalidated;

●

Issued patents may not provide us with any competitive

advantages;

●

Our efforts to protect our intellectual property rights may not be

effective in preventing misappropriation of our

technology;

●

Our efforts may not prevent the development and design by others of

products or technologies similar to or competitive with, or

superior to those we develop;

●

Another party may obtain a blocking patent and we would need to

either obtain a license or design around the patent in order to

continue to offer the contested feature or service in our products;

or

●

The fact cannabis is illegal at the federal level may impact our

ability to secure patents from the United States Patent and

Trademark Office, and other intellectual property protections may

not be available to us.

We may become involved in lawsuits to protect or enforce our

patents that would be expensive and time consuming.

In

order to protect or enforce our patent rights, we may initiate

patent or trademark litigation against third parties. In addition,

we may become subject to interference or opposition proceedings

conducted in patent and trademark offices to determine the priority

and patentability of inventions. The defense of intellectual

property rights, including patent rights through lawsuits,

interference or opposition proceedings, and other legal and

administrative proceedings, would be costly and divert our

technical and management personnel from their normal

responsibilities. An adverse determination of any litigation or

defense proceedings could put our pending patent applications at

risk of not being issued.

Furthermore,

because of the substantial amount of discovery required in

connection with intellectual property litigation, there is a risk

that some of our confidential information could be compromised by

disclosure during this type of litigation. For example, during the

course of this kind of litigation, confidential information may be

inadvertently disclosed in the form of documents or testimony in

connection with discovery requests, depositions or trial testimony.

This disclosure could have a material adverse effect on our

business and our financial results.

We may be involved in litigation at some in the

future.

In

the ordinary course of business, we are from time to time involved

in various pending or threatened legal actions. The litigation

process is inherently uncertain and it is possible that the

resolution of such matters might have a material adverse effect

upon our financial condition and/or results of operations.

Litigation is also expensive and could cause us to spend

substantial sums on legal fees even if we are eventually successful

in the litigation.

We have several opportunities that we may not be able to take

advantage of or close without substantial funding.

As

detailed elsewhere in this Offering Circular we have several

business opportunities that we either cannot continue or cannot

begin without raising substantial funds either in this Offering or

through other sources. Notably, we have an opportunity to close on

a golf course property in New York, with unlimited water extraction

rights from Lake Erie, but currently need approximately $500,000 to

pay the remainder of the purchase price and close on the

acquisition. We are not sure if we will be able to secure the

necessary funds to acquire the property within the current

timeframe. If we are unable to acquire the property we could miss a

significant opportunity and it could affect our future business

plans.

Our common stock has been thinly traded and we cannot predict the

extent to which a trading market will develop.

Our

common stock is traded on the OTC Markets’ “Pink

Current Information” tier. Our common stock is thinly traded

compared to larger more widely known companies. Thinly traded

common stock can be more volatile than common stock trading in an

active public market. We cannot predict the extent to which an

active public market for our common stock will develop or be

sustained after this Offering.

Because we are subject to the “penny stock” rules, the

level of trading activity in our stock may be reduced.

Our

common stock is traded on the OTC Markets’

“OTCQB” tier. Broker-dealer practices in connection

with transactions in “penny stocks” are regulated by

certain penny stock rules adopted by the Securities and Exchange

Commission. Penny stocks, like shares of our common stock,

generally are equity securities with a price of less than $5.00,

other than securities registered on certain national securities

exchanges or quoted on NASDAQ. The penny stock rules require a

broker-dealer, prior to a transaction in a penny stock not

otherwise exempt from the rules, to deliver a standardized risk

disclosure document that provides information about penny stocks

and the nature and level of risks in the penny stock market. The

broker-dealer also must provide the customer with current bid and

offer quotations for the penny stock, the compensation of the

broker-dealer and its salesperson in the transaction, and, if the

broker-dealer is the sole market maker, the broker-dealer must

disclose this fact and the broker-dealer's presumed control over

the market, and monthly account statements showing the market value

of each penny stock held in the customer's account. In addition,

broker-dealers who sell these securities to persons other than

established customers and “accredited investors” must

make a special written determination that the penny stock is a

suitable investment for the purchaser and receive the purchaser's

written agreement to the transaction. Consequently, these

requirements may have the effect of reducing the level of trading

activity, if any, in the secondary market for a security subject to

the penny stock rules, and investors in our common stock may find

it difficult to sell their shares.

