Current Report Filing (8-k)

February 18 2021 - 8:05AM

Edgar (US Regulatory)

0001555074false00015550742021-02-172021-02-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2021 (February 17, 2021)

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Virgin Islands

|

|

001-36063

|

|

66-0783125

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(704) 275-9113

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

AAMC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 17, 2021, Altisource Asset Management Corporation (“AAMC” or the “Company”) entered into a settlement agreement dated as of February 17, 2021 (the “Settlement Agreement”) with Putnam Focused Equity Fund, a series of Putnam Funds Trust, as successor in interest to each of Putnam Equity Spectrum Fund and Putnam Capital Spectrum Fund, each a series of Putnam Funds Trust (collectively, “Putnam”), one of the plaintiffs in the litigation related to the Company’s Series A Convertible Preferred Stock (the “Preferred Shares”).

Under the terms of the Settlement Agreement:

•the Company agreed to exchange all of Putnam’s 81,800 Preferred Shares for 288,283 shares of the Company’s common stock;

•the Company agreed to pay $1,636,000 to Putnam within three business days of the effective date of the Settlement Agreement, and $1,227,000 on the one-year anniversary of the effective date of the Settlement Agreement;

•the Company granted a most favored nation clause to Putnam requiring the Company to pay Putnam the difference, subject to certain terms and conditions, if the Company enters into a mutually agreed settlement with another holder of Preferred Shares at a higher value per Preferred Share than provided to Putnam under the Settlement Agreement;

•Putnam agreed to a stipulation dismissing their claims with prejudice in the subject litigation and releasing the Company from all other claims relating to the Preferred Shares; and

•Putnam agreed to vote the common shares received upon the exchange of its Preferred Shares in favor of each director nominee recommended by the Company’s Board of Directors (the “Board”) and otherwise in accordance with the Board’s recommendation on other proposals, subject to certain exceptions, through at least the Company’s 2022 annual meeting.

The foregoing description of the Settlement Agreement is qualified in its entirety by reference to the text of such agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

The Company issued 288,283 shares of its common stock in exchange for Putnam’s 81,800 Preferred Shares pursuant to the exemption from registration under Section 3(a)(9) of the Securities Act of 1933, as amended, due to the fact that it was an exchange of securities with an existing Company shareholder.

Item 7.01 Regulation FD

On February 18, 2021 the Company issued a press release announcing the entry into the Settlement Agreement, as described in Item 1.01 of this Current Report on Form 8-K.

The press release is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for any other purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Settlement Agreement dated as of February 17, 2021, between the Company and Putnam

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Press Release of Altisource Asset Management Corporation, dated February 18, 2021

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Altisource Asset Management Corporation

|

|

February 18, 2021

|

By:

|

/s/ Indroneel Chatterjee

|

|

|

|

Indroneel Chatterjee

Chairman and Chief Executive Officer

|

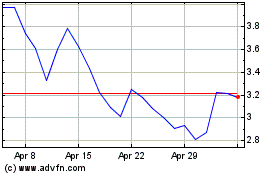

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

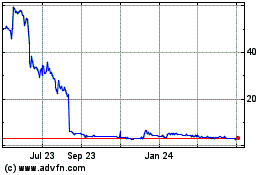

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Apr 2023 to Apr 2024