TIDMSYNC

RNS Number : 1833R

Syncona Limited

04 March 2021

Syncona Limited

Autolus Reports Full Year 2020 Financial Results and Operational

Progress

04 March 2021

Syncona Ltd, a leading healthcare company focused on founding,

building and funding a portfolio of global leaders in life science,

notes that its portfolio company, Autolus Therapeutics Plc (NASDAQ:

AUTL) (Autolus), announced its financial results for the fourth

quarter and full year ended December 31, 2020.

The announcement can be accessed on Autolus' investor website at

https://www.autolus.com/investor-relations and full text of the

announcement from Autolus is contained below. Autolus management

will host a conference call today, at 8:30 a.m. EDT/ 1:30pm GMT to

discuss the company's financial results and operational update. To

listen to the webcast and view the accompanying slide presentation,

please go to:

https://www.autolus.com/investor-relations/news-and-events/events

.

[S]

Enquiries

Syncona Ltd

Annabel Clay

Tel: +44 (0) 20 3981 7940

FTI Consulting

Ben Atwell / Natalie Garland-Collins / Tim Stamper

Tel: +44 (0) 20 3727 1000

About Syncona

Syncona's purpose is to invest to extend and enhance human life.

We do this by founding, building and funding a portfolio of global

leaders in life science, to deliver transformational treatments to

patients in areas of high unmet need.

Our strategy is to found, build and fund companies around

exceptional science to create a dynamic portfolio of 15-20 globally

leading healthcare businesses for the benefit of all our

stakeholders. We focus on developing treatments for patients by

working in close partnership with world-class academic founders and

management teams. Our strategic balance sheet underpins our

strategy enabling us to take a long-term view as we look to improve

the lives of patients with no or few treatment options, build

sustainable life science companies and deliver strong risk-adjusted

returns to shareholders.

Autolus Therapeutics Reports Fourth Quarter and Full Year 2020

Financial Results and Operational Progress

- Conference call to be held on March 4, 2021 at 8:30 am ET/1:30

pm GMT -

LONDON , March 4, 2021 -- Autolus Therapeutics plc (Nasdaq:

AUTL), a clinical-stage biopharmaceutical company developing

next-generation programmed T cell therapies, today announced its

operational and financial results for the fourth quarter and full

year ended December 31, 2020.

"Autolus' primary focus is on delivering the potential pivotal

AUTO1 program and the company starts 2021 in a position of

financial strength, having raised a total of $131 million in gross

proceeds this quarter, giving us a cash runway into the first half

of 2023," said Dr. Christian Itin, chairman and chief executive

officer of Autolus. "We are excited about the unique

characteristics of AUTO1 and the significant commercial opportunity

that adult Acute Lymphoblastic Leukemia represents. Furthermore, we

are committed to building additional value by capitalizing on the

unique clinical profile of AUTO1 in additional B Cell malignancies

and by progressing our pipeline of CAR T cell therapies, including

AUTO1/22 in pediatric ALL, AUTO4 in peripheral T cell Lymphoma and

AUTO6NG in solid tumors. As such, we expect multiple clinical proof

of concept read outs during 2021 and 2022."

Key Pipeline Updates:

-- AUTO1 in relapsed / refractory (r/r) adult B-Acute

Lymphocytic Leukemia (ALL) . Positive data from the ALLCAR Phase 1

clinical trial was presented at the 62(nd) American Society of

Hematology (ASH) Annual Meeting in December 2020, demonstrating

that, as of the November 12, 2020 data cut-off date, AUTO1 was well

tolerated, with no patients experiencing >= Grade 3 cytokine

release syndrome (CRS). Three patients (15%), all of whom had high

leukemia burden (>50% blasts), experienced Grade 3 neurotoxicity

(NT) that resolved swiftly with steroids. Of the 19 patients

evaluable for efficacy, 16 (84%) patients achieved minimum residual

disease (MRD)-negative complete response (CR) at one month. Most

notably, the durability of remissions is highly encouraging. Across

all treated patients, event free survival (EFS) at six and 12

months is 69% and 52% respectively. Median EFS and overall survival

(OS) had not been reached at a median follow up of 16.9 months

(range up to 30.5 months). Data from the potential pivotal program,

FELIX, is expected in 2022.

