SILVERBOW RESOURCES, INC.000035181710-K12/3112/31/2020FALSE2020FYNon-Accelerated Filer11,936,679FALSEFALSETRUEFALSETRUE14,623,839December 31, 202028,09041,2010.010.0110,000,00010,000,000——0.010.0140,000,00040,000,00012,053,76311,895,03211,936,67911,806,679117,08488,3535—28,73122,482——158,726137,060P2Y0.10.1P1YP5YP1YP5YP3Y0MP3Y0M0.6P4Y0.400003518172020-01-012020-12-31iso4217:USD00003518172020-06-30xbrli:shares00003518172021-01-3100003518172020-12-3100003518172019-12-31iso4217:USDxbrli:shares00003518172019-01-012019-12-310000351817us-gaap:CommonStockMember2018-12-310000351817us-gaap:AdditionalPaidInCapitalMember2018-12-310000351817us-gaap:TreasuryStockMember2018-12-310000351817us-gaap:RetainedEarningsMember2018-12-3100003518172018-12-310000351817us-gaap:CommonStockMember2019-01-012019-12-310000351817us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000351817us-gaap:TreasuryStockMember2019-01-012019-12-310000351817us-gaap:RetainedEarningsMember2019-01-012019-12-310000351817us-gaap:CommonStockMember2019-12-310000351817us-gaap:AdditionalPaidInCapitalMember2019-12-310000351817us-gaap:TreasuryStockMember2019-12-310000351817us-gaap:RetainedEarningsMember2019-12-310000351817us-gaap:CommonStockMember2020-01-012020-12-310000351817us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000351817us-gaap:TreasuryStockMember2020-01-012020-12-310000351817us-gaap:RetainedEarningsMember2020-01-012020-12-310000351817us-gaap:CommonStockMember2020-12-310000351817us-gaap:AdditionalPaidInCapitalMember2020-12-310000351817us-gaap:TreasuryStockMember2020-12-310000351817us-gaap:RetainedEarningsMember2020-12-31xbrli:pure00003518172020-03-3100003518172020-04-2100003518172020-09-30utr:MMcfutr:bbl0000351817us-gaap:SwapMembersbow:SwapPurchaseMemberus-gaap:SubsequentEventMembersbow:FirstQuarter2021Member2021-02-26iso4217:USDsbow:Boe0000351817sbow:SecondQuarter2021Memberus-gaap:SwapMembersbow:SwapPurchaseMemberus-gaap:SubsequentEventMember2021-02-260000351817us-gaap:SwapMemberus-gaap:CommodityContractMembersbow:FirstQuarter2022Memberus-gaap:SubsequentEventMember2021-02-260000351817us-gaap:SwapMemberus-gaap:CommodityContractMembersbow:SecondQuarter2022Memberus-gaap:SubsequentEventMember2021-02-260000351817us-gaap:SwapMemberus-gaap:CommodityContractMemberus-gaap:SubsequentEventMembersbow:ThirdQuarter2022Member2021-02-260000351817sbow:FourthQuarter2022Memberus-gaap:SwapMemberus-gaap:CommodityContractMemberus-gaap:SubsequentEventMember2021-02-260000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:FirstQuarter2022Memberus-gaap:SubsequentEventMember2021-02-26iso4217:USDutr:MMBTU0000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:SecondQuarter2022Memberus-gaap:SubsequentEventMember2021-02-260000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMemberus-gaap:SubsequentEventMembersbow:ThirdQuarter2022Member2021-02-260000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMembersbow:FourthQuarter2022Memberus-gaap:BasisSwapMemberus-gaap:SubsequentEventMember2021-02-26utr:MMBTU0000351817us-gaap:EnergyRelatedDerivativeMembersbow:SecondQuarter2021Memberus-gaap:SubsequentEventMemberus-gaap:ForwardContractsMember2021-02-260000351817us-gaap:EnergyRelatedDerivativeMembersbow:ThirdQuarter2021Memberus-gaap:SubsequentEventMemberus-gaap:ForwardContractsMember2021-02-260000351817us-gaap:EnergyRelatedDerivativeMembersbow:FourthQuarter2021Memberus-gaap:SubsequentEventMemberus-gaap:ForwardContractsMember2021-02-260000351817us-gaap:EnergyRelatedDerivativeMembersbow:FirstQuarter2022Memberus-gaap:SubsequentEventMemberus-gaap:ForwardContractsMember2021-02-260000351817us-gaap:BasisSwapMembersbow:FirstQuarter2022Memberus-gaap:OtherContractMemberus-gaap:SubsequentEventMember2021-02-260000351817us-gaap:BasisSwapMemberus-gaap:OtherContractMembersbow:SecondQuarter2022Memberus-gaap:SubsequentEventMember2021-02-260000351817us-gaap:BasisSwapMemberus-gaap:OtherContractMemberus-gaap:SubsequentEventMembersbow:ThirdQuarter2022Member2021-02-260000351817sbow:FourthQuarter2022Memberus-gaap:BasisSwapMemberus-gaap:OtherContractMemberus-gaap:SubsequentEventMember2021-02-260000351817us-gaap:SwapMemberus-gaap:SubsequentEventMembersbow:FirstQuarter2021Membersbow:NGLContractMember2021-02-260000351817sbow:SecondQuarter2021Memberus-gaap:SwapMemberus-gaap:SubsequentEventMembersbow:NGLContractMember2021-02-260000351817sbow:ThirdQuarter2021Memberus-gaap:SwapMemberus-gaap:SubsequentEventMembersbow:NGLContractMember2021-02-260000351817us-gaap:SwapMembersbow:FourthQuarter2021Memberus-gaap:SubsequentEventMembersbow:NGLContractMember2021-02-260000351817srt:MinimumMember2020-01-012020-12-310000351817srt:MaximumMember2020-01-012020-12-310000351817sbow:OilsalesMember2020-01-012020-12-310000351817sbow:OilsalesMember2019-01-012019-12-310000351817sbow:NaturalgassalesMember2020-01-012020-12-310000351817sbow:NaturalgassalesMember2019-01-012019-12-310000351817sbow:NGLsalesMember2020-01-012020-12-310000351817sbow:NGLsalesMember2019-01-012019-12-3100003518172020-01-012020-06-300000351817sbow:KinderMorganConcentrationRiskMember2020-01-012020-12-310000351817sbow:KinderMorganConcentrationRiskMember2019-01-012019-12-310000351817sbow:PlainsMarketingConcentrationRiskMember2020-01-012020-12-310000351817sbow:PlainsMarketingConcentrationRiskMember2019-01-012019-12-310000351817sbow:TwinEagleConcentrationRiskMember2020-01-012020-12-310000351817sbow:TwinEagleConcentrationRiskMember2019-01-012019-12-310000351817sbow:TrafiguraUSConcentrationRiskMember2020-01-012020-12-310000351817sbow:ShellTradingConcentrationRiskMember2019-01-012019-12-310000351817us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000351817us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000351817us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000351817us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000351817us-gaap:PerformanceSharesMember2020-01-012020-12-310000351817us-gaap:WarrantMember2019-01-012019-12-310000351817us-gaap:WarrantMember2020-01-012020-12-310000351817us-gaap:PerformanceSharesMember2019-01-012019-12-310000351817us-gaap:TaxYear2015Member2020-12-310000351817us-gaap:TaxYear2017Member2020-12-310000351817us-gaap:TaxYear2020Member2020-12-310000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2020-12-310000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2019-12-310000351817sbow:SecondLienNotesMember2020-12-310000351817sbow:SecondLienNotesMember2019-12-310000351817sbow:NewCreditFacilityMember2020-12-310000351817sbow:NewCreditFacilityMember2019-12-310000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2020-11-020000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2020-05-120000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2020-11-022020-11-020000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2017-04-190000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2020-05-122020-05-120000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2020-05-122020-05-120000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2020-05-122020-05-120000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2020-01-012020-12-310000351817us-gaap:LineOfCreditMembersbow:NewCreditFacilityMember2019-01-012019-12-310000351817us-gaap:LineOfCreditMember2020-01-012020-12-310000351817us-gaap:LineOfCreditMember2019-01-012019-12-310000351817sbow:SecondLienNotesMember2017-12-150000351817us-gaap:LondonInterbankOfferedRateLIBORMembersbow:SecondLienNotesMember2017-12-152017-12-150000351817us-gaap:BaseRateMembersbow:SecondLienNotesMember2017-12-152017-12-150000351817sbow:SecondLienNotesMember2017-12-152017-12-150000351817sbow:SecondLienNotesMember2020-01-012020-12-310000351817sbow:SecondLienNotesMember2019-01-012019-12-310000351817us-gaap:OtherCurrentAssetsMember2020-12-310000351817us-gaap:OtherNoncurrentAssetsMember2020-12-310000351817us-gaap:OtherCurrentLiabilitiesMember2020-12-310000351817us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310000351817us-gaap:OtherCurrentAssetsMember2019-12-310000351817us-gaap:OtherNoncurrentAssetsMember2019-12-310000351817us-gaap:OtherCurrentLiabilitiesMember2019-12-310000351817us-gaap:OtherNoncurrentLiabilitiesMember2019-12-310000351817us-gaap:SwapMemberus-gaap:CommodityContractMembersbow:FirstQuarter2