UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14C Information

Information Statement

Pursuant to Section 14(c) of the Securities

Exchange Act of

1934

Check the appropriate box:

|

☐

|

Preliminary Information Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by

Rule 14c-5(d) (2))

|

|

|

|

|

☒

|

Definitive Information Statement

|

DIGERATI TECHNOLOGIES, INC.

(Name of Registrant as Specified in

Its Charter)

Payment of Filing Fee (Check the appropriate

box):

|

☒

|

No fee required

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g)

and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

(4)

|

Date Filed:

|

DIGERATI TECHNOLOGIES, INC.

825 W. Bitters,

Suite 104

San Antonio, Texas

78216

NOTICE OF ACTION

TO BE TAKEN PURSUANT TO WRITTEN CONSENT

OF STOCKHOLDERS

IN LIEU OF A MEETING

To the Stockholders of Digerati Technologies,

Inc.:

Notice is hereby given

that stockholders holding a majority of our outstanding capital stock on the basis of voting power, pursuant to a written consent,

dated February 15, 2021, have authorized and approved an amendment (the “Amendment”) of our Articles of Incorporation

to:

|

|

|

Amend our Articles of Incorporation to: (i) increase our authorized

capitalization from 150,000,000 shares of common stock, par value $0.001 per share, and 50,000,000 shares of blank check preferred

stock, par value $0.001 per share, to 500,000,000 shares of common stock, par value $0.001 per share, and 50,000,000 shares

of blank check preferred stock, par value $0.001 per share; and (ii) provide that no amendment to the Bylaws that contradicts

Article II, Section 14 of the Bylaws (providing that the Acquisition of Controlling Interest Statute (Nevada Revised Statutes

§78.378 through §78.3793, inclusive, does not apply to purchases of a “controlling interest” (as defined

in the Acquisition of Controlling Interest Statute)) shall be implemented solely on the basis of a vote of a majority of our

entire Board of Directors.

|

The Amendment was

approved on February 15, 2021 by the unanimous written consent of our Board of Directors and on February 15, 2021 by the consent

of the holders of shares of our common stock and our Series F Super Voting Preferred Stock, which stock represents approximately

62% of the shares, on the basis of voting power, eligible to vote on the Amendment.

The accompanying Information

Statement, which describes the Amendment in more detail, is being furnished to our stockholders for informational purposes only,

pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and

regulations prescribed thereunder. The stockholder consent that we have received constitutes the only stockholder approval required

for the Amendment under the Nevada Revised Statutes, our Articles of Incorporation and our Bylaws. Accordingly, the Amendment

will not be submitted to the other stockholders of the Company for a vote.

The record date for

the determination of stockholders entitled to notice of the action by written consent is February 15, 2021 (the “Record

Date”). Pursuant to Rule 14c-2 under the Exchange Act, the Amendment will not be filed until at least twenty (20) calendar

days after the mailing of this Information Statement to our stockholders. This Information Statement will be mailed on or about

February 24, 2021 to stockholders of record on the Record Date.

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE

HOLDERS OF A MAJORITY OF OUR OUTSTANDING SHARES OF CAPITAL STOCK ON THE BASIS OF VOTING POWER HAVE ALREADY APPROVED THE AMENDMENT

OF OUR ARTICLES OF INCORPORATION BY WRITTEN CONSENT IN LIEU OF A MEETING. SUCH WRITTEN CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER

VOTE REQUIREMENTS IN CONNECTION WITH AN AMENDMENT TO OUR CHARTER UNDER NEVADA LAW AND OUR CHARTER DOCUMENTS. NO ADDITIONAL VOTING

WILL CONSEQUENTLY BE NEEDED TO APPROVE THE AMENDMENT.

|

|

By order of the Board of Directors,

|

|

|

|

|

|

/s/ Arthur L. Smith

|

|

|

Arthur L. Smith

|

|

|

Chief Executive Officer

|

|

|

February 24, 2021

|

DIGERATI TECHNOLOGIES, INC.