-- AUTO1 in indolent B cell Non-Hodgkin Lymphoma (NHL) (cohort

1), high grade B-NHL (cohort 2) and chronic lymphocytic leukemia

(CLL) (cohort 3). Autolus reported positive AUTO1 data at the

62(nd) American Society of Hematology (ASH) Annual Meeting in

December 2020. As of the data cut-off date of November 12, 2020,

four patients in Cohort 1 had been infused with AUTO1. AUTO1 was

well tolerated, with no patients experiencing >= Grade 2 CRS and

no patients experiencing NT of any grade. All four patients

achieved a Complete Metabolic Response (CMR). Autolus is planning

to present updated data on AUTO1 in indolent B-cell lymphoma

indications at the European Hematology Association (EHA) Congress

in June 2021.

-- AUTO1/22 in pediatric ALL . The first patient was dosed in

the extension cohort of the CARPALL clinical trial in Q4 2020 .

Autolus plans to provide a data update in Q4 2021.

-- AUTO3 in relapsed/refractory diffuse large B cell lymphoma

(DLBCL). Positive data from the Phase 1 ALEXANDER clinical trial

was presented at the 62nd American Society of Hematology (ASH)

Annual Meeting in December 2020 demonstrating, as of the October

30, 2020 data cut-off date, AUTO3 was well tolerated, with low

rates of CRS and NT. Across all 49 patients, there was only one

case of Grade 3 CRS with primary infusion, and only three cases of

NT were reported, with two being >= Grade 3. As of the data

cut-off date, none of the patients achieving a complete response

(CR) experienced any NT and all cases of NT observed were seen in a

setting of disease progression and with confounding factors.

Autolus plans to seek a partner for this program.

-- AUTO4 in Peripheral T Cell Lymphoma (PTCL). AUTO4 will

continue, in 2021, to be evaluated in a dose escalation phase of a

Phase 1/2 clinical trial in 2021. Autolus expects to provide a next

data update in H2 2021.

-- AUTO5 in Peripheral T Cell Lymphoma . Positive preclinical

data were presented at the American Association for Cancer Research

II (AACR) Annual Meeting in June 2020. The data highlight the

specificity and selectivity of the Autolus T cell lymphoma product

candidate, AUTO5. Autolus expects to initiate a Phase 1 clinical

trial in H2 2021.

-- AUTO6NG in small cell lung cancer (SCLC). Positive

preclinical data were presented at the AACR Annual Meeting in June

2020. Autolus has designed enhancing modules to specifically

overcome tumor microenvironment (TME) defenses in solid tumor

settings. The new data reported at the AACR meeting suggest that

AUTO6NG can overcome the immune suppressive mechanisms in the TME.

Autolus plans to progress AUTO6NG for evaluation in GD2 positive

tumors into the clinic in H2 2021.

-- AUTO7 in prostate cancer . Positive preclinical data were

presented at an oral presentation at the AACR Annual Meeting in

June 2020. AUTO7 uses an optimized CAR to target cancer cells

expressing PSMA, even at low levels, and includes modules

introduced in AUTO6NG, with a module that activates immune

responses at the tumor site through limited secretion of IL-12. The

data presented at the AACR meeting demonstrated that AUTO7 is

highly potent in cytotoxicity assays against cells expressing PSMA,

even at low levels, and demonstrate the feasibility of this

multi-modular cell programming approach in overcoming the

immunotherapeutic challenges presented by advanced prostate cancer,

which is typically otherwise an immunologically cold tumor. Autolus

plans to progress AUTO7 into the clinic in H1 2022.

-- AUTO8 in multiple myeloma. This program will be explored in a

first clinical trial starting mid-2021.

-- Partnerable Coronavirus Disease (COVID-19) Project . Autolus'

research team has developed a potentially universal SARS-CoV2 decoy

receptor with virus neutralizing activity against SARS-CoV2 and its

variants and also active against SARS-CoV1.

Operational Highlights:

-- Autolus sold 1,718,506 ADSs under its at-the-market program

with Jefferies, for net proceeds of approximately $15.3 million, in

January 2021.

-- Successful closing of a public offering raising net proceeds

to Autolus, after underwriting discounts and commissions, of $108.1

million in February 2021, taking total net cash raised in Q1 2021

to approximately $123.4 million.

-- As announced in Autolus' business update in January 2021, the

company will be prioritizing the AUTO1 program and plans to partner

the AUTO3 program before progressing it into the next phase of

development.

