Current Report Filing (8-k)

February 23 2021 - 5:23PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 23, 2021

(Exact

Name of Registrant as Specified in Charter)

|

Georgia

|

|

000-53754

|

|

20-2027731

|

|

(State

or Other Jurisdiction

of

Incorporation

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

725

Southbridge St

Worcester,

MA

|

|

01609

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (508) 791-9114

n/a

(Former

Name or Former Address, if Changed Since Last Report)

Securities

registered pursuant to Section 12(b) of the Exchange Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

NONE

|

|

NONE

|

|

NONE

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[ ]

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement

Rotmans

Vystar

owns 58% of the issued and outstanding shares of Rotmans.

PPP

Loan. On April 16, 2020, Rotmans received $1,402,900 in loan funding from the Paycheck Protection Program (the “PPP”),

established pursuant to the recently enacted Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”)

and administered by the U.S. Small Business Administration (“SBA”). The unsecured loan (the “PPP Loan”)

was evidenced by a promissory note of the Company dated April 16, 2020 in the principal amount of $1,402,900 with United Community

Bank. This loan was completely forgiven on January 11th, 2021.

On

February 2, 2021, Rotmans received a $1,402,900 in a second round of loan funding from the PPP established pursuant to the CARES

Act and administered by the SBA. The unsecured loan (the “Second PPP Loan”) is evidenced by a promissory note of the

Company (the “Second PPP Note”) in the principal amount of $1,402,900 with United Community Bank. Under the terms

of the Second PPP Note and the Second PPP Loan, interest accrues on the outstanding principal at the rate of 1.0% per annum. The

term of the Second PPP Note is two years, although it may be payable sooner in connection with an event of default under the Second

PPP Note. To the extent the loan amount is not forgiven under the PPP, Rotmans is obligated to make equal monthly payments of

principal and interest, beginning seven months from the date of the Second PPP Note, until the maturity date. The Note may be

prepaid in part or in full, at any time, without penalty. The Note provides for certain customary events of default.

Item

2.03 Creation of a Direct Financial Obligation or an obligation under an Off-Balance Sheet Arrangement of a Registrant

On

October 7, 2020, the Company disclosed that it entered into a $630,000 promissory note for a loan made by the President of the

Company, Steven Rotman, at 5% note payable at maturity no later than July 1, 2021. On February 22nd, 2021, the Company

entered into an additional loan with the Mr. Rotman on the following terms: a $568,000 promissory note for a loan made by the

President of the Company, Steven Rotman, at 5% note payable at maturity no later than February 22nd, 2022. This brings

the total of the two loans to $1,198,000.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

VYSTAR

CORPORATION

|

|

|

|

|

|

Date:

February 23, 2021

|

By:

|

/s/

Steven Rotman

|

|

|

Name:

|

Steven

Rotman

|

|

|

Title:

|

President/Chief

Executive Officer

|

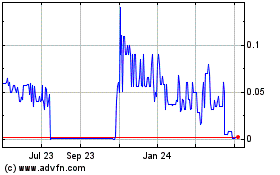

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Mar 2024 to Apr 2024

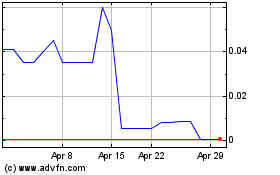

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Apr 2023 to Apr 2024