825 W. Bitters, Suite 104

San Antonio, Texas 78216

INFORMATION STATEMENT

CONCERNING CORPORATE ACTION AUTHORIZED

BY WRITTEN CONSENT OF STOCKHOLDERS OWNING A MAJORITY OF VOTING SHARES ENTITLED TO VOTE THEREON

GENERAL

Digerati Technologies,

Inc. (the “Company,” “we” or “us”) is furnishing this Information Statement to you to provide

a description of actions taken by our Board of Directors (the “Board”) by unanimous written consent on February 15,

2021, and the holders of a majority of our outstanding voting capital stock by written consent (the “Majority Stockholders”)

on February 15, 2021, in accordance with the relevant sections of the Nevada Revised Statutes of the State of Nevada (the “NRS”),

our Articles of Incorporation and our Bylaws (the “Bylaws”).

This Information Statement

is being mailed on or about February 26, 2021 to stockholders of record on February 15, 2021 (the “Record Date”).

This Information Statement is being delivered only to inform you of the corporate action described herein before such action takes

effect in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

No action is requested or required on your part.

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE

OF A MEETING OF STOCKHOLDERS AND NO MEETING OF OUR STOCKHOLDERS WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE

HOLDERS OF MORE THAN A MAJORITY OF OUR OUTSTANDING SHARES ENTITLED TO VOTE HAVE VOTED TO AUTHORIZE THE CORPORATE ACTION. THE NUMBER

OF VOTES RECEIVED IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENTS IN CONNECTION WITH THE CORPORATE ACTION DESCRIBED

HEREIN AND, CONSEQUENTLY, NO ADDITIONAL VOTE WILL BE NEEDED TO APPROVE SUCH CORPORATE ACTION.

GENERAL DESCRIPTION OF THE CORPORATE

ACTION

On February 15, 2021,

the Board approved resolutions by unanimous written consent, and on February 15, 2021, the Majority Stockholders delivered an

executed written consent, authorizing and approving the taking of all steps necessary to amend (the “Amendment”) the

Company’s Articles of Incorporation filed with the Nevada Secretary of State (the “Articles of Incorporation”)

to: (i) increase our authorized capitalization from 150,000,000 shares of common stock, par value $0.001 per share, and 50,000,000

shares of blank check preferred stock, par value $0.001 per share, to 500,000,000 shares of common stock, par value $0.001 per

share, and 50,000,000 shares of blank check preferred stock, par value $0.001 per share; and (ii) provide that no amendment to

the Bylaws that contradicts Article II, Section 14 of the Bylaws (providing that the Acquisition of Controlling Interest Statute

(Nevada Revised Statutes §78.378 through §78.3793, inclusive, does not apply to purchases of a “controlling interest”

(as defined in the Acquisition of Controlling Interest Statute)) shall be implemented solely on the basis of a vote of a majority

of the entire Board.

OUTSTANDING SHARES AND VOTING RIGHTS

Pursuant to the Articles

of Incorporation and the NRS, a vote by the holders of at least a majority of our outstanding capital stock is required to effect

the Amendment. Each share of our common stock entitles its holder to one vote on each matter submitted to the Company’s

stockholders. Each share of our Series B Convertible Preferred Stock and our Series C Convertible Preferred Stock entitles its

holder to no voting rights, and our shares of Series F Super Voting Preferred Stock entitle its holders to vote on each matter

submitted to the Company’s stockholders in an amount equal to 50% of the aggregate voting power of all stockholders plus

one million votes. As of the Record Date, our authorized capitalization consisted of 150,000 shares of our common stock, 1,000,000

shares of our Series B Convertible Preferred Stock, 1,000,000 shares of our Series C Convertible Preferred Stock, and 100 shares

of our Series F Super Voting Preferred Stock, of which 134,359,174 shares of our common stock were issued and outstanding, 407,477

shares of our Series B Convertible Preferred Stock were issued and outstanding, 0 shares of our Series C Convertible Preferred

Stock were issued and outstanding, and 100 shares of our Series F Super Voting Preferred Stock were issued and outstanding. Arthur

L. Smith, our Chief Executive Officer and a member of the Board, Antonio Estrada, our Chief Financial Officer, and Craig Clement,

a member of the Board, collectively own all of the outstanding shares of our Series F Super Voting Preferred Stock and an aggregate

of 31,259,534 shares of our common stock, and, as such, held, as of the Record Date, 62% of our outstanding voting capital stock.

Messrs. Smith, Estrada and Clement delivered to the Company an executed written consent dated February 15, 2021, authorizing the

Amendment.

