Current Report Filing (8-k)

March 02 2021 - 8:32AM

Edgar (US Regulatory)

false 0001175680 0001175680 2021-03-02 2021-03-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 2, 2021

CytoDyn Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-49908

|

|

83-1887078

|

|

(State or other jurisdiction

of incorporation)

|

|

(SEC

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1111 Main Street, Suite 660

|

|

|

|

Vancouver, Washington

|

|

98660

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (360) 980-8524

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

None.

|

|

None.

|

|

None.

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On December 15, 2020, certain directors of CytoDyn Inc. (the “Company”) and other named defendants (collectively, the “Defendants”) reached an agreement in principle with a special litigation committee of the board of directors of the Company (collectively with the Defendants, the “Parties”) to resolve a lawsuit brought derivatively on behalf of the Company in the Delaware Court of Chancery (the “Derivative Action”) challenging certain equity awards granted to the Company’s directors and certain officers in December 2019 (the “December 2019 Awards”) and January 2020, the latter of which were forfeited in July 2020, when the vesting conditions were not met by the stated deadline. On December 18, 2020, the Parties executed a memorandum of understanding outlining the key terms of their agreement. On January 27, 2021, the Parties entered into a proposal (which is set forth in a Stipulation and Agreement of Compromise, Settlement, and Release (the “Stipulation”)) to settle and fully and finally resolve the Derivative Action.

Pursuant to the Stipulation, the current directors agreed to implement a series of corporate governance reforms related to director and executive officer compensation and certain Defendants agreed to forfeit a substantial portion of the December 2019 Awards following approval of the settlement by the Delaware Court of Chancery, in exchange for a release of claims and the dismissal of the Derivative Action with prejudice. Specifically, the December 2019 Awards to Michael A. Klump, Jordan G. Naydenov, and David F. Welch, Ph.D. will be forfeited in their entirety; sixty percent of the December 2019 Awards to Scott A. Kelly, M.D. will be forfeited; and the warrant to acquire 2,000,000 shares of common stock of the Company awarded to Nader Z. Pourhassan, Ph.D. in the December 2019 Awards will be forfeited in its entirety. In addition, Dr. Pourhassan will forfeit vested options to purchase 373,000 shares of common stock of the Company that he currently owns (issued separate and apart from the December 2019 Awards). Executive officers Michael D. Mulholland and Nitya Ray, Ph.D., and former officer Brendan Rae, will retain their December 2019 Awards.

If the Delaware Court of Chancery approves the Stipulation, the Parties will ask the Court to approve an order that will result in, among other things, a dismissal of the Derivative Action with prejudice.

Copies of the Notices of Pendency of Settlement of Action are included as Exhibits 99.1 and 99.2 to this Current Report. The Notices of Pendency of Settlement of Action are also available for review on the Company’s website at https://www.cytodyn.com/investors/notice-to-stockholders.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CYTODYN INC.

|

|

|

|

|

|

|

Dated: March 2, 2021

|

|

|

|

By:

|

|

/s/ Michael D. Mulholland

|

|

|

|

|

|

|

|

Michael D. Mulholland

|

|

|

|

|

|

|

|

Chief Financial Officer

|

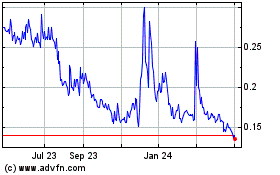

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

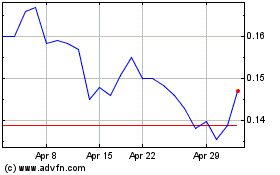

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024