Filed

pursuant to Rule 424(b)(3)

Registration

Statement No. 333-249469

Prospectus

Supplement DATED February 8, 2021

(to

the Prospectus dated October 28, 2020)

RespireRx

Pharmaceuticals Inc.

This

Prospectus Supplement No. 3 supplements and amends the final prospectus dated October 28, 2020 (as previously supplemented by

Prospectus Supplement Nos. 1 and 2, the “Final Prospectus”) relating to the resale of up to 115,000,000 shares of

our common stock, $0.001 par value per share (the “Common Stock”), issuable to White Lion Capital, LLC (the “Selling

Stockholder”), pursuant to a “put right” under an equity purchase agreement, dated July 28, 2020, as amended,

by and between us and the Selling Stockholder. This Prospectus Supplement No. 3 should be read in conjunction with the Final Prospectus

and is qualified by reference to the Final Prospectus except to the extent that the information in this Prospectus Supplement

No. 3 supersedes the information contained in the Final Prospectus.

On

December 14, 2020, January 5, 2021, and January 20, 2021, we filed with the U.S. Securities and Exchange Commission the attached

Current Reports on Form 8-K.

Our

Common Stock is quoted by the OTCQB Venture Market operated by the OTC Markets Group, Inc. (“OTCQB”) under the symbol

“RSPI.” On January 5, 2021, the Company effected a ten-to-one reverse stock split of all of the outstanding shares

of Common Stock of the Company (the “Reverse Split”). The share numbers presented throughout the Final Prospectus

for periods prior to the effectiveness of the Reverse Split do not reflect the Reverse Split. On February 5, 2021, the closing

price of our Common Stock was $0.037 per share and there were 75,646,039 shares of our Common Stock outstanding, on a post-Reverse

Split basis. Due to the Reverse Split, 115,000,000 shares noted above and in the Final Prospectus now relate to 11,500,000 post-Reverse

Split shares. In most cases, in reading the Final Prospectus the number of shares and per share prices referred to therein, would

be divided by ten and multiplied by ten respectively to understand those numbers on a post-Reverse Split basis. There are 3,600,000

post-Reverse Split shares remaining available for issuance under the Final Prospectus as supplemented by this Prospectus

Supplement No. 3.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” beginning on page 7 of the Final Prospectus, and under similar headings in any amendments or

supplements to the Final Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 3 is February 8, 2021

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 10, 2020

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S Employer

Identification No.)

|

|

126

Valley Road, Suite C

Glen

Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

RespireRx

Pharmaceuticals Inc. (the “Company”) received notice from the OTC Markets Group on December 10, 2020, that its common

shares would be moved from the OTCQB market to the OTC Pink Sheets platform on December 11, 2020 due to a bid price deficiency.

The Company’s common stock failed to maintain a closing bid price of at least $0.01 for a 30 consecutive calendar day period,

and failed to cure the deficiency prior to the expiration of an extension granted by the OTC Markets Group, which extension expired

on December 10, 2020.

The

Company’s common shares will continue to be quoted on the OTC Pink Sheets platform.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date: December

14, 2020

|

RESPIRERX

PHARMACEUTICALS INC.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/s/

Jeff E. Margolis

|

|

|

|

Jeff

E. Margolis

SVP,

CFO, Secretary and Treasurer

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 4, 2021

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S

Employer

Identification No.)

|

|

126

Valley Road, Suite C

Glen

Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

January 4, 2021, RespireRx Pharmaceuticals Inc. (the “Company”) filed with the Secretary of State of the State of

Delaware a Sixth Certificate of Amendment (the “Amendment”) to its Second Restated Certificate of Incorporation.