-- Also announced in Autolus' business update in January 2021,

the company will adjust its workforce and infrastructure footprint,

which will involve an overall reduction in headcount of

approximately 20%. The restructuring remains ongoing and Autolus

expects to realize cash savings, on an annualized basis, of

approximately $15 million per annum once the operational changes

are fully implemented.

-- As previously announced, Dr. Nushmia Khokhar, Senior Vice

President, Clinical Development will be leaving the company in

mid-March 2021 and Dr. Adam Hacker, Senior Vice President for

Regulatory Affairs and Quality, left the Company in January 2021.

The company would like to thank Drs. Khokhar and Hacker for their

contributions and wishes them well in the future. A search for a

Chief Medical Officer is ongoing.

-- Appointment of Dr Jay T Backstrom to Autolus' Board of

Directors, effective August 1, 2020. Dr Backstrom currently serves

as EVP, Head of Research & Development at Acceleron Pharma Inc.

and prior to that served as CMO and Head of Regulatory Affairs at

Celgene Corporation.

Key Upcoming Clinical Milestones:

-- AUTO1 updates in 2021 on ALLCAR19 in patients with r/r B-NHL

and longer term follow up of the fully enrolled r/r aALL

cohort.

-- AUTO1 - Currently enrolling Phase 1b/2 pivotal study (FELIX)

in r/r adult ALL patients with data expected in 2022.

-- Updates on Phase 1 programs AUTO1/22 in pediatric ALL, as

well as AUTO4 in TRBC1+ Peripheral TCL, in 2021.

-- Phase 1 trials are expected to be initiated in 2021 with

AUTO1 in Primary CNS Lymphoma, AUTO5 in TRBC2+ Peripheral TCL,

AUTO6NG in Neuroblastoma, and AUTO8 in Multiple Myeloma.

-- First exploratory allogeneic program expected to enter the clinic in H1 2021.

Financial Results for the Quarter and Year Ended December 31,

2020

Cash at December 31, 2020 totaled $153.3 million, as compared to

$210.6 million at December 31, 2019. In January 2021, the company

sold 1.7 million ADSs under its Open Market Sales Agreement(SM)

with Jefferies LLC as sales agent, resulting in net proceeds of

$15.3 million and in February 2021, the company conducted a public

offering of 16,428,572 ADSs representing 16,428,572 ordinary

shares, including the exercise in full by the underwriters of their

option to purchase an additional 2,142,857 ADSs, at a public

offering price of $7.00 per ADS and net proceeds of $108.1

million.

Net total operating expenses for the twelve months ended

December 31, 2020 were $168.1 million, net of grant income and

license revenue of $1.7 million, as compared to net operating

expenses of $146.1 million, net of grant income of $2.9 million,

for the same period in 2019.

Research and development expenses increased to $134.9 million

for the year ended December 31, 2020 from $105.4 million for the

year ended December 31, 2019. Cash costs, which exclude

depreciation and amortization as well as share-based compensation,

increased to $116.9 million from $83.4 million. The increase in

research and development cash costs of $33.5 million consisted

primarily of (i) an increase of $8.8 million in compensation and

employment related costs, net of lower travel costs, due to an

increase in employee headcount to support the advancement of our

product candidates in clinical development and lessened travel due

to the COVID-19 pandemic, (ii) an increase of $14.4 million in

project expenses as a consequence of the advancement of our

clinical portfolio which includes research and process development

and manufacturing activities necessary to prepare, activate, and

monitor clinical trial programs, (iii) an increase of $6.0 million

in facilities costs related to the commencement of a lease for an

additional manufacturing suite and the continued scaling of

manufacturing operations, (iv) an increase of $4.0 million in IT

infrastructure and support for information systems related to the

conduct of clinical trials and manufacturing operations, (v) an

increase of $0.5 million related to legal fees and (vi) an increase

of $1.7 million related to cell logistics, which is offset by a

reduction in materials purchases of $0.7 million and license fees

of $1.1 million.

Non-cash Research & Development costs decreased to $18.1

million for the year ended December 31, 2020 from $22.0 million for

the year ended December 31, 2019. The $3.9 million decrease is

related to a decrease of $4.8 million share-based compensation

expense as a result of a lower fair value of stock options

recognized in the period, offset by a $0.9 million increase in

depreciation.

