|

|

Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-252504

|

PROSPECTUS

AMERICAN

INTERNATIONAL HOLDINGS CORP.

14,750,000

Shares of Common Stock

This

prospectus relates to the resale by the selling stockholders named herein of up to 14,750,000 shares of common stock, par value

$0.0001 per share, which we refer to as common stock, of American International Holdings Corp., which we refer to as us, we, the

Company, the Registrant or American International, consisting of (i) up to 8,000,000 shares of common stock issuable upon conversion

of the principal, accrued interest, and late charges, from time to time, under those certain 6% Original Issue Discount Senior

Secured Convertible Promissory Notes (the “6% Convertible Notes”), in an aggregate principal amount of $850,000,

issued by the Company to the selling stockholders on January 6, 2021 (the “First Tranche Notes”); and (b) up

to 6,750,000 shares of the Company’s common stock issuable upon exercise of those certain Common Stock Purchase Warrants

dated January 6, 2021, which were granted to the selling stockholders on the same date (the “Warrants”).

The

shares of common stock being offered by the selling stockholders (which term includes their respective donees, pledgees, transferees,

or other successors-in-interest) have been issued pursuant to a private offering transaction which closed on January 6, 2021,

which transaction, which 6% Convertible Notes, and which Warrants, are described in greater detail under “Securities Purchase Agreement”, beginning on page 26. The selling stockholders are described in greater detail under “Selling Stockholders”,

beginning on page 36.

The

shares of common stock described in this prospectus may be offered for sale from time to time by the selling stockholders named

herein. The selling stockholders may offer and sell the shares in a variety of transactions as described under the heading “Plan of Distribution” beginning on page 34, including transactions on any stock exchange, market or facility on which our common

stock may be traded, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices

related to such market prices or at negotiated prices. We have no basis for estimating either the number of shares of our common

stock that will ultimately be sold by the selling stockholders or the prices at which such shares will be sold.

We

are not selling any securities covered by this prospectus and will not receive any of the proceeds from the sale of such shares

by the selling stockholders. However, to the extent that the Warrants are exercised for cash, we will receive the payment of the

exercise price in connection with such exercise (see also “Use of Proceeds” on page 29 below). We are bearing all

of the expenses in connection with the registration of the shares of common stock, but all selling and other expenses incurred

by the selling stockholders, including commissions and discounts, if any, attributable to the sale or disposition of the shares

will be borne by them.

The

selling stockholders and intermediaries through whom such securities are sold may be deemed “underwriters”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities

offered hereby, and any profits realized or commissions received may be deemed underwriting compensation.

A

current prospectus must be in effect at the time of the sale of the shares of common stock discussed above and each selling stockholder

or dealer selling the common stock is required to deliver a current prospectus upon the sale. The selling stockholders will be

responsible for any commissions or discounts due to brokers or dealers. We will pay all of the other offering expenses.

In

addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 of the Securities Act may be sold

under Rule 144 rather than pursuant to this prospectus.

Our

common stock is considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under

the Exchange Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded

on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend

low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice

requirements, including a requirement that they make an individualized written suitability determination for the purchaser and

receive the purchaser’s consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act

of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining

the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities

and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose

restrictions on transferring “penny stocks” and as a result, investors in the common stock may have their ability

to sell their shares of the common stock impaired.

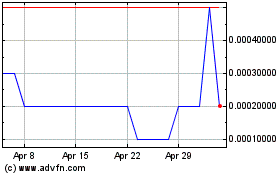

Our

common stock is quoted on the OTCQB Market under the symbol “AMIH”. The closing price for our common stock

on February 4, 2021, was $0.33 per share.

Investing

in our securities involves risks. You should carefully consider the “risk factors” beginning on page 9 of this prospectus

and set forth in the documents incorporated by reference herein before making any decision to invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 5, 2021.

TABLE

OF CONTENTS

About

This Prospectus

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”

or the “Commission”). This prospectus relates to the resale by the selling stockholders listed in this prospectus

of up to 14,750,000 shares of our common stock. We will not receive any proceeds from the resale of any of the shares by the selling

stockholders. However, to the extent that the Warrants are exercised for cash, we will receive the payment of the exercise price

in connection with such exercise (see also “Use of Proceeds” on page 29 below). We have agreed to pay for the expenses

related to the registration of the shares being offered by the selling stockholders.

You

should read this prospectus, together with additional information described under “Where You Can Find More Information”,

beginning on page 74, before making an investment decision.

This

prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information

about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC

as described below under “Where You Can Find More Information”, beginning on page 74.

You

should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. This

prospectus is not an offer to sell or the solicitation of an offer to buy any securities other than the securities to which it

relates and is not an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom

it is unlawful to make an offer or solicitation in that jurisdiction.

We

will disclose any material changes in our affairs in a post-effective amendment to the registration statement of which this prospectus

is a part, or a prospectus supplement. We do not imply or represent by delivering this prospectus that American International

Holdings Corp., or its business, financial condition or results of operations, are unchanged after the date on the front of this

prospectus is correct at any time after such date, provided that we will amend or supplement this prospectus to disclose any material

events which occur after the date of such prospectus to the extent required by applicable law.

Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

Our

logo and some of our trademarks and tradenames are used in this prospectus. This prospectus also includes trademarks, tradenames

and service marks that are the property of others. Solely for convenience, trademarks, tradenames and service marks referred to

in this prospectus may appear without the ®, ™ and SM symbols. References to our trademarks, tradenames and service

marks are not intended to indicate in any way that we will not assert to the fullest extent under applicable law our rights or

the rights of the applicable licensors if any, nor that respective owners to other intellectual property rights will not assert,

to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’

trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The

market data and certain other statistical information used throughout this prospectus are based on independent industry publications,

reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and

third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to

be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the

disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies

are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus,

their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties,

and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors”

beginning on page 9 of this prospectus. These and other factors could cause our future performance to differ materially from our

assumptions and estimates. Some market and other data included herein, as well as the data of competitors as they relate to American

International Holdings Corp., is also based on our good faith estimates.