The Amendment effected a ten-to-one (10 to 1) reverse stock split of all of the outstanding shares of common stock of the

Company, par value $0.001 per share. The reverse stock split is effective as of 5:00 p.m. Eastern Time on January 5, 2021. A

certified copy of the Amendment has been provided to the Financial Industry Regulatory Authority, Inc. (“FINRA”)

in order for it to issue appropriate notifications to the market to allow for the stock to trade on a post-reverse stock

split basis upon market open on Wednesday, January 6, 2021. For twenty (20) business days following the effective date

of the reverse stock split, the Company’s ticker symbol, currently “RSPI,” will have a “D”

appended to it, and will temporarily be traded under the ticker symbol “RSPID”.

The

Amendment was previously approved by the Company’s stockholders at a special meeting of stockholders held on November 24,

2020.

The

above description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment,

which is attached hereto as Exhibit 3.1 to this Current Report on Form 8-K.

The press release announcing the reverse

stock split is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

*

Furnished herewith

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

January 5, 2021

|

RESPIRERX

PHARMACEUTICALS INC.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/s/

Jeff E. Margolis

|

|

|

|

Jeff

E. Margolis

|

|

|

|

SVP,

CFO, Secretary and Treasurer

|

Exhibit

3.1

Sixth

Certificate of Amendment

of

Second

Restated Certificate of Incorporation

of

RespireRx

Pharmaceuticals Inc.

RespireRx

Pharmaceuticals Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of

the State of Delaware (the “DGCL”), hereby adopts this Sixth Certificate of Amendment (this “Certificate of

Amendment”), which amends its Second Restated Certificate of Incorporation (as amended by the Certificate of Designation

filed March 14, 2014, the Certificate of Amendment filed April 17, 2014, the Second Certificate of Amendment filed December 16,

2015, the Third Certificate of Amendment filed September 1, 2016, the Fourth Certificate of Amendment filed April 30, 2020, the

Certificate of Designation filed July 13, 2020 as amended on September 30, 2020, and the Fifth Certificate of Amendment filed

November 24, 2020, the “Certificate of Incorporation”) as described below, and does hereby further certify that:

|

|

1.

|

The

Board of Directors of the Corporation duly adopted a resolution proposing and declaring advisable the amendment to the Certificate

of Incorporation described herein, and the Corporation’s stockholders duly adopted such amendment, all in accordance

with the provisions of Section 242 of the DGCL.

|

|

|

|

|

|

|

2.

|

Article

Fourth of the Certificate of Incorporation is hereby amended by:

|

(i)

adding the following paragraph to succeed paragraph (A)(2) of such article and to precede current paragraph (A)(3) of such article:

(3)

Effective as of 5:00 p.m. Eastern Standard Time on January 5, 2021 (the “Effective Time”), such date being the business

day immediately following the date of the filing of this Certificate of Amendment with the Secretary of State of the State of

Delaware, each ten (10) outstanding shares of the Corporation’s Common Stock shall automatically and without any action

on the part of the respective holders thereof be exchanged and combined into one (1) share of Common Stock. No fractional shares

shall be issued in connection with the exchange. Any fractional shares resulting from the reverse stock split will not be issued

but will be paid out in cash (without interest or deduction) in an amount equal to the number of shares exchanged into such fractional

share multiplied by the average closing trading price of our Common Stock on the OTC Pink Market for the five trading days

immediately before the Effective Time.

(ii)

changing the paragraph number at the beginning of current paragraph (A)(3) from “(3)” to “(4)”.

|

|

3.

|

All

other provisions of the Certificate of Incorporation hereby remain in full force and effect.

|

|

|

By:

|

|

|

|

Name:

|

Jeff

Margolis

|

|

|

Title:

|

Senior

Vice President, Chief Financial Officer,

Treasurer

and Secretary

|

Exhibit

99.1

RespireRx

Pharmaceuticals Inc. Announces 10 to 1 Reverse Stock Split

Glen

Rock, N.J., January 5, 2021 /Globe Newswire – RespireRx Pharmaceuticals Inc. (OTCQB: RSPI) (“RespireRx” or the

