By Anne Steele

Spotify's pandemic boost may be peaking.

The Swedish audio-streaming giant posted stronger-than-expected

subscription growth in the fourth quarter of 2020 as more listeners

tuned into music and podcasts from home amid the coronavirus

pandemic. Still, the company offered a conservative outlook for the

current year as new sign-ups could ebb.

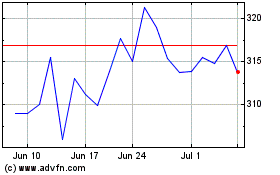

Shares in Spotify Technology SA fell 9% Wednesday morning in New

York to $315.

The pandemic proved to be a boon for streaming content as

lockdowns across the world had consumers turning to screens and

smart speakers for entertainment.

"In a way it's been one of the most interesting social

experiments I've ever seen in real time with a billion-plus people

overnight changing pretty much everything about their habits,"

Spotify Chief Executive Daniel Ek said in an interview. "Assuming

Covid is beyond us in the latter part of 2021, what's going to

happen to consumption then? Are people going to travel? What habits

are changing? That's a massive amount of uncertainty to have

consumers' attention now competing with all other forms of things

they could be doing with their time."

The disruption in listening habits and consumption "caused us to

pull forward subscribers across the back half of 2020, which makes

it hard to predict if we'll drive the same subscriber growth in the

year ahead," Mr. Ek said on a call with investors.

At the end of the fourth quarter, Spotify had 345 million

monthly active users, hitting the high end of its guidance, an

increase of 27% from the same period a year ago. Paying

subscribers, its most lucrative type of customer, grew to 155

million, up 24% from the same period a year ago, and topping

expectations.

Average revenue per user for the subscription business fell 8%

to EUR4.26, the equivalent of $5.13, from a year ago, as the

company continued to attract new subscribers via discounted plans

and charge lower prices in new markets such as India and Russia. In

October, Spotify raised the price of its family plan in seven

markets, a move the company said didn't affect churn or customer

intake. In February, it expanded price increases to another 25

markets, including in Europe, Latin America and Canada.

Revenue from subscriptions rose 15% from the year before, to

EUR1.89 billion. Advertising revenue grew for a second consecutive

quarter after sliding in the first half of the year amid pandemic

headwinds, jumping 29% to EUR281 million. Advertising, historically

less than 10% of Spotify's top line, accounted for 13% of revenue.

It has become a growth area as the company expands its podcast

business.

The company said it now has 2.2 million podcasts available on

its service, and consumption hours nearly doubled from the

prior-year quarter. During the period, 25% of its monthly active

users listened to a podcast, up from 22% in the previous quarter.

In December, "The Joe Rogan Experience," which arrived on Spotify

in September, became exclusive to the service. It is the No. 1 show

in 17 markets, and has helped bring in new users as well as attract

first-time podcast listeners, the company said.

"We do believe Joe Rogan has contributed positively to user

growth," said finance chief Paul Vogel on the investor call.

Spotify may soon be facing competition from bigger rivals, with

Amazon.com Inc. ramping up its commitment to podcasts with its

purchase of Wondery, and Apple Inc. exploring a subscription

service for podcasting.

Mr. Ek said the interest validates Spotify's early move into the

space, and said the focus going forward is on ramping up production

through the studios it's already acquired. He also said Spotify

will commit to making money on podcasts not just through

advertising, but through subscription and a la carte payment as

well.

"We're in the early days of seeing the long term evolution of

how we can monetize audio on the internet," he said. "I don't think

it's one size fits all and you'll have all these models."

In music, sponsored recommendations -- a cornerstone of

Spotify's "two-sided marketplace," where it charges artists and

labels for marketing on the service -- increased 50% from the prior

quarter. Billings rose 82% thanks to campaigns promoting albums by

Bad Bunny, Taylor Swift and Trippie Redd.

Overall revenue for the quarter rose 17% to EUR2.17 billion, in

line with guidance.

The company posted a loss of EUR125 million, or 66 European

cents a share, compared with a loss of EUR209 million, or EUR1.14 a

share, the year before. While Spotify has periodically reported a

quarterly profit, executives have said it would continue to give

priority to growth -- attracting new subscribers and investing in

podcasting.

Free cash flow -- a measure of the cash a company generates from

operations, and viewed by many investors as a proxy for performance

-- was EUR74 million, down from EUR169 million in the previous

year's period, in part due to higher podcast-related payments.

For the first quarter of 2021, the company forecast monthly

active users to grow to between 354 million and 364 million, and

premium subscribers to increase to between 155 million and 158

million. It said it expects to generate revenue of EUR1.99 billion

to EUR2.19 billion.

For this year, Spotify said it expects to grow its monthly

active users to 407 million to 427 million, and grow its premium

subscribers to 172 million to 184 million. It forecast revenue

growth between EUR9.01 billion and EUR9.41 billion. Analysts were

looking for EUR9.57 billion. If Spotify reaches the high end of its

expectations this year, the guidance represents year-over-year

subscription growth of 19%, a slower rate than last year's 25%

increase.

Mr. Ek said it's difficult to forecast how Spotify will perform

when introducing the service to new markets -- most recently South

Korea, following debuts in India and Russia. While the company

tends to be conservative with those estimates, it leaves the

potential to outperform, he said.

"When I look at the future slate of originals and exclusives,

that is a massive unknown but a massive potential upside too," said

Mr. Ek. "What happens when we have hundreds of shows exclusive?

Those things compound."

News Corp's Dow Jones & Co., publisher of The Wall Street

Journal, has a content partnership with Spotify's Gimlet Media

unit.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 03, 2021 11:07 ET (16:07 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

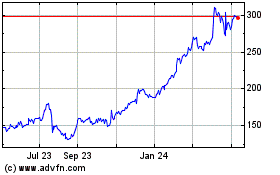

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024