021Member2020-12-310000351817sbow:SecondQuarter2021Memberus-gaap:SwapMemberus-gaap:CommodityContractMember2020-12-310000351817sbow:ThirdQuarter2021Memberus-gaap:SwapMemberus-gaap:CommodityContractMember2020-12-310000351817us-gaap:SwapMemberus-gaap:CommodityContractMembersbow:FourthQuarter2021Member2020-12-310000351817us-gaap:SwapMemberus-gaap:CommodityContractMembersbow:FirstQuarter2022Member2020-12-310000351817us-gaap:SwapMemberus-gaap:CommodityContractMembersbow:ThirdQuarter2022Member2020-12-310000351817us-gaap:CommodityContractMemberus-gaap:ForwardContractsMembersbow:FirstQuarter2021Member2020-12-310000351817sbow:SecondQuarter2021Memberus-gaap:CommodityContractMemberus-gaap:ForwardContractsMember2020-12-310000351817sbow:ThirdQuarter2021Memberus-gaap:CommodityContractMemberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:CommodityContractMembersbow:FourthQuarter2021Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:CommodityContractMembersbow:FirstQuarter2022Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:CommodityContractMembersbow:SecondQuarter2022Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:SwapMembersbow:FirstQuarter2021Member2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:SecondQuarter2021Memberus-gaap:SwapMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:ThirdQuarter2021Memberus-gaap:SwapMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:SwapMembersbow:FourthQuarter2021Member2020-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:ForwardContractsMembersbow:FirstQuarter2021Member2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:SecondQuarter2021Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:ThirdQuarter2021Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:FourthQuarter2021Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:FirstQuarter2022Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:SecondQuarter2022Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMembersbow:ThirdQuarter2022Memberus-gaap:ForwardContractsMember2020-12-310000351817us-gaap:BasisSwapMemberus-gaap:OtherContractMembersbow:FirstQuarter2021Member2020-12-310000351817sbow:SecondQuarter2021Memberus-gaap:BasisSwapMemberus-gaap:OtherContractMember2020-12-310000351817sbow:ThirdQuarter2021Memberus-gaap:BasisSwapMemberus-gaap:OtherContractMember2020-12-310000351817us-gaap:BasisSwapMembersbow:FourthQuarter2021Memberus-gaap:OtherContractMember2020-12-310000351817us-gaap:BasisSwapMembersbow:FirstQuarter2022Memberus-gaap:OtherContractMember2020-12-310000351817us-gaap:BasisSwapMemberus-gaap:OtherContractMembersbow:SecondQuarter2022Member2020-12-310000351817us-gaap:BasisSwapMemberus-gaap:OtherContractMembersbow:ThirdQuarter2022Member2020-12-310000351817sbow:FourthQuarter2022Memberus-gaap:BasisSwapMemberus-gaap:OtherContractMember2020-12-310000351817us-gaap:BasisSwapMembersbow:FirstQuarter2021Membersbow:OilBasisDerivativeMember2020-12-310000351817sbow:SecondQuarter2021Memberus-gaap:BasisSwapMembersbow:OilBasisDerivativeMember2020-12-310000351817sbow:ThirdQuarter2021Memberus-gaap:BasisSwapMembersbow:OilBasisDerivativeMember2020-12-310000351817us-gaap:BasisSwapMembersbow:FourthQuarter2021Membersbow:OilBasisDerivativeMember2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:FirstQuarter2021Member2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMembersbow:SecondQuarter2021Memberus-gaap:BasisSwapMember2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMembersbow:ThirdQuarter2021Memberus-gaap:BasisSwapMember2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:FourthQuarter2021Member2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:FirstQuarter2022Member2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:SecondQuarter2022Member2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMemberus-gaap:BasisSwapMembersbow:ThirdQuarter2022Member2020-12-310000351817sbow:OilBasisCalendarMonthlyRollDifferentialSwapMembersbow:FourthQuarter2022Memberus-gaap:BasisSwapMember2020-12-310000351817sbow:GastransportationandprocessingobligationsMember2020-12-310000351817us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310000351817us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310000351817us-gaap:RestrictedStockUnitsRSUMember2019-04-020000351817sbow:PerformancebasedstockunitMember2019-04-020000351817sbow:SharebasedPaymentArrangementOptionEquityExchangeAwardMember2019-04-020000351817srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310000351817srt:MaximumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310000351817us-gaap:EmployeeStockOptionMember2020-12-310000351817us-gaap:EmployeeStockOptionMember2019-12-310000351817us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2020-01-012020-12-310000351817us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2020-01-012020-12-310000351817us-gaap:RestrictedStockUnitsRSUMember2020-12-310000351817us-gaap:RestrictedStockUnitsRSUMember2019-12-310000351817sbow:PerformancebasedstockunitMember2018-02-202018-02-200000351817srt:MinimumMembersbow:PerformancebasedstockunitMember2018-02-200000351817srt:MaximumMembersbow:PerformancebasedstockunitMember2018-02-200000351817sbow:PerformancebasedstockunitMember2018-02-200000351817srt:MaximumMembersbow:PerformancebasedstockunitMember2020-01-012020-12-310000351817sbow:PerformancebasedstockunitMember2019-05-212019-05-210000351817srt:MinimumMembersbow:PerformancebasedstockunitMember2019-05-210000351817srt:MaximumMembersbow:PerformancebasedstockunitMember2019-05-210000351817sbow:PerformancebasedstockunitMember2019-05-210000351817sbow:PerformancebasedstockunitMember2020-12-310000351817sbow:PerformancebasedstockunitMember2020-12-312020-12-310000351817sbow:PerformancebasedstockunitMember2020-01-012020-12-310000351817us-gaap:PropertyPlantAndEquipmentMember2020-01-012020-12-310000351817us-gaap:PropertyPlantAndEquipmentMember2019-01-012019-12-310000351817sbow:LeaseOperatingExpenseMember2020-01-012020-12-310000351817sbow:LeaseOperatingExpenseMember2019-01-012019-12-310000351817us-gaap:BuildingMember2017-12-310000351817us-gaap:BuildingMember2020-12-310000351817sbow:BayDeCheneMember2017-12-220000351817sbow:BayDeCheneMember2020-12-310000351817sbow:EagleFordAcquisitionMember2020-04-032020-04-030000351817sbow:WyomingDispositionMember2020-05-132020-05-130000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2020-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMemberus-gaap:FairValueInputsLevel1Member2020-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMemberus-gaap:FairValueInputsLevel2Member2020-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2020-12-310000351817us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000351817us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000351817us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000351817us-gaap:FairValueMeasurementsRecurringMembersbow:OilBasisDerivativeMember2020-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membersbow:OilBasisDerivativeMember2020-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Membersbow:OilBasisDerivativeMember2020-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembersbow:OilBasisDerivativeMember2020-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310000351817us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2019-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMemberus-gaap:FairValueInputsLevel1Member2019-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMemberus-gaap:FairValueInputsLevel2Member2019-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2019-12-310000351817us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000351817us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310000351817us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000351817us-gaap:FairValueMeasurementsRecurringMembersbow:OilBasisDerivativeMember2019-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membersbow:OilBasisDerivativeMember2019-12-310000351817us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Membersbow:OilBasisDerivativeMember2019-12-310000351817us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembersbow:OilBasisDerivativeMember2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2020