As the Majority Stockholders

consented to the Amendment on February 15, 2021, by means of a written consent in lieu of a meeting in accordance with 78.320

of the NRS, and because the Majority Stockholders have sufficient voting power to approve such actions through their ownership

of the Company’s capital stock, no other stockholder vote will be solicited in connection with the Amendment or this Information

Statement.

The Company has asked

brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Company’s

common stock and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Financial Information

Our audited consolidated

financial statements and accompanying notes filed with our Annual Report on Form 10-K for the year ended July 31,2020 are incorporated

herein by reference.

No Dissenter’s Rights

No stockholder is

entitled to dissenter’s rights in connection with the Amendment and we will not provide our stockholders with such rights.

AMENDMENT TO THE COMPANY’S

ARTICLES OF INCORPORATION

The

Board and the Majority Stockholders have approved an amendment to: (i) increase our authorized capitalization from 150,000,000

shares of our common stock, par value $0.001 per share, and 50,000,000 shares of our blank check preferred stock, par value $0.001

per share, to 500,000,000 shares of our common stock, par value $0.001 per share, and 50,000,000 shares of our blank check preferred

stock, par value $0.001 per share; and (ii) provide that no amendment to the Bylaws that contradicts Article II, Section 14 of

the Bylaws (providing that the Acquisition of Controlling Interest Statute (Nevada Revised Statutes §78.378 through §78.3793,

inclusive, does not apply to purchases of a “controlling interest” (as defined in the Acquisition of Controlling Interest

Statute)) shall be implemented solely on the basis of a vote of a majority of the entire Board. Pursuant to Rule 14c-2 under the

Exchange Act, the actions will not be effective, and the Certificate will not be filed, until twenty (20) days after the date

this Information Statement is filed with the Securities and Exchange Commission (the “SEC”) and a copy thereof is

mailed to each of the Company’s stockholders. It is presently contemplated that such filing will be made on or about March

16, 2021.

The Authorized Capital Increase

The

purpose of the authorized capital increase is to increase the number of shares of our common stock available in order to have

sufficient shares of our common stock to (i) allow for the full exercise or conversion of outstanding stock options, warrants,

preferred stock and convertible notes and to satisfy any related reserve requirements, (ii) to ensure sufficient shares of our

common stock are available to allow the Company to pursue strategic financing and/or acquisition transactions, and (iii) provide

for such other corporate purposes as the Board determines in its discretion including the Company’s plan to uplist to the

Nasdaq or NYSE American stock exchange.

Except as we may be

required to do so upon exercise or conversion of outstanding stock options, warrants, preferred stock and convertible notes, we

currently have no other plans, proposals or arrangements, written or otherwise, to issue any of the additional authorized shares

of common stock resulting from the authorized capital increase.

To the extent that

additional authorized shares of our common stock are issued in the future, they will decrease our existing stockholders’

percentage equity ownership and, depending upon the price at which they are issued, could be dilutive to our existing stockholders.

Through their ownership of shares of our Series F Super Voting Preferred Stock, Arthur L. Smith, our Chief Executive Officer and

a member of the Board, Antonio Estrada, our Chief Financial Officer, and Craig Clement, a member of the Board, have the ability

to control the vote on all matters submitted to a vote of our stockholders. Such control of our Company may adversely affect the

price of our common stock.

Controlling Interest Provision

NRS Sections 78.378

through 78.3793, inclusive (the “Acquisition of Controlling Interest Statute”), prohibits an acquiror, under certain

circumstances, from voting its shares of a corporation’s stock after crossing three outstanding voting power ownership threshold

percentages: one-fifth or more but less than one-third, one-third but less than a majority, unless the acquiror obtains approval

of the corporation’s disinterested stockholders. The Acquisition of Controlling Interest Statute only applies to Nevada

corporations with at least 200 stockholders of record, including at least 100 stockholders of record who are Nevada residents,

and which conducts business directly or indirectly in Nevada. The Second Amended and Restated Bylaw of the Company (the “Bylaws”),

in Article II, Section 14, contains a provision that provides that the Acquisition of Controlling Interest Statute does not apply

to purchases of a “controlling interest” (as defined in the Acquisition of Controlling Interest Statute) in the Company

(the “Controlling Interests Provision”). While the Bylaws can be amended solely by Board action, the Board feels it

is the best interest of shareholders to only allow the Controlling Interests Provision to be changed by action of the Company’s

stockholders. The Board believes this is in keeping with the intention of the Controlling Interests Provision.