The lack of available and cost-effective directors and

officer’s insurance coverage in our industry may cause us to

be unable to attract and retain qualified executives, and this may

result in our inability to further develop our

business.

Our

business depends on attracting independent directors, executives

and senior management to advance our business plans. We currently

do not have directors and officer’s insurance to protect our

directors, officers and the company against to possible third-party

claims. This is due to the significant lack availability of such

policies in the cannabis industry at reasonably competitive prices.

As a result, the Company and our executive directors and officers

are susceptible to liability claims arising by third parties, and

as a result, we may be unable to attract and retain qualified

independent directors and executive management causing the

development of our business plans to be impeded as a

result.

If product liability lawsuits are successfully brought against us,

we will incur substantial liabilities.

From

time to time, we may receive complaints from customers regarding

our goods and services. We may become subject to product liability

lawsuits from customers alleging injury because of a purported

defect in our products or services, claiming substantial damages

and demanding payments from us. Liability claims may include

allegations of defects in manufacturing, defects in design, a

failure to warn of dangers inherent in the product, negligence,

strict liability and a breach of warranties. Claims could also be

asserted under state consumer protection acts. We may be in the

chain of ownership when we supply or distributes products, and

therefore is subject to the risk of being held legally responsible

for such products. Given the nature of these products (including

their relation to cannabis or for other reasons), these claims may

not be subject to insurance coverage or covered by insurance

policies. Any resulting litigation, regardless of the merits or

eventual outcome, could decrease demand for our products, result in

product recalls or withdrawals, be costly, divert management

attention, result in increased costs of doing business, or

otherwise have a material adverse effect on our business, results

of operations, and financial condition. Any litigation or even

negative publicity generated as a result of customer frustration or

disagreement with the products or services could damage our

reputation and diminish the value of our brand name, which could

have a material adverse effect on our business, results of

operations, and financial condition.

Due to our involvement in the cannabis industry, we may have a

difficult time obtaining the various insurances that are desired to

operate our business, which may expose us to additional risk and

financial liability.

Insurance

that is otherwise readily available, such as general liability, and

directors and officer’s insurance, is more difficult for us

to find, and more expensive, because we are service providers to

companies in the cannabis industry. There are no guarantees that we

will be able to find such insurances in the future, or that the

cost will be affordable to us. If we are forced to go without such

insurances, it may prevent us from entering into certain business

sectors, may inhibit our growth, and may expose us to additional

risk and financial liabilities.

SPECIAL

NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have

made forward-looking statements in this Offering Circular,

including the sections entitled “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” and “Business,” that are based on our

management’s beliefs and assumptions and on information

currently available to our management. Forward-looking statements

include the information concerning our possible or assumed future

results of operations, business strategies, financing plans,

competitive position, industry environment, potential growth

opportunities, the effects of future regulation and the effects of

competition. Forward-looking statements include all statements that

are not historical facts and can be identified by the use of

forward-looking terminology such as the words

“believe,” “expect,”

“anticipate,” “intend,” “plan,”

“estimate” or similar expressions. These statements are

only predictions and involve known and unknown risks and

uncertainties, including the risks outlined under “Risk

Factors” and elsewhere in this prospectus.

Although we believe

that the expectations reflected in our forward-looking statements

are reasonable, we cannot guarantee future results, events, levels

of activity, performance or achievement. We are not under any duty

to update any of the forward-looking statements after the date of

this prospectus to conform these statements to actual results,

unless required by law.