Commission File Number 1-8754

SILVERBOW RESOURCES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

Delaware

|

20-3940661

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification No.)

|

575 North Dairy Ashford, Suite 1200

Houston, Texas 77079

(281) 874-2700

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Class

|

Trading Symbol(s)

|

Exchanges on Which Registered:

|

|

Common Stock, par value $0.01 per share

|

SBOW

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

o

|

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

þ

|

|

Smaller reporting company

|

þ

|

|

Emerging Growth Company

|

o

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

o

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate public float of common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as quoted on the New York Stock Exchange as of June 30, 2020, the last business day of the second quarter for fiscal year 2020, was approximately $14,623,839.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13

or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a

court.

The number of shares of common stock outstanding as of January 31, 2021 was 11,936,679.

Documents incorporated by reference: Portions of the registrant’s definitive proxy statement for its 2021 annual meeting of stockholders, to be filed within 120 days after the registrant’s fiscal year end, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Form 10-K

SilverBow Resources, Inc. and Subsidiary

10-K Part and Item No.

|

|

|

|

|

|

|

|

|

|

|

Part I

|

|

Page

|

|

|

|

|

|

Items 1 & 2

|

Business and Properties

|

|

|

|

|

|

|

Item 1A.

|

Risk Factors

|

|

|

|

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

|

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

|

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

|

|

|

|

Part II

|

|

|

|

|

|

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

|

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

|

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

|

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

|

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

|

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

|

|

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

|

|

|

|

Item 9B.

|

Other Information

|

|

|

|

|

|

|

Part III

|

|

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

|

|

|

|

Item 11.

|

Executive Compensation

|

|

|

|

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters

|

|

|

|

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

|

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

|

|

|

|

|

Part IV

|

|

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

Item 16.

|

10-K Summary

|

|

Items 1 and 2. Business and Properties

As used in this Annual Report on Form 10-K, unless the context otherwise requires or indicates, references to “SilverBow Resources,” “the Company,” “we,” “our,” “ours” and “us” refer to SilverBow Resources, Inc. See pages 30 and 31 for explanations of abbreviations and terms used herein.

Overview

SilverBow Resources is an independent oil and gas company headquartered in Houston, Texas. The Company, originally founded in 1979, was organized as a Delaware corporation in 2016. The Company's strategy is focused on acquiring and developing assets in the Eagle Ford Shale located in South Texas where the Company has assembled approximately 155,000 net acres across five operating areas. The Company's acreage position in each of its operating areas is highly contiguous and designed for optimal and efficient horizontal well development. The Company believes it has built a balanced portfolio of properties with a significant base of current production and reserves coupled with low-risk development drilling opportunities and meaningful upside from newer operating areas.

The Company produced an average of 178 MMcfe per day during the fourth quarter of 2020 and had proved reserves of 1,106 Bcfe (86% natural gas) with a Standardized Measure of $513 million and a PV-10 of $526 million as of December 31, 2020. PV-10 Value is a non-GAAP measure; see the section titled “Oil and Natural Gas Reserves” of this Form 10-K for a reconciliation of this non-GAAP measure to the Standardized Measure of discounted future net cash flows, the most directly comparable GAAP measure.

Being a committed and long-term operator in South Texas, the Company possesses a significant understanding of the reservoir characteristics, geology, landowners and competitive landscape in the region. The Company leverages this in-depth knowledge to continue to assemble high quality drilling inventory while continuously enhancing its operations to position itself to maximize returns on capital invested.

