Current Report Filing (8-k)

March 01 2021 - 9:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 26, 2021

Future

FinTech Group Inc.

(Exact name of registrant as specified

in its charter)

|

Florida

|

|

001-34502

|

|

98-0222013

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

(Address of principal executive offices,

including zip code)

888-622-1218

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

FTFT

|

|

Nasdaq Stock Market

|

Item 1.01 Entry into a Material

Definitive Agreement

On February 26, 2021, Future FinTech Group

Inc. (the “Company”) and Future Supply Chain Co., Ltd., a wholly owned subsidiary of the Company and a company incorporated

under the laws of China (“Buyer”) entered into a Share Exchange Agreement (the “Agreement”) with Sichuan

Longma Electronic Technology Co. Ltd., a company incorporated under the laws of China (“Seller”) and Sichuan Ticode

Supply Chain Management Co., Ltd., a company incorporated under the laws of China (the “Ticode”).

Pursuant to the Agreement, the Company,

through the Buyer will acquire 60% of the equity interest of Ticode from the Seller in exchange for 7,789,882 shares of common

stock of the Company (the “Company Shares”). The Seller also agrees: (i) if Ticode does not achieve an Earning Before

Interest and Taxes (the “EBIT”) for at least RMB 50 million (approximately $7.69 million) for the fiscal year ended

December 31, 2021 as evidenced by the financial statements of Ticode audited by the auditor of the Company, the Seller shall transfer

an additional 5% of the equity interest of Ticode to Buyer at no cost within 30 days of the date of the 2021 audit report; and

(ii) if Ticode does not achieve an EBIT for at least RMB 57.5 million (approximately $8.85 million) for the fiscal year ended December

31, 2022 as evidenced by the financial statements of Ticode audited by the auditor of the Company, the Seller shall further transfer

an additional 5% of the equity interest of Ticode to Buyer at no cost within 30 days of the date of the 2022 audit report. The

transaction contemplated in the Agreement will close upon the satisfaction of certain closing conditions, including the Company

to complete and effect the increase of its authorized shares of common stock to 300 million shares with the State of Florida and

the Seller to enter into a Noncompetition and Non-solicitation Agreement in a form satisfactory to Company and Buyer which restricts

the Seller and its affiliates from resigning from the Board or as an officer of Ticode and prohibits Seller and its affiliates

from competing with Ticode for a term of five (5) years from the closing date. The parties also agree that the Board of Directors

of Ticode will be composed of 5 directors. After the closing, Buyer and Seller will appoint designees to the Board of Directors

of Ticode in proportion to their ownership in Ticode. The Seller further agrees that it shall not sell, transfer, dispose, pledge

or contract to sell any of its remaining equity interest in Ticode without written consent by the Company for a period of 5

years from the closing date. After that, the Company has a right of first refusal to acquire any additional equity interest of

Ticode from the Seller.

The representations, warranties and covenants

contained in the Agreement were made solely for the benefit of the parties to the Agreement. In addition, such representations,

warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Agreement and not as statements

of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by shareholders

of, or other investors in the Company. Accordingly, the Agreement is filed with this report only to provide investors with information

regarding the terms of the transactions, and not to provide investors with any other factual information regarding the Company.

Shareholders should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations

of the actual state of facts or condition of the Company. Moreover, information concerning the subject matter of the representations

and warranties may change after the respective date of the Agreement, which subsequent information may or may not be fully reflected

in public disclosures.

The foregoing description of the Share

Exchange Agreement is not complete and is qualified in its entirety by reference to the full text of the Share Exchange Agreement,

a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity

Securities

Please see the disclosure set forth under

Item 1.01, which is incorporated by reference into this Item 3.02. The Company Shares will

be issued pursuant to the exemption from registration provided by Regulation S promulgated under the Securities Act of 1933, as

amended.

ITEM 7.01.

Regulation FD Disclosure.

On March 1, 2021, the Company issued a

press release announcing the Share Exchange Agreement described in Item 1.01 above, a copy of which is attached hereto as Exhibit

99.1 and is incorporated herein by reference. Exhibit 99.1 to this Report on Form 8-K shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of

1933 or the Exchange Act.

Item 9.01 Financial Statements

and Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

Future FinTech Group Inc.

|

|

|

|

|

Date: March 1, 2021

|

By:

|

/s/ Shanchun Huang

|

|

|

Name:

|

Shanchun Huang

|

|

|

Title:

|

Chief Executive Officer

|

3

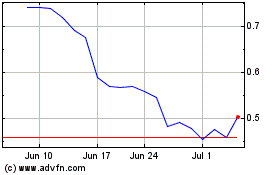

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024