USE

OF PROCEEDS

If we raise Maximum

Offering hereunder, our net proceeds (after our estimated offering

expenses of $75,000, plus payments to

Dalmore Group) will be $38,693,500.(5) We will use these net

proceeds for the following:

|

%

of Offering Amount Sold)(1)

|

100%

of Offering Amount Sold

|

75%

of Offering Amount Sold

|

50%

of Offering Amount Sold

|

25% of Offering Amount Sold

|

|

Gross

Offering Proceeds(3)(5)

|

$40,000,000

|

$30,000,000

|

$20,000,000

|

$10,000,000

|

|

Approximate Offering Expenses

|

|

|

|

|

|

Misc.

Expenses

|

35,000

|

35,000

|

35,000

|

35,000

|

|

Legal

and Accounting

|

40,000

|

40,000

|

40,000

|

40,000

|

|

Dalmore – One-Time Fees (4)

|

31,500

|

31,500

|

31,500

|

31,500

|

|

Dalmore – 1% Commission (4)

|

400,000

|

300,000

|

200,000

|

100,000

|

|

GPC – 2% Commission

(5)

|

800,000

|

600,000

|

400,000

|

200,000

|

|

Total

Offering Expenses

|

75,000

|

75,000

|

75,000

|

75,000

|

|

Total

Net Offering Proceeds(3)

|

38,693,500

|

29,593,500

|

19,293,500

|

9,593,500

|

|

Principal Uses of Net Proceeds (2)

|

|

|

|

|

|

Employee/Officers

& Directors / Independent Contractor Compensation

|

$4,000,000

|

$3,000,000

|

$1,500,000

|

$600,000

|

|

Marketing

|

$2,000,000

|

$1,000,000

|

$500,000

|

-0-

|

|

Public

Company Costs

|

$750,000

|

$500,000

|

$300,000

|

$200,000

|

|

Sangre

Genomic Study

|

$10,000,000

|

$7,500,000

|

$5,000,000

|

$3,000,000

|

|

Other

Research & Development

|

$3,200,000

|

$2,400,000

|

$600,000

|

$418,500

|

|

Insurance

(Directors, Officers, Product, General Liability)

|

$1,000,000

|

$500,000

|

$250,000

|

$100,000

|

|

WEED

Israel Cannabis, Ltd.

|

$4,000,000

|

$3,000,000

|

$2,800,000

|

$1,500,000

|

|

WEED

Australia Ltd.

|

$4,000,000

|

$3,000,000

|

$2,800,000

|

$1,500,000

|

|

Purchase and

Build-Out of NY Property

|

$3,000,000

|

$3,000,000

|

$3,000,000

|

$2,000,000

|

|

Acquisitions

|

$3,000,000

|

$1,500,000

|

$1,000,000

|

-0-

|

|

Travel

|

$1,000,000

|

$1,000,000

|

$500,000

|

$150,000

|

|

Misc.

Costs and Expenses

|

$1,268,500

|

$1,643,500

|

$543,500

|

$25,000

|

|

Legal,

IP & Compliance

|

$1,475,000

|

$1,000,000

|

$500,000

|

$100,000

|

|

Total

Principal Uses of Net Proceeds(3)

|

39,493,500

|

29,593,500

|

19,693,500

|

9,793,500

|

|

Amount

Unallocated

|

-0-

|

-0-

|

-0-

|

-0-

|

(1)

We are offering the

Units at $1.00 per Unit.

(2)

These amounts are

estimated. The expected use of net proceeds from this Offering

represents our intentions based upon our current plans and business

conditions, which could change in the future as our plans and

business conditions evolve and change. The amounts and timing of

our actual expenditures, specifically with respect to working

capital, may vary significantly depending on numerous factors. The

precise amounts that we will devote to each of the foregoing items,

and the timing of expenditures, will vary depending on numerous

factors. As a result, our management will retain broad discretion

over the allocation of the net proceeds from this

offering.

(3)

For the Offering

Proceeds we did not account for any money received by us for the

exercise of the warrants that are a part of the Units since there

is no guarantee such warrants would ever be exercised.

(4)

We

have engaged Dalmore Group, LLC (“Dalmore”) a

broker-dealer registered with the SEC and a member of FINRA, to

perform the following administrative and technology related

functions in connection with this Offering, but not for

underwriting or placement agent services. The total fees that we

estimate that we will pay Dalmore Group, pursuant to a

fully-subscribed offering would be $431,500.