Unless

the context otherwise requires, references in this prospectus to:

|

|

●

|

“we,”

“us,” “our,” the “Registrant”, the “Company,”

and “American International”, refer to American International Holdings Corp. and its subsidiaries;

|

|

|

|

|

|

|

●

|

“Exchange

Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

|

|

|

|

|

●

|

“SEC”

or the “Commission” refers to the United States Securities and Exchange Commission; and

|

|

|

|

|

|

|

●

|

“Securities

Act” refers to the Securities Act of 1933, as amended. All dollar amounts in this prospectus are in U.S. dollars

unless otherwise stated. You should read the entire prospectus before making an investment decision to purchase our securities.

|

Cautionary

Statement Regarding Forward-Looking Statements

This

prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement

contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act. The words “believe,” “may,”

“will,” “potentially,” “estimate,” “continue,” “anticipate,”

“intend,” “could,” “would,” “project,” “plan,”

“expect” and the negative and plural forms of these words and similar expressions are intended to identify

forward-looking statements, but are not the exclusive means of identifying such statements. Those statements appear in this prospectus,

any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly in the sections

titled “Prospectus Summary” and “Risk Factors,” and include statements regarding the intent, belief or current

expectations of the Company and management that are subject to known and unknown risks, uncertainties and assumptions.

This

prospectus, any prospectus supplement and the information incorporated by reference in this prospectus and any prospectus supplement

also contain statements that are based on the current expectations of our Company and management. You are cautioned that any such

forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results

may differ materially from those projected in the forward-looking statements as a result of various factors.

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified,

you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in

the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in

the forward-looking statements. Except as required by applicable law, including the securities laws of the United States and the

rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein

after we distribute this prospectus, whether as a result of any new information, future events or otherwise.

You

should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, which address

additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution

investors not to place significant reliance on the forward-looking statements contained in this prospectus.

Prospectus

Summary

The

following summary highlights material information found in more detail elsewhere in the prospectus. It does not contain all of

the information you should consider. As such, before you decide to buy our common stock, in addition to the following summary,

we urge you to carefully read the entire prospectus, especially the risks of investing in our common stock as discussed under

“Risk Factors.”

About

American International Holdings Corp.

The

Company is headquartered in Addison, Texas and operates as a holding company dedicated to acquiring, managing and operating subsidiaries

in (a) the health, wellness, medical spa and auxiliary industries across the United States and abroad; (b) general contracting

and construction services; and (c) life coaching industry. The Company seeks opportunities to acquire and grow businesses that

possess strong brand values and that can generate long-term sustainable free cash flow and attractive returns in order to maximize

value for all stakeholders.

The

Company currently is the parent to seven wholly-owned subsidiaries and one majority owned subsidiary.

MEDICAL

SPA AND WELLNESS

The

Company currently owns three wholly-owned subsidiaries that are in the Medical Spa and Wellness Sector (collectively hereinafter

referred to as “MedSpa”, or “VISSIA”). They are:

|

|

1.

|

VISSIA

MCKINNEY, LLC (F/K/A NOVOPELLE DIAMOND, LLC) – 100% OWNED

|

VISSIA

McKinney is a physician supervised, medical spa and wellness clinic that when operational offers a full menu of wellness services

including anti-aging, weight loss and skin rejuvenation treatments located at 5000 Collin McKinney Parkway, Suite 150, McKinney,

Texas 75070.

|

|

2.

|

VISSIA

WATERWAY, INC. (F/K/A NOVOPELLE WATERWAY, INC.) – 100% OWNED

|

VISSIA

McKinney is a physician supervised, medical spa and wellness clinic that when operational offers a full menu of wellness services

including anti-aging, weight loss and skin rejuvenation treatments located at 25 Waterway, Suite 150, The Woodlands, Texas.

|

|

3.

|

NOVOPELLE

TYLER, INC. – 100% OWNED

|

On

December 3, 2019, the Company formed and organized Novopelle Tyler, Inc. in the State of Texas with the plan to come to terms

on a retail location for a newly established Novopelle branded med spa to be located in Tyler, Texas. The Company no longer intends

to open this location and no activity has been performed under this entity to date.

*

* * * *

As

a result of COVID-19 and ‘stay-at-home’ and social distancing orders issued in McKinney and The Woodlands, Texas,

we had to close both of our then operational MedSpas, VISSIA McKinney and VISSIA Waterway, Inc., which were closed effective March

10, 2020, and which resulted in both the loss of income and the loss of most of our workforce, who had to be let go. VISSIA Waterway,

Inc. reopened effective June 21, 2020 and VISSIA McKinney reopened effective August 8, 2020. However, due to the termination of

employees associated with the shutdown we were forced to expend resources to attract, hire and train completely new staff for

preparation of the re-launchings. Notwithstanding the re-openings, customer traffic and demand at our VISSIA Waterway, Inc. and

VISSIA McKinney MedSpa locations failed to rebound to pre-closure levels due to COVID-19 and the pandemic’s effects on the

economy, and because we are unable to predict the length of the pandemic or ultimate outcome thereof, and further due to our limited

capital resources, effective on October 25, 2020, we made the decision to temporarily close both our VISSIA Waterway, Inc. and

VISSIA McKinney locations, which remain closed as of the date of this prospectus. We are currently seeking both financial and

operating partners to assist in the further management and operations of our VISSIA brand, to help fund the re-opening of our

spas and are also entertaining any and all purchase opportunities for such brand and spas as well.

VISSIA

Service Offerings

Our

VISSIA med spas are Texas based, physician-supervised medical spa & wellness clinics. When operational, VISSIA offers the

following products and services:

|

●

|

Stem

Cell Therapy

|

●

|

Acne

& Acne Scar Reduction

|

|

●

|

Laser

Hair Removal

|

●

|

Testosterone

Replacement Therapy

|

|

●

|

PRP

Facial (Vampire Facial)

|

●

|

Hair

Restoration

|

|

●

|

Novo

Lipo (Body Contouring)

|

●

|

Botox

& Fillers

|

|

●

|

Laser

Vein Removal

|

●

|

Facials

& Peels

|

|

●

|

Cellulite

Reduction

|

●

|

Weight

Loss Solutions

|

|

●

|

Stretch

Mark Reduction

|

●

|

IV

Therapies

|

Medical

Spa Marketing Strategy

When

operational, VISSIA markets its products and services to both men and women that are conscience about fitness, health, wellness

and aesthetics.

When

operational, VISSIA deploys unique, proven marketing strategies through social media with both sponsored and paid advertisements

as well as the use of local brand ambassadors and influencers. VISSIA has also experienced a lot of success by placing marketing

materials in nearby retail establishments and utilizing cross marketing relationships with other vendors and retailers that market

to similar demographics.