General and administrative expenses decreased to $35.0 million

for the year ended December 31, 2020 from $39.5 million for the

year ended December 31, 2019. Cash costs, which exclude

depreciation as well as share-based compensation increased to $27.4

million from $26.6 million. There were increases of $1.3 million

related to D&O insurance costs and intellectual property and

$0.1 million of facilities cost, offset by decreases of $0.5

million of compensation and other employment related costs and $0.1

million in general office expense.

Non-cash General and Administrative costs decreased to $7.6

million for the year ended December 31, 2020 from $12.9 million for

the year ended December 31, 2019. The decrease of $5.3 million is

mainly attributed to lower share-based compensation expenses as a

result of the lower fair value of share options recognized during

the period.

Interest income decreased to $0.5 million for the year ended

December 31, 2020 from $2.5 million for the year ended December 31,

2019. This decrease is due to the lower cash balances held during

the year combined with lower interest rates for cash held on

deposit. Other income decreased to $1.4 million for the year ended

December 31, 2020 from $4.5 million for the year ended December 31,

2019 primarily due to a weakening of the U.S. dollar exchange rate

relative to the pound sterling. The decrease of $4.6 million in the

year ended December 31, 2020 was offset by lease termination gains

of $1.5 million.

The Income tax benefit increased to $24.2 million for the year

ended December 31, 2020 from $15.2 million for the year ended

December 31, 2019 due to additional U.K. research and development

tax credits receivable from HMRC. Research and development credits

are obtained at a maximum rate of 33.35% of our qualifying research

and development expenses, and the increase in the net credit was

primarily attributable to an increase in the company's eligible

research and development expenses.

Net loss attributable to ordinary shareholders was $142.1

million for the twelve months ended December 31, 2020, compared to

$123.8 million for the same period in 2019. The basic and diluted

net loss per ordinary share for the twelve months ended December

31, 2020 totaled $(2.76) compared to a basic and diluted net loss

per ordinary share of $(2.88) for the twelve months ended December

31, 2019.

Autolus estimates that its current cash on hand, which includes

the recent financings in January and February 2021, will extend the

Company's runway into H1 2023.

Management will host a conference call and webcast at 8:30 am

ET/1:30 pm GMT to discuss the company's financial results and

provide a general business update. To listen to the webcast and

view the accompanying slide presentation, please go to the events

section of Autolus' website

The call may also be accessed by dialing (866) 679-5407 for U.S.

and Canada callers or (409) 217-8320 for international callers.

Please reference conference ID 2268057. After the conference call,

a replay will be available for one week. To access the replay,

please dial (855) 859-2056 for U.S. and Canada callers or (404)

537-3406 for international callers. Please reference conference ID

2268057.

About Autolus Therapeutics plc

Autolus is a clinical-stage biopharmaceutical company developing

next-generation, programmed T cell therapies for the treatment of

cancer. Using a broad suite of proprietary and modular T cell

programming technologies, the company is engineering precisely

targeted, controlled and highly active T cell therapies that are

designed to better recognize cancer cells, break down their defense

mechanisms and eliminate these cells. Autolus has a pipeline of

product candidates in development for the treatment of

hematological malignancies and solid tumors. For more information

please visit www.autolus.com .

About AUTO1

AUTO1 is a CD19 CAR T cell investigational therapy designed to

overcome the limitations in clinical activity and safety compared

to current CD19 CAR T cell therapies. Designed to have a fast

target binding off-rate to minimize excessive activation of the

programmed T cells, AUTO1 may reduce toxicity and be less prone to

T cell exhaustion, which could enhance persistence and improve the

ability of the programmed T cells to engage in serial killing of

target cancer cells. In collaboration with our academic partner,

UCL, AUTO1 is currently being evaluated in a Phase 1 clinical trial

in adult ALL and B-NHL. The company has also progressed AUTO1 to

the FELIX study, a potential pivotal study.

About AUTO1 FELIX study

The FELIX study is enrolling adult patients with relapsed /

refractory ALL. The trial has a short Phase 1b component prior to

proceeding to a single arm Phase 2 clinical trial. The primary

endpoint is overall response rate, and the key secondary endpoints

include duration of response, MRD negative CR rate and safety. The

trial will enroll approximately 100 patients across 30 of the

leading academic and non-academic centers in the United States,

United Kingdom and Europe.