(5)

We engaged Great Point Capital

LLC (“GPC”), a broker-dealer registered with the SEC

and a member of FINRA, pursuant to an Investment Banking Agreement,

to assist in identification and qualification of identification of

investors who may be interested in funding the Company’s

capital needs via the Company’s qualified Reg A+ offering.

Their fee includes a 2% commission of all funds raised through

their introductions, as well as a one-time payment of

120,000 shares of the Company’s common stock which shares are

Restricted Securities under Rule 14. We may pay other

broker-dealers and finders as well, but information as to the finder

or brokers must be disclosed in an amendment to this offering

circular. The

maximum amount of fees we would pay to GPC pursuant to a

fully-subscribed offering would be $800,000, though it is unlikely

that all investors would come through GPC introductions and the

amount would likely be less than

$800,000.

In the

event we do not sell all of the Units being offered, we may seek

additional financing from other sources in order to support the

intended use of proceeds indicated above. If we secure additional

equity funding, investors in this offering would be diluted. In all

events, there can be no assurance that additional financing would

be available to us when wanted or needed and, if available, on

terms acceptable to us.

DILUTION

We

are offering for sale to new investors up to 40,000,000 Units at

$1.00 per Unit with one share per Unit. The following

table sets forth on a pro forma basis at September 30, 2020, the

differences between existing stockholders and new investors with

respect to the number of shares of common stock purchased from us,

the total consideration paid to us, and the price paid per Unit,

which is $1.00 per Unit.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing

Shareholders

|

112,972,685

|

74%

|

$80,200,784(2)

|

67%

|

$0.72

|

|

|

|

|

|

|

|

|

New

Investors

|

40,000,000(1)

|

26%

|

$40,000,000

|

33%

|

$1.00

|

|

|

|

|

|

|

|

|

Total

|

152,972,685

|

100%

|

$120,200,784

|

100%

|

$0.79

|

(1)

Does not include any shares from the exercise of warrants from the

Units.

(2)

Includes the value of shares issued for services.

If

you purchase Units in this offering, your ownership interest in our

Common Stock will be diluted immediately. The difference between

the public offering price per share of common stock and the net

tangible book value per share of common stock after this offering

constitutes the dilution to investors in this offering. Net

tangible book value per share is determined by dividing the net

tangible book value (total assets less intangible assets and total

liabilities) by the number of outstanding shares of common

stock. The dilution calculations we have set forth in

this section reflects an offering price of $1.00 per

share.

As

of September 30, 2020, we had a net tangible book value of

($959,221) or ($0.008) per share of issued and outstanding common

stock. After giving effect to the sale of the Units

proposed to be offered in the maximum offering of 40,000,000 Units

(40,000,000 shares), the net tangible book value at that date would

have been $40,959,221 or approximately $0.27 per

share. This represents an immediate increase in net

tangible book value of approximately $0.26 per share to existing

shareholders and an immediate dilution of approximately $0.74 per

share to new investors.

The

following table illustrates such per share dilution:

|

Proposed

public offering price (per share)

|

|

$1.00

|

|

Net

tangible book value per share (September 30, 2020)

|

$0.008

|

|

|

Increase in net

tangible book value per share attributable to proceeds from the

maximum offering

|

$0.26

|

|

|

Pro

forma net tangible book value per share after the

offering

|

|

$0.27

|

|

|

|

|

|

Dilution

to new investors

|

$0.74

|

|

PLAN

OF DISTRIBUTION

This

Offering Circular is part of an Offering Statement that we filed

with the SEC, using a continuous offering process. Periodically, as

we have material developments, we will provide an Offering Circular

supplement that may add, update or change information contained in

this Offering Circular. Any statement that we make in this Offering

Circular will be modified or superseded by any inconsistent

statement made by us in a subsequent Offering Circular supplement.

