Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the

“Company”), a specialty health sciences company that develops

clinically supported nutrition, medical foods, nutraceuticals and

medical devices, with a focus in the ocular health marketplace,

today announced it will effect a 1-for-6 reverse split of its

common stock effective as of 6:00 a.m. Eastern Time on Monday,

March 1, 2021. Commencing with the opening of trading on the Nasdaq

Capital Market on Monday, March 1, 2021, the Company’s common stock

will trade on a post-split basis under the same symbol GHSI.

The reverse stock split was implemented by the

Company to comply with the $1.00 per share minimum bid price

requirement for continued listing on the Nasdaq Capital Market

pursuant to Listing Rule 5550(a)(2) (the “Minimum Bid Price Rule”).

On September 20, 2019, the Company received a letter from the

Listing Qualifications Department of The Nasdaq Stock Market, Inc.

(the “Staff”) noting non-compliance with the Minimum Bid Price

Rule. Ultimately, the Staff granted the Company an exception until

March 15, 2021 to evidence compliance with the Minimum Bid Price

Rule. Following the reverse stock split, the Company must maintain

a minimum closing bid price of $1.00 per share for ten consecutive

trading days to achieve compliance with the Minimum Bid Price Rule

(although the Staff, at its discretion, may determine to monitor

the bid price for up to 20 consecutive trading days before makings

its final compliance determination).

As a result of the reverse stock split, the

CUSIP number for the Company’s common stock will now be 40145Q 401.

As a result of the reverse stock split, every 6 shares of issued

and outstanding common stock will be exchanged for 1 share of

common stock, with any fractional shares being rounded up to the

next higher whole share. Immediately after the reverse stock split

becomes effective, the Company will have approximately 24,385,052

shares of common stock issued and outstanding. The reverse stock

split was approved by the Company’s Board of Directors on February

25, 2021, and was previously approved by stockholders holding a

majority of the Company’s voting power at the Company’s Annual

Meeting of Stockholders held on October 29, 2020.

Completion of At-the-Market Financings

in 2021

During January and February 2021, the Company

completed two at-the-market financings as described below, which

generated gross proceeds of approximately $35,000,000 and net

proceeds of approximately $33,600,000.

On January 8, 2021, the Company entered into a

sales agreement and filed a prospectus supplement with the

Securities and Exchange Commission to sell up to $10,000,000 of

shares of common stock in an at-the-market offering (the “January

2021 1st ATM Offering”). On January 15, 2021, Guardian

completed the January 2021 1st ATM Offering, pursuant to which

the Company sold an aggregate of 15,359,000 shares of common stock

(pre-reverse split), raising gross proceeds of approximately

$10,000,000 and net proceeds of approximately $9,500,000.

Subsequently, on January 28, 2021, the Company

entered into a sales agreement and filed a prospectus supplement

with the Securities and Exchange Commission to sell up to

$25,000,000 of shares of common stock in an at-the-market offering

(the “January 2021 2nd ATM Offering”). On February 10, 2021,

Guardian completed the January 2021 2nd ATM Offering, pursuant

to which it sold an aggregate of 30,041,400 shares of common stock

(pre-reverse split), raising gross proceeds of approximately

$25,000,000 and net proceeds of approximately $24,100,000.

In addition, in January and February 2021, the

Company issued an aggregate of 9,886,145 shares of common stock

(pre-reverse split) upon the exercise of previously issued and

registered warrants and received cash proceeds of $3,608,509.

As of February 25, 2021, the Company had a total

of 146,310,312 shares of its common stock (pre-reverse split)

issued and outstanding.

Guardian’s Chief Executive Officer, Bret

Scholtes, commented, “These recent financings provide Guardion with

a significant cash runway, currently in excess of $44 million, to

enable management to execute on Guardion’s stated objective of

becoming a leader in the clinical nutrition industry, with a

particular focus on ocular and immuno-health. Additionally, these

substantial corporate cash resources provide us with more

flexibility when considering potential acquisitions.”

Commenting on the reverse stock split, Mr.

Scholtes stated, “We have implemented the reverse stock split to

not only enable Guardion to meet the requirements to remain

compliant with Nasdaq’s minimum bid price rule and thus allow

Guardion to remain listed on Nasdaq, but also to allow our common

stock to trade at a price that we believe may be more attractive to

investors and potential acquisition targets. We very much

appreciate the continued support from our stockholders and look

forward to providing updates on that progress soon.”

About Guardion Health Sciences,

Inc.

Guardion is a specialty health sciences company

that develops clinically supported nutrition, medical foods,

nutraceuticals and medical devices, with a focus in the ocular

health marketplace. Located in San Diego, California, the Company

combines targeted nutrition with innovative, evidence-based

diagnostic technology. Guardion boasts impressive Scientific and

Medical Advisory Boards. Information and risk factors with respect

to Guardion and its business, including its ability to successfully

develop and commercialize its proprietary products and

technologies, may be obtained in the Company’s filings with the

U.S. Securities and Exchange Commission (the “SEC”) at

www.sec.gov.

Forward-Looking Statement

Disclaimer

With the exception of the historical information

contained in this news release, the matters described herein may

contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Statements

preceded by, followed by or that otherwise include the words

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. These statements involve unknown risks and uncertainties

that may individually or materially impact the matters discussed

herein for a variety of reasons that are outside the control of the

Company, including, but are not limited to, the Company’s ability

to raise sufficient financing to implement its business plan, the

integration of a new management team, the impact of the COVID-19

pandemic on the Company’s business, operations and the economy in

general, the Company’s ability to successfully develop and

commercialize its proprietary products and technologies, and the

Company’s ability to maintain continued compliance with Nasdaq’s

listing requirements. Readers are cautioned not to place undue

reliance on these forward-looking statements, as actual results

could differ materially from those described in the forward-looking

statements contained herein. Readers are urged to read the risk

factors set forth in the Company’s filings with the SEC, which are

available at the SEC’s website (www.sec.gov). The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Investor Relations Contact:CORE

IRScott Arnold516-222-2560scotta@coreir.com

Media Relations Contact:Jules

AbrahamDirector of Public RelationsCORE

IR917-885-7378julesa@coreir.com

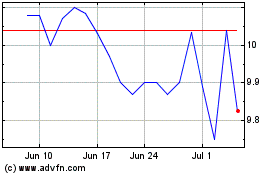

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

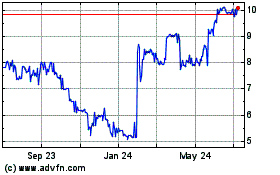

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Apr 2023 to Apr 2024