About AUTO3

AUTO3 is a programmed T cell investigational therapy containing

two independent chimeric antigen receptors targeting CD19 and CD22

that have each been independently optimized for single target

activity. AUTO3 is designed to combine a favorable safety profile

with a reduced risk of relapse due to single antigen loss. AUTO3 is

has been tested in diffuse large B cell lymphoma in the ALEXANDER

clinical trial demonstrating a high level of clinical activity with

a favorable safety profile. The ALEXANDER study included a

20-patient out-patient cohort and demonstrated feasibility of AUTO3

delivery in an outpatient setting.

About AUTO4

AUTO4 is a programmed T cell product candidate in clinical

development for T cell lymphoma, a setting where there are

currently no approved programmed T cell therapies. AUTO4 is

specifically designed to target TRBC1 derived cancers, which

account for approximately 40% of T cell lymphomas, and is a

complement to the AUTO5 T cell product candidate, which is in

pre-clinical development.

About AUTO5

AUTO5 is a programmed T cell product candidate in pre-clinical

development for T cell lymphoma, a setting where there are

currently no approved programmed T cell therapies. AUTO5 is

specifically designed to target TRBC2 derived cancers, which

account for approximately 60% of T cell lymphomas, and is a

complement to the AUTO4 T cell product candidate currently in

clinical development.

About AUTO6NG

AUTO6NG is a next generation programmed T cell product candidate

in pre-clinical development. AUTO6NG builds on preliminary proof of

concept data from AUTO6, a CAR targeting GD2-expression cancer cell

currently in clinical development for the treatment of

neuroblastoma. AUTO6NG incorporates additional cell programming

modules to overcome immune suppressive defense mechanisms in the

tumor microenvironment, in addition to endowing the CAR T cells

with extended persistence capacity. AUTO6NG is currently in

pre-clinical development for the potential treatment of both

neuroblastoma and other GD2-expressing solid tumors.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are statements that are not historical facts, and in

some cases can be identified by terms such as "may," "will,"

"could," "expects," "plans, " "anticipates," and "believes." These

statements include, but are not limited to, statements regarding

Autolus' refocused business strategy, including specifically on the

development of the AUTO1 program; the future clinical development,

efficacy, safety and therapeutic potential of its product

candidates, including progress, expectations as to the reporting of

data, conduct and timing and potential future clinical activity and

milestones; expectations regarding the initiation, design and

reporting of data from clinical trials ; the development of

Autolus' pipeline of next generation programs, including for solid

tumor indications, in collaboration with its academic partners,

including expectations as to the reporting of data, conduct and

timing; the efficacy, safety and therapeutic potential of AUTO3 and

ability for Autolus to obtain a partner for next stages of clinical

development; needs for additional funding and ability to raise

additional capital; Autolus' ability to attract and retain

qualified employees and key personnel; the restructuring program

and Autolus' expected cash savings as a result of the restructuring

program and operational changes; and Autolus' expected cash runway.

Any forward-looking statements are based on management's current

views and assumptions and involve risks and uncertainties that

could cause actual results, performance or events to differ

materially from those expressed or implied in such statements.

These risks and uncertainties include, but are not limited to, the

risks that Autolus' preclinical or clinical programs do not advance

or result in approved products on a timely or cost effective basis

or at all; the results of early clinical trials are not always

being predictive of future results; the cost, timing and results of

clinical trials; that many product candidates do not become

approved drugs on a timely or cost effective basis or at all; the

ability to enroll patients in clinical trials; possible safety and

efficacy concerns; and the impact of the ongoing COVID-19 pandemic

on Autolus' business. For a discussion of other risks and

uncertainties, and other important factors, any of which could

cause Autolus' actual results to differ from those contained in the

forward-looking statements, see the section titled "Risk Factors"

in Autolus' Annual Report on Form 20-F filed with the Securities

and Exchange Commission on March 3, 2020, as amended, as well as

discussions of potential risks, uncertainties, and other important

factors in Autolus' subsequent filings with the Securities and

Exchange Commission. All information in this press release is as of

the date of the release, and Autolus undertakes no obligation to

publicly update any forward-looking statement, whether as a result

of new information, future events, or otherwise, except as required

by law.

