Current Report Filing (8-k)

February 08 2021 - 6:14AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

February

4, 2021

Date

of Report (Date of earliest event reported)

EVIO,

Inc.

(Exact

name of registrant as specified in its charter)

|

Colorado

|

|

000-12350

|

|

47-1890509

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

2654

W. Horizon Ridge Parkway, Ste B5-208

Henderson,

NV

|

|

89052

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code (702) 748-9944

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

February 4, 2021, EVIO, Inc. (the “Company”) entered into an 8% convertible promissory note (the “Note”)

with existing note holder in the amount of $174,445. The company received $150,000 of the proceeds, with $7,000 allocated to legal

expenses, and an original issue discount of $17,445.

The

note maybe prepaid based on the following schedule:

|

Days

Since Effective Date

|

|

Prepayment

Amount

|

|

0-90

|

|

125%

of Principal Amount

|

|

91-180

|

|

135%

of Principal Amount

|

|

181+

|

|

150%

of Principal Amount

|

At

any time after the Original Issue Date until the Note is no longer outstanding, the Note shall be convertible at the lower of

$0.006 or 70% of the lowest daily trade price in the twenty (20) Trading Days prior to the Conversion Date.

The

company has also entered into agreements with debenture holders from the January 29, 2018, October 17, 2018 and October 23, 2018

funding events to modify the terms of their debentures. The terms of the amendment, extend the maturity of these debentures to

December 31, 2021 and modify the conversion price to $0.003. As of February 4, approximately $4.25 million of the outstanding

$5.183 million have accepted the terms of the amendment.

Item

2.03. Creation of a Direct Financial Obligation under an Off-Balance Sheet Arrangement of a Registrant.

See

Item 1.01 above which is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

information set forth under Item 1.01 is incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

The

terms of this note specific that the proceeds from this Note must be used to facilitate the payment and completion of the company’s

10K report for the period ending September 30, 2020, and the company’s 8K report for the period ending December 31, 2020.

The net proceeds have been distributed to the auditors, transfer agent, accountant and attorneys supporting the completion of

these required reports.

Forward-Looking

Statements

Statements

contained in this current report that are not statements of historical fact are intended to be and are hereby identified as “forward-looking

statements” for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Generally,

forward-looking statements include expressed expectations of future events and the assumptions on which the expressed expectations

are based. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning

future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results

to differ materially from those projected. The Company undertakes no obligation to update or revise this current report to reflect

future developments except as otherwise required by the Securities Exchange Act of 1934.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

EVIO,

INC.,

|

|

|

|

|

|

Date:

February 8, 2021

|

By:

|

/s/

Lori Glauser

|

|

|

|

Lori

Glauser

|

|

|

|

Interim

Chief Executive Officer

|

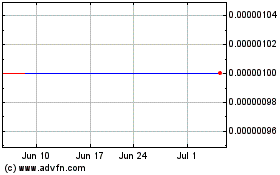

EVIO (CE) (USOTC:EVIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

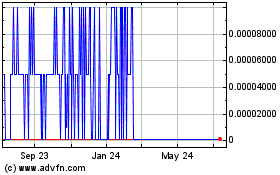

EVIO (CE) (USOTC:EVIO)

Historical Stock Chart

From Apr 2023 to Apr 2024