Business Strategies

•Leverage technical expertise to efficiently develop Eagle Ford Shale drilling locations. As of December 31, 2020, our technical team has an average of approximately 21 years of experience which we believe gives us a technical advantage when developing and organically expanding our asset base. We leverage this advantage in our existing asset base to create highly efficient drilling and completion operations. Focusing solely on the Eagle Ford play allows us to use our operating, technical and regional expertise to interpret geological and operating trends, enhance production rates and maximize well recovery. We are focused on enhancing asset value through utilizing cost-effective technology to locate the highest quality intervals to drill and complete oil and gas wells. We continue to optimize our drilling techniques, shorten our drill times and steer our laterals to target high quality intervals in the Eagle Ford. We have also enhanced fracture stimulation designs, optimizing fluid and proppant usage and fracture stage spacing. We believe these factors will enhance the return profile of our drilling and completion operations. Our 2021 capital budget range of $100-$110 million provides for drilling 17 gross (15 net) horizontal wells which is expected to be funded primarily from operating cash flow.

•Prudently grow and maintain balanced inventory of locations. Oil, natural gas and natural gas liquids prices have the potential to exhibit volatile and unpredictable fluctuations. Further, the timing and duration of such fluctuations are difficult to predict. As a result, the Company is focused on continuing to expand its liquids-rich inventory through technical advancements on existing acreage, organic leasing and bolt-on acquisitions. This strategy of diversification allows us to pursue our most economic hydrocarbon locations that in turn generate the most compelling returns, with the ability to shift our focus to locations with different hydrocarbon mixes based on prevailing prices. Given the state of commodity prices in 2020, the Company focused its 2020 drilling and completion (“D&C”) program toward gas development. Of the 446 gross undrilled horizontal locations at year-end 2020, 212 locations are liquids-weighted and 234 locations are gas-weighted. The Company’s balanced commodity mix provides opportunity to selectively allocate capital towards our highest rate of return locations as dictated by prices. We assess optimal production timing in response to the market and are agile enough to strategically shift sales to higher prices periods. The re-imposition of restrictions by governments to mitigate the COVID-19 pandemic or other events that adversely affect oil, natural gas and natural gas liquids prices could result in further curtailments and adversely affect our expectation for improved performance in future.

•Operate our properties as a low-cost producer. We believe our concentrated acreage position in the Eagle Ford and our experience as an operator of substantially all of our properties enables us to apply drilling and completion techniques and

economies of scale that improve returns. Operating control allows us to manage pace of development, timing, and associated annual capital expenditures. Furthermore, we are able to achieve lower operating costs through concentrated infrastructure and field operations. In addition, our concentrated acreage positions allow the Company to drill multiple wells from a single pad while optimizing lateral lengths. Pad drilling reduces facilities costs and consolidates surface level operations. Our operational control is critical to our being able to transfer successful drilling and completion techniques and cost cutting initiatives from one field to another. Finally, we will continue to leverage our proximity to end-user markets of natural gas which gives us the ability to lower transportation costs relative to other basins and enhance returns to our shareholders.

•Continue to pursue strategic opportunities to further expand our core position in the Eagle Ford Shale. We continue to take advantage of opportunities to expand our core positions through leasing and acquisitions. In 2020, we successfully closed an acquisition directly offsetting our existing assets further increasing our blocky, contiguous acreage position. We plan to continue strategically targeting certain areas of the Eagle Ford where our technical experience and successful drilling results can be replicated and expanded. We believe our extensive basin-wide experience gives us a competitive advantage in locating both strategic acquisitions and ground-floor leasing opportunities to expand our core acreage position in the future.

•Maintain our financial flexibility and liquidity profile. We are committed to preserving our financial flexibility and are focused on continued growth in a disciplined manner. We have historically funded our capital program by using a combination of internally generated cash flows and funds available on our Credit Facility (Note 4 to the Company's consolidated financial statements in this Form 10-K). As of December 31, 2020, the Company had $80.0 million in available borrowing capacity under its Credit Facility, which we believe, along with our projected operating cash flow, provides us with liquidity to execute our 2021 development plan and opportunistically acquire or lease additional acreage. Our Credit Facility and Second Lien (Note 4 to the Company's consolidated financial statements in this Form 10-K), maturing in April 2022 and December 2024, respectively, are our only stated debt maturities.

•Manage risk exposure. We utilize a disciplined hedging program to limit our exposure to volatility in commodity prices and achieve a more predictable level of cash flows to support current and future capital expenditure plans. Our multi-year price risk management program also includes hedges to limit our basis differential to oil and natural gas pricing. We take a systematic approach to hedging and periodically add hedges to our portfolio in an effort to protect the rates of returns on our drilling program. As of February 26, 2021, we had approximately 63% of total production volumes hedged for full year 2021, using the midpoint of production guidance of 180 - 200 MMcfe/d.

Our Competitive Strengths

•Inventory of drilling locations with high degree of operational control. We have developed a significant inventory of future drilling locations. As of December 31, 2020, we had approximately 155,000 net acres in the Eagle Ford and roughly 446 gross horizontal drilling locations. Approximately 54% of our estimated proved reserves at December 31, 2020 were undeveloped. We operate essentially all of our proved reserves and have an average working interest of approximately 78% across our identified locations. These factors provide us with a high level of control over our operations, allowing us to manage our development drilling schedule, utilize pad drilling where applicable, and implement leading edge modern completion techniques. We plan to continue to deliver production, reserve and cash flow growth by developing our extensive inventory of low-risk drilling locations in a disciplined manner.

•Ability to adjust cadence and hydrocarbon mix of operations activity. In 2020, we drilled 19 net wells, completed 15 net wells and brought 15 net wells online. Our activity through the first quarter of 2020 was primarily focused on our AWP Oil assets. At the end of the first quarter, we temporarily ceased D&C activity and strategically curtailed production in order to maximize cash flows. In response to fluctuations in commodity prices, we re-focused our capital budget through the end of the year towards our dry-gas assets. The ability to adjust our drilling and completion schedule in response to prices allows us to focus on the highest return, lowest risk projects. We are able to make incremental investment decisions and protect returns in advance of pursuing our balanced set of low-risk development opportunities.

•Proximity to Demand Centers. Our assets are positioned in one of the most economically advantaged natural gas and oil regions of North America. Our proximity to the Gulf Coast affords us much lower commodity basis differentials and meaningfully higher price realizations when compared to other domestic basins. For instance, in 2020 our average natural gas basis differentials to NYMEX were $0.01/Mcf discount versus $0.96/Mcf discount for the Permian Basin index into the El Paso pipeline. Additionally, our assets are in close proximity to the largest and highest growth natural gas and NGL demand centers, including increasing LNG exports, natural gas exports to Mexico and industrial, petrochemical, and power demand in the Gulf Coast markets.