Contact:

Lucinda Crabtree, PhD

Vice President, Investor Relations and Corporate

Communications

+44 (0) 7587 372 619

l.crabtree@autolus.com

Julia Wilson

+44 (0) 7818 430877

j.wilson@autolus.com

Susan A. Noonan

S.A. Noonan Communications

+1-212-966-3650

susan@sanoonan.com

Financial Results for the Year Ended December 31, 2020

Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

For the Year Ended For the three-months For the

December 31, ended December Year Ended

31, September

30,

2020 2019 2018 2018

------------- ------------ ---------------------- ---------------

Grant income $ 1,473 $ 2,908 $ 296 $ 1,407

License revenue 242 - - -

Operating expenses:

Research and development (134,888) (105,418) (17,713) (36,150)

General and administrative (34,972) (39,452) (7,593) (22,790)

Loss on impairment of leasehold

improvements - (4,102) - -

------------- ------------ ---------------------- -------------

Total operating expenses, net (168,145) (146,064) (25,010) (57,533)

Other income (expense):

Interest income 536 2,542 660 1,532

Other income (expense) 1,352 4,514 1,097 3,970

------------- ------------ ---------------------- -------------

Total other income, net 1,888 7,056 1,757 5,502

------------- ------------ ---------------------- -------------

Net loss before income tax (166,257) (139,008) (23,253) (52,031)

Income tax benefit 24,163 15,159 2,605 7,280

------------- ------------ ---------------------- -------------

Net loss attributable to ordinary

shareholders (142,094) (123,849) (20,648) (44,751)

Other comprehensive (loss) income:

Foreign currency exchange translation

adjustment 2,830 6,797 (5,568) (6,071)

------------- ------------ ---------------------- -------------

Total comprehensive loss (139,264) (117,052) (26,216) (50,822)

============= ============ ====================== =============

Basic and diluted net loss per

ordinary share $ (2.76) $ (2.88) $ (0.52) $ (1.42)

Weighted-average basic and diluted

ordinary shares 51,558,075 43,065,542 39,366,634 31,557,034

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

December 31,

2020 2019

----------- -------------

Assets

Current assets:

Cash $ 153,299 $ 210,643

Restricted cash 786 787

Prepaid expenses and other current assets 42,899 37,826

----------- -----------

Total current assets 196,984 249,256

Non-current assets:

Property and equipment, net 38,046 28,164

Prepaid expenses and other non-current assets 3,033 -

Right of use asset, net 51,637 23,409

Long-term deposits 2,625 2,040

Deferred tax asset 1,754 410

Intangible assets, net 158 254

----------- -----------

Total assets $ 294,237 $ 303,533

======= =======

Liabilities and shareholders' equity

Current liabilities:

Accounts payable 2,263 1,075

Accrued expenses and other liabilities 27,781 21,398

Lease liability 3,590 2,511

----------- -----------

Total current liabilities 33,634 24,984

Non-current liabilities:

Lease liability 50,571 23,710

----------- -----------

Total liabilities 84,205 48,694

Shareholders' equity:

Ordinary shares, $0.000042 par value; 200,000,000 shares

authorized at December 31, 2020 and 2019, 52,346,231

and 44,983,006 shares issued and outstanding at December

31, 2020 and 2019 3 2

Deferred shares, GBP0.00001 par value; 34,425 shares

authorized, issued and outstanding at December 31,

2020 and 2019 - -

Deferred B shares, GBP0.00099 par value; 88,893,548

shares authorized, issued and outstanding at December

31, 2020 and 2019 118 118

Deferred C shares, GBP0.000008 par value; 1 share authorized,

issued and outstanding at December 31, 2020 and 2019 - -

Additional paid-in capital 595,016 500,560

Accumulated other comprehensive loss (5,861) (8,691)

Accumulated deficit (379,244) (237,150)

----------- -----------

Total shareholders' equity 210,032 254,839

----------- -----------

Total liabilities and shareholders' equity $ 294,237 $ 303,533

======= =======

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUFIFVAVSISIIL

(END) Dow Jones Newswires

March 04, 2021 07:10 ET (12:10 GMT)

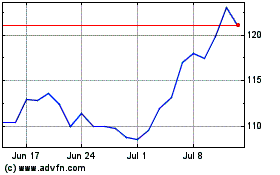

Syncona (LSE:SYNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Syncona (LSE:SYNC)

Historical Stock Chart

From Apr 2023 to Apr 2024