CAPITOL

CITY SOLUTIONS, USA, INC. – 100% OWNED

On

September 17, 2019, the Company formed and organized Capitol City Solutions USA, Inc. (“CCS”) in the State

of Texas to act as a general contracting and construction company focused on the remodeling, general construction and interior

finish of both the Company’s newly established med spa locations as well as to market to other commercial real estate projects

within the United States.

Service

Offerings

CCS

currently offers a variety of general contracting services to oversee the entirety of commercial construction projects and manage

all phases of construction. These areas can range from permitting, roofing and exterior construction or remodeling, to interior

finish out, including but not limited to cabinetry, drywall, plumbing and electrical. CCS primarily utilizes the services of its

sub-contractors in order to perform its services and in some instances will perform various construction related tasks with its

own work force in order to improve its project specific margins and profitability.

LEGEND

NUTRITION, INC. – 100% OWNED

On

September 23, 2019, the Company formed and organized Legend Nutrition, Inc. (“Legend Nutrition”) in the State

of Texas to act as a new brand of retail vitamin and supplement stores to be branded and marketed as Legend Nutrition.

October

18, 2019, Legend entered into an Asset Purchase Agreement to acquire all of the assets associated with and related to a retail

vitamin, supplements and nutrition store located in McKinney, Texas and previously identified and doing business as “Ideal

Nutrition.” Pursuant to the Asset Purchase Agreement, Legend purchased a variety of assets including software, contracts,

bank and merchant accounts, products, inventory, computers, security systems and other intellectual properties.

Product

and Service Offerings

Legend

Nutrition is currently operating a 1,500 square foot retail store offering a variety of vitamin & nutritional supplements

as well as nutritional and weight loss plans through a consultative approach with each and every customer. Legend Nutrition’s

products include, but are not limited to, a variety of workout related supplements such as vitamins, protein powders, pre-workout

powders, and post-workout supplements that focus on muscle and overall health recovery. Legend Nutrition is currently located

at 2851 Craig Drive, Suite #204, McKinney, TX 75070.

Although

our MedSpas were forced to close during the second and third quarters of 2020, and are temporarily closed for economic reasons

currently, Legend Nutrition was able to remain open as an essential business as we sold vitamins and other nutritional supplements.

Though the store was able to remain open, the store saw, and continues to see, a deep decline in sales due to social distancing

orders and decreases in customers who are willing to venture out to brick and mortar establishments. Legend Nutrition’s

lease is up January 31, 2021, and the Company plans to not renew the lease, close the store, and not continue in this line of

business moving forward.

LIFE

GURU, INC. – 51% OWNED

On

May 15, 2020, the Company acquired a 51% interest in Life Guru, Inc., a Delaware corporation. Life Guru owns the website www.LifeGuru.me

– a website dedicated to providing an online platform to connect consumers to a variety of mentors, professionals, life

coaches and career coaches (which includes information the Company does not desire to incorporate by reference into this prospectus).

The LifeGuru.me website is currently in development and is anticipated to be fully launched on or before March 31, 2021.

ZIPDOCTOR,

INC. – 100% OWNED

On

April 28, 2020, the Company incorporated a wholly-owned subsidiary, ZipDoctor, Inc. (“ZipDoctor”) in the State

of Texas. ZipDoctor plans to provide its customers with unlimited, 24/7 access to board certified physicians and licensed mental

and behavioral health counselors and therapists via a newly developed, monthly subscription based online telemedicine platform.

ZipDoctor’s online telemedicine platform is available to customers across the United States and offers bilingual coverage

(both English and Spanish), with virtual visits taking place either via the phone or through a secured video chat platform. ZipDoctor

customers subscribe through the website and are only required to pay a low monthly fee, which is determined based on if they are

an individual, a couple, or a family. ZipDoctor is currently being sold on a direct-to-consumer basis with an emphasis on digital

marketing and advertising. The Company intends to shift the business model to focus on offering ZipDoctor’s services to

small to medium size companies, to be used by their employees as an employment health benefit. The Company launched the platform

in the third quarter of 2020 and has generated nominal revenues to date.

EPIQ

MD, INC. – 100% OWNED

On

October 23, 2020, the Company incorporated a wholly-owned subsidiary, EPIQ MD, Inc. (“EPIQ MD”) in the State

of Nevada. EPIQ MD is planned to be a direct to consumer, telemedicine and healthcare company targeting the over approximately

76 million Americans who are uninsured or underinsured; this includes, but is not limited to the working class, middle income

and upper middle-income demographics. The EPIQ MD service offering is planned to be a convergence of primary care telemedicine,

preventative care services and wellness programs – under one brand and on one platform. The EPIQ MD services are planned

to be sold directly to consumers using a direct sales model and utilizing brand ambassadors.

*

* * * * *

The

Company intends to continue to grow its business both organically and through identifying acquisition targets over the next 12

months in the telemedicine, life coaching and wellness space. As these opportunities arise, the Company will determine the best

method for financing its growth which may include the issuance of additional debt instruments, common stock, preferred stock,

or a combination thereof, any one or more of which may cause significant dilution to existing shareholders. The Company will also

seek to raise capital through the issuance of shares under its ongoing Regulation A offering, in which the Company is offering

for sale up to 10,000,000 shares of common stock at $0.50 per share, for a total of up to $5,000,000 in gross offering proceeds

(the “Offering Statement”), assuming all securities are sold.

COVID-19

Outlook

The

outbreak of the 2019 novel coronavirus disease (“COVID-19”), which was declared a global pandemic by the World

Health Organization on March 11, 2020, and the related responses by public health and governmental authorities to contain and

combat its outbreak and spread has severely impacted the U.S. and world economies, the market for health spa services, nutrition

supplements and our other business offerings during the end of the first quarter of 2020, and continuing through the second and

third quarters of 2020. Government mandated ‘stay-at-home’ and similar orders have to date, and may in the future,

prevent us from staffing our spas and construction services, and prohibit us from operating altogether. As discussed above, effective

on October 25, 2020, we made the decision to temporarily close both our VISSIA Waterway, Inc. and VISSIA McKinney locations. Such

locations remain closed through the date of this prospectus. We are currently seeking both financial and operating partners to

assist in the further management and operations of our VISSIA brand, to help fund the re-opening of our spas and are also entertaining

any and all purchase opportunities for such brand and spas as well.