The Offering Statement we filed with the SEC includes exhibits that

provide more detailed descriptions of the matters discussed in this

Offering Circular. You should read this Offering Circular and the

related exhibits filed with the SEC and any Offering Circular

supplement, together with additional information contained in our

annual reports, semi-annual reports and other reports and

information statements that we will file periodically with the SEC.

See the section entitled “Additional Information” below

for more details.

Pricing of the Offering

Prior

to the Offering, our common stock trades on OTC Markets. However,

the public offering price herein ($1 per share) was determined by

our management. The principal factors considered in determining the

public offering price include:

-the

information set forth in this Offering Circular and otherwise

available;

-our

history and prospects and the history of and prospects for the

industry in which we compete;

-our

past and present financial performance;

-our

prospects for future earnings and the present state of our

development;

-the

general condition of the securities markets at the time of this

Offering;

-the

recent market prices of, and demand for, publicly traded common

stock of generally comparable companies; and

-other

factors deemed relevant by us.

Offering Period and Expiration Date

This

Offering will start on or after the Qualification Date and will

terminate at our discretion or, on the Termination

Date.

Dalmore Group

We have engaged Dalmore Group, LLC (“Dalmore”) a

broker-dealer registered with the SEC and a member of FINRA, to

perform the following administrative and technology related

functions in connection with this Offering, but not for

underwriting or placement agent services:

|

|

●

|

Review investor information, including KYC (“Know Your

Customer”) data,

AML (“Anti Money Laundering”) and other compliance

background checks, and provide a

recommendation to us whether or not to accept investor as a

customer.

|

|

|

●

|

Review each investors subscription agreement to confirm such

investors participation in the

Offering, and provide a determination to us whether or not to

accept the use of the

subscription agreement for the investor’s

participation.

|

|

|

●

|

Contact and/or notify us, if needed, to gather additional

information or clarification

on an investor.

|

|

|

●

|

Not provide any investment advice nor any investment

recommendations to any investor.

|

|

|

●

|

Keep investor details and data confidential and not disclose to any

third-party except as required

by regulators or pursuant to the terms of the agreement (e.g. as

needed for AML and background checks).

|

|

|

●

|

Coordinate with third party providers to ensure adequate review and

compliance.

|

As compensation for the services listed above, the company has

agreed to pay Dalmore $31,500 in one-time set up fees, consisting

of the following:

|

|

●

|

$5,000 advance payment for out of pocket expenses.

|

|

|

●

|

$20,000 consulting fee due and payable immediately after FINRA

issues a no objection letter.

|

|

|

●

|

$6,500 for fees to be paid to FINRA.

|

In addition, we will pay Dalmore Group a commission equal to 1% of

the amount raised in the Offering to support the Offering. Assuming

that the Offering is open for 12 months, we estimate that fees due

to pay Dalmore, pursuant to the 1% commission would be $400,500 for

a fully-subscribed Offering. Finally, the total fees that we

estimate that we will pay Dalmore Group, pursuant to a

fully-subscribed offering would be $431,500. These assumptions were

used in estimating the fees due in the “Use of

Proceeds.”

Great

Point Capital

On

March 3, 2021, WEED, Inc. (the “Company”) and Great

Point Capital, LLC (“GPC”) entered into an Investment

Banking Agreement (the “Agreement”) whereby GPC shall

serve as a nonexclusive investment banker for the Company in

connection with the identification of investors who may be

interested in funding the Company’s capital needs via the

Company’s qualified Reg A+ offering (the

“Raise”). GPC is an independent contractor for the

purposes of the Agreement.

The

Term of the Agreement shall be for the duration of the Raise or

until 15 days after effective notice of termination has been

received by either party. Company may not terminate until 45 days

from the Effective Date, March 3, 2021.

In

consideration of GPC’s services, the Company will pay to GPC

2% of gross proceeds of all money raised by GPC during the term of

the Agreement and a one-time payment of 120,000 shares of the

Company’s common stock, which shares are Restricted

Securities under Rule 144. Company shall reimburse all expenses of

GPC up to an aggregate of $2,500, after which approval is required.

The Company has significant indemnification obligations pursuant to

the Agreement, whereby GPC is indemnified from most actions falling

short of intentional misconduct. Company’s recovery for any

liability is also strictly limited.