•Experienced and proven technical team. As of December 31, 2020, we employed 13 oil and gas technical professionals, including geoscientists, drilling, completion, production and reservoir engineers, and other oil and gas professionals who collectively have an average of approximately 21 years of experience in their technical fields. Our senior technical team has come from a number of large and successful organizations. Our technical team is focused on utilizing modern completion techniques to increase our estimated ultimate recovery and maximize our per-well returns. Our enhanced completion designs include tighter fracture stage spacing as well as optimized proppant loadings and intensity. Additionally, we rely on advanced technologies to better define geologic risk and enhance the results of our drilling efforts. We are a leader in drilling some of the best natural gas wells in the play. We continually apply our extensive in-house experience and current technologies to benefit our drilling and production operations.

•Proven low cost operator with contiguous acreage. Our core acreage positions are contiguous in nature which allows us to continue to lower per unit costs through drilling longer laterals, utilizing pad drilling, consolidating in-field infrastructure, and efficiently sourcing materials through our procurement strategies. We believe the nature of our positions and our operational improvements and efficiencies will allow us to continue to successfully mitigate service cost inflation. Additionally, we continually seek to optimize our production operations with the objective of reducing our operating costs through efficient well management. Finally, our significant operational control, as well as our manageable leasehold drilling obligations, provide us the flexibility to control our costs as we transition to a development mode across our portfolio.

•Balance Sheet discipline and sufficient liquidity. As of December 31, 2020, the Company had $80.0 million in available borrowing capacity under our Credit Facility, which we believe, along with our operating cash flow, provides us with a sufficient amount of liquidity to execute our 2021 development plan and opportunistically acquire or lease additional acreage even with modest changes in the commodity environment. Our Credit Facility and Second Lien, maturing in April 2022 and December 2024, respectively, are our only stated debt maturities. As of December 31, 2020, we had $230.0 million drawn on our $310.0 million borrowing base under the Credit Facility.

Property Overview

The Company's operations are focused in five fields located in the Eagle Ford Shale trend of South Texas. The following table sets forth information regarding its Eagle Ford fields in 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fields

|

|

Net Acreage

|

|

2020 Production (Mcfe/d)

|

|

Gas as % of 2020 Production

|

|

2020 Net Wells Drilled

|

|

2020 Net Wells Completed

|

|

Artesia

|

|

12,252

|

|

|

36,437

|

|

|

43

|

%

|

|

3

|

|

|

3

|

|

|

AWP

|

|

51,073

|

|

|

34,061

|

|

|

38

|

%

|

|

8

|

|

|

10

|

|

|

Fasken

|

|

7,802

|

|

|

97,013

|

|

|

100

|

%

|

|

8

|

|

|

2

|

|

|

Oro Grande

|

|

60,763

|

|

|

11,367

|

|

|

100

|

%

|

|

—

|

|

|

—

|

|

|

Uno Mas

|

|

6,670

|

|

|

2,153

|

|

|

97

|

%

|

|

—

|

|

|

—

|

|

|

Other (1)

|

|

16,342

|

|

|

1,984

|

|

|

34

|

%

|

|

—

|

|

|

—

|

|

|

Total

|

|

154,902

|

|

|

183,015

|

|

|

76

|

%

|

|

19

|

|

|

15

|

|

|

(1) Other includes non-core properties

|

|

|

|

|

|

|

|

|

|

|

The following table sets forth information regarding the Company's 2020 year-end proved reserves of 1,106.4 Bcfe and production of 66.8 Bcfe by area:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fields

|

|

Proved Developed Reserves (Bcfe)

|

|

Proved Undeveloped Reserves

(Bcfe)

|

|

Total Proved Reserves

(Bcfe)

|

|

% of Total Proved Reserves

|

|

Oil and

NGLs as % of Proved Reserves

|

|

Total

Production (Bcfe)

|

|

Artesia

|

|

93.3

|

|

|

73.1

|

|

|

166.4

|

|

|

15.0

|

%

|

|

54.1

|

%

|

|

13.3

|

|

|

AWP

|

|

71.5

|

|

|

38.0

|

|

|

109.5

|

|

|

9.9

|

%

|

|

61.1

|

%

|

|

12.4

|

|

|

Fasken

|

|

289.3

|

|

|

489.2

|

|

|

778.4

|

|

|

70.4

|

%

|

|

—

|

%

|

|

35.4

|

|

|

Oro Grande

|

|

40.7

|

|

|

—

|

|

|

40.7

|

|

|

3.7

|

%

|

|

—

|

%

|

|

4.1

|

|

|

Uno Mas

|

|

9.5

|

|

|

—

|

|

|

9.5

|

|

|

0.9

|

%

|

|

3.6

|

%

|

|

0.8

|

|

|

Other (1)

|

|

1.9

|

|

|

—

|

|

|

1.9

|

|

|

0.1

|

%

|

|

52.8

|

%

|

|

0.7

|

|

|

Total

|

|

506.1

|

|

|

600.3

|

|

|

1,106.4

|

|

|

100.0

|

%

|

|

14.3

|

%

|

|

66.8

|

|

|

(1) Other includes non-core properties

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and Natural Gas Reserves

The following tables present information regarding proved oil and natural gas reserves attributable to the Company's interests in proved properties as of December 31, 2020, 2019 and 2018. The information set forth in the tables regarding reserves is based on proved reserves reports prepared in accordance with Securities and Exchange Commission’s (“SEC") rules. H.J. Gruy and Associates, Inc. (“Gruy”), independent petroleum engineers, prepared the Company's proved reserves reports as of December 31, 2020, 2019 and 2018.

The reserves estimation process involves members of the reserves and evaluation department who report to the Chief Reservoir Engineer. The staff includes engineers whose duty is to prepare estimates of reserves in accordance with the SEC's rules, regulations and guidelines. This team worked closely with Gruy to ensure the accuracy and completeness of the data utilized for the preparation of the 2020, 2019 and 2018 reserve reports. All information from the Company's secure engineering database as well as geographic maps, well logs, production tests and other pertinent data were provided to Gruy.

The Chief Reservoir Engineer supervises this process with multiple levels of review and reconciliation of reserve estimates to ensure they conform to SEC guidelines. Reserves data are also reported to and reviewed by senior management quarterly. The Board of Directors (the “Board”) reviews the reserve data periodically and the independent Board members meet with Gruy in executive sessions at least annually.

The technical person at Gruy primarily responsible for overseeing preparation of the 2020, 2019 and 2018 reserves report and the audits of prior year reports is a Licensed Professional Engineer, holds a degree in petroleum engineering, is past Chairman of the Gulf Coast Section of the Society of Petroleum Engineers, is past President of the Society of Petroleum Evaluation Engineers, and has over 30 years of experience in preparing reserves reports and overseeing reserves audits.