Additionally,

our Legend Nutrition store saw, and continues to see, a deep decline in sales due to social distancing orders and decreases in

customers who are willing to venture out to brick and mortar establishments. Legend Nutrition’s lease is up January 31,

2021, and the Company plans to not renew the lease, close the store, and not continue in this line of business moving forward.

We

currently anticipate experiencing ongoing disruptions to our ability to reopen our medical spas and provide construction services,

and provide future planned telehealth services and other offerings throughout the first half of 2021, at a minimum, as Texas,

and the U.S. in general, continues to deal with the COVID-19 pandemic. Any prolonged disruption to our operations, work force

available, or failure to reopen our MedSpas, is likely to have a significant adverse effect on our results of operations, cash

flows and ability to meet continuing debt service requirements. We have also experienced delays in completing construction projects

due to the effects of COVID-19.

Summary

Risk Factors

Our

business is subject to numerous risks and uncertainties, including those in the section entitled “Risk Factors” and

elsewhere in this prospectus. These risks include, but are not limited to, the following:

|

|

●

|

Our

limited operating history;

|

|

|

|

|

|

|

●

|

Our

need for additional funding to support our operations, repay debt and expand our operations;

|

|

|

|

|

|

|

●

|

The

effects of COVID-19 on our operations and prospects, including the recent closures of our MedSpas, and the future effects

of COVID-19 on us and our operations;

|

|

|

|

|

|

|

●

|

The

fact that our MedSpas are currently shut down;

|

|

|

|

|

|

|

●

|

Impairments

we may be required to assess in connection with our assets and goodwill as a result of such shutdowns and/or otherwise;

|

|

|

|

|

|

|

●

|

Risks

associated with our recent launch of a telehealth platform, including liability in connection therewith, funding needed to

support such operations and other risks associated with the operations of the telehealth platform;

|

|

|

●

|

Disruptions

to our operations or liabilities associated with future acquisitions;

|

|

|

|

|

|

|

●

|

Our

ability to continue as a going concern;

|

|

|

|

|

|

|

●

|

Our

dependence on our sole officer and director, Jacob D. Cohen, including the lack of independent directors, and related party

transactions affecting the Company;

|

|

|

|

|

|

|

●

|

Competition

we face;

|

|

|

|

|

|

|

●

|

Our

ability to maintain our varied operations, and service our indebtedness;

|

|

|

|

|

|

|

●

|

Material

weaknesses in our controls and procedures;

|

|

|

|

|

|

|

●

|

Our

ability to obtain and maintain adequate insurance;

|

|

|

|

|

|

|

●

|

Legal

challenges and litigation;

|

|

|

|

|

|

|

●

|

Liability

associated with our contracting operations;

|

|

|

|

|

|

|

●

|

The

terms of Mr. Cohen’s employment agreement;

|

|

|

|

|

|

|

●

|

Dilution

caused by the conversion of outstanding notes, conversion of preferred stock, exercise of outstanding warrants, and future

fund-raising activities;

|

|

|

|

|

|

|

●

|

The

price of, volatility in, and lack of robust trading market for, our common stock; and

|

|

|

|

|

|

|

●

|

The

fact that Mr. Cohen has voting control over the Company.

|

Penny

Stock Rules

Our

common stock is considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under

the Exchange Act. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted

on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities

to persons other than established customers and accredited investors must satisfy special sales practice requirements, including

a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser’s

consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional

disclosure in connection with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining

the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities

and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose

restrictions on transferring “penny stocks” and as a result, investors in the common stock may have their ability

to sell their shares of the common stock impaired.

Additional

Information

Additional

information about us can be obtained from the documents described under “Where You Can Find More Information.”

This

Offering

The

selling stockholders named in this prospectus may offer and sell up to 14,750,000 shares of our common stock, par value $0.0001

per share. Our common stock is currently quoted on the OTC Markets Group Inc.’s OTCQB Market (the “OTCQB”)

under the trading symbol, “AMIH.”

|

Shares

of Common Stock Offered by the Selling Stockholders:

|

|

14,750,000

shares of common stock, which represents (i) up to 8,000,000 shares of common stock issuable upon conversion of the principal,

accrued interest, and late charges, from time to time, under the $850,000 in 6% Convertible Notes, issued by the Company to

the selling stockholders on January 6, 2021, at the option of the holders thereof; and (b) up to 6,750,000 shares of the Company’s

common stock issuable upon exercise of the Warrants, which 6% Convertible Notes, and which Warrants, are described in greater

detail under “Securities Purchase Agreement”, beginning on page 26.

|

|

|

|

|

|

Shares

of Common Stock Outstanding Prior to this Offering:

|

|

65,475,605

shares of common stock.

|

|

|

|

|

|

Shares

of Common Stock Outstanding After this Offering1:

|

|

80,225,605

shares of common stock.

|

|

|

|

|

|

Use

of Proceeds:

|

|

We

will not receive any of the proceeds from the sale or other disposition by the selling stockholders or their transferees of

the shares of common stock covered hereby. However, to the extent that the Warrants are exercised for cash, we will receive

the payment of the exercise price in connection with such exercise (see also “Use of Proceeds” on page 29 below).

|

|

|

|

|

|

Risk

factors:

|

|

The

purchase of our common stock involves a high degree of risk. The common stock offered in this prospectus is for investment

purposes only and currently only a limited market exists for our common stock. Please refer to the section entitled “Risk Factors” before making an investment in our common stock.

|

|

|

|

|

|

Trading

symbol:

|

|

Our

common stock is quoted on the OTCQB under the trading symbol “AMIH”.

|

In

this prospectus, unless otherwise indicated, the number of shares of our common stock and other capital stock, and the other information

based thereon, is as of February 5, 2021 and excludes:

|

|

●

|

shares

issuable upon the exercise of outstanding warrants, options and convertible notes.

|

Additionally,

unless otherwise stated, all information in this prospectus:

|

|

●

|

reflects

all currency in United States dollars.

|

1

Assumes the issuance of all shares of common stock registered in the registration statement, of which this prospectus

forms a part.

Risk

Factors

You

should be aware that there are substantial risks for an investment in our common stock. You should carefully consider these risk

factors, along with the other information included in this prospectus, before you decide to invest in our common stock.

If

any of the following risks were to occur, such as our business, financial condition, results of operations or other prospects,

any of these could materially affect our likelihood of success. If that happens, the market price of our common stock, if any,

could decline, and prospective investors would lose all or part of their investment in our common stock.