“Company” or “we”), has, on January 4, 2021, filed with the Secretary of State of the State of Delaware

a Sixth Certificate of Amendment (the “Amendment”) to its Second Restated Certificate of Incorporation. The Amendment

effected a ten-to-one (10 to 1) reverse stock split of all of the outstanding shares of common stock of the Company, par value

$0.001 per share. The reverse stock split is effective as of 5:00 p.m. Eastern Time on January 5, 2021. A certified copy of the

Amendment has been provided to the Financial Industry Regulatory Authority, Inc. (“FINRA”) in order for it to issue

appropriate notifications to the market to allow for the stock to trade on a post-reverse stock split basis upon the OTC market

opening on Wednesday, January 6, 2021. For twenty (20) business days following the effective date of the reverse stock

split, the Company’s ticker symbol, currently “RSPI,” will have a suffix “D” appended to it and

will temporarily be traded under the ticker symbol “RSPID”.

The

Amendment was previously approved by the Company’s stockholders at a special meeting of stockholders held on November 24,

2020.

The

above description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment,

which is attached as Exhibit 3.1 to the Company’s report on Form 8-K filed with The Securities and Exchange Commission on

January 5, 2021.

About

RespireRx Pharmaceuticals Inc.

The

mission of the Company is to develop innovative and revolutionary treatments to combat disorders caused by disruption of neuronal

signaling. We are developing treatment options that address conditions that affect millions of people, but for which there are

limited or poor treatment options, including obstructive sleep apnea (“OSA”), attention deficit hyperactivity disorder

(“ADHD”) epilepsy, chronic pain, including inflammatory and neuropathic pain, recovery from spinal cord injury (“SCI”),

as well as other areas of interest based on results of animal studies to date.

RespireRx

is developing a pipeline of new drug products based on our broad patent portfolios across two distinct drug platforms:

|

|

(i)

|

ResolutionRx,

our pharmaceutical cannabinoids platform including dronabinol (a synthetic form of ∆9-tetrahydrocannabinol (“Δ9-THC”)),

which acts upon the nervous system’s endogenous cannabinoid receptors, and

|

|

|

|

|

|

|

(ii)

|

EndeavourRx,

our neuromodulators platform is made up of two programs: (a) our ampakines program, including proprietary compounds that are

positive allosteric modulators (“PAMs”) of AMPA-type glutamate receptors to promote neuronal function and (b)

our GABAkines program, including proprietary compounds that are PAMs of GABAA receptors, which was recently established

pursuant to our entry into a patent license agreement with the University of Wisconsin-Milwaukee Research Foundation, Inc.,

an affiliate of the University of Wisconsin-Milwaukee,

|

Management

believes that there are advantages to separating these platforms formally into newly formed subsidiaries, including but not limited

to optimizing their asset values through separate finance channels and making them more attractive for capital raising as well

as for strategic deal making. The Company is also engaged in a number of business development efforts (licensing/sub-licensing,

joint venture and other commercial structures) with a view to securing strategic partnerships that represent strategic and operational

infrastructure additions, as well as cash and in-kind funding opportunities. These efforts have focused on, but have not been

limited to, transacting with brand and generic pharmaceutical and biopharmaceutical companies as well as companies with potentially

useful formulation or manufacturing capabilities, significant subject matter expertise and financial resources. No assurance can

be given that any transaction will come to fruition and that if it does, that the terms will be favorable to the Company.

Additional

information about the Company and the matters discussed herein can be obtained on the Company’s web-site at www.RespireRx.com

or in the Company’s filings with the Securities and Exchange Commission at www.sec.gov.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the Company intends that such forward-looking statements be subject to the safe harbor created thereby. These

might include statements regarding the Company’s future plans, targets, estimates, assumptions, financial position, need

for, and availability of, additional financing, business strategy and other plans and objectives for future operations, and assumptions

and predictions about research and development efforts, including, but not limited to, preclinical and clinical research design,

execution, timing, costs and results, future product demand, supply, manufacturing, costs, marketing and pricing factors.

