Current Report Filing (8-k)

February 12 2021 - 5:40PM

Edgar (US Regulatory)

false 0001731348 0001731348 2021-02-08 2021-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2021

Tilray, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38594

|

|

82-4310622

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1100 Maughan Rd.,

Nanaimo, BC, Canada

|

|

V9X 1J2

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (844) 845-7291

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class 2 Common Stock, $0.0001 par value per share

|

|

TLRY

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e)

As reported by Tilray, Inc. (the “Company”) in its Current Report on Form 8-K dated January 28, 2021, the Company and Andrew Pucher reached the mutual decision to have Mr. Pucher step down as the Company’s Chief Corporate Development Officer, effective as of March 31, 2021 (the “Separation Date”).

On February 8, 2021, the Company entered into a separation agreement and complete release with Mr. Pucher (the “Separation Agreement”) specifying the terms of Mr. Pucher’s separation from service with the Company.

Pursuant to the Separation Agreement, Mr. Pucher will receive payment of Mr. Pucher’s base salary and continued vesting of options and restricted stock units (“RSUs”) through the Separation Date. Mr. Pucher will remain eligible to receive his 2020 annual discretionary bonus in accordance with the Company’s discretional incentive bonus plan. In addition, if the closing date of the proposed arrangement between the Company and Aphria as described on the Company’s Current Report on Form 8-K dated December 21, 2020 (the “Proposed Arrangement”) occurs on or before September 30, 2021, the Company will accelerate the vesting of all unvested RSUs held by Mr. Pucher, such that all RSUs will be fully vested on the closing of the Proposed Arrangement. If the Proposed Arrangement does not close on or before September 30, 2021, any remaining and unvested RSUs held by Mr. Pucher will not vest.

In addition, pursuant to the Separation Agreement, Mr. Pucher is entitled to receive (a) severance payments equal to 20 months of his base salary, (b) contributions by the Company to the health and dental benefit plans in which Mr. Pucher currently participates until November 30, 2022 and (c) a lump sum payment of CAD 250,000.00 (less applicable taxes and withholdings) on the Separation Date (the “Severance Payments”). The Severance Payments are conditional on Mr. Pucher not revoking the Separation Agreement, which includes a general release of claims against the Company or its successor, its subsidiaries and their respective directors, officers and stockholders and other related parties, and allowing such release to become effective.

The foregoing summary of the Separation Agreement is qualified by reference to the Separation Agreement, which is filed herewith as Exhibit 10.1.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Tilray, Inc.

|

|

|

|

|

|

|

Date: February 12, 2021

|

|

|

|

By:

|

|

/s/ Brendan Kennedy

|

|

|

|

|

|

|

|

Brendan Kennedy

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

2

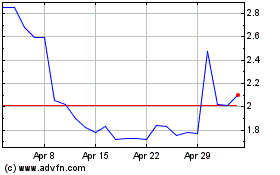

Tilray Brands (NASDAQ:TLRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tilray Brands (NASDAQ:TLRY)

Historical Stock Chart

From Apr 2023 to Apr 2024