Risks

Related to our Business

Since

we have a limited operating history it is difficult for potential investors to evaluate our business.

Our

short operating history in the health and wellness industry, construction industry and mentoring/life coach industry may hinder

our ability to successfully meet our objectives and makes it difficult for potential investors to evaluate our business or prospective

operations. As an early-stage company, we are subject to all the risks inherent in the financing, expenditures, operations, complications

and delays inherent in a new business. Accordingly, our business and success face risks from uncertainties faced by developing

companies in a competitive environment. There can be no assurance that our efforts will be successful or that we will ultimately

be able to attain profitability.

We

may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our service locations

and product development programs or commercialization efforts and could cause our business to fail.

We

expect to need substantial additional funding to pursue additional service locations and product development and commercialize

our products and services. There are no assurances that future funding will be available on favorable terms or at all. The failure

to fund our operating and capital requirements could have a material adverse effect on our business, financial condition and results

of operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate

our expansion of spa locations and development programs or any future commercialization efforts. Any of these events could significantly

harm our business, financial condition and prospects.

Our

business has been materially and adversely disrupted by COVID-19, and the control response measures that state and local governments

have implemented to address it, and may be impacted by other epidemics or pandemics in the future. We have been forced to temporarily

close our MedSpas.

An

epidemic, pandemic or similar serious public health issue, and the measures undertaken by governmental authorities to address

it, could significantly disrupt or prevent us from operating our business in the ordinary course for an extended period, and thereby,

and/or along with any associated economic and/or social instability or distress, have a material adverse impact on our consolidated

financial statements.

On

March 11, 2020, the World Health Organization characterized the outbreak of COVID-19 as a global pandemic and recommended containment

and mitigation measures. On March 13, 2020, the United States declared a national emergency concerning the outbreak, and several

states and municipalities have declared public health emergencies. Along with these declarations, there have been extraordinary

and wide-ranging actions taken by international, federal, state and local public health and governmental authorities to contain

and combat the outbreak and spread of COVID-19 in regions across the United States and the world, including quarantines, “stay-at-home”

orders and similar mandates for many individuals to substantially restrict daily activities and for many businesses to curtail

or cease normal operations.

The

COVID-19 pandemic, and related social distancing requirements, travel bans, stay-at-home orders and closures limited access to

our spas and store and forced us to close our spas and store during the first quarter of 2020 and into the second quarter of 2020.

Specifically, as a result of COVID-19 and ‘stay-at-home’ and social distancing orders issued in McKinney and The Woodlands,

Texas, we had to close both of our MedSpas, VISSIA McKinney and VISSIA Waterway, Inc., which were closed effective March 10, 2020,

and which resulted in both the loss of income and the loss of most of our workforce, who had to be let go. VISSIA Waterway, Inc.

reopened effective June 21, 2020 and VISSIA McKinney reopened effective August 8, 2020. However, due to the termination of employees

associated with the shutdown we were forced to expend resources to attract, hire and train completely new staff for preparation

of the re-launchings. Notwithstanding the re-openings, customer traffic and demand at our VISSIA Waterway, Inc. and VISSIA McKinney

MedSpa locations failed to rebound to pre-closure levels due to COVID-19 and the pandemic’s effects on the economy, and

because we are unable to predict the length of the pandemic or ultimate outcome thereof, and further due to our limited capital

resources, effective on October 25, 2020, we made the decision to temporarily close both our VISSIA Waterway, Inc. and VISSIA

McKinney locations. Such locations remain closed through the date of this prospectus. We are currently seeking both financial

and operating partners to assist in the further management and operations of our VISSIA brand, to help fund the re-opening of

our spas and are also entertaining any and all purchase opportunities for such brand and spas as well.

Although

our MedSpas were forced to close during the second and third quarters, and are temporarily closed for economic reasons currently,

Legend Nutrition was able to remain open as an essential business as we sold vitamins and other nutritional supplements. Though

the store was able to remain open, the store saw, and continues to see, a deep decline in sales due to social distancing orders

and decreases in customers who are willing to venture out to brick and mortar establishments. Legend Nutrition’s lease is

up January 31, 2021, and the Company plans to not renew the lease, close the store, and not continue in this line of business

moving forward.

All

of the above has in turn, not only negatively impacted our operations, financial condition and demand for our services, but our

overall ability to react timely to mitigate the impact of this event. To date, our second through fourth 2020 financial results

have been, and we anticipate our financial results for the first half of 2021, at a minimum, will be, significantly negatively

affected by COVID-19 and the closure of our med spas in connection therewith (both due to governmental orders and separately due

to our lack of operating funds); however, the full effect on our business and operation is currently unknown. The outbreak of

COVID-19 has caused significant disruptions to the Company’s ability to generate revenues and cash flows, and uncertainty

regarding the length of the disruption may adversely impact our ability to raise additional capital.

The

ultimate impact of the COVID-19 pandemic on our business, results of operations, financial condition and cash flows will depend

on our ability to have sufficient liquidity until such time as we are able to re-open our stores and until our stores can again

generate revenue capable of supporting our ongoing operations, if at all, all of which remain highly uncertain at this time.

We

currently anticipate experiencing ongoing disruptions to our ability to provide construction services, throughout 2021 (and likely

beyond) as the U.S. continues to deal with the COVID-19 pandemic. Any prolonged disruption to our operations is likely to have

a significant adverse effect on our results of operations, cash flows and ability to meet continuing debt service requirements.

The

inherent uncertainty surrounding COVID-19, due in part to rapidly changing governmental directives, public health challenges and

progress, and market reactions thereto, also makes it more challenging for our management to estimate the future performance of

our business and develop strategies to generate growth. Should the adverse impacts described above (or others that are currently

unknown) occur, whether individually or collectively, we would expect to experience, among other things, significant decreases

in our revenues and increases in net loss, as we did during our 2020 first, second, third and fourth quarters, and such impacts

are likely to continue be material to our consolidated financial statements in the fourth quarter and beyond. In addition, should

the COVID-19 public health effort intensify to such an extent that we cannot operate, if there are prolonged government restrictions

on our business and our customers, and/or an extended economic recession, we could be unable to produce revenues and cash flows

sufficient to conduct our business; or service our outstanding debt. Such a circumstance could, among other things, exhaust our

available liquidity (and ability to access liquidity sources) and/or trigger an acceleration to pay a significant portion or all

of our then-outstanding debt obligations, which we may be unable to do.