In

some cases, forward-looking statements may be identified by words including “assumes,” “could,” “ongoing,”

“potential,” “predicts,” “projects,” “should,” “will,” “would,”

“anticipates,” “believes,” “intends,” “estimates,” “expects,” “plans,”

“contemplates,” “targets,” “continues,” “budgets,” “may,” or the negative

of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking

statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties

and other factors that may cause our results, levels of activity, performance or achievements to be materially different from

the information expressed or implied by the forward-looking statements in this announcement.

These

factors include but are not limited to, regulatory policies or changes thereto, available cash, research and development results,

issuance of patents, competition from other similar businesses, interest of third parties in collaborations with us, and market

and general economic factors, and other risk factors disclosed in our Form 10-K for the year ended December 31, 2019, our Form

S-1 filed on October 14, 2020, as amended and supplemented, and in our Form 10-Q for the quarter ended September 30, 2020. These

risks and uncertainties are not exclusive and further information concerning us and our business, including factors that potentially

could materially affect our financial results or condition, may emerge from time to time.

You

should read these risk factors and the other cautionary statements made in the Company’s filings as being applicable to

all related forward-looking statements wherever they appear in in this press release. We cannot assure you that the forward-looking

statements in this press release will prove to be accurate and therefore prospective investors are encouraged not to place undue

reliance on forward-looking statements. Other than as required by law, we undertake no obligation to update or revise these forward-looking

statements, even though our situation may change in the future.

This

discussion should be read in conjunction with our consolidated financial statements and notes thereto included in our Annual Report

on Form 10-K for the year ended December 31, 2019 and in our condensed consolidated financial statements (unaudited) and notes

thereto included in our Form 10-Q for the quarter ended September 30, 2020.

Company

Contact:

Jeff

Margolis

Senior Vice President, Chief Financial Officer, Treasurer and Secretary

Telephone:

(917) 834-7206

E-mail: jmargolis@respirerx.com

RespireRx

Pharmaceuticals, Inc.

126

Valley Road,

Suite

C,

Glen

Rock, NJ 07452

www.respirerx.com

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 13, 2021

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S

Employer

Identification

No.)

|

|

126

Valley Road, Suite C

Glen

Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement

FirstFire

Note Waiver and Amendment

On

January 13, 2021, RespireRx Pharmaceuticals Inc. (the “Company”) and FirstFire Global Opportunities Fund LLC (“FF”)

entered into a Waiver and Amendment (the “FF Amendment”) to that certain Convertible Promissory Note, dated July 2,

2020 (the “FF Note”).

Pursuant

to the FF Amendment, FF waived the following defaults under the FF Note: (i) the Company’s failure to make amortization

payments that were due on each of November 1, 2020, December 1, 2020 and January 1, 2021; (ii) the Company’s failure to

give prior written notice to FF of the January 5, 2021 10-for-1 reverse stock split (the “Reverse Split”); (iii) the

Company’s failure to maintain the listing of the common stock of the Company, par value $0.001 per share (“Common

Stock”) on the OTC QB Venture Market; and (iv) the Company’s failure to give the required prior notice of the record

date of the special meeting of shareholders called to approve the Reverse Split.

In

addition, the FF Amendment amends the schedule of amortization payments under the FF Note such that no amortization payment is

due until February 28, 2021, when $121,000 will be due. The remaining $30,250 will be due on March 1, 2021, unless earlier paid

by FF’s conversion of the FF Note.

The

FF Amendment also amends the FF Note such that no adjustment was made to the conversion price of the FF Note as a result of the

Reverse Split.

The

FF Note was filed by the Company on July 7, 2020 as an exhibit to a Current Report on Form 8-K.