The Company's Chief Reservoir Engineer, the primary technical person responsible for overseeing the preparation of its 2020, 2019 and 2018 reserve estimates, holds a bachelor's degree in geology, is a member of the Society of Petroleum Engineers and the Society of Professional Well Log Analysts, and has over 25 years of experience in petrophysical analysis, reservoir engineering, and reserves estimation.

Estimates of future net revenues from the Company's proved reserves, Standardized Measure and PV-10 (PV-10 is a non-GAAP measure defined below), as of December 31, 2020, 2019 and 2018 are made in accordance with SEC criteria, which is based on the preceding 12-months' average adjusted price after differentials based on closing prices on the first business day of each month (excluding the effects of hedging) and are held constant for that year's reserves calculation throughout the life of the properties, except where such guidelines permit alternate treatment, including, in the case of natural gas contracts, the use of fixed and determinable contractual price escalations. The Company has interests in certain tracts that are estimated to have additional hydrocarbon reserves that cannot be classified as proved and are not reflected in the following tables.

The following prices were used to estimate the Company's SEC proved reserve volumes, year-end Standardized Measure and PV-10. The 12-month 2020 average adjusted prices after differentials were $2.13 per Mcf of natural gas, $37.83 per barrel of oil, and $11.66 per barrel of NGL, compared to $2.62 per Mcf of natural gas, $58.37 per barrel of oil, and $16.83 per barrel of NGL for 2019 and $3.04 per Mcf of natural gas, $66.96 per barrel of oil, and $26.63 per barrel of NGL for 2018.

As noted above, PV-10 Value is a non-GAAP measure. The most directly comparable GAAP measure to the PV-10 Value is the Standardized Measure. The Company believes the PV-10 Value is a useful supplemental disclosure to the Standardized Measure because the PV-10 Value is a widely used measure within the industry and is commonly used by securities analysts, banks and credit rating agencies to evaluate the value of proved reserves on a comparative basis across companies or specific properties without regard to the owner's income tax position. The Company uses the PV-10 Value for comparison against its debt balances, to evaluate properties that are bought and sold and to assess the potential return on investment in its oil and gas properties. PV-10 Value is not a measure of financial or operating performance under GAAP, nor should it be considered in isolation or as a substitute for any GAAP measure. The Company's PV-10 Value and the Standardized Measure do not purport to represent the fair value of the Company's proved oil and natural gas reserves.

The following table provides a reconciliation between the Standardized Measure (the most directly comparable financial measure calculated in accordance with U.S. GAAP) and PV-10 Value of the Company's proved reserves:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

(in millions)

|

2020

|

|

2019

|

|

2018

|

|

Standardized Measure of Discounted Future Net Cash Flows

|

$

|

513

|

|

|

$

|

868

|

|

|

$

|

994

|

|

|

Adjusted for: Future income taxes (discounted at 10%)

|

13

|

|

|

108

|

|

|

134

|

|

|

PV-10 Value

|

$

|

526

|

|

|

$

|

976

|

|

|

$

|

1,128

|

|

The following tables set forth estimates of future net revenues presented on the basis of unescalated prices and costs in accordance with criteria prescribed by the SEC and presented on a Standardized Measure and PV-10 basis as of December 31, 2019 and 2018. Operating costs, development costs, asset retirement obligation costs, and certain production-related taxes were deducted in arriving at the estimated future net revenues.

At December 31, 2020, the Company had estimated proved reserves of 1,106 Bcfe with a Standardized Measure of $513 million and PV-10 Value of $526.3 million. This is a decrease of approximately 314 Bcfe from the Company's year-end 2019 proved reserves quantities primarily due to decreases in our natural gas reserves primarily from our AWP field. The Company's total proved reserves at December 31, 2020 were approximately 7% crude oil, 86% natural gas, and 7% NGLs, while 46% of its total proved reserves were developed. Essentially all of the Company's proved reserves are located in Texas. The following amounts shown in MMcfe below are based on an oil and natural gas liquids conversion factor of 1 Bbl to 6 Mcf:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Proved Natural Gas, Oil and NGL Reserves

|

|

As of December 31,

|

|

|

|

2020

|

|

2019

|

|

2018

|

|

Natural gas reserves (MMcf):

|

|

|

|

|

|

|

|

Proved developed

|

|

415,390

|

|

478,005

|

|

466,129

|

|

Proved undeveloped

|

|

532,704

|

|

680,347

|

|

630,279

|

|

Total

|

|

948,094

|

|

1,158,352

|

|

1,096,408

|

|

Oil reserves (MBbl):

|

|

|

|

|

|

|

|

Proved developed

|

|

6,963

|

|

6,476

|

|

5,507

|

|

Proved undeveloped

|

|

5,569

|

|

10,592

|

|

7,271

|

|

Total

|

|

12,532

|

|

17,068

|

|

12,779

|

|

NGL reserves (MBbl):

|

|

|

|

|

|

|

|

Proved developed

|

|

8,164

|

|

10,377

|

|

9,287

|

|

Proved undeveloped

|

|

5,692

|

|

16,236

|

|

19,427

|

|

Total

|

|

13,855

|

|

26,614

|

|

28,714

|

|

|

|

|

|

|

|

|

|

Total Estimated Reserves (MMcfe) (1)

|

|

1,106,415

|

|

1,420,439

|

|

1,345,362

|

|

|

|

|

|

|

|

|

|

Standardized Measure of Discounted Future Net Cash Flows (in millions) (2)

|

|

$

|

513

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

PV-10 by reserve category

|

|

|

|

|

|

|

|

Proved developed

|

|

$

|

382

|

|

|

$

|

635

|

|

|

$

|

681

|

|

|

Proved undeveloped

|

|

144

|

|

|

341

|

|

|

447

|

|

|

Total PV-10 Value (2)

|

|

$

|

526

|

|

|

$

|

976

|

|

|

$

|

1,128

|

|

(1) The reserve volumes exclude natural gas consumed in operations.

(2) The Standardized Measure and PV-10 Values as of December 31, 2020, 2019 and 2018 are net of $2.2 million, $1.7 million and $3.7 million of plugging and abandonment costs, respectively.

Proved reserves are estimates of hydrocarbons to be recovered in the future. Reserves estimation is a subjective process of estimating the sizes of underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserves estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. Reserves reports of other engineers might differ from the reports contained herein. Results of drilling, testing, and production subsequent to the date of the estimate may justify revision of such estimates. Future prices received for the sale of oil and natural gas may be different from those used in preparing these reports. The amounts and timing of future operating and development costs may also differ from those used. Accordingly, reserves estimates are often different from the quantities of oil and natural gas that are ultimately recovered. There can be no assurance that these estimates are accurate predictions of the present value of future net cash flows from oil and natural gas reserves.