General

As

the result of the Amendment, the par value of our common stock will remain at $0.001 per share, and the number of authorized shares

of our blank check preferred stock will remain at 50,000,000. The relative rights and limitations of the shares of our common

stock will also remain unchanged.

The

holders of shares of our common stock are not entitled to preemptive rights with respect to the issuance of additional shares

of common stock or securities convertible into or exercisable for shares of our common stock.

The

Amendment will not change the terms of our common stock. The additional shares of our common stock for which authorization is

sought will have the same voting rights, the same rights to dividends and distributions and will be identical in all other respects

to our common stock which is currently authorized.

POTENTIAL ANTI-TAKEOVER EFFECTS OF

THE AUTHORIZED CAPITAL INCREASE

THE OVERALL EFFECT

OF THE AUTHORIZED CAPITAL INCREASE MAY BE TO RENDER MORE DIFFICULT THE CONSUMMATION OF MERGERS WITH THE COMPANY OR THE ASSUMPTION

OF CONTROL BY A PRINCIPAL STOCKHOLDER, AND THUS MAKE IT DIFFICULT TO REMOVE MANAGEMENT.

The implementation

of the authorized capital increase will have the effect of increasing the proportion of unissued authorized shares to issued shares.

Under certain circumstances this may have an anti-takeover effect. These authorized but unissued shares could be used by the Company

to oppose a hostile takeover attempt or to delay or prevent a change of control or changes in or removal of the Board, including

a transaction that may be favored by a majority of our stockholders or in which our stockholders might receive a premium for their

shares over then-current market prices or benefit in some other manner. For example, without further stockholder approval, the

Board could issue and sell shares, thereby diluting the stock ownership of a person seeking to effect a change in the composition

of our Board or to propose or complete a tender offer or business combination involving us and potentially strategically placing

shares with purchasers who would oppose such a change in the Board or such a transaction.

Although an increased

proportion of unissued authorized shares to issued shares could, under certain circumstances, have a potential anti-takeover effect,

the proposed amendments to our Articles of Incorporation is not in response to any effort of which we are aware to accumulate

the shares of our Common Stock or obtain control of the Company. There are no plans or proposals to adopt other provisions or

enter into other arrangements that may have material anti-takeover consequences. We are currently not engaged in any negotiations

or otherwise have no specific plans to use the additional authorized shares for any acquisition, merger or consolidation.

EFFECTIVE

DATE OF THE AMENDMENT

Pursuant

to Rule 14c-2 under the Exchange Act, the Amendment will not be effective until at least twenty (20) days after the date on which

this Information Statement is filed with the SEC and a copy hereof has been mailed to each of the Company’s stockholders.

The Company anticipates that this Information Statement will be mailed to our stockholders as of the Record Date on or about February

26, 2021. Therefore, the Company anticipates that the Amendment will be effective, and the Certificate amending our Articles of

Incorporation will be filed with the Secretary of State for the State of Nevada, on or around March 20, 2021.

INTEREST OF CERTAIN PERSONS IN FAVOR

OF OR OPPOSITION TO MATTERS ACTED UPON

None of our directors

or executive officers has any substantial interest resulting from the Amendment.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding beneficial ownership of our common stock and Series F Super Voting Preferred

Stock, our only classes of voting stock, as of the Record Date, by (i) each person known by us to be the beneficial owner of more

than 5% of our outstanding common stock or our outstanding Series F Super Voting Preferred Stock, (ii) each of our directors and

executive officers, and (iii) all of our executive officers and directors as a group.