White

Lion Note Waiver

On

January 13, 2021, the Company and White Lion Capital, LLC (“WL”) entered into a Waiver (the “WL Waiver”)

with respect to that certain 8% Fixed Promissory Note, dated July 28, 2020, as amended by that Amendment No. 1 to 8% Fixed Promissory

Note, dated September 30, 2020 (as amended, the “WL Note”).

Under

the terms of the WL Waiver, WL waives the Company’s failure to maintain the listing of its Common Stock on the OTC QB Venture

Market. This waiver is effective through and until February 9, 2021. The WL Waiver further provides that, if the Common Stock

is relisted on the OTC QB Venture Market on or before February 9, 2021, the parties agree that no event of default will be deemed

to have occurred as a result of the previous delisting.

The

WL Note was filed by the Company on August 3, 2020, and the amendment was filed on October 5, 2020, each as exhibits to Current

Reports on Form 8-K.

The

foregoing descriptions of the FF Amendment and the WL Waiver do not purport to be complete and are qualified in their entirety

by reference to the FF Amendment and the WL Waiver, copies of which are attached to this Current Report on Form 8-K as Exhibits

99.1 and 99.2, respectively.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

January 20, 2021

|

RESPIRERX

PHARMACEUTICALS INC.

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/

Jeff E. Margolis

|

|

|

|

Jeff

E. Margolis

|

|

|

|

SVP,

CFO, Secretary and Treasurer

|

Exhibit

99.1

WAIVER

AND AMENDMENT

TO

CONVERTIBLE PROMISSORY NOTE

This

Waiver and Amendment to Convertible Promissory Note (this “Waiver and Amendment”), dated as of January 13, 2021, by

and between FirstFire Global Opportunities Fund LLC, a Delaware limited liability company (the “Investor”) and RespireRx

Pharmaceuticals Inc., a Delaware corporation (the “Company” and, together with the Investor, the “Parties”).

Capitalized terms used and not defined herein have the respective meanings assigned to them in the Note (as defined below).

WHEREAS,

the Company issued to the Investor a Convertible Promissory Note, dated July 2, 2020 (the “Note”);

WHEREAS,

the Company failed to make amortization payments to the Investor of $30,250.00 on each of November 1, 2020, December 1, 2020,

and January 1, 2021, as is required by Section 1.10 of the Note;

WHEREAS,

the Company has requested that the Investor waive the requirements of Section 1.10 solely with respect to the payments due on

each of November 1, 2020, December 1, 2020 and January 1, 2021;

WHEREAS,

the Parties desire to amend Section 1.10 of the Note such that (i) no amortization payment is due as of November 1, 2020, December

1, 2020, or January 1, 2020, (ii) no amortization payment is due on February 1, 2020, and (iii) an amortization payment of $121,000.00

is due on February 28, 2021 unless earlier paid by the Investor’s conversion of the Note, which conversion would take into

account any amortization amount due and payable.

WHEREAS,

the Company effectuated a 10-for-1 reverse stock split (the “Reverse Split”) on January 5, 2020 without providing

prior written notice to the Investor, as appropriate; and

WHEREAS,

in consideration of the amendments and waivers set forth herein, the Parties desire to amend Section 1.6(b) of the Note such that

no adjustment to the Conversion Price is made in respect of the Reverse Split.

NOW,

THEREFORE, in consideration of the mutual covenants and promises contained in the Note and this Waiver and Amendment and other

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1.

Waivers. The Investor hereby waives (i) Section 1.10 of the Note, solely with respect to the payments due on each of November

1, 2020, December 1, 2020 and January 1, 2021, such that the Company’s failure to make amortization payments on those dates

shall not constitute a breach of any provision under the Note; (ii) Section 1.7 of the Note, such that neither (a) the Company’s

failure to give prior written notice to the Investor of the Reverse Split as required nor (b) the delisting of the Company’s

common stock by the OTC QB Venture Market, and the related cessation of trading on such market, shall trigger an adjustment to

the Conversion Price; (iii) Section 3.14 of the Note, such that the Company’s failure to give required prior written notice

to the Investor of the Reverse Split shall not constitute an Event of Default under the Note and (iv) Section 1.6(b) such that

the Company’s failure to give required prior notice of the record date of the special meeting of shareholders to approve

the Reverse Split shall not constitute a breach of any provision under the Note.