Proved Undeveloped Reserves

The following table sets forth the aging of the Company's proved undeveloped reserves as of December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Added

|

|

Volume

(Bcfe)

|

|

% of PUD

Volumes

|

|

% of PV-10

|

|

2020

|

|

97.3

|

|

16

|

%

|

|

11

|

%

|

|

2019

|

|

238.2

|

|

40

|

%

|

|

45

|

%

|

|

2018

|

|

118.0

|

|

20

|

%

|

|

15

|

%

|

|

2017

|

|

105.8

|

|

17

|

%

|

|

23

|

%

|

|

2016 (1)

|

|

40.9

|

|

7

|

%

|

|

6

|

%

|

|

Total

|

|

600.2

|

|

100

|

%

|

|

100

|

%

|

(1) The Company did not carry proved undeveloped reserves forward through bankruptcy except for locations that were converted to developed reserves early in 2016; therefore all proved undeveloped reserves as of December 31, 2016 were 2016 additions.

During 2020, the Company's proved undeveloped reserves decreased by approximately 241.1 Bcfe primarily due to the removal of undeveloped reserves mainly in the Company's AWP and Oro Grande fields as a result of the reduction in our planned capital activity. The Company also incurred approximately $73.7 million in capital expenditures during the year which resulted in the conversion of 54.7 Bcfe of its December 31, 2019 proved undeveloped reserves to proved developed reserves, primarily in our Artesia and AWP fields. During 2019, the Company's proved undeveloped reserves increased by approximately 50.9 Bcfe primarily due to extensions added based on drilling and leasing of adjacent acreage.

The PV-10 Value from the Company's proved undeveloped reserves was $144 million at December 31, 2020, which was approximately 27% of its total PV-10 Value of $526.3 million.

Sensitivity of Reserves to Pricing

As of December 31, 2020, a 5% increase in natural gas pricing would increase the Company's total estimated proved reserves by approximately 4.0 Bcfe and would increase the PV-10 Value by approximately $43.3 million. Similarly, a 5% decrease in natural gas pricing would decrease the Company's total estimated proved reserves by approximately 4.5 Bcfe and would decrease the PV-10 Value by approximately $43.3 million.

As of December 31, 2020, a 5% increase in oil and NGL pricing would increase the Company's total estimated proved reserves by approximately 1.6 Bcfe, and would increase the PV-10 Value by approximately $16.3 million. Similarly, a 5% decrease in oil and NGL pricing would decrease the Company's total estimated proved reserves by approximately 1.5 Bcfe and would decrease the PV-10 Value by approximately $16.3 million.

This sensitivity analysis is as of December 31, 2020 and, accordingly, does not consider drilling and completion activity, acquisitions or dispositions of oil and gas properties, production, changes in oil, natural gas and natural gas liquids prices, and changes in development and operating costs occurring subsequent to December 31, 2020 that may require revisions to estimates of proved reserves.

Oil and Gas Wells

The following table sets forth the total gross and net wells in which the Company owned an interest at the following dates:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Wells

|

|

Gas Wells

|

|

Total

Wells(1)

|

|

December 31, 2020

|

|

|

|

|

|

|

Gross (1)

|

103

|

|

|

266

|

|

|

369

|

|

|

Net

|

100.9

|

|

|

216.9

|

|

|

317.8

|

|

|

December 31, 2019

|

|

|

|

|

|

|

Gross (1)

|

95

|

|

|

246

|

|

|

341

|

|

|

Net

|

93.0

|

|

|

198.8

|

|

|

291.8

|

|

|

December 31, 2018

|

|

|

|

|

|

|

Gross (1)

|

78

|

|

|

223

|

|

|

301

|

|

|

Net

|

76.1

|

|

|

178.1

|

|

|

254.1

|

|

(1)Excludes 8, 4, and 5 service wells in 2020, 2019 and 2018, respectively.

Oil and Gas Acreage

The following table sets forth the developed and undeveloped leasehold acreage held by the Company at December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Developed

|

|

Undeveloped

|

|

|

Gross

|

|

Net

|

|

Gross

|

|

Net

|

|

Texas (1)

|

58,472

|

|

|

54,708

|

|

|

107,569

|

|

|

100,193

|

|

|

Louisiana

|

5,084

|

|

|

4,775

|

|

|

4,920

|

|

|

4,478

|

|

|

Wyoming

|

—

|

|

|

—

|

|

|

1,596

|

|

|

1,147

|

|

|

Total

|

63,556

|

|

|

59,483

|

|

|

114,085

|

|

|

105,818

|

|

(1) The Company's total Texas acreage is located in the Eagle Ford field.

As of December 31, 2020, the Company's net undeveloped acreage subject to expiration over the next three years, if not renewed, is approximately 39% in 2021, 21% in 2022 and less than 1% in 2023. The Company has four (4) federal leases that expire in 2029 covering 2,427 gross and net acres. In our core areas, acreage scheduled to expire can be held through drilling operations or the Company can exercise extension options. The exploration potential of all undeveloped acreage is fully evaluated before expiration. In each fiscal year where undeveloped acreage is subject to expiration, our intent is to reduce the expirations through either development or extensions, if we believe it is commercially advantageous to do so.

Drilling and Other Exploratory and Development Activities

The following table sets forth the results of the Company's drilling and completion activities during the years ended December 31, 2020, 2019 and 2018:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Wells

|

|

Net Wells

|

|

Year

|

|

Type of Well

|

|

Total

|

|

Producing

|

|

Dry

|

|

Total

|

|

Producing

|

|

Dry

|

|

2020

|

|

Exploratory

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

Development

|

|

19

|

|

|

19

|

|

—

|

|

|

14.8

|

|

|

14.8

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

Exploratory

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

Development

|

|

30

|

|

|

30

|

|

|

—

|

|

|

27.7

|

|

|

27.7

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

Exploratory

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

Development

|

|

37

|

|

|

37

|

|

|

—

|

|

|

32.7

|

|

|

32.7

|

|

|

—

|

|

Recent Activities

As of December 31, 2020, we were in the process of drilling three wells in our La Mesa field where we have a 96% working interest. These wells were completed in the first quarter of 2021.

Operations

The Company generally seeks to be the operator of the wells in which it has a significant economic interest. As operator, the Company designs and manages the development of a well and supervises operation and maintenance activities on a day-to-day basis. The Company does not own drilling rigs or other oil field services equipment used for drilling or maintaining wells on properties it operates. Independent contractors supervised by the Company provide this equipment and personnel. The Company employs drilling, production and reservoir engineers, geoscientists, and other specialists who work to improve production rates, increase reserves, and lower the cost of operating the Company's oil and natural gas properties.