Our

business may suffer from the severity or longevity of the Coronavirus/COVID-19 Global Outbreak.

The

demand for our services relies upon, among other things, (a) customers being able to, and being willing to, visit our health,

wellness and beauty medical spas (all of which are now closed, pending our receipt of further funding and/or entry into partnerships

to operate such medical spas) and vitamin store and our ability to keep our vitamin store open for business and/or re-open our

medical spas, (b) our ability to perform construction services for construction clients, and (c) the ability of our telemedicine

platform to provide telemedicine services. The inability due to state and local social distancing orders, or unwillingness of,

individuals to congregate in large groups, visit retail business or travel outside of their homes will, and has to date, had a

negative effect on our operations. Additionally, government mandated ‘stay-at-home’ and similar orders have to date,

and may in the future, prevent us from staffing our spas (all of which are currently closed) and construction services, and prohibited

us from operating altogether. Loss of available employees due to health concerns in the future may also limit our ability to operate.

Economic recessions, including those brought on by the COVID-19 outbreak may have a negative effect on the demand for our services

and our operating results. We have also experienced delays due to the COVID-19 outbreak in receiving products and supplies which

we need to operate. All of the above may be exacerbated in the future as the COVID-19 outbreak and the governmental responses

thereto continues. All of the above may in the future cause, and have to date caused, a material adverse effect on our operating

results.

We

have decided to temporarily shut down our MedSpas and are subject to continuing losses while such businesses are shut down.

Customer

traffic and demand at our VISSIA Waterway, Inc. and VISSIA McKinney MedSpa locations which were re-opened after mandatory closures

associated with COVID-19 in June and August 2020, respectively, failed to rebound to pre-closure levels due to COVID-19 and the

pandemic’s effects on the economy, and because we are unable to predict the length of the pandemic or ultimate outcome thereof,

and further due to our limited capital resources, effective on October 25, 2020, we made the decision to temporarily close both

our VISSIA Waterway, Inc. and VISSIA McKinney locations. Such locations remain closed through the date of this prospectus. We

are currently seeking both financial and operating partners to assist in the further management and operations of our VISSIA brand,

to help fund the re-opening of our spas and are also entertaining any and all purchase opportunities for such brand and spas as

well. While such locations are closed, they are not generating any revenue; however, we are still required to pay the rent and

utilities for each location. Such continuing expenses, without corresponding revenues, may have a significant negative affect

on our results of operations and cash flows. Furthermore, we may be forced to sell off our VISSIA brand, operations or locations

at a loss, or may be forced to write-off the full amount of such operations in the future, which would have a significant negative

affect on our financial position.

If

our assets and equipment (including our VISSIA MedSpa assets, equipment and goodwill) become impaired, we may be required to record

a significant charge to earnings.

We

have assets, goodwill and equipment on our balance sheet relating to our VISSIA MedSpa operations. Due to COVID-19’s effects

on the economy, and because we are unable to predict the length of the pandemic or ultimate outcome thereof, and further due to

our limited capital resources, effective on October 25, 2020, we made the decision to temporarily close both locations. Such locations

remain closed through the date of this prospectus. We are currently seeking both financial and operating partners to assist in

the further management and operations of our VISSIA brand, to help fund the re-opening of our spas and are also entertaining any

and all purchase opportunities for such brand and spas as well.

In

accordance with the Generally Accepted Accounting Principles of the United States of America (“GAAP”), we review

our assets for impairment when events or changes in circumstances indicate the carrying value of the asset may not be recoverable.

In the event we determine that the value of our assets, and particularly our VISSIA MedSpa assets are not recoverable, or have

declined in value, we may be forced to impair such assets, which impairment may be significant, and which result in a loss being

booked equal to the carrying value of the asset(s) impaired and the fair value thereof. Such impairments may have a significant

negative effect on our balance sheet, results of operations and financial results, and could cause the value of our common stock

to decline in value or become worthless.

We

face numerous risks associated with our telehealth planform which only recently commenced operations.

On

April 28, 2020, the Company incorporated a wholly-owned subsidiary, ZipDoctor, Inc. (“ZipDoctor”) in the State

of Texas. ZipDoctor plans to provide its customers with unlimited, 24/7 access to board certified physicians and licensed mental

and behavioral health counselors and therapists via a newly developed, monthly subscription based online telemedicine platform.

ZipDoctor’s online telemedicine platform is available to customers across the United States and offers bilingual coverage

(both English and Spanish), with virtual visits taking place either via the phone or through a secured video chat platform. Zip

Doctor’s telemedicine platform does not require the customer to have an existing insurance plan and does not demand or require

any additional copays. ZipDoctor customers subscribe through the website and are only required to pay a low monthly fee, which

is determined based on if they are an individual, a couple, or a family. There were no significant activities in ZipDoctor as

of September 30, 2020. The Company launched the platform in August 2020, and has generated nominal revenues through this soft

launch period. There is no significant operating history upon which to base any assumption as to the likelihood that our telemedicine

platform will prove successful, and we may never achieve operations or profitable operations. Our telehealth platform also faces

the following risks, any one of which may significantly negatively affect our operations, results of operations, and cash flows

and could cause the value of our common stock to decline in value:

●

Our telehealth platform could be adversely affected by legal challenges or by actions restricting our ability of our health providers

to provide services in certain jurisdictions;

●

We will be dependent on the relationships of our partners with health care professionals;

●

Evolving government regulations may require increased costs or adversely affect our results of operations;

●

The market for telehealth services is new and if it does not develop as we forecast or develops more slowly than we expect our

growth may be harmed;

●

The market for telehealth services is competitive and we compete with multiple competitors which have more resources and funding

than we have and a more well-known brand name;

●

Economic uncertainty or downturns, particularly as it impacts particular industries, could adversely affect our business and operating

results; and

●

We will be entirely dependent on the infrastructure and operations of our partner to operate our telehealth platform and such

infrastructure and operations are completely outside of our control.

We

may have difficulty obtaining future funding sources, if needed, and we may have to accept terms that would adversely affect stockholders.

We

will need to raise funds from additional financing in the future to complete our business plan and may need to raise additional

funding in the future to support our operations. We have no commitments for any financing and any financing commitments may result

in dilution to our existing stockholders. We may have difficulty obtaining additional funding, and we may have to accept terms

that would adversely affect our stockholders. For example, the terms of any future financings may impose restrictions on our right

to declare dividends or on the manner in which we conduct our business. Additionally, we may raise funding by issuing additional

convertible notes, which if converted into shares of our common stock would dilute our then stockholders’ interests. Lending

institutions or private investors may impose restrictions on a future decision by us to make capital expenditures, acquisitions

or significant asset sales. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business

plan.