2.

Amendments.

(i)

Section 1.10 is hereby amended and restated in its entirety to read as follows:

“Amortization

Payments. The Borrower shall make the following amortization payments in cash to the Holder towards the repayment of this

Note, as provided in the following table:

|

Payment Date:

|

|

Payment Amount:

|

|

|

|

|

|

|

|

11/01/2020

|

|

$

|

0.00

|

|

|

12/01/2020

|

|

$

|

0.00

|

|

|

01/01/2021

|

|

$

|

0.00

|

|

|

02/01/2021

|

|

$

|

0.00

|

|

|

02/28/2021

|

|

$

|

121,000.00

|

|

|

03/01/2021

|

|

$

|

30,250.00

|

|

Provided,

that to the extent that Holder makes a conversion of Principal Amount or interest under this Note into shares of Common Stock

at any time during the remaining life of the Note, the dollar amount converted shall reduce the 02/28/21 payment amount until

satisfied in full before a conversion reduces the 03/01/2021 payment amount, and shall reduce the 03/01/21 payment amount until

satisfied in full before a conversion reduces the amount of interest accrued.”

(ii)

Section 1.6(b) is hereby amended to place the following sentence at the end of Section 1.6(b):

“Notwithstanding

anything to the contrary herein, no adjustment or provision pursuant to this Section 1.6(b) shall be effected with respect to

the reverse stock split effectuated by the Borrower on January 5, 2021, such that the Conversion Price shall remain $0.02 upon

the effectuation of such reverse stock split.”

3.

Effect of Waiver and Amendment. Except as amended or waived hereby, the existing Note is in all respects ratified and confirmed,

and all of the terms, provisions and conditions thereof shall be and remain in full force and effect and are hereby incorporated

by reference, except as waived, modified, amended and/or restated as set forth herein. In the event of any inconsistency or conflict

between the provisions of the Note and this Waiver and Amendment, the provisions of this Waiver and Amendment will prevail and

govern. All references to the existing Note shall hereinafter refer to the existing Note as waived and amended by this Waiver

and Amendment.

4.

Governing Law. This Waiver and Amendment, and the rights and obligations of the parties hereunder, will be governed, construed

and interpreted in accordance with the laws of the State of Delaware, without giving effect to principles of conflicts of law.

5.

Entire Agreement. This Waiver and Amendment constitutes the entire agreement of the Parties with respect to the subject

matter hereof and supersede all prior understandings and writings between the Parties relating thereto.

6.

Further Assurances. The Parties agree to execute such further documents and instruments and to take such further actions

as may be reasonably necessary to carry out the purposes and intent of this Waiver and Amendment.

7. Counterparts.

This Waiver and Amendment may be executed in counterparts and delivered by facsimile or any similar electronic transmission

device, each of which shall be deemed an original, but all of which shall be considered one and the same

agreement.

[signature

page follows]

IN

WITNESS WHEREOF, the Parties have executed this Waiver and Amendment as of the date first written above.

|

|

RESPIRERX

PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Jeff Eliot Margolis

|

|

|

Name:

|

Jeff

E. Margolis

|

|

|

Title:

|

SVP,

CFO, Treasurer and Secretary

|

|

|

|

|

|

|

FIRSTFIRE GLOBAL OPPORUNITIES FUND LLC

|

|

|

|

|

|

|

By:

|

FirstFire

Capital Management, LLC, its Manager

|

|

|

|

|

|

|

By:

|

/s/

Eli Fireman

|

|

|

Name:

|

Eli

Fireman

|

|

|

Title:

|

|

Exhibit

99.2

WAIVER

WITH

RESPECT TO

8%

FIXED PROMISSORY NOTE

This

Waiver, dated as of January 13, 2021 (this “Waiver”), is made by White Lion Capital LLC, a Nevada limited liability

company (the “Investor”), in favor of RespireRx Pharmaceuticals Inc., a Delaware corporation (the “Company”

and, together with the Investor, the “Parties”). Capitalized terms used and not defined herein have the respective

meanings assigned to them in the Note (as defined below).