Operations on the Company's oil and natural gas properties are customarily accounted for in accordance with Council of Petroleum Accountants Societies' guidelines. The Company charges a monthly per-well supervision fee to the wells it operates including its wells in which it owns up to a 100% working interest. Supervision fees vary widely depending on the geographic location and depth of the well and whether the well produces oil or natural gas. The fees for these activities in 2020 totaled $4.4 million and ranged from $250 to $1,689 per well per month.

Marketing of Production

The Company typically sells its oil and natural gas production at market prices near the wellhead or at a central point after gathering and/or processing. The Company usually sells its natural gas in the spot market on a monthly basis, while it sells its oil at prevailing market prices. The Company does not refine any oil it produces. For the years ended December 31, 2020 and 2019, parties which accounted for approximately 10% or more of the Company's total oil and gas receipts were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchasers greater than 10%

|

Year Ended December 31, 2020

|

|

Year Ended December 31, 2019

|

|

Kinder Morgan

|

19

|

%

|

|

31

|

%

|

|

Plains Marketing

|

17

|

%

|

|

14

|

%

|

|

Twin Eagle

|

17

|

%

|

|

13

|

%

|

|

Trafigura

|

13

|

%

|

|

*

|

|

Shell Trading

|

*

|

|

11

|

%

|

*Oil and gas receipts less than 10%

The Company has gas processing and gathering agreements with Southcross Energy for a majority of the Company's natural gas production in the AWP area. Oil production is transported to market by truck and sold at prevailing market prices.

The Company has a gas gathering agreement with Howard Energy Partners providing for the transportation of the Company's Eagle Ford production on the pipeline from our Fasken area to the Kinder Morgan Texas Pipeline or Eagle Ford Midstream, where it is sold at prices tied to monthly and daily natural gas price indices. At Fasken, the Company also has a connection with the Navarro gathering system into which it may deliver natural gas from time to time.

The Company has agreements with Eagle Ford Gathering LLC that provide for the gathering and processing for almost all of its natural gas production in the Artesia area. Natural gas in the area can also be delivered to the Targa (formerly Atlas) system for processing and transportation to downstream markets. In the Artesia area, the Company's oil production is sold at prevailing market prices and transported to market by truck.

The prices in the tables below do not include the effects of hedging. Quarterly prices are detailed under “Results of Operations – Revenues” in “Management's Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K.

The following table summarizes production volumes, sales prices, and production cost information for the Company's net oil, NGL and natural gas production for the years ended December 31, 2020, 2019 and 2018:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

All Fields

|

|

2020

|

|

2019

|

|

2018

|

|

Net Production Volume:

|

|

|

|

|

|

|

|

Oil (MBbls)

|

|

1,521

|

|

|

1,605

|

|

|

685

|

|

|

Natural gas liquids (MBbls)

|

|

1,114

|

|

|

1,717

|

|

|

1,123

|

|

|

Natural gas (MMcf)

|

|

50,988

|

|

|

64,388

|

|

|

56,665

|

|

|

Total (MMcfe)

|

|

66,800

|

|

|

84,320

|

|

|

67,530

|

|

|

|

|

|

|

|

|

|

|

Average Sales Price:

|

|

|

|

|

|

|

|

Oil (Per Bbl)

|

|

$

|

37.89

|

|

|

$

|

57.84

|

|

|

$

|

65.93

|

|

|

Natural gas liquids (Per Bbl)

|

|

$

|

13.02

|

|

|

$

|

14.70

|

|

|

$

|

25.51

|

|

|

Natural gas (Per Mcf)

|

|

$

|

2.06

|

|

|

$

|

2.65

|

|

|

$

|

3.23

|

|

|

Total (Per Mcfe)

|

|

$

|

2.66

|

|

|

$

|

3.42

|

|

|

$

|

3.81

|

|

|

|

|

|

|

|

|

|

|

Average Production Cost (Per Mcfe sold) (1)

|

|

$

|

0.63

|

|

|

$

|

0.57

|

|

|

$

|

0.61

|

|

(1) Average production cost includes lease operating costs, transportation and gas processing costs but excludes severance and ad valorem taxes.

The following table provides a summary of the Company's production volumes, average sales prices, and average production costs for its fields with proved reserves greater than 15% of total proved reserves. These fields account for approximately 85% of the Company's proved reserves based on total MMcfe as of December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

Fasken

|

|

2020

|

|

2019

|

|

2018

|

|

Net Production Volume:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas liquids (MBbls)

|

|

2

|

|

|

2

|

|

|

2

|

|

|

Natural gas (MMcf) (1)

|

|

35,399

|

|

|

38,195

|

|

|

35,963

|

|

|

Total (MMcfe)

|

|

35,410

|

|

|

38,206

|

|

|

35,976

|

|

|

|

|

|

|

|

|

|

|

Average Sales Price:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas liquids (Per Bbl)

|

|

$

|

10.41

|

|

|

$

|

14.13

|

|

|

$

|

24.96

|

|

|

Natural gas (Per Mcf)

|

|

$

|

2.03

|

|

|

$

|

2.65

|

|

|

$

|

3.21

|

|

|

Total (Per Mcfe)

|

|

$

|

2.03

|

|

|

$

|

2.65

|

|

|

$

|

3.21

|

|

|

|

|

|

|

|

|

|

|

Average Production Cost (Per Mcfe sold) (2)

|

|

$

|

0.56

|

|

|

$

|

0.60

|

|

|

$

|

0.60

|

|

(1) Excludes natural gas consumed in operations.

(2) Average production cost includes lease operating costs, transportation and gas processing costs but excludes severance and ad valorem taxes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

AWP

|

|

2020

|

|

2019

|

|

2018

|

|

Net Production Volume:

|

|

|

|

|

|

|

|

Oil (MBbls)

|

|

964

|

|

|

846

|

|

|

347

|

|

|

Natural gas liquids (MBbls)

|

|

323

|

|

|

491

|

|

|

480

|

|

|

Natural gas (MMcf) (1)

|

|

4,716

|

|

|

6,613

|

|

|

5,510

|

|

|

Total (MMcfe)

|

|

12,432

|

|

|

14,637

|

|

|

10,470

|

|

|

|

|

|

|

|

|

|

|

Average Sales Price:

|

|

|

|

|

|

|

|

Oil (Per Bbl)

|

|

$

|

38.09

|

|

|

$

|

58.66

|

|

|

$

|

65.64

|

|

|

Natural gas liquids (Per Bbl)

|

|

$

|

12.50

|

|

|

$

|

14.89

|

|

|

$

|

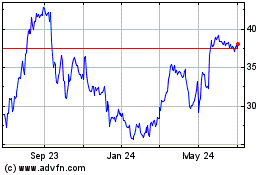

25.84