The

number of shares of our common stock and our Series F Super Voting Preferred Stock beneficially owned by each person and entity

identified below is determined under the rules of the SEC and the information is not necessarily indicative of beneficial ownership

for any other purpose. Under such rules, beneficial ownership includes any shares as to which such person or entity has sole or

shared voting power or dispositive power and also any shares over which the individual or entity has the right to acquire sole

or shared voting or dispositive power within 60 days after the Record Date, including through the exercise of any stock option,

warrant or other right. Unless otherwise indicated, each person and entity identified below has sole voting and dispositive power

(or, in the case of individuals, shares such power with his or her spouse) with respect to the shares set forth in the following

table. The inclusion herein of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of

those shares.

|

|

|

Common

|

|

|

Vested

|

|

|

Total

|

|

|

|

|

|

|

|

|

Shares of

Series F

|

|

|

Votes from

Series F

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Warrants and

|

|

|

Beneficial

|

|

|

% Of

|

|

|

Held via

|

|

|

Super Voting

|

|

|

Super Voting

|

|

|

Total

|

|

|

% Of

|

|

|

Name of Beneficial Owner

|

|

Owned

Votes

|

|

|

Options

(1)

|

|

|

Ownership

|

|

|

Class

(2)

|

|

|

Warrant

(3)

|

|

|

Preferred

Stock

|

|

|

Preferred

Stock

|

|

|

Votes

(4)

|

|

|

Total

Votes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL OFFICERS,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTORS AND NOMINEES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arthur L. Smith

|

|

|

11,453,804

|

|

|

|

735,000

|

|

|

|

12,188,804

|

|

|

|

8.99

|

%

|

|

|

-

|

|

|

|

34

|

|

|

|

46,022,120

|

|

|

|

57,475,924

|

|

|

|

21.31

|

%

|

|

President, Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Antonio Estrada Jr.

|

|

|

10,087,936

|

|

|

|

770,000

|

|

|

|

10,857,936

|

|

|

|

8.04

|

%

|

|

|

-

|

|

|

|

33

|

|

|

|

44,668,527

|

|

|

|

54,756,464

|

|

|

|

20.30

|

%

|

|

Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Craig K. Clement

|

|

|

9,735,794

|

|

|

|

670,000

|

|

|

|

10,405,794

|

|

|

|

7.71

|

%

|

|

|

-

|

|

|

|

33

|

|

|

|

44,668,527

|

|

|

|

54,404,321

|

|

|

|

20.17

|

%

|

|

Chairman of the Board

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maxwell A. Polinsky

|

|

|

81,594

|

|

|

|

325,000

|

|

|

|

406,594

|

|

|

|

0.30

|

%

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

81,594

|

|

|

|

0.03

|

%

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post Road Special Opportunity Fund II LP

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0.00

|

%

|

|

|

44,786,391

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0.00

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALL OFFICERS, DIRECTORS

AND

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFICIAL OWNERS AS A

GROUP

|

|

|

31,359,128

|

|

|

|

2,500,000

|

|

|

|

33,859,128

|

|

|

|

25.04

|

%

|

|

|

44,786,391

|

|

|

|

100

|

|

|

|

135,359,174

|

|

|

|

166,718,303

|

|

|

|

61.81

|

%

|

|

|

(1)

|

Based on 2,500,000 vested

stock options as of the Record Date.

|

|

|

(2)

|

Based on 134,359,174 shares of

Common Stock outstanding as of the Record Date and 2,500,000 vested stock options as of the Record Date.

|

|

|

(3)

|

Represents twenty-five percent

(25%) of the Company’s shares that are currently outstanding including the shares issuable to Post Road Special Opportunity

Fund II LP (“Post Road”) pursuant to the exercise of the warrant issued to Post Road on the Record Date. The 107,701,179

warrant shares that Post Road reported it owned in the Schedule 13D it filed on November 27, 2020 represents twenty-five percent

(25%) of the Company’s total shares of common stock, calculated on a fully diluted basis, which assumes future share issuances

that are not certain or not yet contractually obligated to be issued. In addition, twenty-five percent (25%) of the 107,701,179

warrant shares are not yet vested and subject to forfeiture if the Company achieves certain performance targets which, if achieved,

would result in the warrant being exercisable into twenty percent (20%) of the Company’s common stock, calculated on a fully-diluted

basis as described above. If the minority stockholders of the Company’s majority owned subsidiary, T3 Communications, Inc.,

a Nevada corporation (“T3 Nevada”), convert their T3 Nevada shares into shares of the Company’s common stock,

the number of shares into which the warrant may be exercised would also be decreased such that, if the Company also achieves certain

performance targets, the warrant would be exercisable into fifteen percent (15%) of the Company’s common stock, calculated

on a fully-diluted basis as described above. T3 Nevada’s minority stockholders have an obligation to (and may not otherwise)

convert their T3 Nevada shares into shares of the Company’s common stock upon being asked to do so by the Company at any

time after our common stock has a current market price of $1.50 or more per share for 20 consecutive trading days.

|

|

|

(4)

|

Total Votes excludes 2,500,000

vested stock options as of the Record Date.

|

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

The Company is subject

to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and other information

including annual and quarterly reports on Forms 10-K and 10-Q, respectively, with the SEC. The SEC maintains a website (http://www.sec.gov)

that contains the filings of issuers that file electronically with the SEC through the EDGAR system. Copies of such filings may

also be obtained by writing to the Company at 825 Bitters, Suite 104, San Antonio, Texas 78216.