WHEREAS,

the Company issued to the Investor an 8% Fixed Promissory Note, dated July 28, 2020, as amended by that Amendment No. 1 to 8%

Fixed Promissory Note, dated September 30, 2020 (as amended, the “Note”);

WHEREAS,

on December 11, 2020, the Company’s common stock (the “Common Stock”) was delisted by the OTC QB Venture Market

due to the Company’s failure to meet minimum listing requirements;

WHEREAS,

pursuant to Section 3(a)(xi) of the Note, such delisting constitutes an Event of Default under the Note;

WHEREAS,

in order for the Common Stock to recommence trading on the OTC QB Venture Market, the Common Stock must maintain a closing bid

price of at least $0.01 for 30 consecutive calendar days, and to increase the likelihood of meeting this standard, the Company

effectuated a 10-for-1 reverse stock split on January 5, 2020; and

WHEREAS,

the Company has requested that the Investor waive the Event of Default triggered by the delisting of its Common Stock until February

9, 2021.

NOW,

THEREFORE, in consideration of the premises set forth above and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the Parties agree as follows:

1.

Waiver. The Investor hereby waives the Event of Default set forth in Section 3(a)(xi) of the Note through and until February

9, 2021, such that the delisting of the Company’s Common Stock shall not constitute an Event of Default under the Note until

such date. For the avoidance of doubt, if the Company’s Common Stock is relisted on the OTC QB Venture Market on or prior

to February 9, 2021, the Parties agree that no Event of Default shall have occurred with respect to the previous delisting.

2.

No Other Modifications. Except as expressly set forth herein, nothing contained in this Waiver will be deemed or construed

to amend, supplement, or modify the Note or otherwise affect the rights and obligations of any party thereto, or any other arrangement

between or among the Parties, all of which remain in full force and effect.

3.

Miscellaneous.

(a)

This Waiver shall be governed by, and construed and interpreted in accordance with, the substantive laws of the State of Delaware

without giving effect to any conflict of laws rule or principle that might require the application of the laws of another jurisdiction.

(b)

This Waiver shall inure to the benefit of and be binding upon each of the Parties and each of their respective successors and

assigns.

(c)

This Waiver may be executed in counterparts, each of which is deemed an original, but all of which constitutes one and the same

agreement.

(d)

This Waiver constitutes the sole and entire agreement of the Parties with respect to the subject matter contained herein and supersedes

all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral, with respect

to such subject matter.

[signature

page follows]

IN

WITNESS WHEREOF, the Parties have executed this Waiver as of the date first written above.

|

|

RESPIRERX

PHARMACEUTICALS INC.

|

|

|

|

|

|

|

By:

|

/s/

Jeff Eliot Margolis

|

|

|

Name:

|

Jeff

Eliot Margolis

|

|

|

Title:

|

SVP,

CFO, Treasurer and Secretary

|

|

|

|

|

|

|

WHITE

LION CAPITAL LLC

|

|

|

|

|

|

|

|

/s/

Yash Thukral

|

|

|

By:

|

Yash

Thukral

|

|

|

Title:

|

Managing

Partner

|

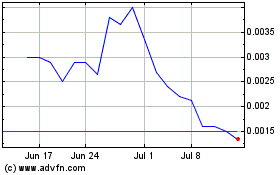

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

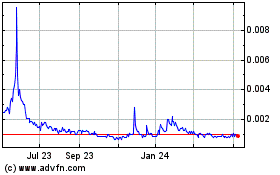

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Apr 2023 to Apr 2024