If

we make any acquisitions, they may disrupt or have a negative impact on our business.

If

we make acquisitions in the future, funding permitting, which may not be available on favorable terms, if at all, we could have

difficulty integrating the acquired company’s assets, personnel and operations with our own. We do not anticipate that any

acquisitions or mergers we may enter into in the future would result in a change of control of the Company. In addition, the key

personnel of the acquired business may not be willing to work for us. We cannot predict the effect expansion may have on our core

business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business,

distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied

by a number of inherent risks, including, without limitation, the following:

|

|

●

|

the

difficulty of integrating acquired products, services or operations;

|

|

|

●

|

the

potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies;

|

|

|

|

|

|

|

●

|

difficulties

in maintaining uniform standards, controls, procedures and policies;

|

|

|

|

|

|

|

●

|

the

potential impairment of relationships with employees and customers as a result of any integration of new management personnel;

|

|

|

|

|

|

|

●

|

the

potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products

to new and existing customers;

|

|

|

|

|

|

|

●

|

the

effect of any government regulations which relate to the business acquired;

|

|

|

|

|

|

|

●

|

potential

unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool,

reposition or modify the marketing and sales of acquired products or operations, or the defense of any litigation, whether

or not successful, resulting from actions of the acquired company prior to our acquisition; and

|

|

|

|

|

|

|

●

|

potential

expenses under the labor, environmental and other laws of various jurisdictions.

|

Our

business could be severely impaired if and to the extent that we are unable to succeed in addressing any of these risks or other

problems encountered in connection with an acquisition, many of which cannot be presently identified. These risks and problems

could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results

of operations.

Our

independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our

historical financial statements have been prepared under the assumption that we will continue as a going concern. Our independent

registered public accounting firm has issued a report on our financial statements for the year ended December 31, 2019, that included

an explanatory paragraph referring to our recurring operating losses and expressing substantial doubt in our ability to continue

as a going concern. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity financing

or other capital, attain further operating efficiencies, reduce expenditures, and, ultimately, generate revenue. Our financial

statements do not include any adjustments that might result from the outcome of this uncertainty. However, if adequate funds are

not available to us when we need it, we will be required to curtail our operations which would, in turn, further raise substantial

doubt about our ability to continue as a going concern. The doubt regarding our potential ability to continue as a going concern

may adversely affect our ability to obtain new financing on reasonable terms or at all. Additionally, if we are unable to continue

as a going concern, our stockholders may lose some or all of their investment in the Company.

We

depend heavily on our Chief Executive Officer, and the loss of his services could harm our business.

Our

future business and results of operations depend in significant part upon the continued contributions of our senior management

personnel, which currently consists solely of our Chief Executive Officer, Jacob D. Cohen. If we lose his services or if he fails

to perform in his current position, or if we are not able to attract and retain skilled personnel as needed, our business could

suffer. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing

senior management team. We depend on the skills and abilities of these key personnel in managing the operations of our medical

spas, product development, marketing and sales aspects of our business, any part of which could be harmed by turnover in the future.

Because

we do not have an audit or compensation committee, shareholders will have to rely on the entire board of directors to perform

these functions.

We

do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit or compensation

committee, nor any independent directors. These functions are performed by the board of directors as a whole (currently consisting

solely of Jacob D. Cohen, our sole director). Thus, there is a potential conflict in that board members who are also part of management

will participate in discussions concerning management compensation and audit issues that may affect management decisions. Such

conflicts of interest will be exacerbated until such time as we appoint additional directors, and during such period that Jacob

D. Cohen serves as our sole director.

We

expect to face intense competition, often from companies with greater resources and experience than we have.

The

health, wellness, construction, and mentoring/life coach industries are highly competitive and subject to rapid change. The industries

continue to expand and evolve as an increasing number of competitors and potential competitors enter the market. Many of these

competitors and potential competitors have substantially greater financial, technological, managerial and research and development

resources and experience than we have. Some of these competitors and potential competitors have more experience than we have in

the development of health and wellness services and products. In addition, our services and products compete with service and

product offerings from large and well-established companies that have greater marketing and sales experience and capabilities

than we or our collaboration partners have. If we are unable to compete successfully, we may be unable to grow and sustain our

revenue.

Current

global financial conditions have been characterized by increased volatility which could negatively impact our business, prospects,

liquidity and financial condition.

Current

global financial conditions and recent market events have been characterized by increased volatility and the resulting tightening

of the credit and capital markets has reduced the amount of available liquidity and overall economic activity. We cannot guaranty

that debt or equity financing, the ability to borrow funds or cash generated by operations will be available or sufficient to

meet or satisfy our initiatives, objectives or requirements. Our inability to access sufficient amounts of capital on terms acceptable

to us for our operations will negatively impact our business, prospects, liquidity and financial condition.

We

are growing the size of our organization, and we may experience difficulties in managing any growth we may achieve.

As

of the date of this prospectus, we have six full-time employees. As our development and commercialization plans and strategies

develop, we expect to need additional development, managerial, operational, sales, marketing, financial, accounting, legal, and

other resources. Future growth would impose significant added responsibilities on members of management. Our management may not

be able to accommodate those added responsibilities, and our failure to do so could prevent us from effectively managing future

growth, if any, and successfully growing our company.

We

may expend our limited resources to pursue particular products, services or locations and may fail to capitalize on products,

locations or services that may be more profitable or for which there is a greater likelihood of success.

Because

we have limited financial and managerial resources, we must focus our efforts on particular service programs, products and locations.

As a result, we may forego or delay pursuit of opportunities with other services, products or locations that later prove to have

greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial products

or profitable market opportunities. Any such failure could result in missed opportunities and/or our focus on products, services

or locations with low market potential, which would harm our business and financial condition.

We

engage in transactions with related parties and such transactions present possible conflicts of interest that could have an adverse

effect on us.

We

have entered, and may continue to enter, into transactions with related parties for financing, corporate, business development

and operational services, as detailed herein. Such transactions may not have been entered into on an arm’s-length basis,

and we may have achieved more or less favorable terms because such transactions were entered into with our related parties. This

could have a material effect on our business, results of operations and financial condition. The details of certain of these transactions

are set forth under “Certain Relationships and Related Transactions”. Such conflicts could cause an individual in

our management to seek to advance his or her economic interests or the economic interests of certain related parties above ours.