Any statement contained

in a document that is incorporated by reference will be modified or superseded for all purposes to the extent that a statement

contained in this Information Statement (or in any other document that is subsequently filed with the SEC and incorporated by

reference) modifies or is contrary to such previous statement. Any statement so modified or superseded will not be deemed a part

of this Information Statement except as so modified or superseded.

This Information Statement

is provided to our stockholders only for information purposes in connection with the Authorized Share Increase, pursuant to and

in accordance with Rule 14c-2 of the Exchange Act. Please carefully read this Information Statement.

STOCKHOLDERS SHARING AN ADDRESS

Unless we have received

contrary instructions from a stockholder, we are delivering only one Information Statement to multiple stockholders sharing an

address. We will, upon request, promptly deliver a separate copy of this Information Statement to a stockholder who shares an

address with another stockholder. A stockholder who wishes to receive a separate copy of the Information Statement may make such

a request in writing to the Company at 825 Bitters, Suite 104, San Antonio, Texas 78216, or by calling (210) 614-7240.

|

Dated: February 24, 2021

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

|

By:

|

/s/ Arthur L. Smith

|

|

|

Name:

|

Arthur L. Smith

|

|

|

Title:

|

CEO and Director

|

APPENDIX A

Form of Certificate of Amendment

to the Articles of Incorporation of

Digerati Technologies, Inc.

Certificate of Amendment to Articles

of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 — After Issuance of Stock)

1. Name of corporation:

Digerati Technologies, Inc.

2. The articles have been amended as follows: (provide article

numbers, if available)

The First Amended and Restated Articles of Incorporation are

hereby amended as follows:

(a) “ARTICLE III. CAPITAL STOCK” is hereby amended

and restated as follows:

“The total number of shares of all

classes that this Corporation shall have authority to issue shall be 550,000,000, of which 500,000,000 shall be shares of common

stock, par value $0.001 per share, and 50,000,000 shall be shares of preferred stock, par value $0.001 per share. The Board of

Directors of the corporation is authorized, by resolution or resolutions from time to time adopted, to provide for the issuance

of preferred stock in series and to fix and state the powers, designations, preferences and relative, participating, optional

or other special rights of the shares of each such series, and the qualifications, limitation or restrictions thereof.”

(B) “ARTICLE XII. AMENDMENT OF ARTICLES

OF INCORPORATION AND BYLAWS” is hereby amended and restated as follows:

“The Articles of Incorporation and

the Bylaws of the corporation may be repealed, altered, amended or rescinded only by a vote of a majority of the entire Board

of Directors or a majority of the outstanding shares of capital stock, voting as classes, provided, however, that no amendment

to the Bylaws of the Corporation or these Articles of Incorporation contradicting Article II, Section 14 of the Bylaws of the

Corporation (Controlling Interests) shall be implemented solely on the basis of a vote of a majority of the entire Board of Directors.”

3. The vote by which the stockholders

holding shares in the corporation entitling them to exercise a least a majority of the voting power, or such greater proportion

of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of

the articles of incorporation have voted in favor of the amendment is: Shares representing [ ]%

of the outstanding voting power were voted in favor of the amendment.

4. Effective date of filing: (optional) (must not be later

than 90 days after the certificate is filed)

5. Signature: (required)

|

Signature of Officer Arthur L. Smith,

Chief Executive Officer

|

|

|

A-1

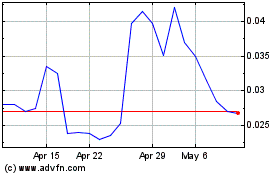

Digerati Technologies (QB) (USOTC:DTGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Digerati Technologies (QB) (USOTC:DTGI)

Historical Stock Chart

From Apr 2023 to Apr 2024