Please

see Exhibit 10.1 to the

Company’s 8k filed on March 8, 2021for the full text of the

Agreement with GPC.

Procedures for Subscribing

When

you decide to subscribe for Offered Shares in this Offering, you

should:

Contact

us via phone or email.

1.

Electronically

receive, review, execute and deliver to us a subscription

agreement; and

2.

Deliver

funds directly by wire or electronic funds transfer via ACH to the

specified account maintained by us.

Any

potential investor will have ample time to review the subscription

agreement, along with their counsel, prior to making any final

investment decision. We shall only deliver such subscription

agreement upon request after a potential investor has had ample

opportunity to review this Offering Circular.

Right to Reject

Subscriptions. After we receive

your complete, executed subscription agreement and the funds

required under the subscription agreement have been transferred to

the escrow account, we have the right to review and accept or

reject your subscription in whole or in part, for any reason or for

no reason. We will return all monies from rejected subscriptions

immediately to you, without interest or

deduction.

Acceptance of

Subscriptions. Upon our

acceptance of a subscription agreement, we will countersign the

subscription agreement and issue the shares and warrants subscribed

at closing. Once you submit the subscription agreement and it is

accepted, you may not revoke or change your subscription or request

your subscription funds. All accepted subscription agreements are

irrevocable.

No Escrow

The

proceeds of this offering will not be placed into an escrow

account. We will offer the Units on a best effort’s basis. As

there is no minimum offering, upon the approval of any subscription

to this Offering Circular, we will immediately deposit said

proceeds into our bank account and may dispose of the proceeds in

accordance with the Use of Proceeds at Management’s

discretion.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Disclaimer Regarding Forward Looking Statements

Our

Management’s Discussion and Analysis or Plan of Operations

contains not only statements that are historical facts, but also

statements that are forward-looking. Forward-looking statements

are, by their very nature, uncertain and risky. These risks and

uncertainties include international, national and local general

economic and market conditions; demographic changes; our ability to

sustain, manage, or forecast growth; our ability to successfully

make and integrate acquisitions; raw material costs and

availability; new product development and introduction; existing

government regulations and changes in, or the failure to comply

with, government regulations; adverse publicity; competition; the

loss of significant customers or suppliers; fluctuations and

difficulty in forecasting operating results; changes in business

strategy or development plans; business disruptions; the ability to

attract and retain qualified personnel; the ability to protect

technology; and other risks that might be detailed from time to

time in our filings with the Securities and Exchange

Commission.

Although

the forward-looking statements in this Registration Statement

reflect the good faith judgment of our management, such statements

can only be based on facts and factors currently known by them.

Consequently, and because forward-looking statements are inherently

subject to risks and uncertainties, the actual results and outcomes

may differ materially from the results and outcomes discussed in

the forward-looking statements. You are urged to carefully review

and consider the various disclosures made by us in this report and

in our other reports as we attempt to advise interested parties of

the risks and factors that may affect our business, financial

condition, and results of operations and prospects.

Overview

We

are an early stage holding company currently focused on the

development and application of cannabis-derived compounds for the

treatment of human disease. Our wholly-owned subsidiary, Sangre AT,

LLC (“Sangre”), has begun a planned five-year Cannabis

Genomic Study to complete a genetic blueprint of the Cannabis plant

genus, by creating a global genomic classification of the entire

plant. By targeting cannabis-derived molecules that stimulate the

endocannabinoid system, Sangre’s research team plans to

develop scientifically-valid and evidence-based cannabis strains

for the production of disease-specific medicines. The goal of the

research is to identify, collect, patent, and archive a collection

of highly-active medicinal strains. We plan to conduct this study

only in states where cannabis has been legalized for medicinal

purposes.

Using

annotated genomic data and newly generated phenotypic data, Sangre

plans to identify and isolate regions of the plant genome which are

related to growth, synthesis of desired molecules, and drought and

pest resistance. This complex data set would then be utilized in a

breeding program to generate and establish new hybrid cultivars