Further, the appearance of conflicts of interest created by related party transactions could impair the confidence of our investors.

Such conflicts of interest will likely be greater until such time as we are able to appoint new directors, as we currently have

only one member of our board of directors, Jacob D. Cohen.

We

operate our business through many locations, and if we are unable to effectively oversee all of these locations, our business

reputation and operating results could be materially adversely affected.

Because

we operate at various different locations throughout Texas, we are subject to risks related to our ability to oversee these locations.

If in the future we are unable to effectively oversee our locations, our results of operations could be materially adversely affected,

we could lose customers, we could lose control of inventory and other assets, and our business could be materially adversely affected.

Our

ability to service our indebtedness will depend on our ability to generate cash in the future.

Our

ability to make payments on our indebtedness will depend on our ability to generate cash in the future. Our ability to generate

cash is subject to general economic and market conditions and financial, competitive, legislative, regulatory and other factors

that are beyond our control. Our business may not generate sufficient cash to fund our working capital requirements, capital expenditure,

debt service and other liquidity needs, which could result in our inability to comply with financial and other covenants contained

in our debt agreements, our being unable to repay or pay interest on our indebtedness, and our inability to fund our other liquidity

needs. If we are unable to service our debt obligations, fund our other liquidity needs and maintain compliance with our financial

and other covenants, we could be forced to curtail our operations, our creditors could accelerate our indebtedness and exercise

other remedies and we could be required to pursue one or more alternative strategies, such as selling assets or refinancing or

restructuring our indebtedness. However, such alternatives may not be feasible or adequate.

We

have identified material weaknesses in our disclosure controls and procedures and internal control over financial reporting. If

not remediated, our failure to establish and maintain effective disclosure controls and procedures and internal control over financial

reporting could result in material misstatements in our financial statements and a failure to meet our reporting and financial

obligations, each of which could have a material adverse effect on our financial condition and the trading price of our common

stock.

Maintaining

effective internal control over financial reporting and effective disclosure controls and procedures are necessary for us to produce

reliable financial statements. As reported under “Controls and Procedures”, as of December 31, 2020 we determined

that our disclosure controls and procedures were not effective. Separately, management assessed the effectiveness of the Company’s

internal control over financial reporting as of December 31, 2020 and determined that such internal control over financial reporting

was not effective as a result of such assessment.

A

material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there

is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not

be prevented or detected on a timely basis. A control deficiency exists when the design or operation of a control does not allow

management or employees, in the normal course of performing their assigned functions, to prevent or detect misstatements on a

timely basis.

Maintaining

effective disclosure controls and procedures and effective internal control over financial reporting are necessary for us to produce

reliable financial statements and the Company is committed to remediating its material weaknesses in such controls as promptly

as possible. However, there can be no assurance as to when these material weaknesses will be remediated or that additional material

weaknesses will not arise in the future. Any failure to remediate the material weaknesses, or the development of new material

weaknesses in our internal control over financial reporting, could result in material misstatements in our financial statements

and cause us to fail to meet our reporting and financial obligations, which in turn could have a material adverse effect on our

financial condition and the trading price of our common stock, and/or result in litigation against us or our management. In addition,

even if we are successful in strengthening our controls and procedures, those controls and procedures may not be adequate to prevent

or identify irregularities or facilitate the fair presentation of our financial statements or our periodic reports filed with

the SEC.

Our

potential for rapid growth and our entry into new markets make it difficult for us to evaluate our current and future business

prospects, and we may be unable to effectively manage any growth associated with these new markets, which may increase the risk

of your investment and could harm our business, financial condition, results of operations and cash flow.

Our

entry into the rapidly growing health, wellness, construction and mentoring/life coaching market may place a significant strain

on our resources and increase demands on our executive management, personnel and systems, and our operational, administrative

and financial resources may be inadequate. We may also not be able to effectively manage any expanded operations, or achieve planned

growth on a timely or profitable basis, particularly if the number of customers using our technology significantly increases or

their demands and needs change as our business expands. If we are unable to manage expanded operations effectively, we may experience

operating inefficiencies, the quality of our products and services could deteriorate, and our business and results of operations

could be materially adversely affected.

If

we are unable to develop and maintain our brand and reputation for our service and product offerings, our business and prospects

could be materially harmed.

Our

business and prospects depend, in part, on developing and then maintaining and strengthening our brand and reputation in the markets

we serve. If problems arise with our products or services, our brand and reputation could be diminished. If we fail to develop,

promote and maintain our brand and reputation successfully, our business and prospects could be materially harmed.

We

may not maintain sufficient insurance coverage for the risks associated with our business operations.

Risks

associated with our business and operations include, but are not limited to, claims for wrongful acts committed by our officers,

directors, and other representatives, the loss of intellectual property rights, the loss of key personnel, risks posed by natural

disasters and risks of lawsuits from customers who are injured from or dissatisfied with our services. Any of these risks may

result in significant losses. We cannot provide any assurance that our insurance coverage is sufficient to cover any losses that

we may sustain, or that we will be able to successfully claim our losses under our insurance policies on a timely basis or at

all. If we incur any loss not covered by our insurance policies, or the compensated amount is significantly less than our actual

loss or is not timely paid, our business, financial condition and results of operations could be materially and adversely affected.

Our

business could be adversely affected by ongoing legal challenges to our business model or by new state actions restricting our

ability to provide the full range of our services in certain states.

Our

ability to conduct planned business operations in each state is dependent upon the state’s treatment of medical spas under

such state’s laws, and rules and policies governing the practice of physician supervised services, which are subject to

changing political, regulatory and other influences.

We

may become subject to medical liability claims, which could cause us to incur significant expenses and may require us to pay significant

damages if not covered by insurance.

Our

wellness business entails the risk of medical liability claims. Successful medical liability claims could result in substantial

damage awards that exceed the limits of our insurance coverage. Any claims made against us that are not fully covered by insurance

could be costly to defend against, result in substantial damage awards against us and divert the attention of our management and

our physicians from our operations, which could have a material adverse effect on our business, financial condition and results

of operations. In addition, any claims may adversely affect our business or reputation.

Our

use and disclosure of personally identifiable information, including health information, is subject to federal and state privacy